Consumer products company Colgate-Palmolive (NYSE:CL) reported Q1 CY2024 results topping analysts' expectations, with revenue up 6.2% year on year to $5.07 billion. It made a non-GAAP profit of $0.86 per share, improving from its profit of $0.73 per share in the same quarter last year.

Colgate-Palmolive (CL) Q1 CY2024 Highlights:

- Revenue: $5.07 billion vs analyst estimates of $4.96 billion (2.1% beat)

- EPS (non-GAAP): $0.86 vs analyst estimates of $0.81 (5.8% beat)

- Full year 2024 guidance: organic sales growth guidance to 5% to 7% (versus 3% to 5% previously) (above expectations of 4.8%)

- Gross Margin (GAAP): 60%, up from 56.9% in the same quarter last year

- Free Cash Flow of $555 million, down 40.9% from the previous quarter

- Organic Revenue was up 9.8% year on year (above expectations of up 5.1%)

- Sales Volumes were up 1.3% year on year

- Market Capitalization: $73.4 billion

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

Following the merger, Colgate-Palmolive engaged in further acquisitions and divestitures to build out and optimize its brand portfolio. In addition to the namesake brands, the company also goes to market with Irish Spring (soap), Softsoap (soap), Speed Stick (deodorant), Ajax (household cleaner), and Hill’s (pet food) among other brands.

Colgate-Palmolve primarily targets middle-income shoppers. These consumers are looking for trusted brands since the products will be used on themselves, their family members, and in their own homes. They also want cost-effective products, although many are willing to pay a reasonable premium to buy established brands rather than lesser-known or private-label brands.

It’s not hard to find (or smell your way to) Colgate-Palmolive’s products in stores. Places such as grocery stores, mass retailers, drug stores, and specialty stores are the most common sellers of the company’s products. Given Colgate-Palmolive’s scale and traffic-driving brands, the company often enjoys prominent placement on retailers' shelves.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Competitors that offer a wide range of household and personal care products include Proctor & Gamble (NYSE:PG), Unilever (LSE:ULVR), and Church & Dwight (NYSE:CHD).Sales Growth

Colgate-Palmolive is one of the largest consumer staples companies and benefits from a strong brand, giving it customer trust and leverage in many purchasing and distribution negotiations.

