Internet, cable TV, and phone provider Cable One (NYSE:CABO) fell short of analysts' expectations in Q1 CY2024, with revenue down 4.2% year on year to $404.3 million. It made a GAAP profit of $8.11 per share, down from its profit of $9.62 per share in the same quarter last year.

Cable One (CABO) Q1 CY2024 Highlights:

- Revenue: $404.3 million vs analyst estimates of $408.4 million (1% miss)

- Adjusted EBITDA: $217.1 million vs analyst estimates of $220.9 million (1.7% miss)

- EPS: $8.11 vs analyst expectations of $10.37 (21.8% miss)

- Gross Margin (GAAP): 73.7%, in line with the same quarter last year

- Free Cash Flow of $98.86 million, up 174% from the previous quarter

- Residential Data Subscribers: 967,400

- Market Capitalization: $2.23 billion

Founded in 1986, Cable One (NYSE:CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

The company was early to recognize the lack of high-quality and reliable communications services in communities often overlooked by larger providers. By focusing on these less urbanized areas, the company was able to carve a niche for itself as an affordable yet reliable provider.

Today, Cable One generates revenue through subscriptions to its various services including internet, cable TV, and cellular wireless plans. The company recently pivoted in 2019 to focus more on its internet business, re-branding itself to Sparklight.

Cable and Satellite

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

Competitors in the telecommunications and media services industry include Charter Communications (NASDAQ:CHTR), Comcast (NASDAQ:CMCSA), and WideOpenWest (NYSE:WOW).Sales Growth

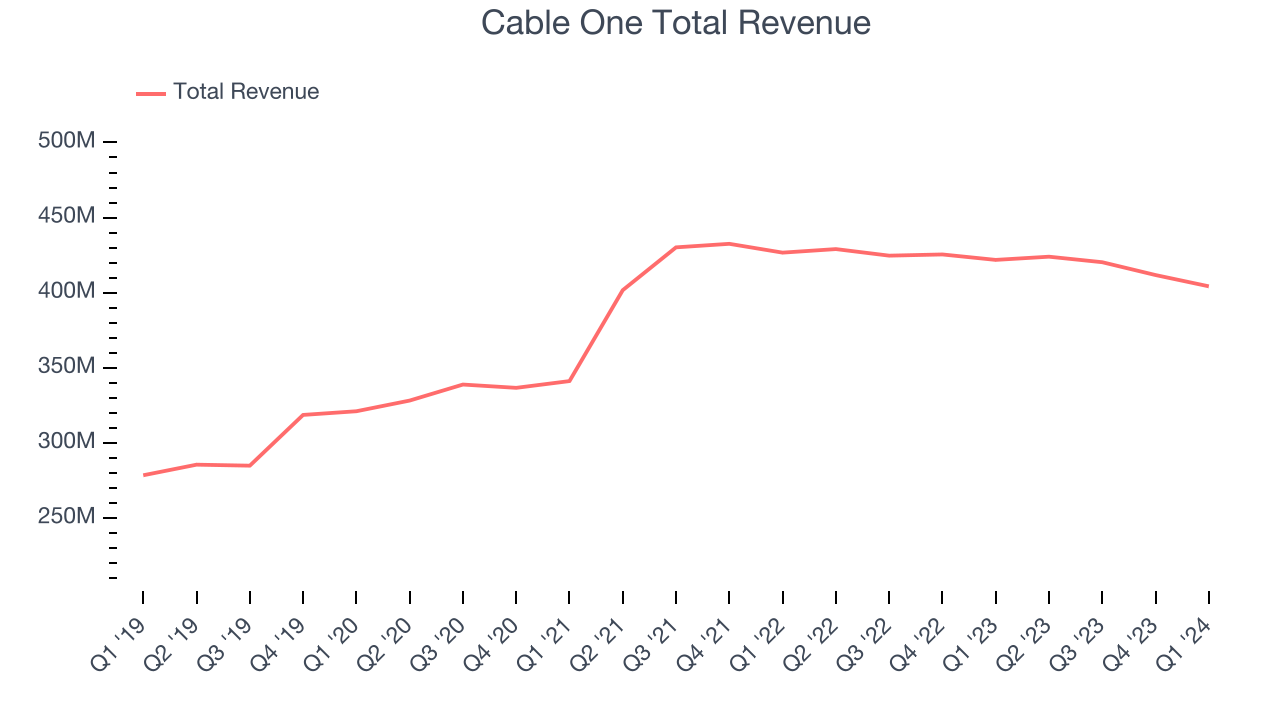

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Cable One's annualized revenue growth rate of 8.9% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Cable One's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Cable One's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

This quarter, Cable One missed Wall Street's estimates and reported a rather uninspiring 4.2% year-on-year revenue decline, generating $404.3 million of revenue. Looking ahead, Wall Street expects revenue to decline 2% over the next 12 months.

