Consumer products giant Clorox (NYSE:CLX) fell short of analysts' expectations in Q1 CY2024, with revenue down 5.3% year on year to $1.81 billion. It made a non-GAAP profit of $1.71 per share, improving from its profit of $1.51 per share in the same quarter last year.

Clorox (CLX) Q1 CY2024 Highlights:

- Revenue: $1.81 billion vs analyst estimates of $1.87 billion (3% miss)

- EPS (non-GAAP): $1.71 vs analyst estimates of $1.38 (24% beat)

- Full year 2024 organic revenue growth : lowered to the low end of the previous range, which was "down low single digit" percentages year on year

- Full year 2024 EPS (non-GAAP) guidance: $5.88 at the midpoint (raised from previous) vs analyst estimates of $5.62 (4.5% beat)

- Gross Margin (GAAP): 42.2%, up from 41.8% in the same quarter last year

- Organic Revenue was up 2% year on year

- Market Capitalization: $18.48 billion

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Clorox bleach is still a powerhouse home care brand used to clean, disinfect, and whiten. However, the company now also boasts Glad garbage bags, Burt’s Bees skincare products, Kingsford charcoal for grilling, and Fresh Step kitty litter to name a few. These brands are both household mainstays as well as innovators that help steer the direction of these categories. For example, Glad was one of the first garbage bags to feature drawstrings, making the bags easier to tie, lift, and carry.

Clorox’s core customer is typically someone who makes purchases for the household. These consumers seek trusted brands that are convenient to find and get the job done. While price matters, Clorox usually doesn’t have to be the cheapest option, as many are willing to pay a reasonable premium to buy established brands rather than lesser-known or private-label brands.

As a consumer goods giant, Clorox products can be found in many retail stores. Grocery stores, mass merchandisers like Walmart (NYSE:WMT), warehouse clubs like Costco (NASDAQ:COST), dollar stores like Dollar General (NYSE:DG), and drug stores like CVS (NYSE:CVS) all carry the company’s offerings.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Competitors that offer a wide range of household and personal care products include Proctor & Gamble (NYSE:PG), Unilever (LSE:ULVR), Reckitt Benckiser (LSE:RKT), and Colgate-Palmolive (NYSE:CL).Sales Growth