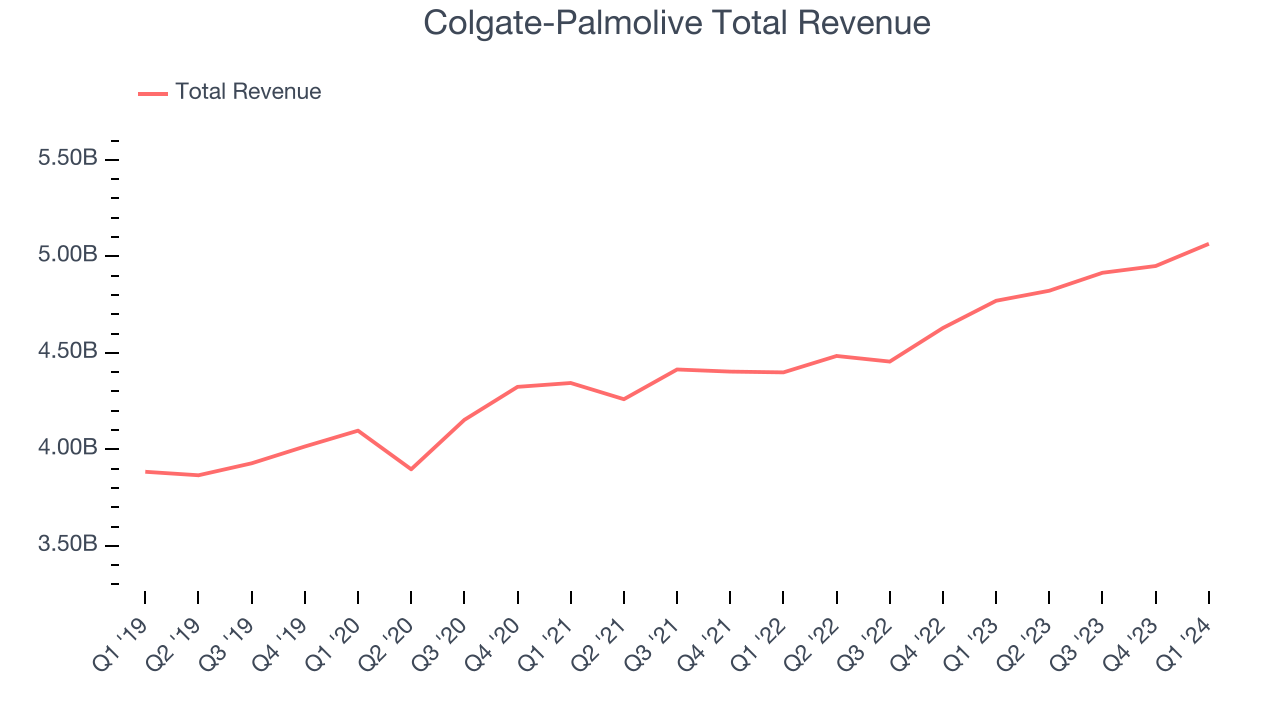

As you can see below, the company's annualized revenue growth rate of 5.7% over the last three years was mediocre as consumers bought less of its products. We'll explore what this means in the "Volume Growth" section.

This quarter, Colgate-Palmolive reported solid year-on-year revenue growth of 6.2%, and its $5.07 billion in revenue outperformed Wall Street's estimates by 2.1%. Looking ahead, Wall Street expects sales to grow 3.1% over the next 12 months, a deceleration from this quarter.

