Looking back on hotels, resorts and cruise lines stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Carnival (NYSE:CCL) and its peers.

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 15 hotels, resorts and cruise lines stocks we track reported a mixed Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Stocks--especially those trading at higher multiples--had a strong end of 2023, but this year has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts. However, hotels, resorts and cruise lines stocks have held steady amidst all this with average share prices relatively unchanged since the latest earnings results.

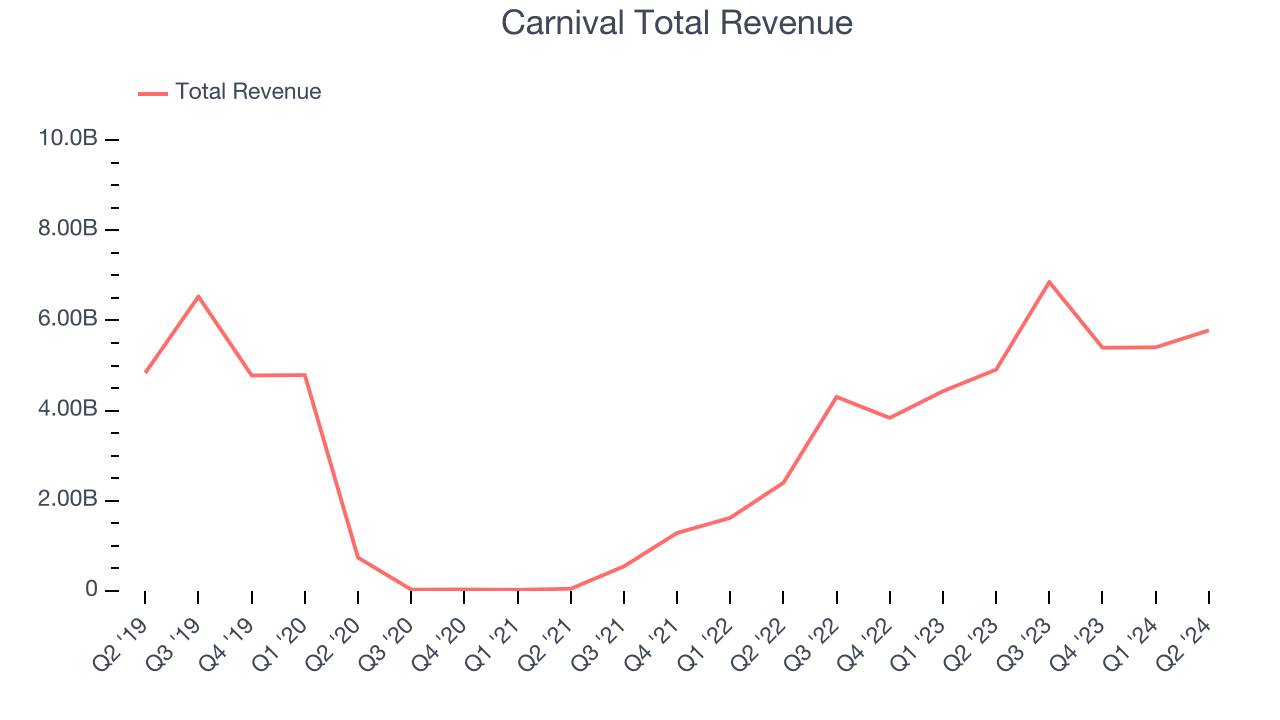

Best Q2: Carnival (NYSE:CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Carnival reported revenues of $5.78 billion, up 17.7% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ earnings estimates and an impressive beat of analysts’ operating margin estimates.

"We have made incredible strides in improving our commercial operations, strategically reallocating our portfolio composition and formulating growth plans, while strengthening even further our global team, the best in the business. Off the back of that effort, we closed yet another quarter delivering records, this time across revenues, operating income, customer deposits and booking levels, exceeding our guidance on every measure," commented Carnival Corporation & plc's Chief Executive Officer Josh Weinstein.

Unsurprisingly, the stock is down 1.9% since reporting and currently trades at $16.07.

Is now the time to buy Carnival? Access our full analysis of the earnings results here, it’s free.