Clorox is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

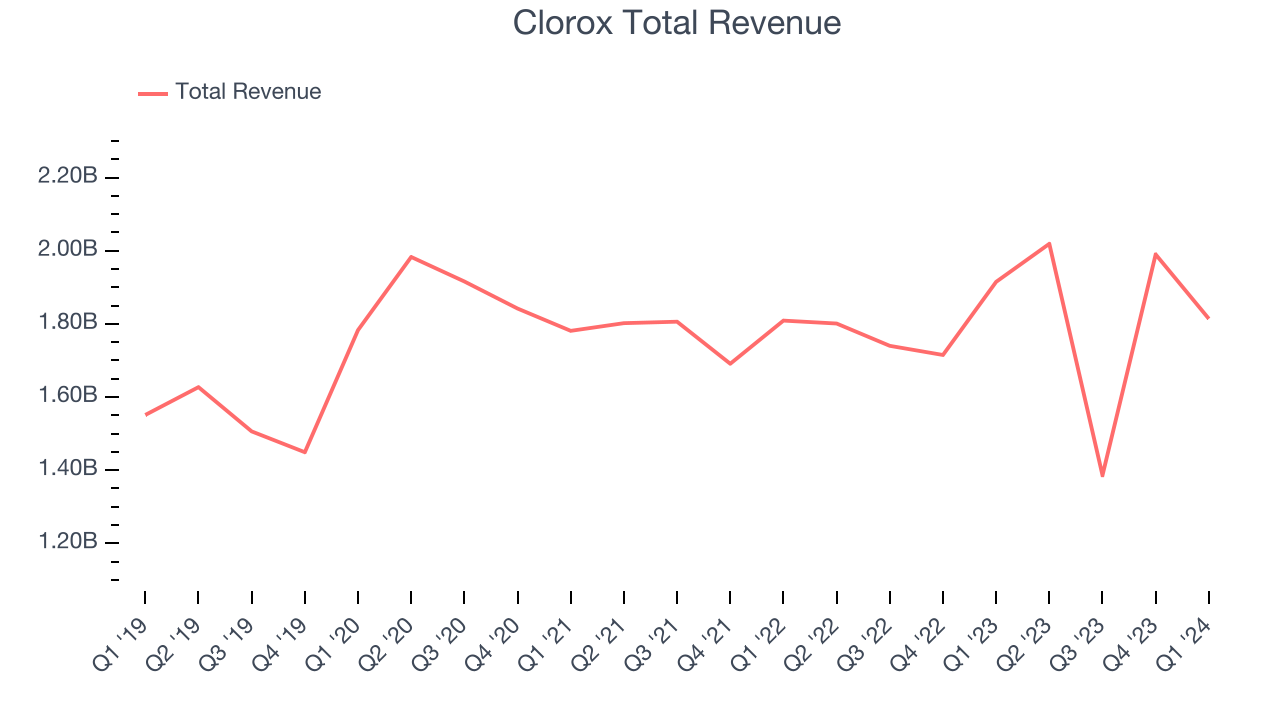

As you can see below, the company's revenue has declined over the last three years, dropping 1.4% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Clorox missed Wall Street's estimates and reported a rather uninspiring 5.3% year-on-year revenue decline, generating $1.81 billion in revenue. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

Organic Revenue Growth

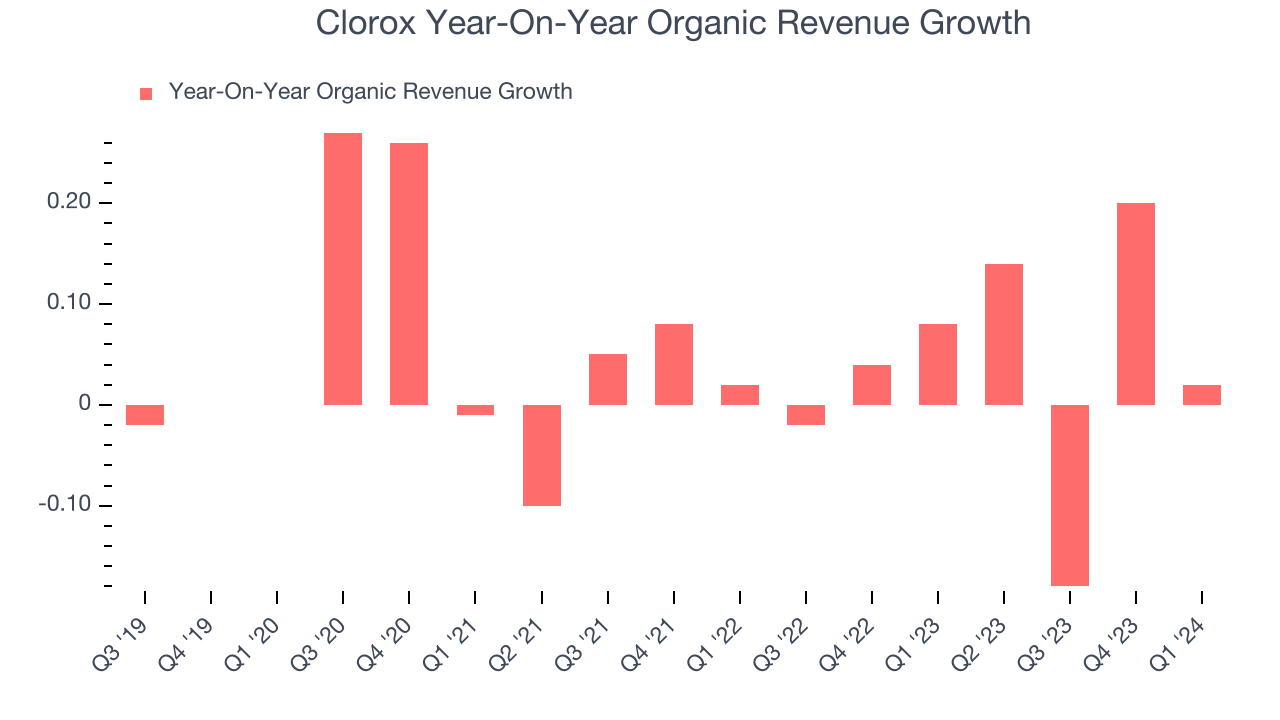

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Clorox's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 4% year on year.

