Online new and used car marketplace Cars.com (NYSE:CARS) missed analysts' expectations in Q2 CY2024, with revenue up 6.4% year on year to $178.9 million. Next quarter's revenue guidance of $179.5 million also underwhelmed, coming in 3.4% below analysts' estimates. It made a GAAP profit of $0.17 per share, down from its profit of $1.37 per share in the same quarter last year.

Is now the time to buy Cars.com? Find out by accessing our full research report, it's free.

Cars.com (CARS) Q2 CY2024 Highlights:

- Revenue: $178.9 million vs analyst estimates of $181.8 million (1.6% miss)

- EPS: $0.17 vs analyst estimates of $0.11 ($0.06 beat)

- Revenue Guidance for Q3 CY2024 is $179.5 million at the midpoint, below analyst estimates of $185.9 million

- EBITDA Margin: 28.2%, up from 27.1% in the same quarter last year

- Free Cash Flow of $28.99 million, similar to the previous quarter

- Dealer Customers: 19,390, up 605 year on year

- Market Capitalization: $1.18 billion

"We drove disciplined growth and strong profitability during the second quarter on top of returning to sequential expansion in our dealer customer base," said Alex Vetter, Chief Executive Officer of Cars Commerce.

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE:CARS) is a digital marketplace that connects new and used car buyers and sellers.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

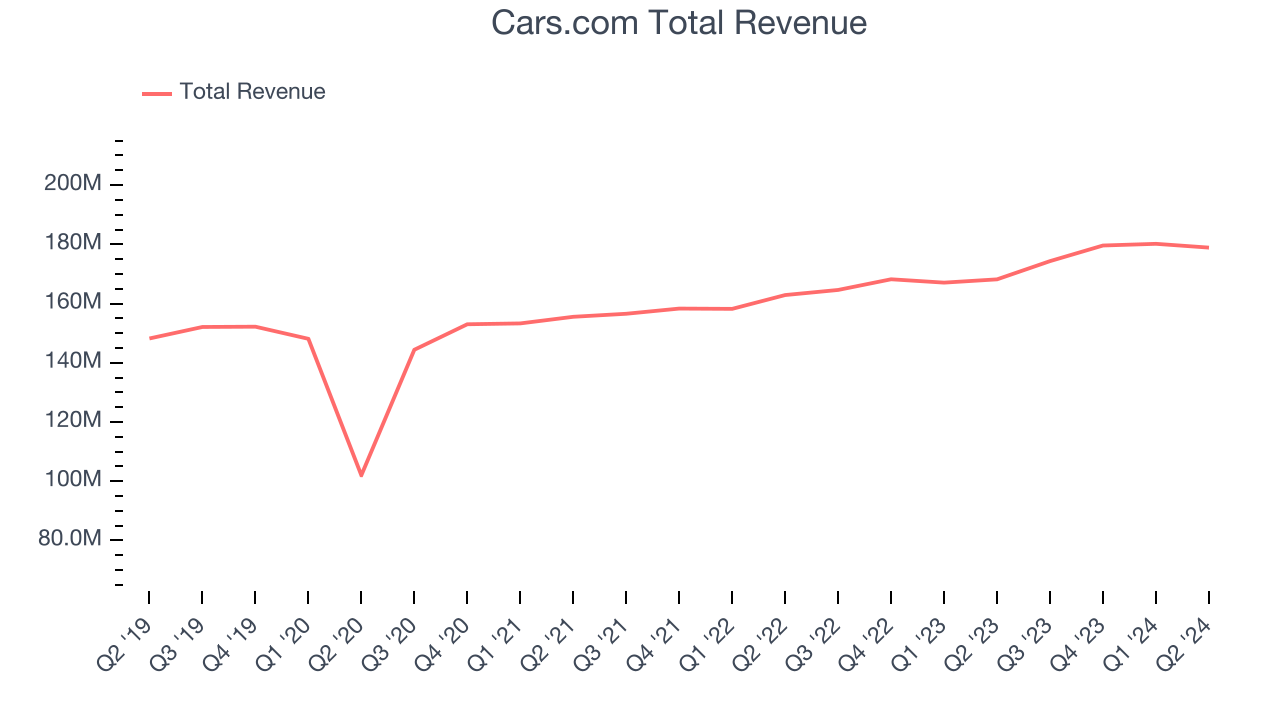

Sales Growth

Cars.com's revenue growth over the last three years has been unimpressive, averaging 5.6% annually. This quarter, Cars.com reported mediocre 6.4% year-on-year revenue growth, missing Wall Street's expectations.

