Hotel franchisor Choice Hotels (NYSE:CHH) fell short of analysts' expectations in Q2 CY2024, with revenue up 1.8% year on year to $435.2 million. It made a non-GAAP profit of $1.84 per share, improving from its profit of $1.75 per share in the same quarter last year.

Is now the time to buy Choice Hotels? Find out by accessing our full research report, it's free.

Choice Hotels (CHH) Q2 CY2024 Highlights:

- Revenue: $435.2 million vs analyst estimates of $438.2 million (small miss)

- EPS (non-GAAP): $1.84 vs analyst expectations of $1.85 (in line)

- EPS (non-GAAP) guidance for the full year is $6.53 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 95.2%, in line with the same quarter last year

- EBITDA Margin: 37.2%, up from 35.8% in the same quarter last year

- Free Cash Flow of $71.09 million is up from -$31.04 million in the previous quarter

- RevPAR: $60 at quarter end, up 15.5% year on year

- Market Capitalization: $5.92 billion

"Choice Hotels generated another quarter of record financial performance amid a normalizing domestic RevPAR environment, demonstrating the strength of our versatile business model and proven growth strategy," said Patrick Pacious, President and Chief Executive Officer.

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE:CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

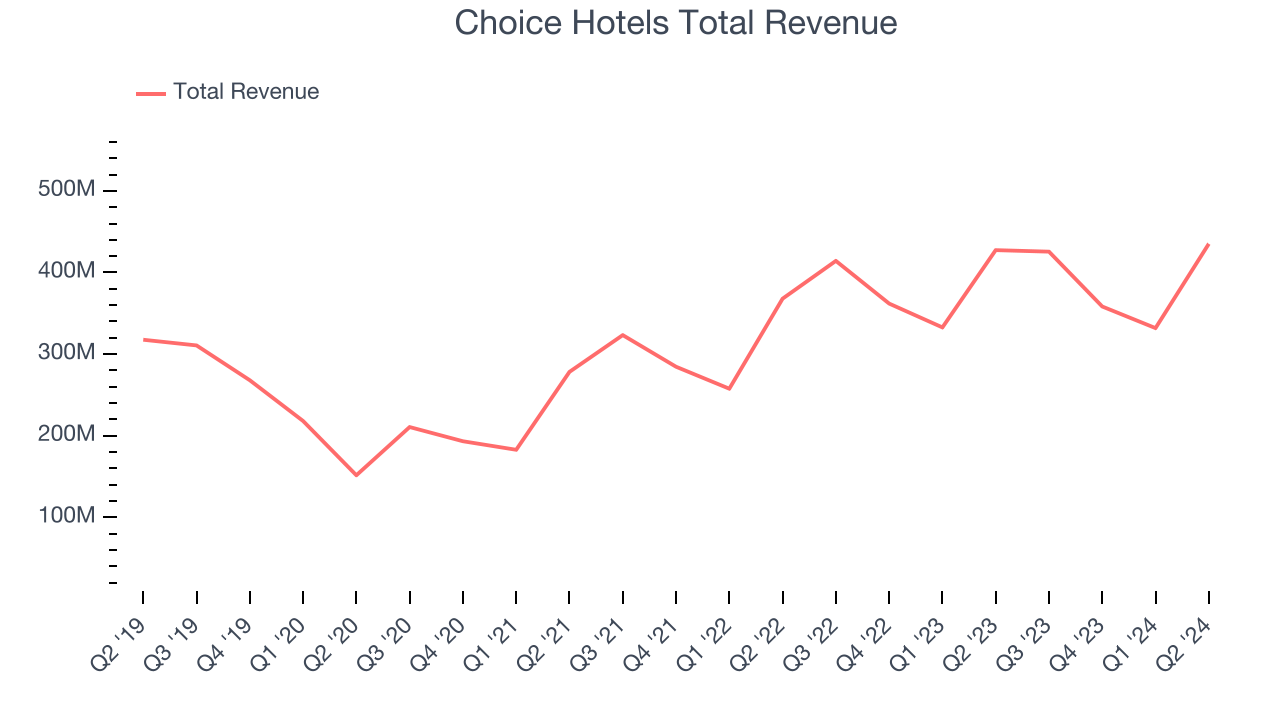

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, Choice Hotels grew its sales at a weak 7.7% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Choice Hotels's annualized revenue growth of 12.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can better understand the company's revenue dynamics by analyzing its revenue per available room, which clocked in at $60 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Choice Hotels's revenue per room averaged 7.5% year-on-year growth. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings.