In the latest quarter, Clorox's organic sales rose 2% year on year. By the company's standards, this growth was a meaningful deceleration from the 8% year-on-year increase it posted 12 months ago. We'll be watching Clorox closely to see if it can reaccelerate growth.

Gross Margin & Pricing Power

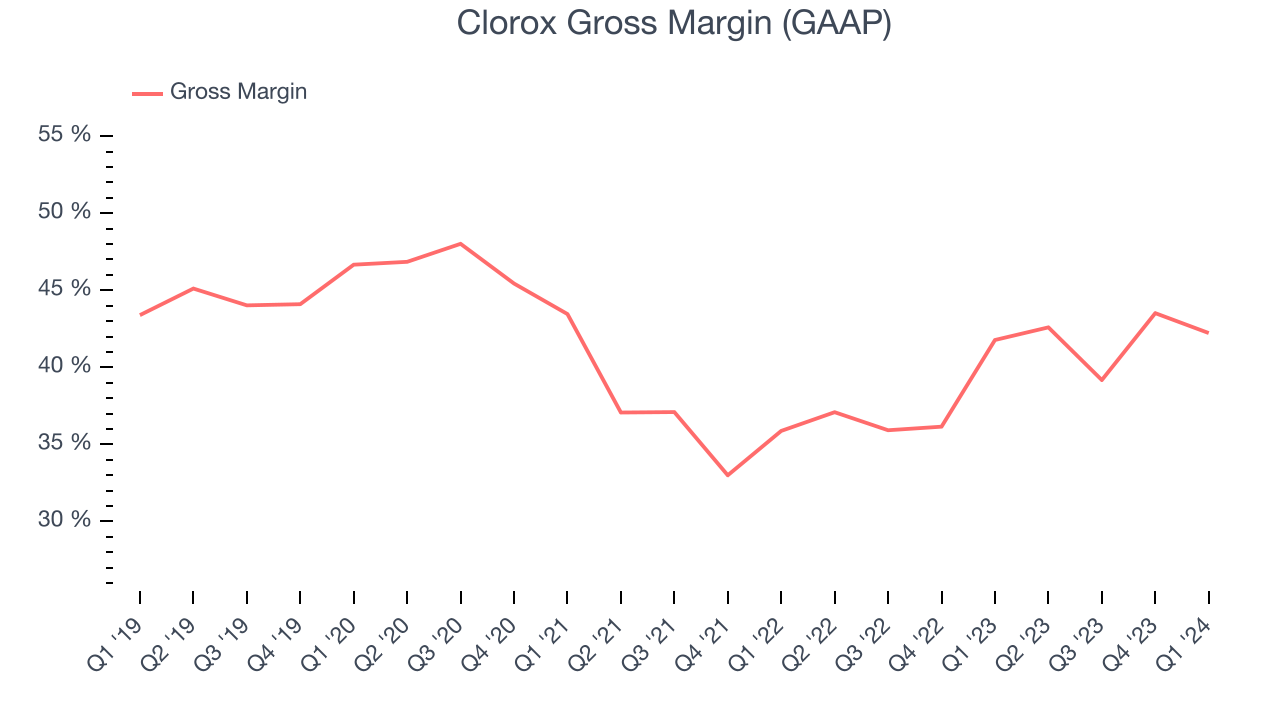

All else equal, we prefer higher gross margins. They usually indicate that a company sells more differentiated products and commands stronger pricing power.

Clorox's gross profit margin came in at 42.2% this quarter, in line with the same quarter last year. That means for every $1 in revenue, $0.58 went towards paying for raw materials, production of goods, and distribution expenses.

Clorox has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 40% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 11.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Clorox generated an operating profit margin of negative 1.2%, down 14 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, Clorox has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9.4%, higher than the broader consumer staples sector. However, Clorox's margin has slightly declined by 1.3 percentage points on average over the last year. This shows the company has faced some small speed bumps along the way.

This quarter, a loss related to divestiture (a one-time, non-recurring charge) is negatively impacting GAAP operating profit.

