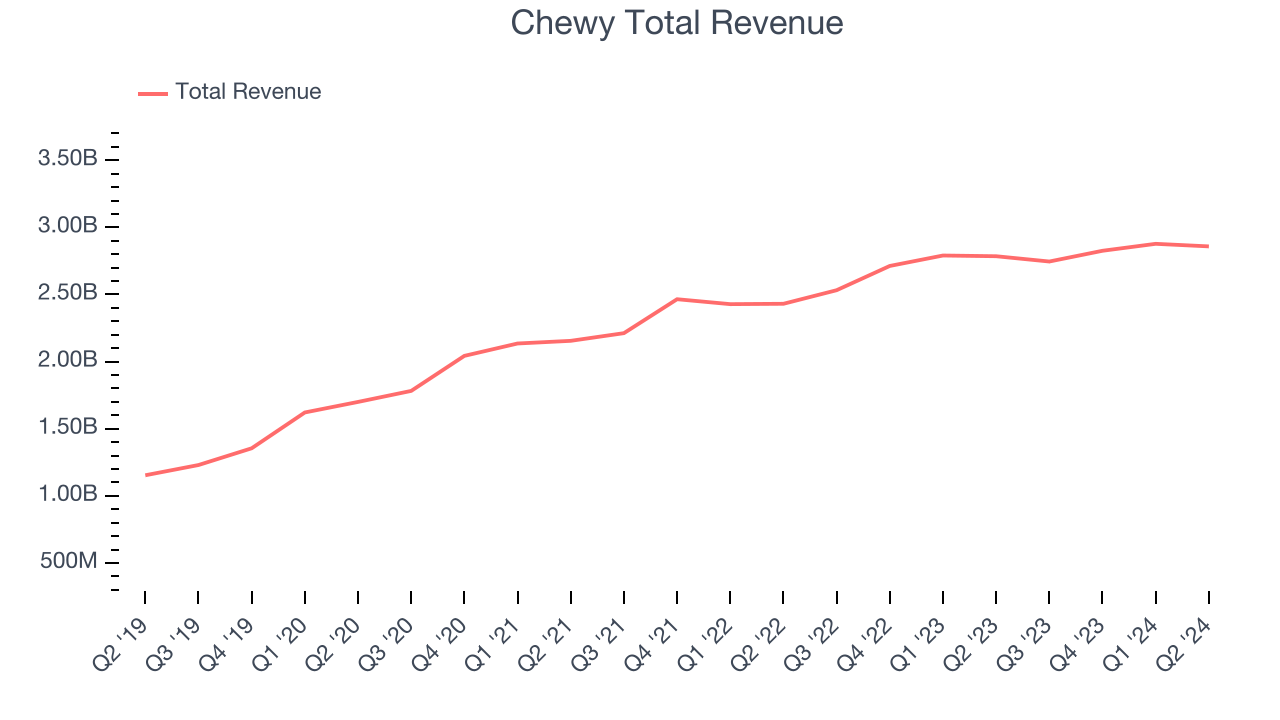

E-commerce pet food and supplies retailer Chewy (NYSE:CHWY) reported results in line with analysts’ expectations in Q2 CY2024, with revenue up 2.6% year on year to $2.86 billion. It made a non-GAAP profit of $0.24 per share, improving from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Chewy? Find out by accessing our full research report, it’s free.

Chewy (CHWY) Q2 CY2024 Highlights:

- Revenue: $2.86 billion vs analyst estimates of $2.86 billion (small beat)

- EPS (non-GAAP): $0.24 vs analyst estimates of $0.21 (14.1% beat)

- Gross Margin (GAAP): 29.5%, up from 28.5% in the same quarter last year

- EBITDA Margin: 5.1%, up from 3.2% in the same quarter last year

- Free Cash Flow Margin: 3.2%, up from 1.8% in the previous quarter

- Market Capitalization: $11.27 billion

Founded by Ryan Cohen who later became known for his involvement in GameStop, Chewy (NYSE: CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Sales Growth

Chewy’s revenue growth over the last three years has been unremarkable, averaging 12% annually. This quarter, Chewy reported lacklustre 2.6% year-on-year revenue growth, in line with analysts’ expectations.

Ahead of the earnings results, analysts were projecting sales to grow 7.1% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Chewy’s Q2 Results

It was great to see Chewy beat analysts' revenue and EPS expectations this quarter. We were also glad its EBITDA margin increased year on year. The stock traded up 1.7% to $26.25 immediately following the results.

So should you invest in Chewy right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.