Footwear company Caleres (NYSE:CAL) reported results in line with analysts' expectations in Q4 FY2023, with revenue flat year on year at $697.1 million. It made a GAAP profit of $1.57 per share, improving from its profit of $1.13 per share in the same quarter last year.

Caleres (CAL) Q4 FY2023 Highlights:

- Revenue: $697.1 million vs analyst estimates of $694.3 million (small beat)

- EPS: $1.57 vs analyst estimates of $0.81 (95% beat)

- Gross Margin (GAAP): 43.9%, up from 40.4% in the same quarter last year

- Free Cash Flow of $27.33 million, up 109% from the previous quarter

- Market Capitalization: $1.38 billion

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

The company started as a niche footwear manufacturer and retailer, Bryan-Brown Shoe Company, and has expanded over time by acquiring numerous brands including Naturalizer, Buster Brown, and LifeStride. In 2015, the company rebranded itself as Caleres in a strategic shift for global expansion and product diversification.

Caleres's brand acquisitions over its 100+ year history made it a major player in the shoe industry. Today, Caleres owns and operates Vince, Allen Edmonds, Dr. Scholls, and many other household names. The company's portfolio approach allows it to cater to a wide range of consumer preferences and market segments, from fashion-forward footwear to comfort and orthopedic options.

In addition to its shoemakers, Caleres owns Famous Footwear, a large retailer of popular athletic and casual shoes. Along with its own line of shoes, Famous Footwear carries popular brands like Nike and Adidas through its expansive retail store network and e-commerce platform.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Caleres's shoe brands compete with Deckers Outdoor (NYSE:DECK) and VF Corp (NYSE:VFC) while Famous Footwear competes with retailers such as Foot Locker (NYSE:FL) and Designer Brands (NYSE:DBI).Sales Growth

