Vacation ownership interests company Bluegreen Vacations (NYSE:BVH) reported Q3 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 6.4% year on year to $277.5 million. It made a GAAP profit of $1.25 per share, improving from its profit of $1.19 per share in the same quarter last year.

Bluegreen Vacations (BVH) Q3 FY2023 Highlights:

- Revenue: $277.5 million vs analyst estimates of $255.1 million (8.8% beat)

- EPS: $1.25 vs analyst estimates of $1.15 (8.4% beat)

- Gross Margin (GAAP): 87.3%, down from 88.4% in the same quarter last year

- Free Cash Flow was -$73.87 million compared to -$30.86 million in the previous quarter

- Market Capitalization: $1.27 billion

Managing resorts in top leisure and urban destinations, Bluegreen Vacations (NYSE:BVH) is a leading vacation ownership company that markets and sells vacation ownership interests.

At its core, the company allows customers to purchase ownership interests that entitle them to a range of vacation experiences at various resorts and locations. The company's portfolio of properties includes roughly 70 club resorts and access to more than 11,000 other hotels and resorts through partnerships and exchange networks.

Bluegreen Vacations operates under the Bluegreen Vacation Club brand, a points-based, deeded vacation ownership plan. Members are allotted a certain number of points annually, which they can use to book vacations at different resorts, providing a customizable vacation experience. This system offers owners the flexibility to choose the timing, duration, location, and accommodation size for their vacations, subject to availability.

In addition to vacation ownership, Bluegreen Vacations also provides management services for its resorts. This includes the operation of club reservation services, maintenance, housekeeping, and other administrative functions. The company prides itself on its customer service, striving to create memorable vacation experiences that encourage long-term relationships with its owners.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Bluegreen Vacations’s primary competitors include Marriott Vacations (NYSE:VAC), Hilton Grand Vacations (NYSE:HGV), Wyndham Destinations (NYSE:WYND), and Diamond Resorts International (owned by Apollo, NYSE:APO).Sales Growth

