Footwear company Caleres (NYSE:CAL) reported results in line with analysts' expectations in Q4 FY2023, with revenue flat year on year at $697.1 million. It made a GAAP profit of $1.57 per share, improving from its profit of $1.13 per share in the same quarter last year.

Is now the time to buy Caleres? Find out by accessing our full research report, it's free.

Caleres (CAL) Q4 FY2023 Highlights:

- Revenue: $697.1 million vs analyst estimates of $694.3 million (small beat)

- EPS: $1.57 vs analyst estimates of $0.81 (95% beat)

- Gross Margin (GAAP): 43.9%, up from 40.4% in the same quarter last year

- Free Cash Flow of $27.33 million, up 109% from the previous quarter

- Market Capitalization: $1.38 billion

“The Caleres team delivered another strong operational performance in the fourth quarter, culminating in a third consecutive year of adjusted earnings per share in excess of our $4.00 baseline and underscoring the durability of our earnings power,” said Jay Schmidt, president and chief executive officer.

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

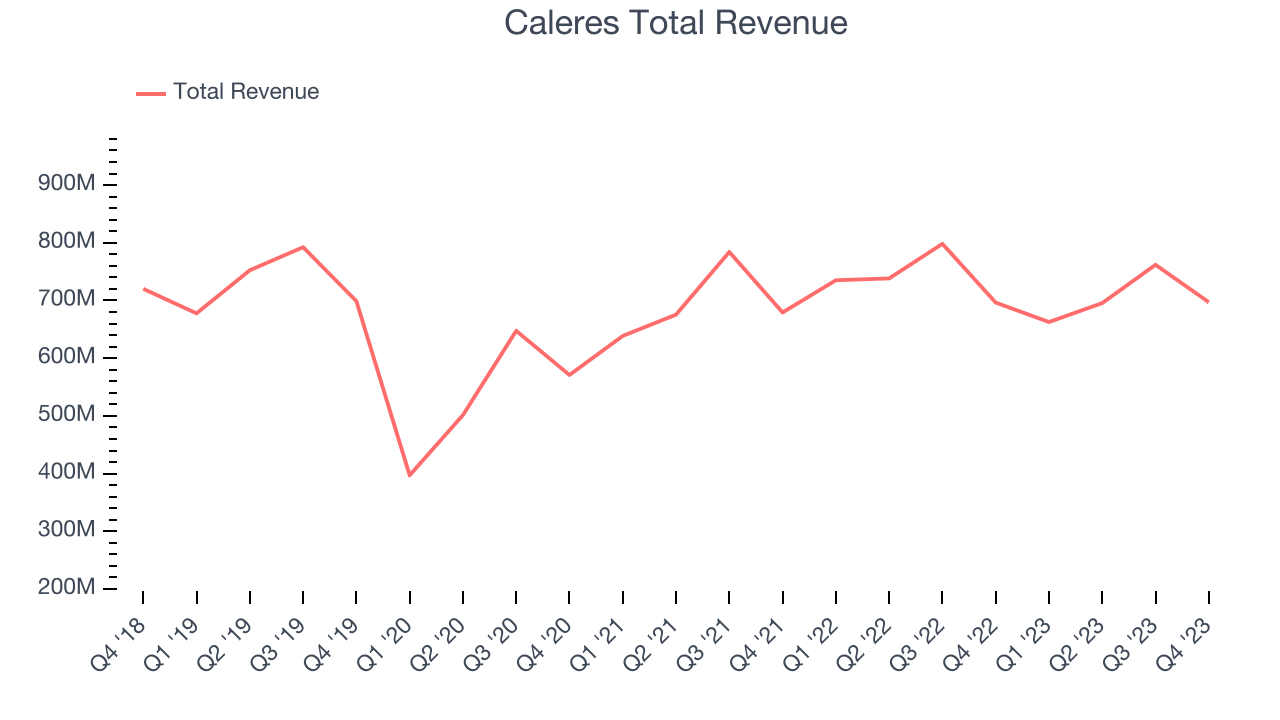

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Caleres's revenue was flat over the last five years.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Just like its five-year revenue trend, Caleres's revenue over the last two years has been flat, suggesting the company is in a slump.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Just like its five-year revenue trend, Caleres's revenue over the last two years has been flat, suggesting the company is in a slump.

