Cruise ship company Carnival (NYSE:CCL) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 17.7% year on year to $5.78 billion. It made a non-GAAP profit of $0.11 per share, improving from its loss of $0.31 per share in the same quarter last year.

Is now the time to buy Carnival? Find out by accessing our full research report, it's free.

Carnival (CCL) Q2 CY2024 Highlights:

- Revenue: $5.78 billion vs analyst estimates of $5.69 billion (1.6% beat)

- EPS (non-GAAP): $0.11 vs analyst estimates of -$0.02 ($0.13 beat)

- Gross Margin (GAAP): 50.5%, up from 47.4% in the same quarter last year

- Free Cash Flow of $722 million is up from -$370 million in the previous quarter

- Passenger Cruise Days: 24.3 million, up 2.5 million year on year

- Market Capitalization: $20.5 billion

"We have made incredible strides in improving our commercial operations, strategically reallocating our portfolio composition and formulating growth plans, while strengthening even further our global team, the best in the business. Off the back of that effort, we closed yet another quarter delivering records, this time across revenues, operating income, customer deposits and booking levels, exceeding our guidance on every measure," commented Carnival Corporation & plc's Chief Executive Officer Josh Weinstein.

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

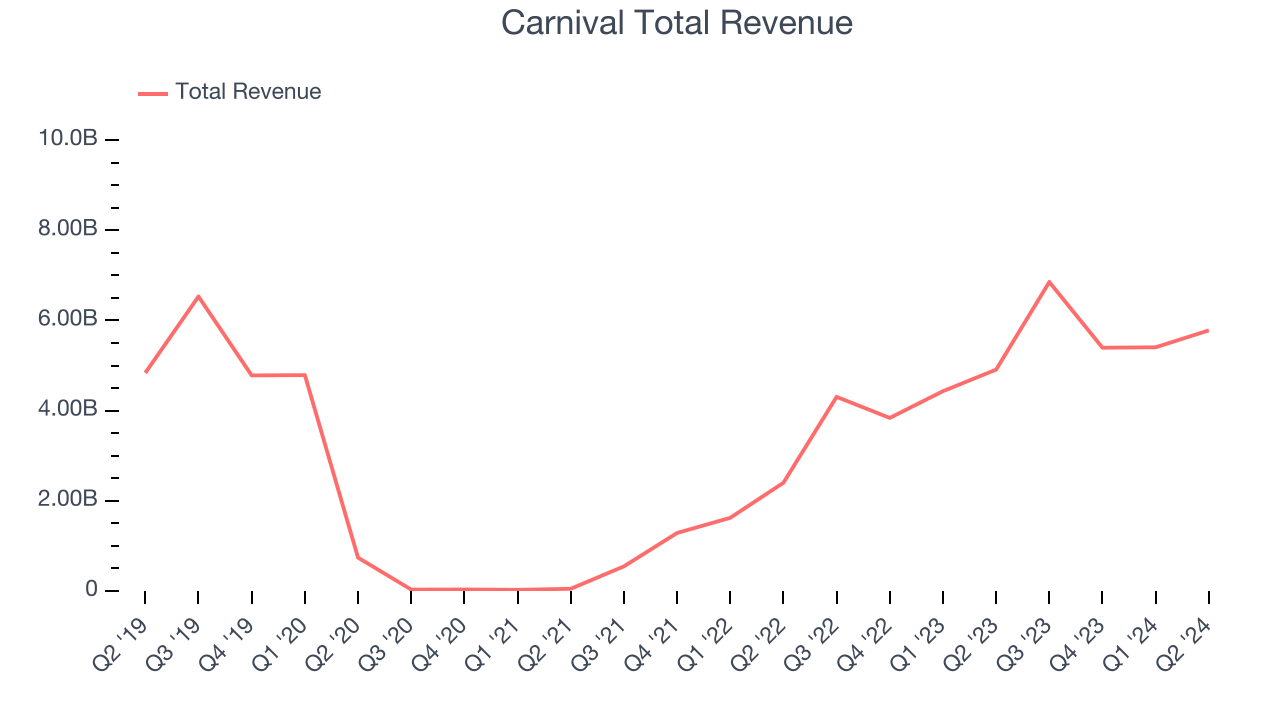

Sales Growth