Volume Growth

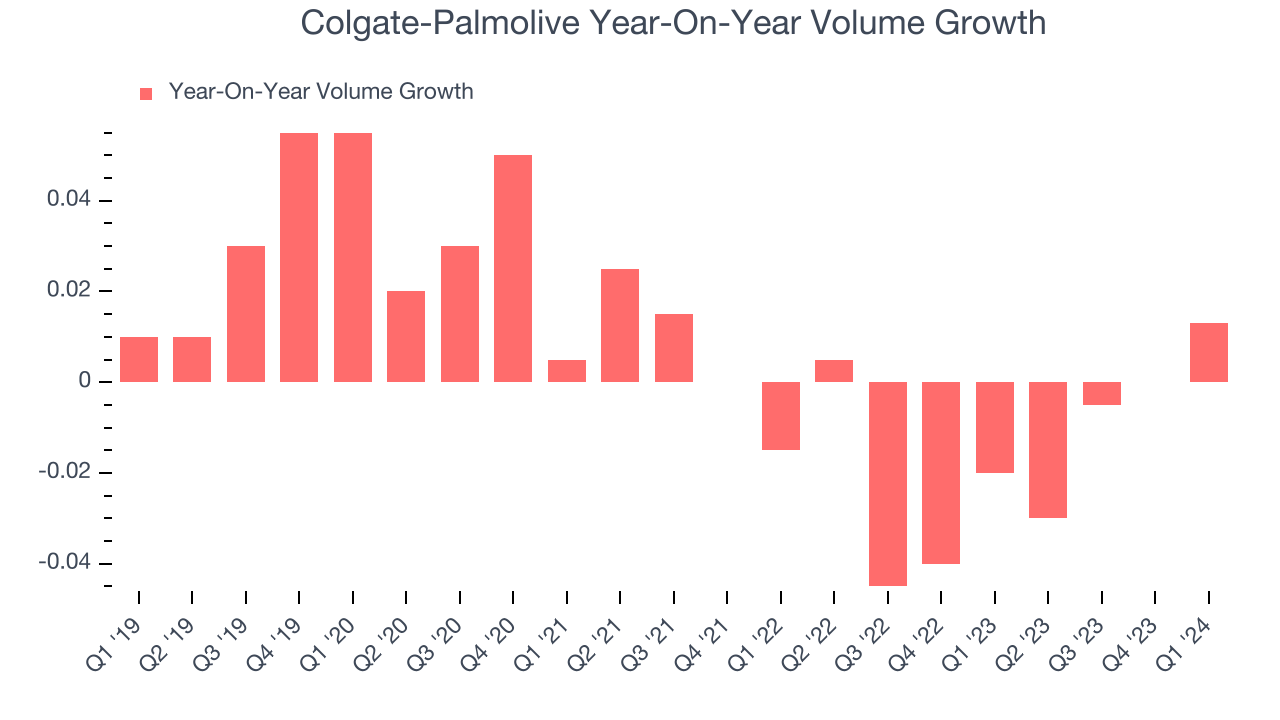

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Colgate-Palmolive generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Colgate-Palmolive's average quarterly sales volumes have shrunk by 1.5%. This decrease isn't ideal as the quantity demanded for consumer staples products is typically stable. Luckily, Colgate-Palmolive was able to offset fewer customers purchasing its products by charging higher prices, enabling it to generate 8.5% average organic revenue growth. We hope the company can grow its volumes soon, however, as consistent price increases (on top of inflation) aren't sustainable over the long term unless the business is really really special.

In Colgate-Palmolive's Q1 2024, sales volumes jumped 1.3% year on year. This result was a well-appreciated turnaround from the 2% year-on-year decline it posted 12 months ago, showing the company is heading in the right direction.

