Hotel franchisor Choice Hotels (NYSE:CHH) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $331.9 million. It made a non-GAAP profit of $1.28 per share, improving from its profit of $1.12 per share in the same quarter last year.

Choice Hotels (CHH) Q1 CY2024 Highlights:

- Revenue: $331.9 million vs analyst estimates of $343 million (3.2% miss)

- EPS (non-GAAP): $1.28 vs analyst estimates of $1.14 (12.7% beat)

- Gross Margin (GAAP): 94.2%, in line with the same quarter last year

- Free Cash Flow was -$31.04 million, down from $14.49 million in the previous quarter

- RevPAR: $45.24, down 5.9% year on year

- Market Capitalization: $6.07 billion

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE:CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Other brands in the company's portfolio include well-known names such as Comfort Suites, Sleep Inn, Cambria Hotels, MainStay Suites, Suburban Extended Stay Hotel, WoodSpring Suites, Econo Lodge, and Rodeway Inn. Each of these banners is designed to offer unique experiences to meet the varying needs of travelers, from upscale to economy lodging. This range allows Choice Hotels to serve a broad spectrum of customers including leisure travelers seeking affordable accommodations and business professionals requiring premium services.

Choice Hotels's franchise model allows for expansion and market penetration without needing to front capital to build its properties. Franchisees benefit from the company's strong brand recognition, robust marketing campaigns, and comprehensive support services, including training, reservation systems, and customer loyalty programs.

Choice Hotels is known for its Choice Privileges loyalty program, which incentivizes frequent travelers with benefits and rewards, enhancing customer loyalty and satisfaction. This program is a critical component of the company’s strategy to attract and retain customers in a competitive market.

The global presence of Choice Hotels is marked by its properties in over 40 countries and territories. This international footprint allows the company to capitalize on tourism and business travel worldwide.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Choice Hotels's primary competitors include Marriott International (NASDAQ:MAR), Hilton Worldwide Holdings (NYSE:HLT), InterContinental Hotels Group PLC (NYSE:IHG), Wyndham Hotels & Resorts (NYSE:WH), and private company Best Western Hotels & Resorts.Sales Growth