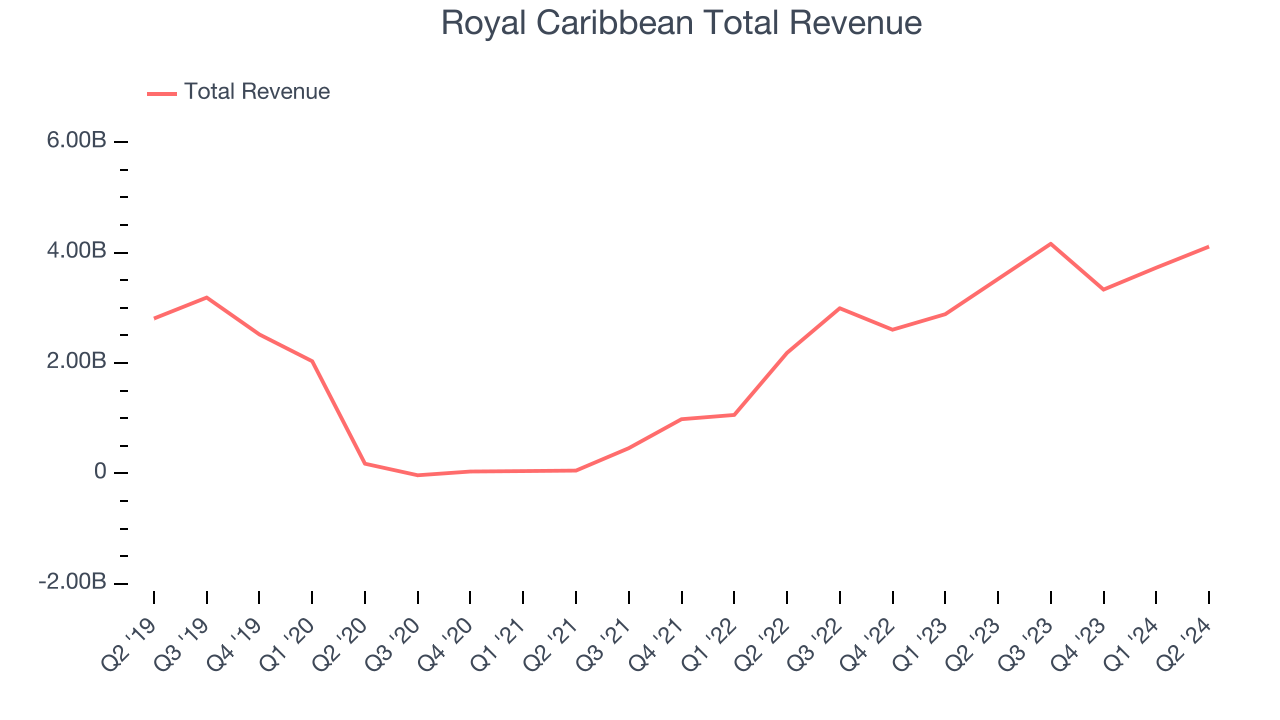

Royal Caribbean (NYSE:RCL)

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

Royal Caribbean reported revenues of $4.11 billion, up 16.7% year on year, outperforming analysts’ expectations by 1.6%. The business had a strong quarter with optimistic earnings guidance for the next quarter and a decent beat of analysts’ earnings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.7% since reporting. It currently trades at $160.25.

Is now the time to buy Royal Caribbean? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Marriott Vacations (NYSE:VAC)

Spun off from Marriott International in 1984, Marriott Vacations (NYSE:VAC) is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.14 billion, down 3.2% year on year, falling short of analysts’ expectations by 5.9%. It was a disappointing quarter as it posted underwhelming earnings guidance for the full year.

As expected, the stock is down 15.9% since the results and currently trades at $71.13.

Read our full analysis of Marriott Vacations’s results here.

Sabre (NASDAQ:SABR)

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $767.2 million, up 4% year on year. This result surpassed analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also recorded a decent beat of analysts’ earnings estimates.

Sabre scored the highest full-year guidance raise among its peers. The stock is down 15.7% since reporting and currently trades at $2.90.

Read our full, actionable report on Sabre here, it’s free.

Hilton Grand Vacations (NYSE:HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.24 billion, up 22.6% year on year. This number missed analysts’ expectations by 7.7%. Overall, it was a disappointing quarter as it also logged a miss of analysts’ earnings estimates.

Hilton Grand Vacations delivered the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 7.4% since reporting and currently trades at $35.75.

Read our full, actionable report on Hilton Grand Vacations here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.