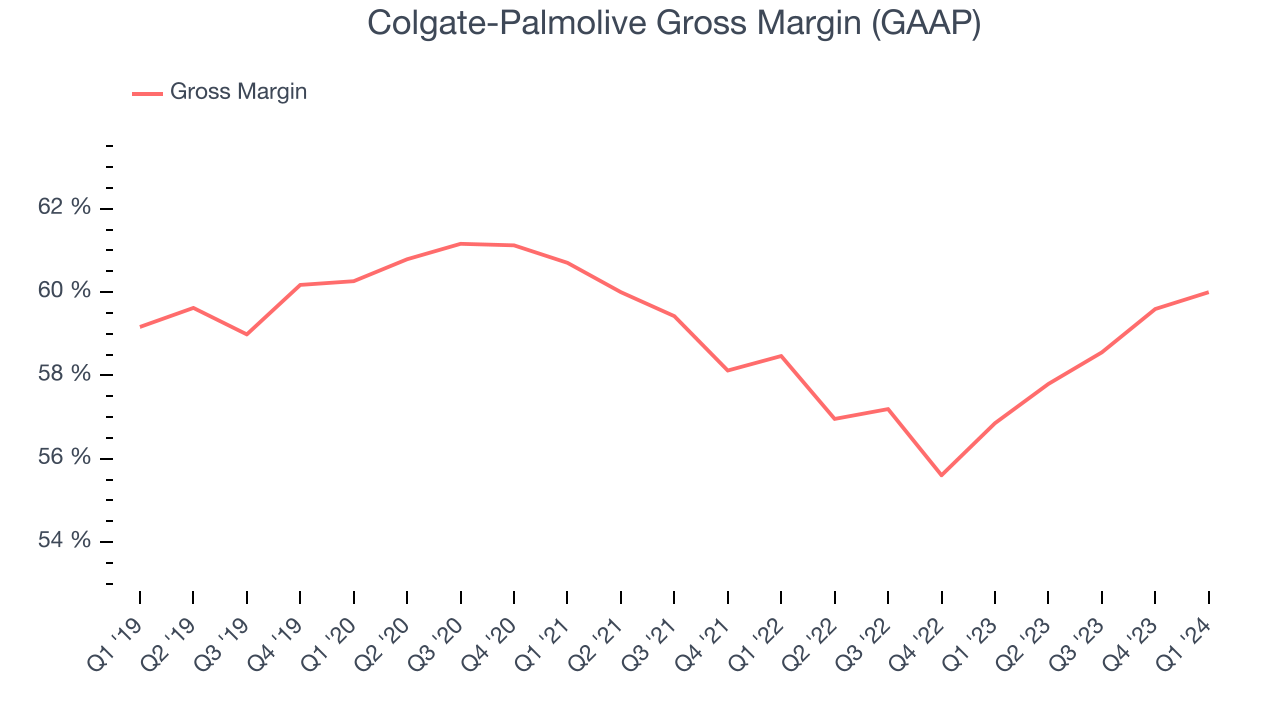

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

This quarter, Colgate-Palmolive's gross profit margin was 60%, up 3.1 percentage points year on year. That means for every $1 in revenue, $0.40 went towards paying for raw materials, production of goods, and distribution expenses.

Colgate-Palmolive has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 57.9% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 4.1% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

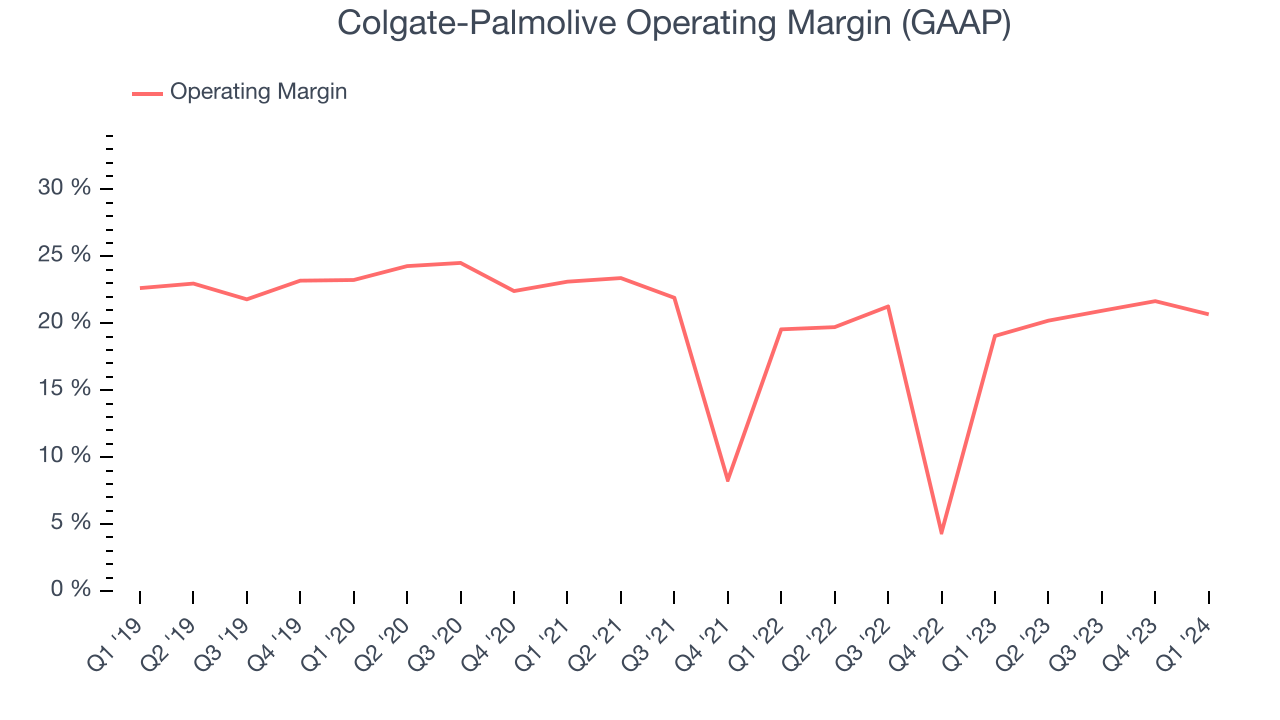

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Colgate-Palmolive generated an operating profit margin of 20.7%, up 1.6 percentage points year on year. This increase was solid and driven by stronger pricing power and lower raw materials/transportation costs, as indicated by the company's larger rise in gross margin.