A company’s long-term performance can indicate its business health. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Over the last five years, Carnival grew its sales at a weak 3.4% compounded annual growth rate. This shows it failed to expand its business in any major way.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Carnival's annualized revenue growth of 100% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Carnival's business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can dig further into the company's revenue dynamics by analyzing its number of passenger cruise days, which reached 24.3 million in the latest quarter. Over the last two years, Carnival's passenger cruise days averaged 168% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, Carnival reported robust year-on-year revenue growth of 17.7%, and its $5.78 billion of revenue exceeded Wall Street's estimates by 1.6%. Looking ahead, Wall Street expects sales to grow 7.7% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

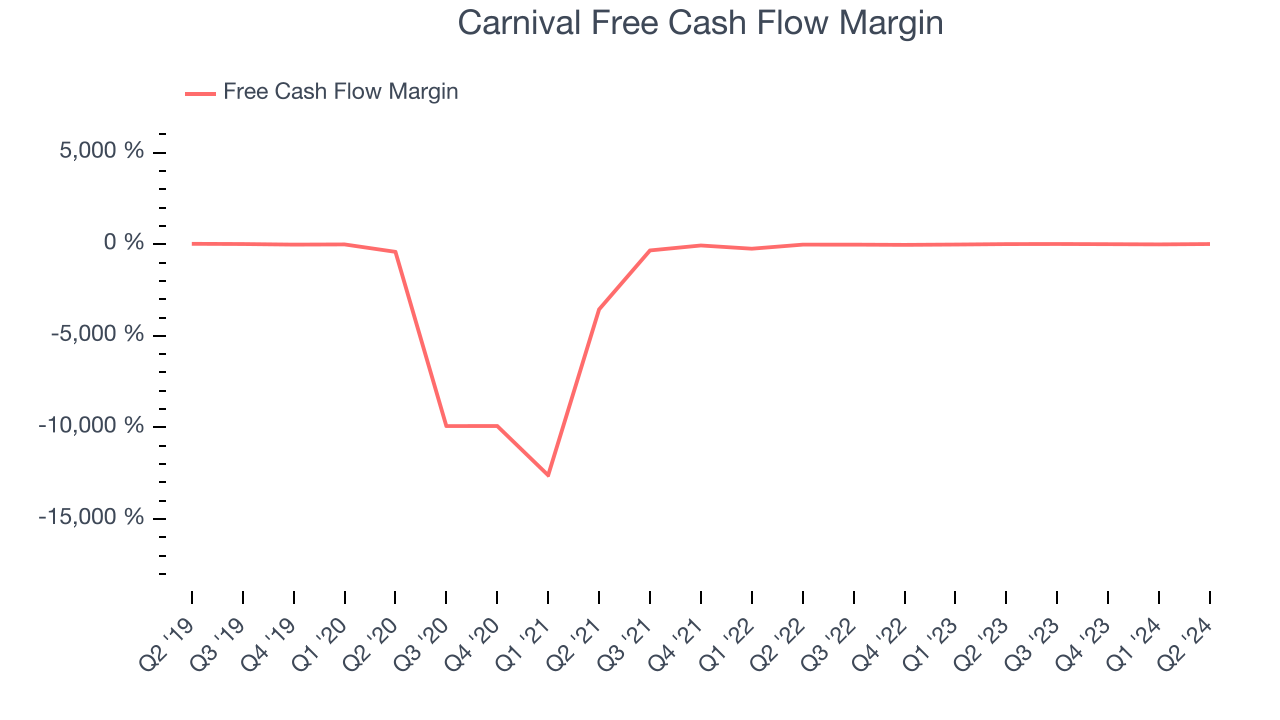

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

While Carnival posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Carnival's demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 2%.

Carnival's free cash flow clocked in at $722 million in Q2, equivalent to a 12.5% margin. This quarter's result was good as its margin was 3.5 percentage points higher than in the same quarter last year, but we wouldn't put too much weight on it because a business's working capital needs can be seasonal, causing quarter-to-quarter swings.

Key Takeaways from Carnival's Q2 Results

We were impressed by how significantly Carnival blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock traded up 4.1% to $17.07 immediately after reporting.

Carnival may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.