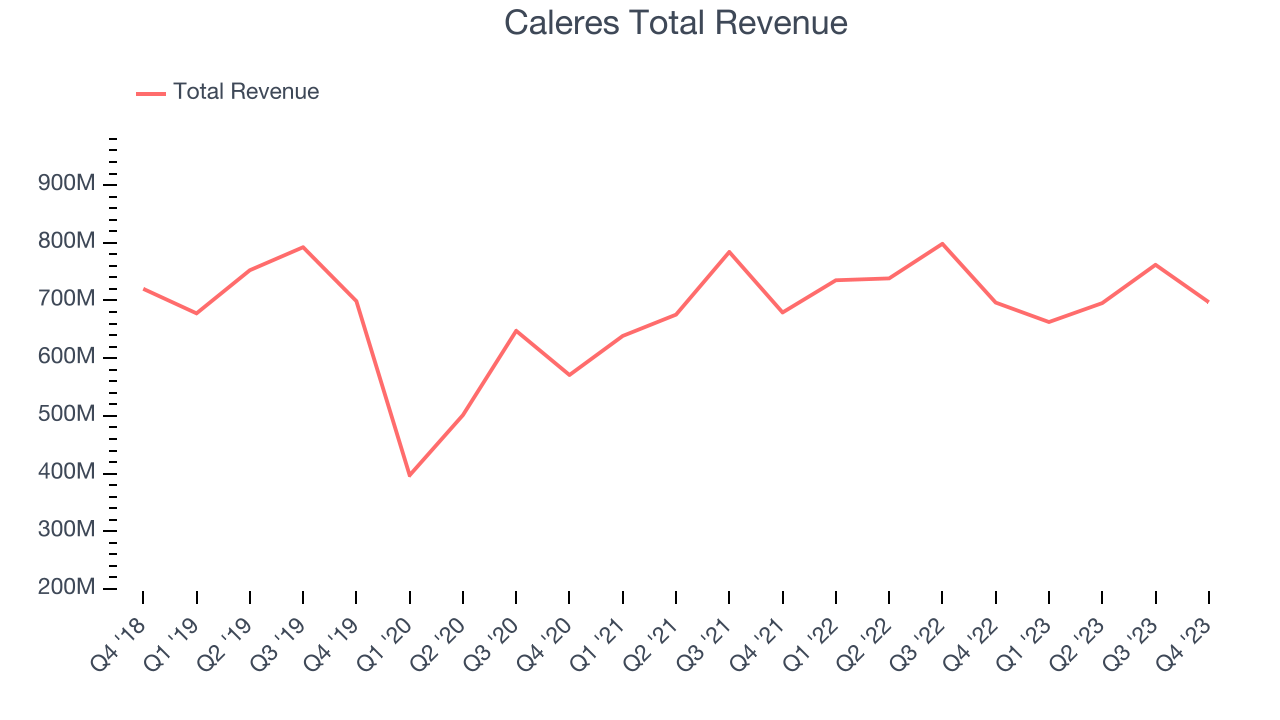

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Caleres's revenue was flat over the last five years.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Just like its five-year revenue trend, Caleres's revenue over the last two years has been flat, suggesting the company is in a slump.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Just like its five-year revenue trend, Caleres's revenue over the last two years has been flat, suggesting the company is in a slump.

This quarter, Caleres's $697.1 million of revenue was flat year on year and in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.8% over the next 12 months, an acceleration from this quarter.

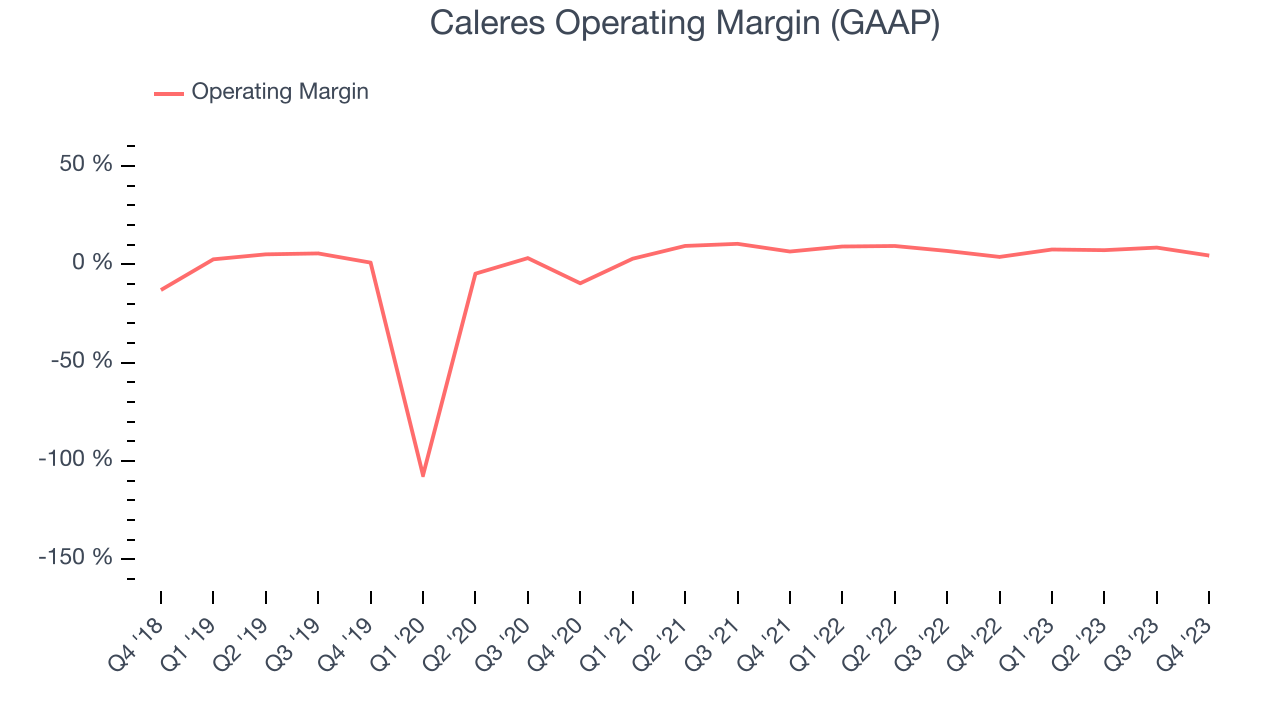

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Caleres was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 7.1%.