This quarter, Caleres's $697.1 million of revenue was flat year on year and in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.8% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

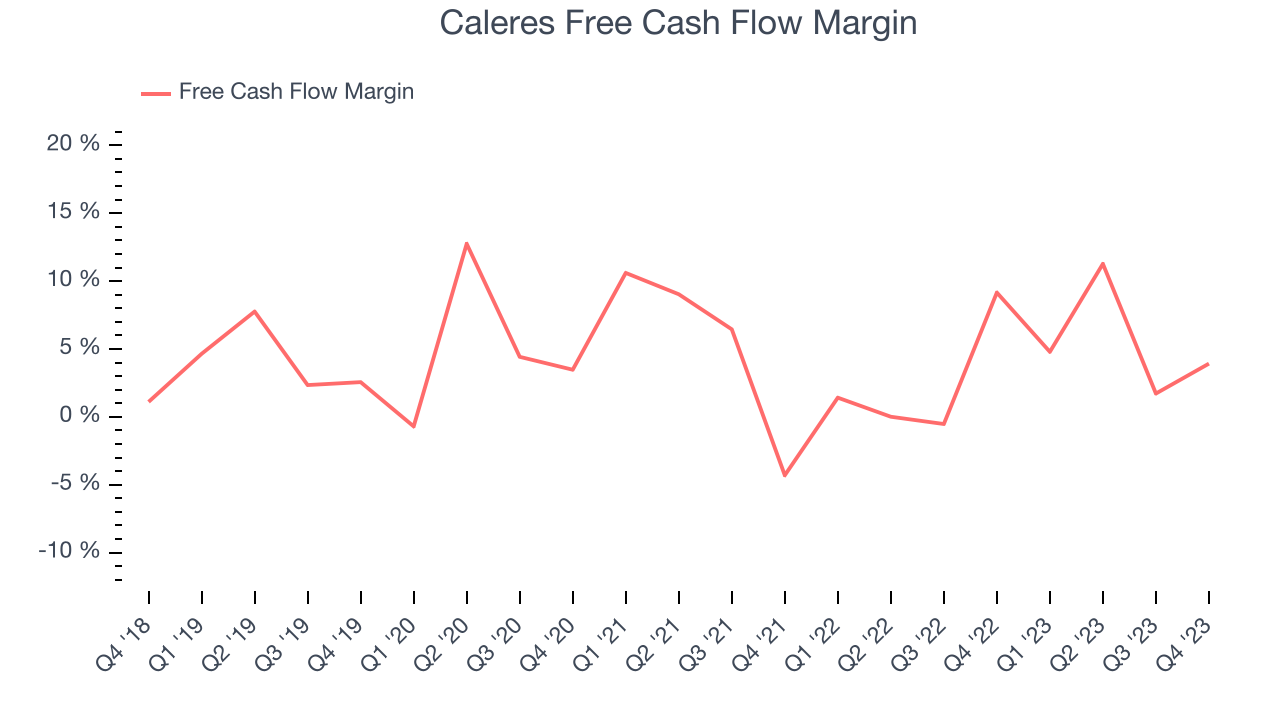

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Caleres has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.8%, subpar for a consumer discretionary business.

Caleres's free cash flow came in at $27.33 million in Q4, equivalent to a 3.9% margin and down 57.1% year on year. Over the next year, analysts predict Caleres's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 5.3% will increase to 7%.

Key Takeaways from Caleres's Q4 Results

We were impressed by how significantly Caleres blew past analysts' EPS expectations this quarter. On the other hand, its operating margin missed and its full-year earnings guidance fell short of Wall Street's estimates. Overall, the results could have been better. The company is down 3.5% on the results and currently trades at $37.4 per share.

Caleres may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.