EPS

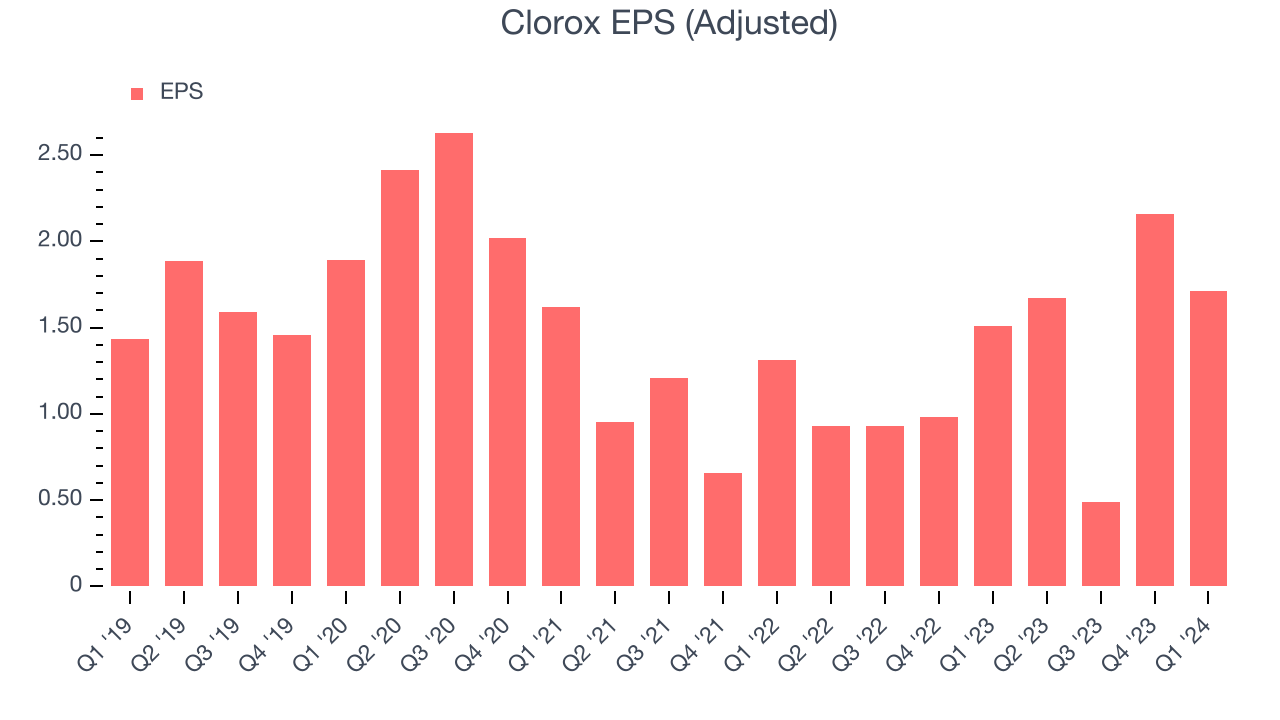

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Clorox reported EPS at $1.71, up from $1.51 in the same quarter a year ago. This print beat Wall Street's estimates by 24%.

Between FY2021 and FY2024, Clorox's EPS dropped 30.6%, translating into 11.4% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 3.3% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Clorox hasn't been the highest-quality company lately because of its poor top-line performance, it historically did an excellent job investing in profitable business initiatives. Its five-year average ROIC was 22.5%, impressive for a consumer staples company.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Clorox's ROIC averaged 5.3 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Clorox's Q1 Results

We enjoyed seeing Clorox exceed analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its organic revenue unfortunately missed analysts' expectations and its operating margin missed Wall Street's estimates. While EPS guidance was favorable as mentioned, the company actually lowered its full year organic revenue growth outlook. Overall, the results could have been better. The company is down 2.3% on the results and currently trades at $144.5 per share.

Is Now The Time?

Clorox may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Clorox, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its market-beating ROIC suggests it has been a well-managed company historically, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its projected EPS for the next year is lacking.

Clorox's price-to-earnings ratio based on the next 12 months is 23.7x. While we've no doubt one can find things to like about Clorox, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $154.05 per share right before these results (compared to the current share price of $144.50).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.