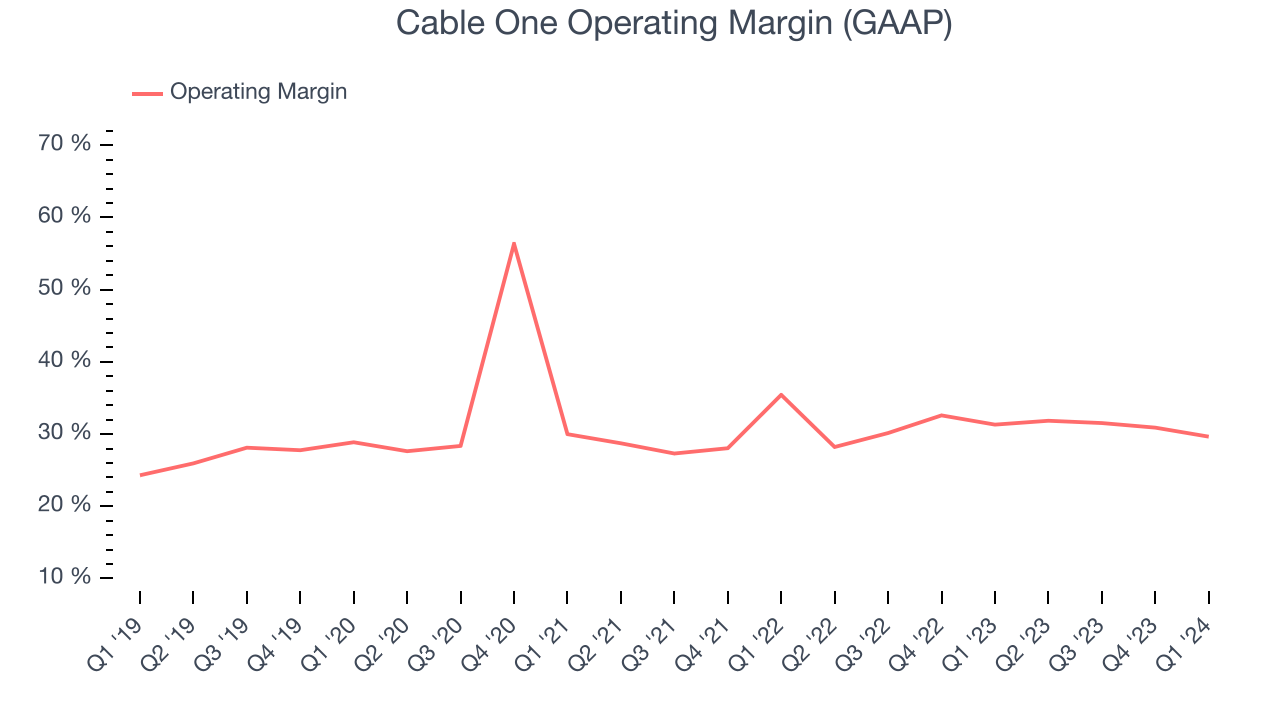

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Cable One has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 30.8%.

This quarter, Cable One generated an operating profit margin of 29.6%, down 1.7 percentage points year on year.

Over the next 12 months, Wall Street expects Cable One to maintain its LTM operating margin of 31%.EPS

