Wrapping up Q2 earnings, we look at the numbers and key takeaways for the shelf-stable food stocks, including Conagra (NYSE:CAG) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues missed analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was 0.7% below.

Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. On the other hand, 2024 has been a bumpier ride as the market switches between optimism and pessimism around rate cuts and inflation. Thankfully, shelf-stable food stocks have been resilient with share prices up 7% on average since the latest earnings results.

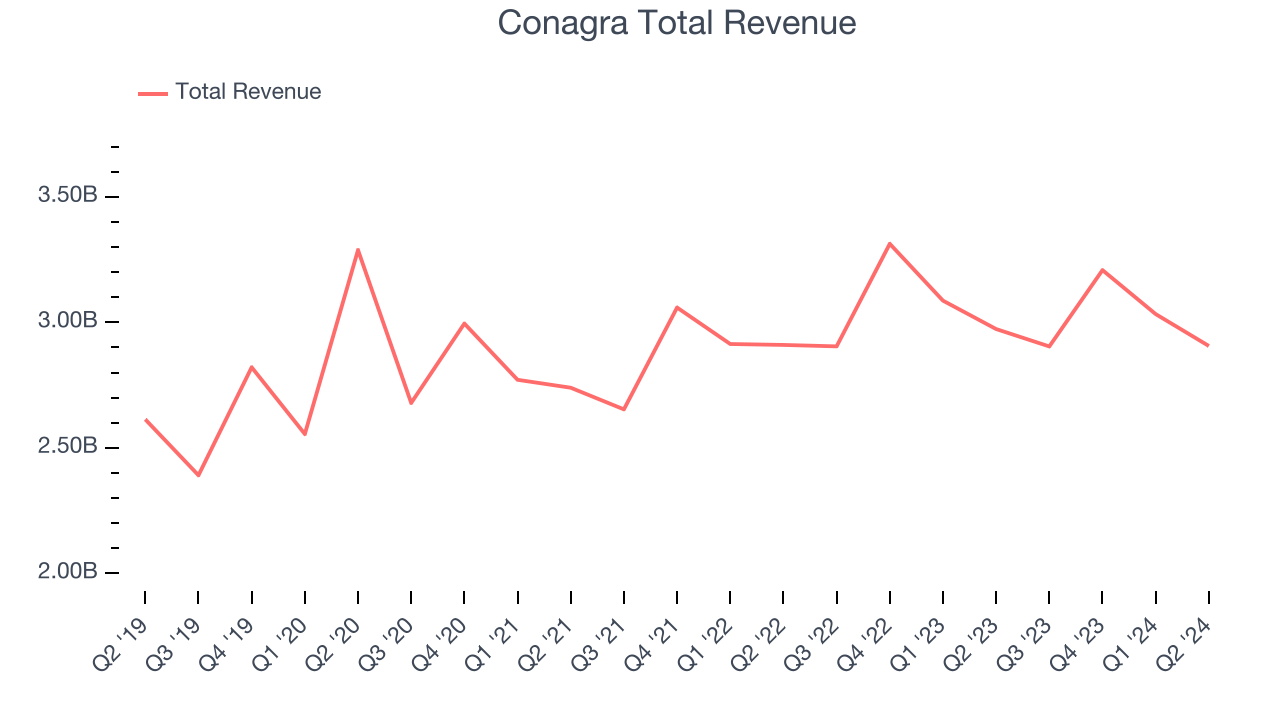

Conagra (NYSE:CAG)

Founded in 1919 as Nebraska Consolidated Mills in Omaha, Nebraska, Conagra Brands today (NYSE:CAG) boasts a diverse portfolio of packaged foods brands that includes everything from whipped cream to jarred pickles to frozen meals.

Conagra reported revenues of $2.91 billion, down 2.3% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ organic revenue growth estimates and underwhelming earnings guidance for the full year.

Interestingly, the stock is up 13.4% since reporting and currently trades at $32.66.

Read our full report on Conagra here, it’s free.