Zooming out, Colgate-Palmolive has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.5%. On top of that, its margin has improved by 4.8 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Colgate-Palmolive has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.5%. On top of that, its margin has improved by 4.8 percentage points on average over the last year, a great sign for shareholders. EPS

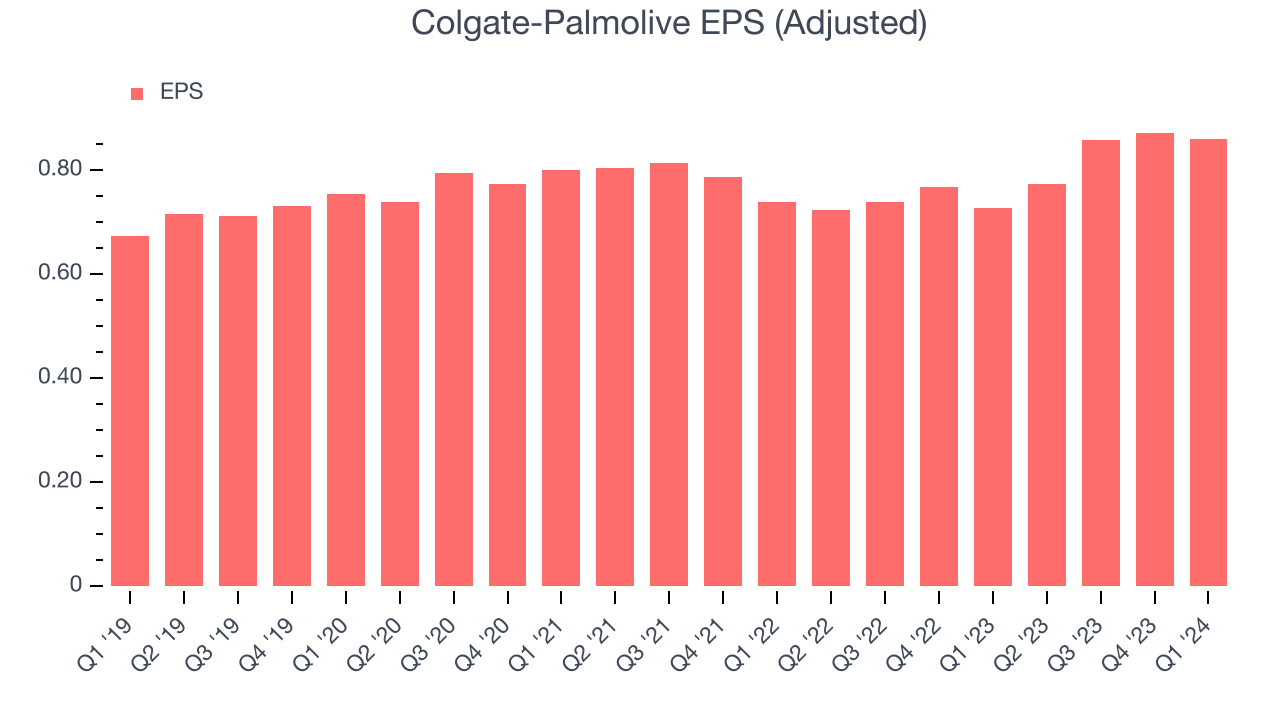

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Colgate-Palmolive reported EPS at $0.86, up from $0.73 in the same quarter a year ago. This print beat Wall Street's estimates by 5.8%.

Between FY2021 and FY2024, Colgate-Palmolive's EPS grew 8.3%, translating into an unimpressive 2.7% compounded annual growth rate.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 6.1% year-on-year increase in EPS.