This quarter, Caleres generated an operating profit margin of 4.4%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Caleres to maintain its LTM operating margin of 6.9%.EPS

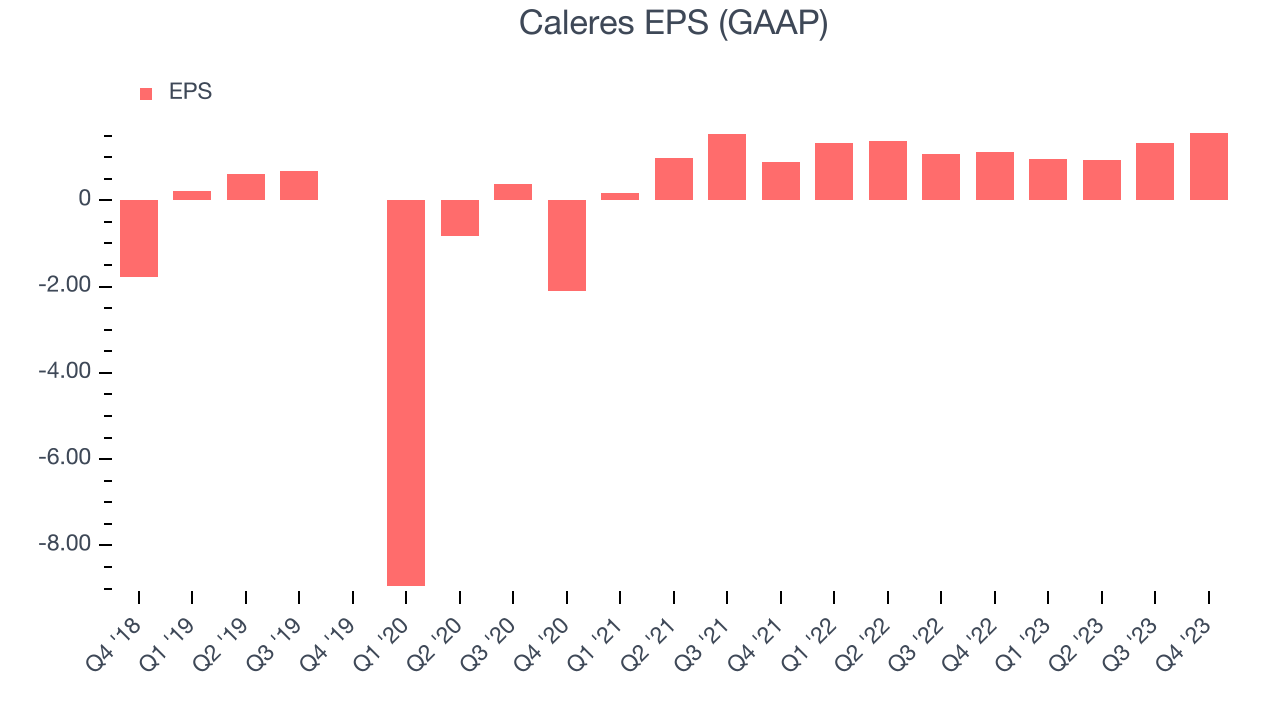

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Caleres cut its earnings losses and improved its EPS by 35.6% each year. This performance is materially higher than its flat revenue over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals. While we mentioned earlier that Caleres's operating margin was flat this quarter, a five-year view shows its margin has expanded 17.5 percentage points while its share count has shrunk 17.2%. Improving profitability and share buybacks are positive signs as they juice EPS growth relative to revenue growth.

In Q4, Caleres reported EPS at $1.57, up from $1.13 in the same quarter a year ago. This print beat analysts' estimates by 95%. Over the next 12 months, Wall Street expects Caleres to perform poorly. Analysts are projecting its LTM EPS of $4.80 to shrink by 2.9% to $4.67.