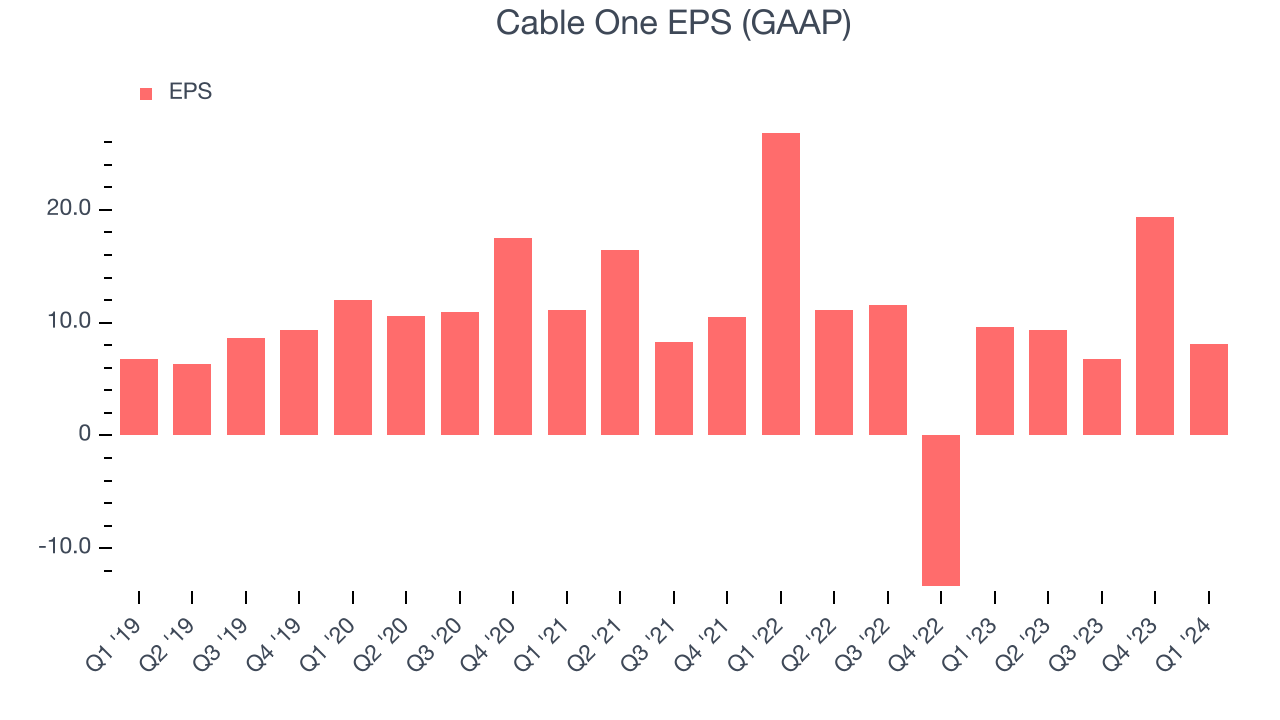

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Cable One's EPS grew 53.4%, translating into an unimpressive 8.9% compounded annual growth rate. This performance is in line with its 8.9% annualized revenue growth over the same period.

In Q1, Cable One reported EPS at $8.11, down from $9.62 in the same quarter last year. This print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street expects Cable One to perform poorly. Analysts are projecting its LTM EPS of $43.67 to shrink by 5.6% to $41.21.

Cash Is King

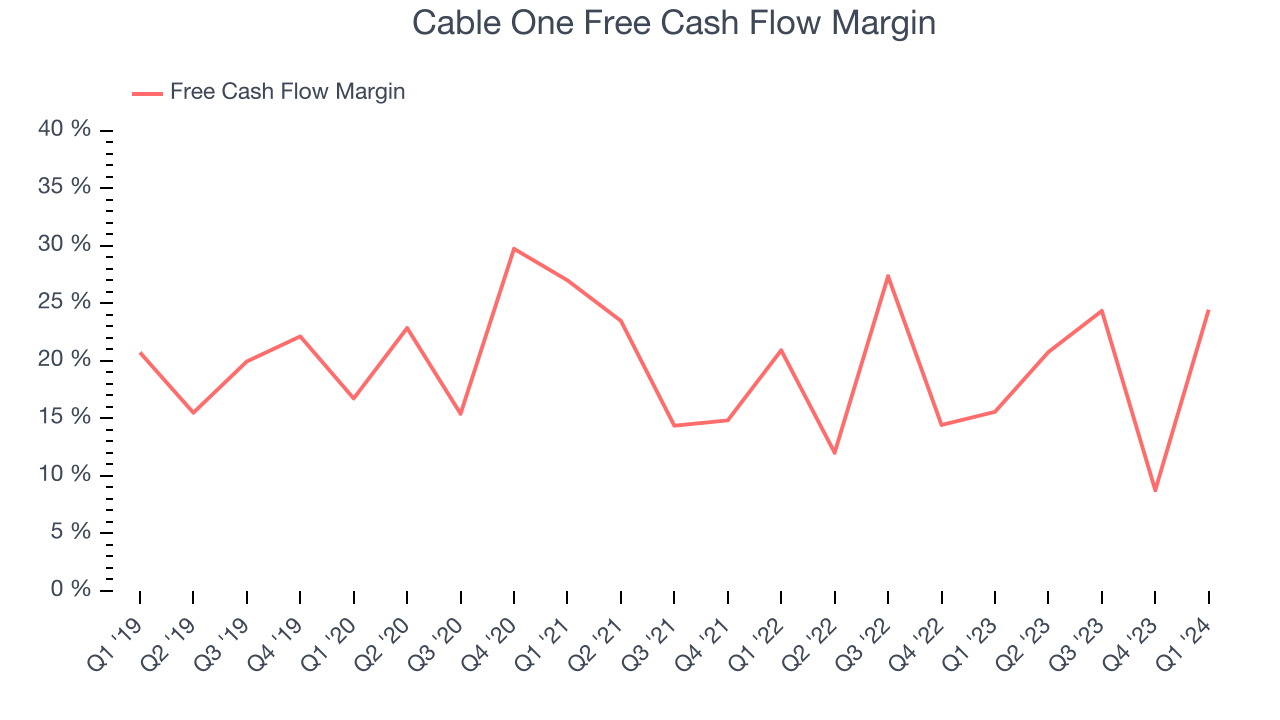

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Cable One has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 18.4%, quite impressive for a consumer discretionary business.