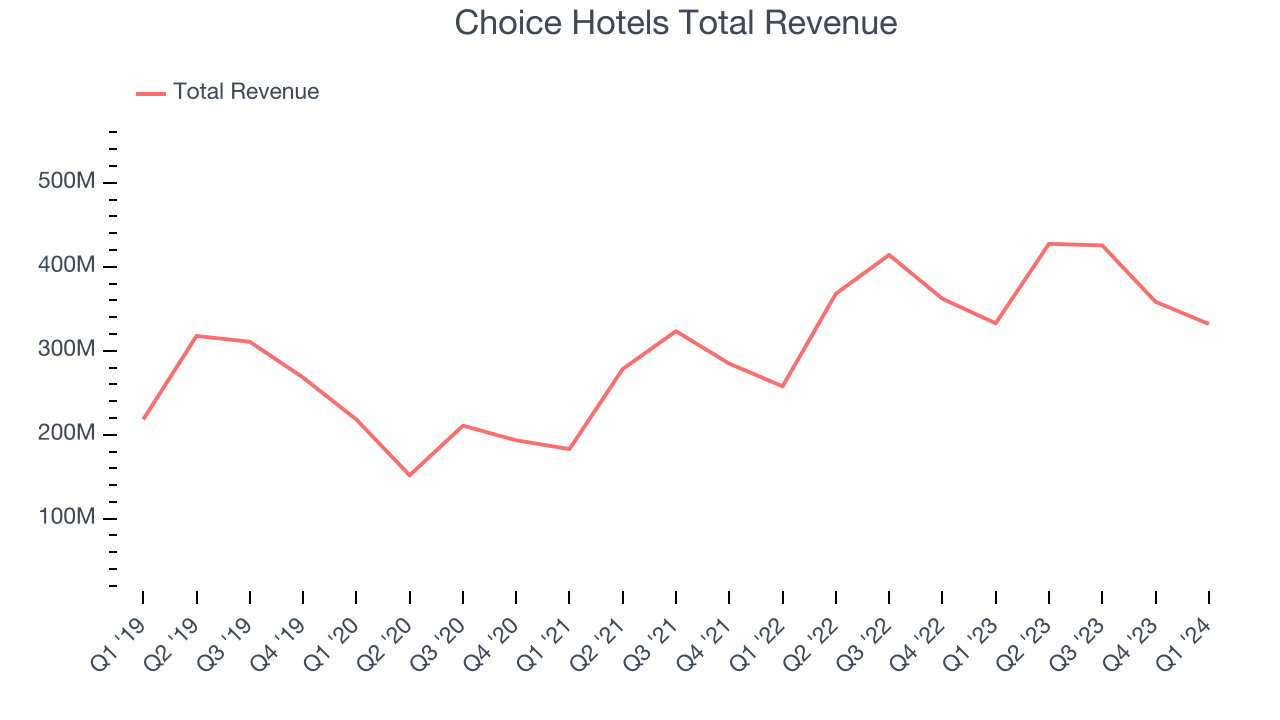

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Choice Hotels's annualized revenue growth rate of 8% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Choice Hotels's annualized revenue growth of 16.1% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig even further into the company's revenue dynamics by analyzing its revenue per available room, which clocked in at $45.24 this quarter and is a key metric accounting for average daily rates and occupancy levels. Over the last two years, Choice Hotels's revenue per room averaged 7.3% year-on-year growth. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings.

This quarter, Choice Hotels missed Wall Street's estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $331.9 million of revenue. Looking ahead, Wall Street expects sales to grow 4.6% over the next 12 months, an acceleration from this quarter.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Choice Hotels has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer discretionary business, boasting an average operating margin of 27%.In Q1, Choice Hotels generated an operating profit margin of 18.1%, down 5.3 percentage points year on year.

Over the next 12 months, Wall Street expects Choice Hotels to become more profitable. Analysts are expecting the company’s LTM operating margin of 23.2% to rise to 30%.EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Choice Hotels's EPS grew 54.6%, translating into an unimpressive 9.1% compounded annual growth rate. This performance, however, is higher than its 8% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

A five-year view shows that Choice Hotels has repurchased its stock, shrinking its share count by 10.1%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Choice Hotels reported EPS at $1.28, up from $1.12 in the same quarter last year. This print beat analysts' estimates by 12.7%. Over the next 12 months, Wall Street expects Choice Hotels to grow its earnings. Analysts are projecting its LTM EPS of $6.31 to climb by 2.9% to $6.49.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Choice Hotels has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 12.9%, slightly better than the broader consumer discretionary sector.

Choice Hotels burned through $31.04 million of cash in Q1, equivalent to a negative 9.3% margin, reducing its cash burn by 312% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Choice Hotels hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 28.7%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Choice Hotels's ROIC averaged 2.7 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Choice Hotels reported $42.11 million of cash and $1.81 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $558.4 million of EBITDA over the last 12 months, we view Choice Hotels's 3.2x net-debt-to-EBITDA ratio as safe. We also see its $62.27 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Choice Hotels's Q1 Results

It was good to see Choice Hotels beat analysts' EPS expectations this quarter. On the other hand, its revenue fell short of Wall Street's estimates as its domestic revenue per available room (RevPAR) decreased 5.9% year on year. Looking ahead, it lowered its full-year adjusted net income guidance, though its EPS outlook was unchanged because the decline in net income is projected to be offset by share repurchases. Lastly, the company announced it will re-open its Park Inn by Radisson brand in Q3 of this year. Overall, the results could have been better. The stock is flat after reporting and currently trades at $122.14 per share.

Is Now The Time?

Choice Hotels may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Choice Hotels, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its impressive operating margins show it has a highly efficient business model, the downside is its revenue per room has been disappointing. On top of that, its projected EPS for the next year is lacking.

Choice Hotels's price-to-earnings ratio based on the next 12 months is 18.8x. While there are some things to like about Choice Hotels and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $128.08 per share right before these results (compared to the current share price of $122.14).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.