Metal packaging products manufacturer Crown Holdings (NYSE:CCK) met Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $3.07 billion. Its non-GAAP profit of $1.99 per share was 10.4% above analysts’ consensus estimates.

Is now the time to buy Crown Holdings? Find out by accessing our full research report, it’s free.

Crown Holdings (CCK) Q3 CY2024 Highlights:

- Revenue: $3.07 billion vs analyst estimates of $3.06 billion (in line)

- EPS (non-GAAP): $1.99 vs analyst estimates of $1.80 (10.4% beat)

- EPS (non-GAAP) guidance for the full year is $6.30 at the midpoint, beating analyst estimates by 2.4%

- Gross Margin (GAAP): 22.5%, up from 20.9% in the same quarter last year

- Market Capitalization: $11.21 billion

Commenting on the quarter, Timothy J. Donahue, Chairman, President and Chief Executive Officer, stated, "The Company continued its strong 2024 performance during the third quarter, with results in each of its global beverage can businesses exceeding original expectations. Global beverage shipments improved 5% during the quarter, with Brazil, Europe, Mexico and the United States all recording increases of 5% or more. Segment income on a combined basis advanced 10% over the prior year third quarter, as the Company benefited from favorable manufacturing performance and exposure to a well-balanced portfolio of end markets. Transit Packaging performed in line with expectations while global manufacturing activity continues in contraction."

Company Overview

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

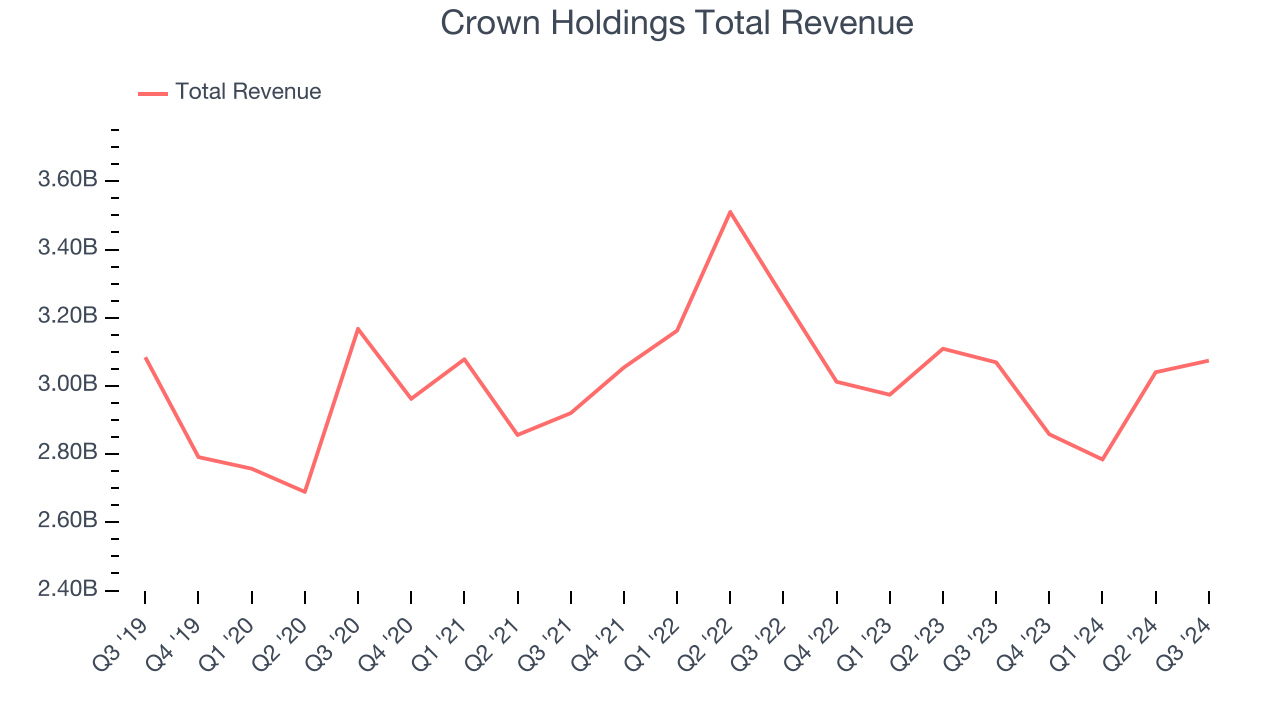

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Crown Holdings struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Crown Holdings’s recent history shows its demand has stayed suppressed as its revenue has declined by 4.8% annually over the last two years. Crown Holdings isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Crown Holdings’s $3.07 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, an acceleration versus the last two years. While this projection shows the market believes its newer products and services will spur better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