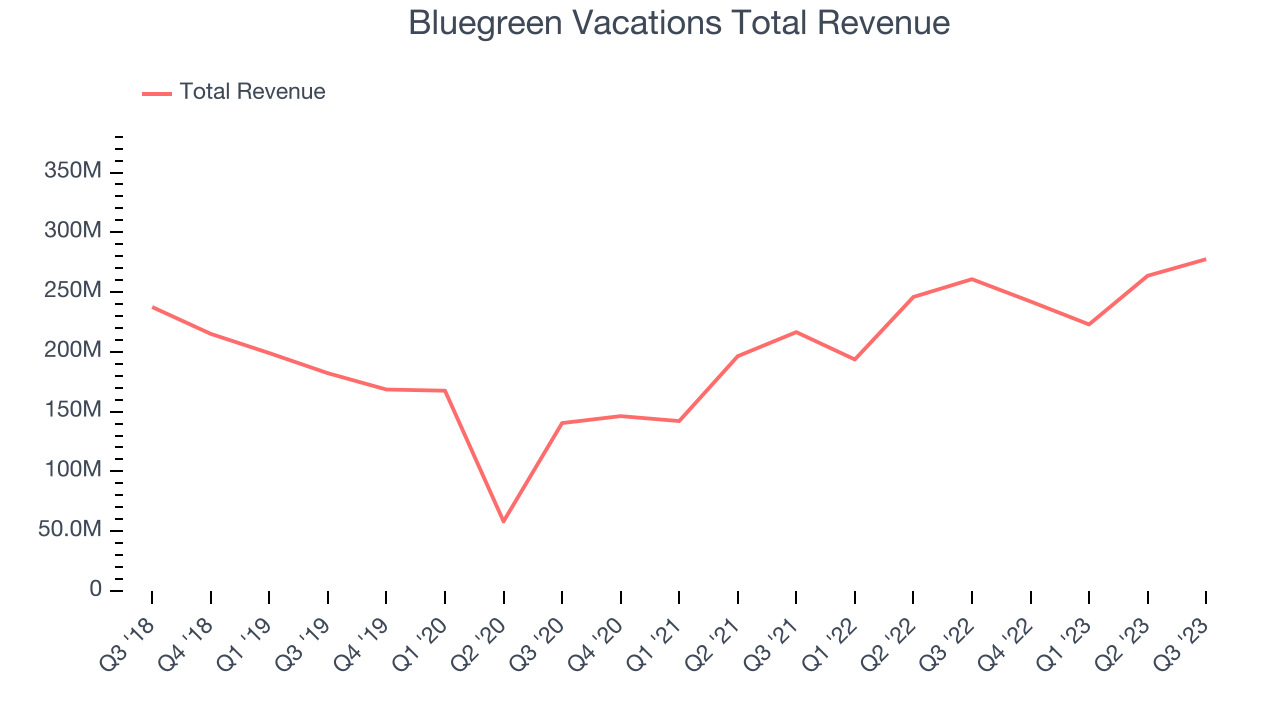

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Bluegreen Vacations's annualized revenue growth rate of 23.5% over the last three years was exceptional for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Bluegreen Vacations's recent history shows its momentum has slowed as its annualized revenue growth of 19.8% over the last two years is below its three-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Bluegreen Vacations's recent history shows its momentum has slowed as its annualized revenue growth of 19.8% over the last two years is below its three-year trend.

This quarter, Bluegreen Vacations reported solid year-on-year revenue growth of 6.4%, and its $277.5 million of revenue outperformed Wall Street's estimates by 8.8%. Looking ahead, Wall Street expects revenue to decline 2.1% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Bluegreen Vacations has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 28.5%.In Q3, Bluegreen Vacations generated an operating profit margin of 30.9%, up 1.1 percentage points year on year.

Over the next 12 months, Wall Street expects Bluegreen Vacations to become less profitable. Analysts are expecting the company’s LTM operating margin of 29.2% to decline to 18.3%.EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last three years, Bluegreen Vacations cut its earnings losses and improved its EPS by 41.2% each year. This performance is materially higher than its 23.5% annualized revenue growth over the same period. Let's dig into why.

Bluegreen Vacations's operating margin has expanded 33.3 percentage points over the last three years while its share count has shrunk 12%. Improving profitability and share buybacks are positive signs as they juice EPS growth relative to revenue growth.In Q3, Bluegreen Vacations reported EPS at $1.25, up from $1.19 in the same quarter a year ago. This print beat analysts' estimates by 8.4%. Over the next 12 months, Wall Street expects Bluegreen Vacations to grow its earnings. Analysts are projecting its LTM EPS of $3.71 to climb by 26.9% to $4.71.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Bluegreen Vacations's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 9.4%.

Bluegreen Vacations burned through $73.87 million of cash in Q3, equivalent to a negative 26.6% margin, reducing its cash burn by 4,045% year on year. Over the next year, analysts predict Bluegreen Vacations will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 21.8% will increase to positive 4.8%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Bluegreen Vacations's five-year average return on invested capital was 19.6%, higher than most consumer discretionary companies. Just as you’d like your investment dollars to generate returns, Bluegreen Vacations's invested capital has produced solid profits.

Key Takeaways from Bluegreen Vacations's Q3 Results

We were impressed by how significantly Bluegreen Vacations blew past analysts' operating margin expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is flat after reporting and currently trades at $75 per share.

Is Now The Time?

Bluegreen Vacations may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Bluegreen Vacations isn't a bad business. First off, its revenue growth has been exceptional over the last three years. And while its cash burn raises the question of whether it can sustainably maintain growth, its impressive operating margins show it has a highly efficient business model.

Bluegreen Vacations's price-to-earnings ratio based on the next 12 months is 15.4x. In the end, beauty is in the eye of the beholder. While Bluegreen Vacations wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $55 per share right before these results (compared to the current share price of $75).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.