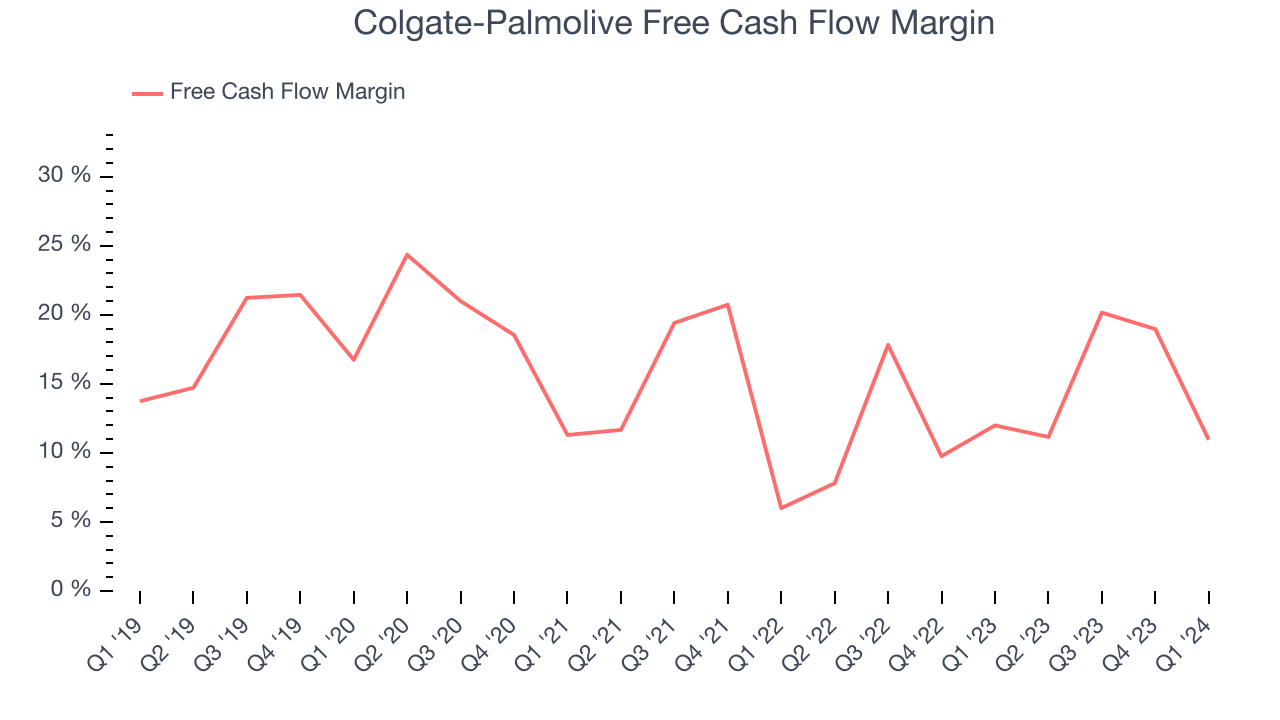

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Colgate-Palmolive's free cash flow came in at $555 million in Q1, in line with the same quarter last year. This result represents a 11% free cash flow margin.

Over the last eight quarters, Colgate-Palmolive has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the consumer staples sector, averaging 13.6%. Furthermore, its margin has averaged year-on-year increases of 3.5 percentage points over the last 12 months. This likely pleases the company's investors.

