Online payroll and human resource software provider Ceridian (NYSE:CDAY) will be announcing earnings results tomorrow after the bell. Here's what investors should know.

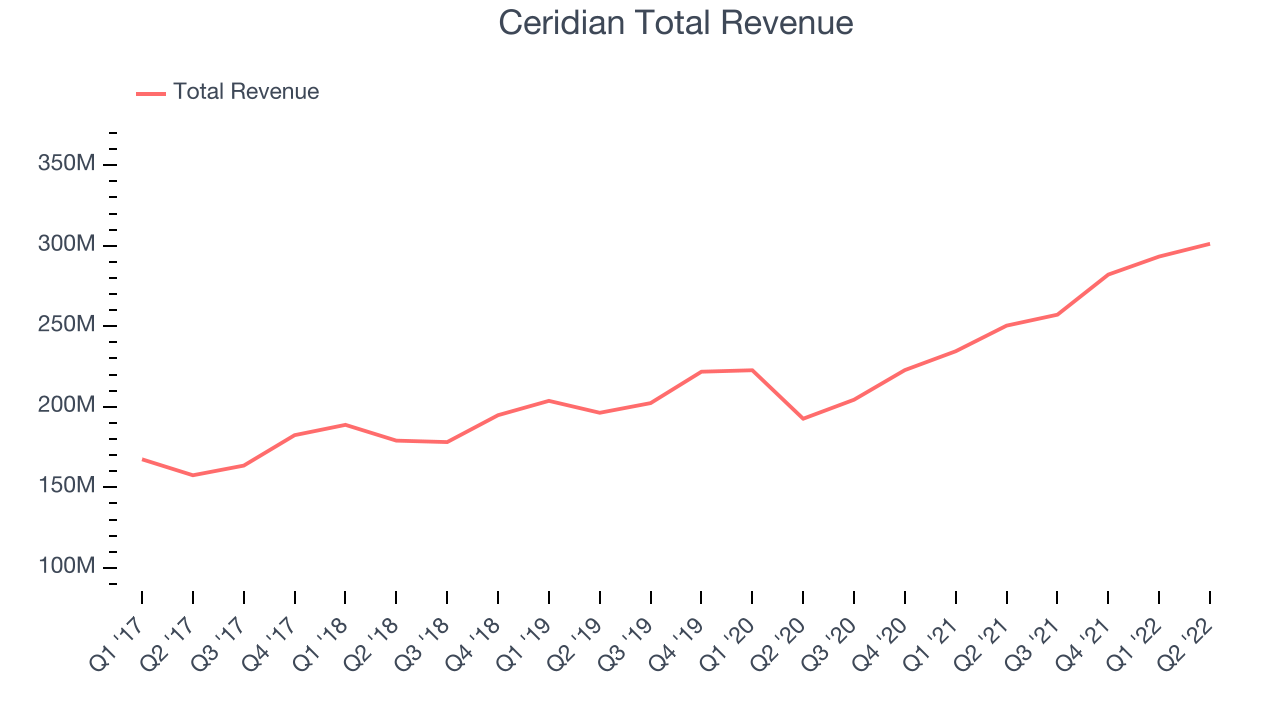

Last quarter Ceridian reported revenues of $301.2 million, up 20.2% year on year, beating analyst revenue expectations by 2.27%. It was a decent quarter for the company, with a significant improvement in gross margin but decelerating customer growth. The company added 119 customers to a total of 5,728.

Is Ceridian buy or sell heading into the earnings? Read our full analysis here, it's free.

This quarter analysts are expecting Ceridian's revenue to grow 18.8% year on year to $305.5 million, slowing down from the 25.8% year-over-year increase in revenue the company had recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.12 per share.

The analysts covering the company have been growing increasingly bearish about the business heading into the earnings, with revenue estimates seeing 2 downward revisions over the last thirty days. The company has a history of exceeding Wall St's expectations, beating revenue estimates every single time over the past two years on average by 2.78%.

With Ceridian being the first among its peers to report earnings this season, we don't have anywhere else to look at to get a hint at how this quarter will unravel for software stocks, but there has been positive sentiment among investors in the segment, with the stocks up on average 1.66 % over the last month. Ceridian is up 15.5% during the same time, and is heading into the earnings with analyst price target of $82.70, compared to share price of $66.19.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.