Guidance for the next quarter indicates Cars.com is expecting revenue to grow 3% year on year to $179.5 million, slowing from the 5.9% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 6.1% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Usage Growth

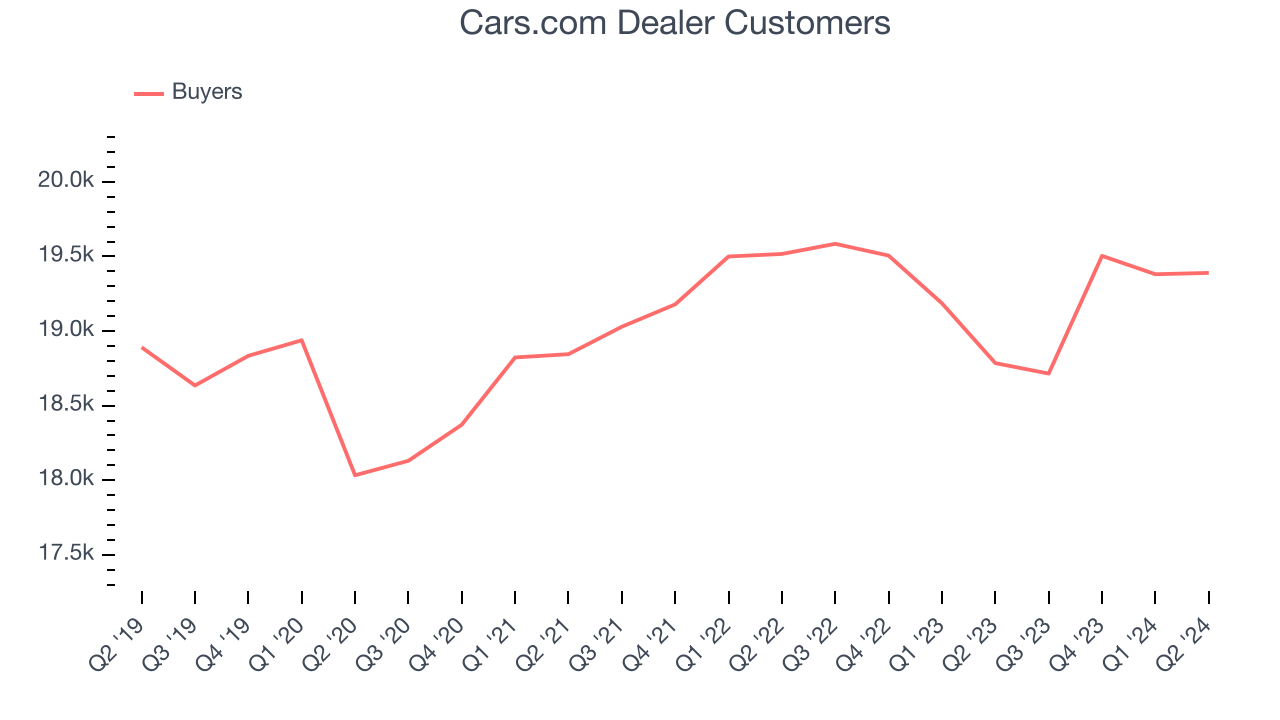

As an online marketplace, Cars.com generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

Cars.com has been struggling to grow its active buyers, a key performance metric for the company. Over the last two years, its buyers have declined 0.1% annually to 19,390. This is one of the lowest rates of growth in the consumer internet sector.

Luckily, Cars.com added 605 active buyers in Q2, leading to 3.2% year-on-year growth.

Key Takeaways from Cars.com's Q2 Results

We struggled to find many strong positives in these results. Its revenue guidance for next quarter missed analysts' expectations and its revenue missed Wall Street's estimates. Overall, this was a weaker quarter for Cars.com. The stock traded down 10.6% to $16 immediately following the results.

Cars.com may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.