Cable One's free cash flow came in at $98.86 million in Q1, equivalent to a 24.5% margin and up 50.5% year on year. Over the next year, analysts' consensus estimates show they're expecting Cable One's LTM free cash flow margin of 19.6% to remain the same.

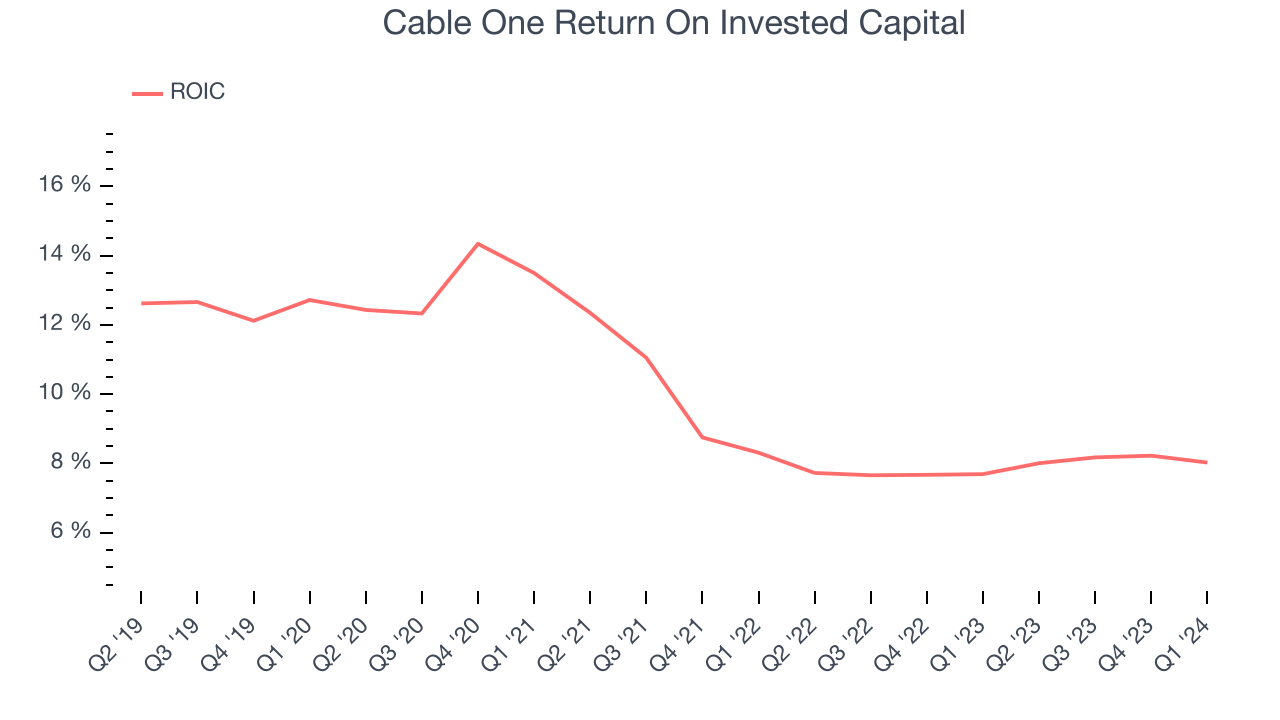

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Cable One's five-year average return on invested capital was 10%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Cable One's ROIC averaged 5.2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Cable One reported $210.7 million of cash and $3.59 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $905.2 million of EBITDA over the last 12 months, we view Cable One's 3.7x net-debt-to-EBITDA ratio as safe. We also see its $150.1 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Cable One's Q1 Results

We struggled to find many strong positives in these results. Its adjusted EBITDA and EPS fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Cable One. The company is down 5.4% on the results and currently trades at $375 per share.

Is Now The Time?

Cable One may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Cable One, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its impressive operating margins show it has a highly efficient business model, the downside is its projected EPS for the next year is lacking. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While there are some things to like about Cable One and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $552.17 per share right before these results (compared to the current share price of $375).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.