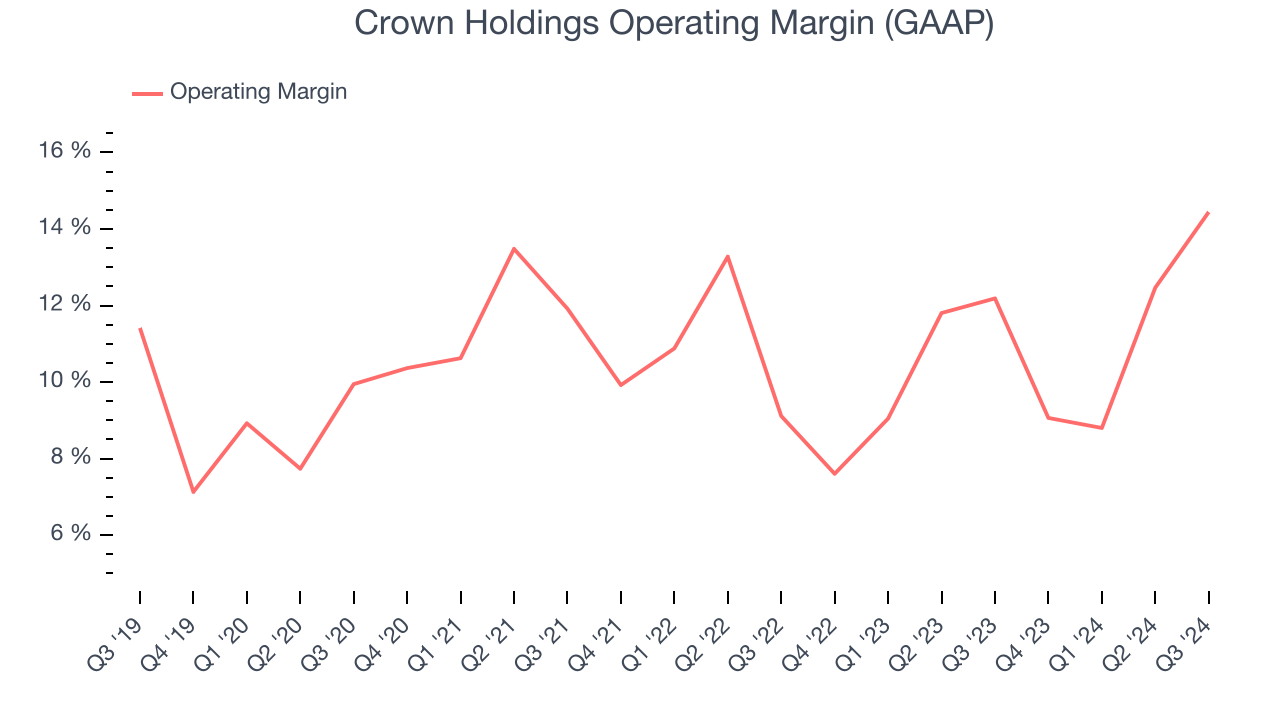

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Crown Holdings has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Crown Holdings’s annual operating margin rose by 2.8 percentage points over the last five years, showing its efficiency has improved.

This quarter, Crown Holdings generated an operating profit margin of 14.4%, up 2.3 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