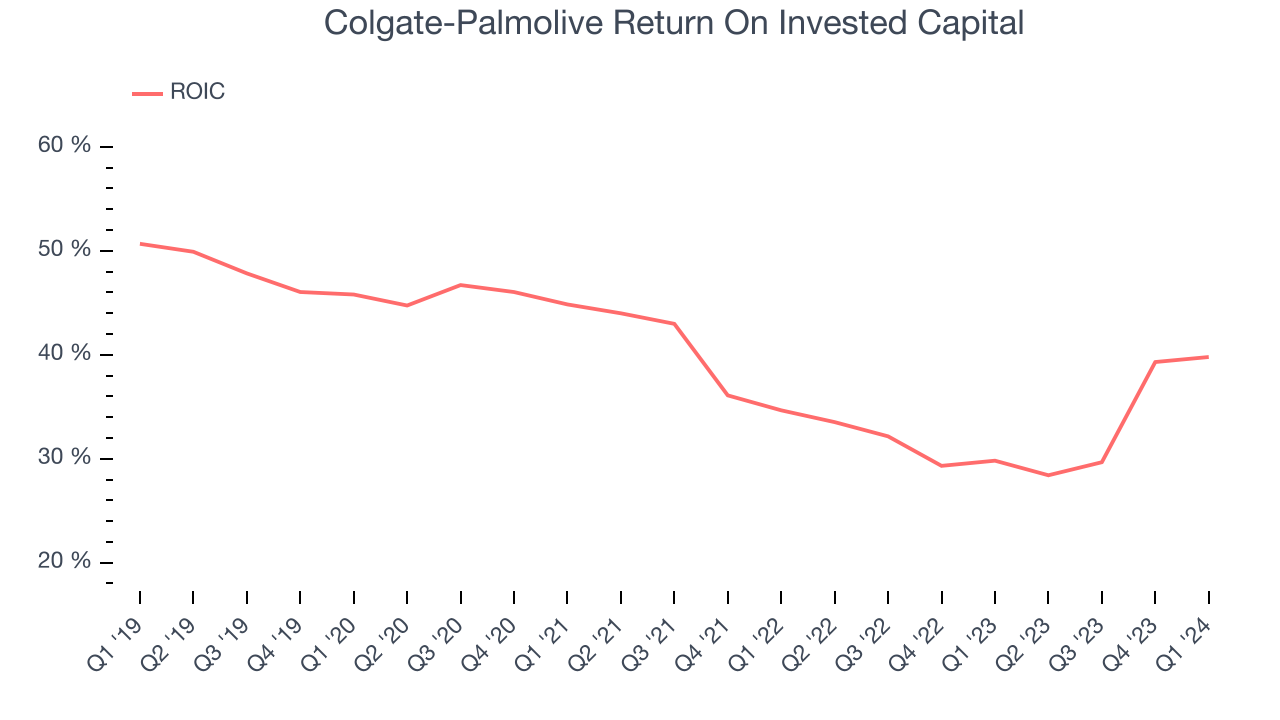

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Colgate-Palmolive's five-year average ROIC was 39%, placing it among the best consumer staples companies. Just as you’d like your investment dollars to generate returns, Colgate-Palmolive's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Colgate-Palmolive's ROIC averaged 10.5 percentage point decreases over the last few years. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Colgate-Palmolive reported $1.08 billion of cash and $8.69 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $4.73 billion of EBITDA over the last 12 months, we view Colgate-Palmolive's 1.6x net-debt-to-EBITDA ratio as safe. We also see its $120 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Colgate-Palmolive's Q1 Results

We were impressed by how significantly Colgate-Palmolive blew past analysts' organic revenue growth expectations this quarter. We were also glad its revenue and EPS outperformed Wall Street's estimates. Looking ahead, the company raised its full year organic revenue growth guidance, which at the midpoint was above expectations. Overall, we think this was a really good quarter that should please shareholders. The stock is up 2.9% after reporting and currently trades at $91.89 per share.

Is Now The Time?

Colgate-Palmolive may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Colgate-Palmolive is a great business. Although its revenue growth has been a little slower over the last three years with analysts expecting growth to slow from here, its stellar ROIC suggests it has been a well-run company historically. On top of that, its scale gives it immense negotiating leverage with retailers.

Colgate-Palmolive's price-to-earnings ratio based on the next 12 months is 25.0x. Looking at the consumer staples landscape today, Colgate-Palmolive's qualities stand out and we still like it at this price.

Wall Street analysts covering the company had a one-year price target of $92.11 per share right before these results (compared to the current share price of $91.89).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.