This quarter, Choice Hotels's revenue grew 1.8% year on year to $435.2 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.9% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

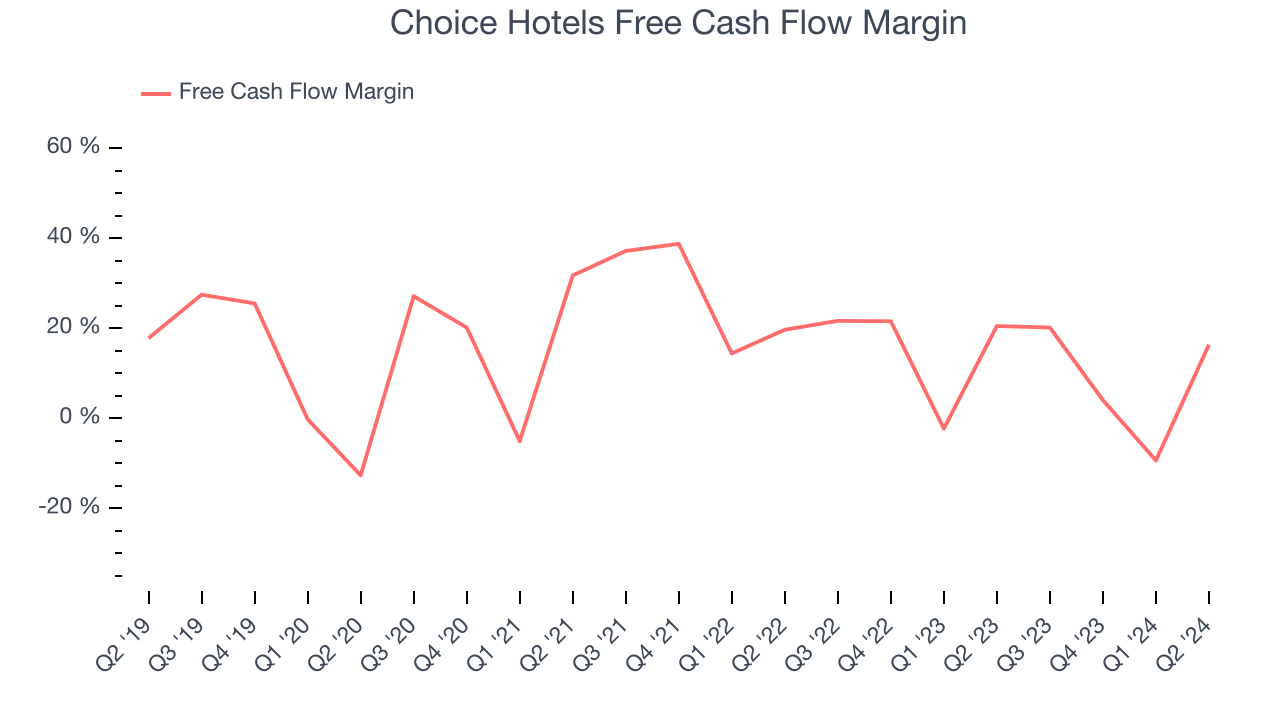

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Choice Hotels has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company's free cash flow margin averaged 12.6% over the last two years, slightly better than the broader consumer discretionary sector.

Choice Hotels's free cash flow clocked in at $71.09 million in Q2, equivalent to a 16.3% margin. The company's cash profitability regressed as it was 4.2 percentage points lower than in the same quarter last year, but it's still above its two-year average. We wouldn't read too much into this quarter's decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Choice Hotels's Q2 Results

EPS in the quarter was in line, as was full year guidance for EPS. This shows that the company is on track. The stock traded up 1% to $125.25 immediately after reporting.

So should you invest in Choice Hotels right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.