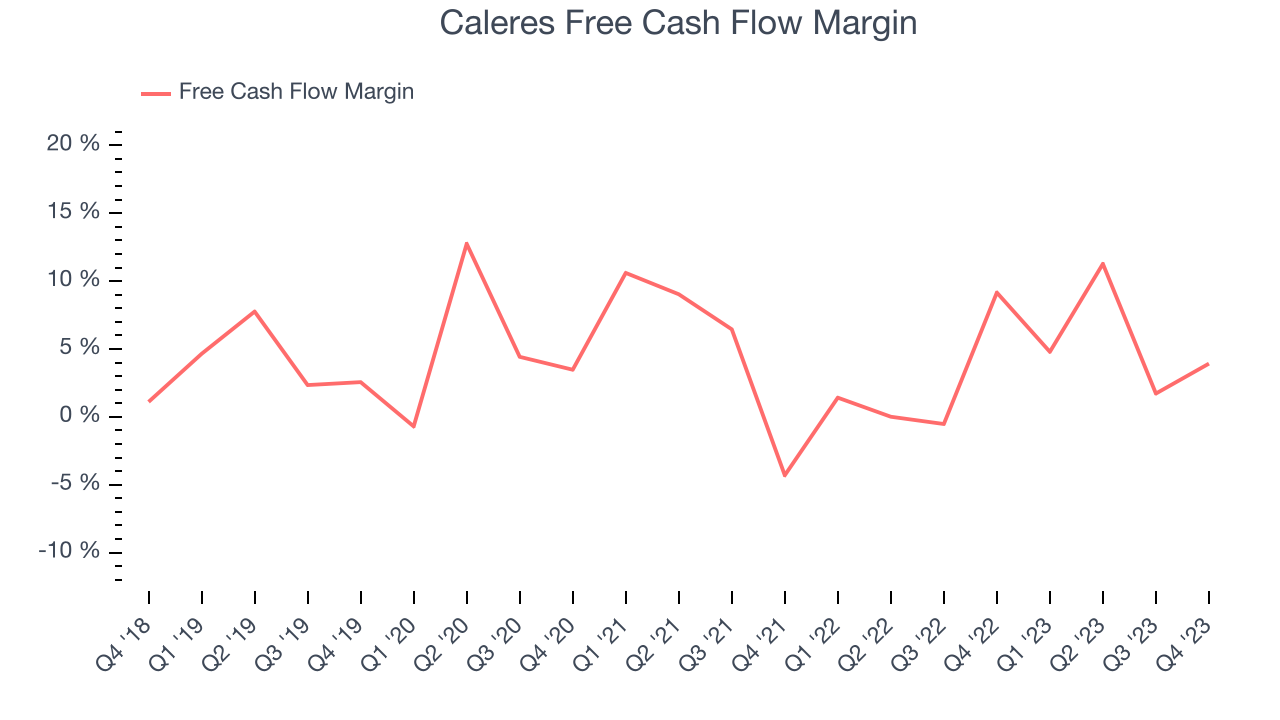

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Caleres has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.8%, subpar for a consumer discretionary business.

Caleres's free cash flow came in at $27.33 million in Q4, equivalent to a 3.9% margin and down 57.1% year on year. Over the next year, analysts predict Caleres's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 5.3% will increase to 7%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Caleres's five-year average return on invested capital was 3%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Caleres's ROIC averaged 38.1 percentage point increases each year. This is a good sign and we hope the company can continue to improving.

Key Takeaways from Caleres's Q4 Results

We were impressed by how significantly Caleres blew past analysts' EPS expectations this quarter. On the other hand, its operating margin missed and its full-year earnings guidance fell short of Wall Street's estimates. Overall, the results could have been better. The company is down 3.5% on the results and currently trades at $37.4 per share.

Is Now The Time?

Caleres may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Caleres, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its EPS growth over the last five years has been fantastic, the downside is its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. On top of that, its projected EPS for the next year is lacking.

Caleres's price-to-earnings ratio based on the next 12 months is 8.4x. While the price is reasonable and there are some things to like about Caleres, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $38.75 per share right before these results (compared to the current share price of $37.40).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.