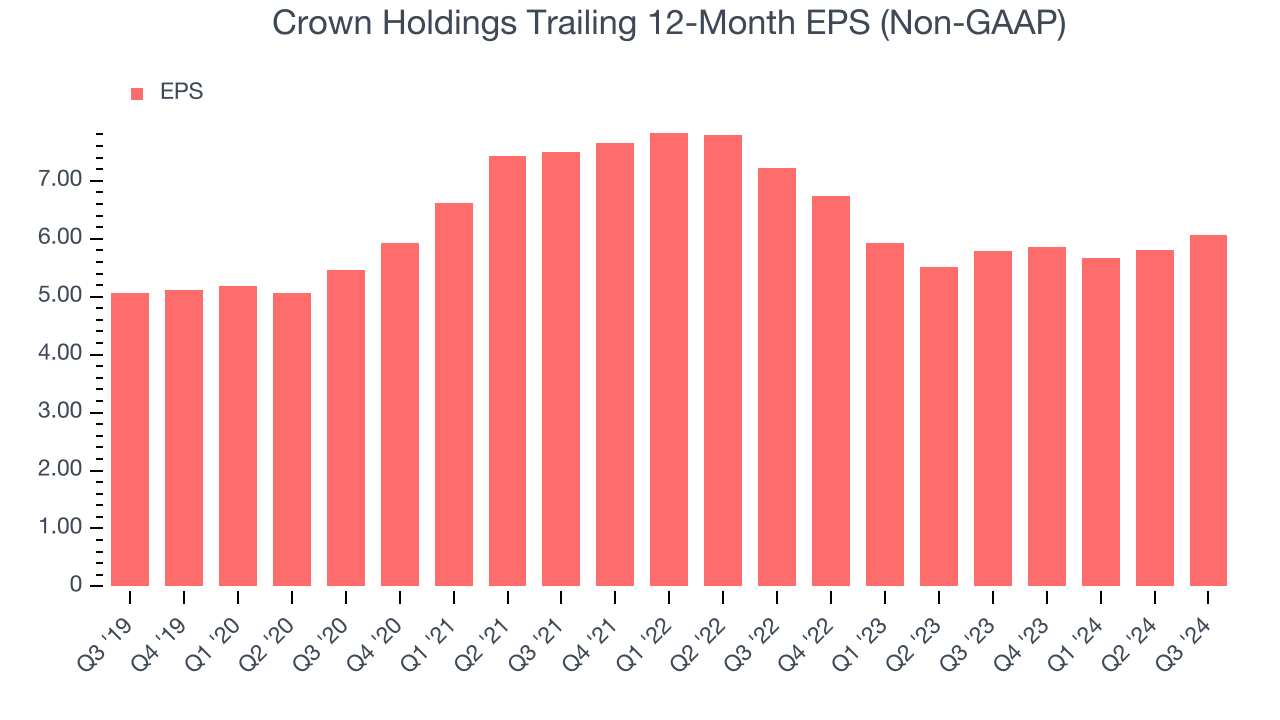

Earnings Per Share

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

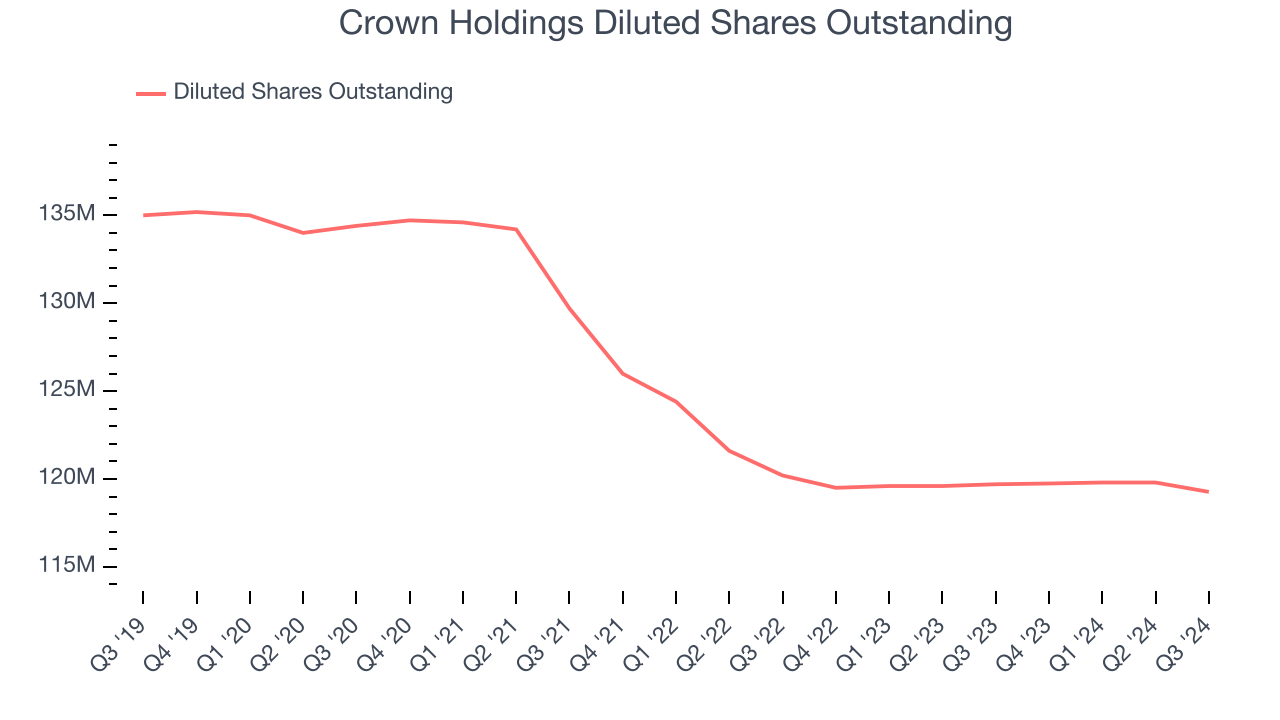

Crown Holdings’s EPS grew at a weak 3.7% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Diving into the nuances of Crown Holdings’s earnings can give us a better understanding of its performance. As we mentioned earlier, Crown Holdings’s operating margin expanded by 2.8 percentage points over the last five years. On top of that, its share count shrank by 11.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Crown Holdings, its two-year annual EPS declines of 8.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Crown Holdings reported EPS at $1.99, up from $1.73 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Crown Holdings’s full-year EPS of $6.06 to grow by 11%.

Key Takeaways from Crown Holdings’s Q3 Results

It was good to see Crown Holdings beat analysts’ EPS expectations this quarter. We were also glad it raised its full-year EPS guidance, exceeding Wall Street’s estimates. Overall, this quarter had some key positives. The stock remained flat at $94.70 immediately after reporting.

Crown Holdings put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.