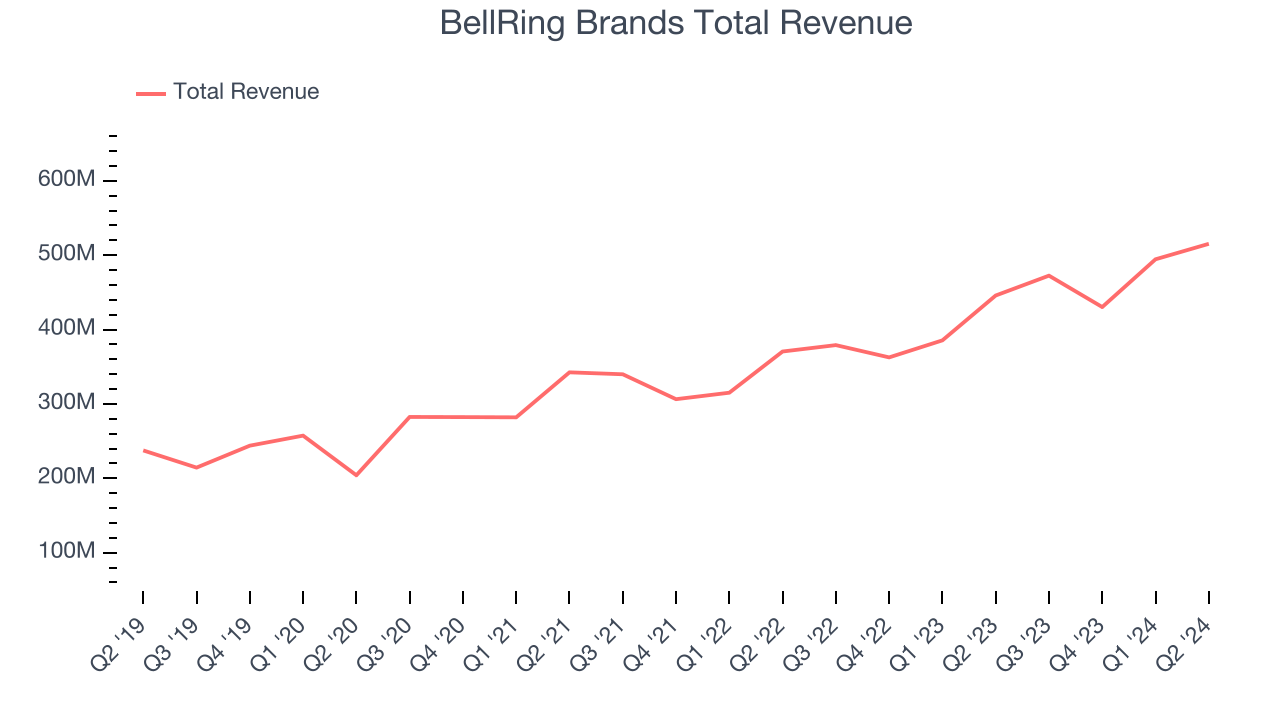

Best Q2: BellRing Brands (NYSE:BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

BellRing Brands reported revenues of $515.4 million, up 15.6% year on year, outperforming analysts’ expectations by 2%. It was a strong quarter for the company with an impressive beat of analysts’ gross margin and organic revenue growth estimates.

The market seems happy with the results as the stock is up 15.2% since reporting. It currently trades at $56.85.

Is now the time to buy BellRing Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Lamb Weston (NYSE:LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE:LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.61 billion, down 4.9% year on year, falling short of analysts’ expectations by 5.5%. It was a weak quarter for the company with underwhelming earnings guidance for the full year and a miss of analysts’ organic revenue growth estimates.

Lamb Weston had the weakest full-year guidance update in the group. As expected, the stock is down 21.1% since the results and currently trades at $62.03.

Read our full analysis of Lamb Weston’s results here.

Hershey (NYSE:HSY)

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE:HSY) is an iconic company known for its chocolate products.

Hershey reported revenues of $2.07 billion, down 16.7% year on year, falling short of analysts’ expectations by 10.6%. Revenue aside, it was a weak quarter for the company with a miss of analysts’ organic revenue growth and earnings estimates.

Hershey had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 1.3% since reporting and currently trades at $199.80.

Read our full, actionable report on Hershey here, it’s free.

Lancaster Colony (NASDAQ:LANC)

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ:LANC) sells bread, dressing, and dips to the retail and food service channels.

Lancaster Colony reported revenues of $452.8 million, flat year on year, falling short of analysts’ expectations by 2%. Revenue aside, it was a weak quarter for the company with a miss of analysts’ operating margin and earnings estimates.

The stock is down 9.3% since reporting and currently trades at $179.

Read our full, actionable report on Lancaster Colony here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.