Mexican fast-food chain Chipotle (NYSE:CMG) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 14.1% year on year to $2.70 billion. It made a non-GAAP profit of $13.37 per share, improving from its profit of $10.50 per share in the same quarter last year.

Chipotle (CMG) Q1 CY2024 Highlights:

- Revenue: $2.70 billion vs analyst estimates of $2.67 billion (1.2% beat)

- EPS (non-GAAP): $13.37 vs analyst estimates of $11.68 (14.5% beat)

- Gross Margin (GAAP): 41.7%, up from 41% in the same quarter last year

- Free Cash Flow of $436.5 million, up from $93.53 million in the previous quarter

- Same-Store Sales were up 7% year on year (beat vs. expectations of up 5% year on year)

- Full year guidance for "comparable restaurant sales growth in the mid to high-single digit range" (raised from previous guide of mid-single digit, analyst estimates are for up 5.9% year on year)

- Store Locations: 3,479 at quarter end, increasing by 255 over the last 12 months

- Market Capitalization: $80.07 billion

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE:CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

The company was founded in 1993 by Steve Ells, a classically trained chef, who recognized a gap in the market for fast food that didn’t compromise on taste or quality. To execute this vision, Chipotle exclusively uses top-notch ingredients like responsibly raised meats and organic produce in its burritos, bowls, tacos, and salads.

At its restaurants, each customer has the freedom to craft their meal exactly to their liking, choosing from a range of proteins, salsas, and toppings. This allows for endless combinations, ensuring that every visit to Chipotle is unique and tailored. It’s a personalized dining experience that other fast-food competitors simply don’t offer.

The average Chipotle store is designed with an open kitchen layout, allowing customers to witness the food preparation process firsthand. The assembly line-style setup ensures efficiency as customers move along, selecting their desired ingredients and watching as their creation comes to life.

In response to the digital age, Chipotle has established a strong online presence. The company's website and mobile app offer seamless ordering options, providing features such as real-time tracking, exclusive offers, and the convenience of skipping the line.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Some fast-food competitors with similar concepts include CAVA (NYSE:CAVA), Noodles & Company (NASDAQ:NDLS), Potbelly (NASDAQ:PBPB), and Sweetgreen (NYSE:SG).Sales Growth

Chipotle is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

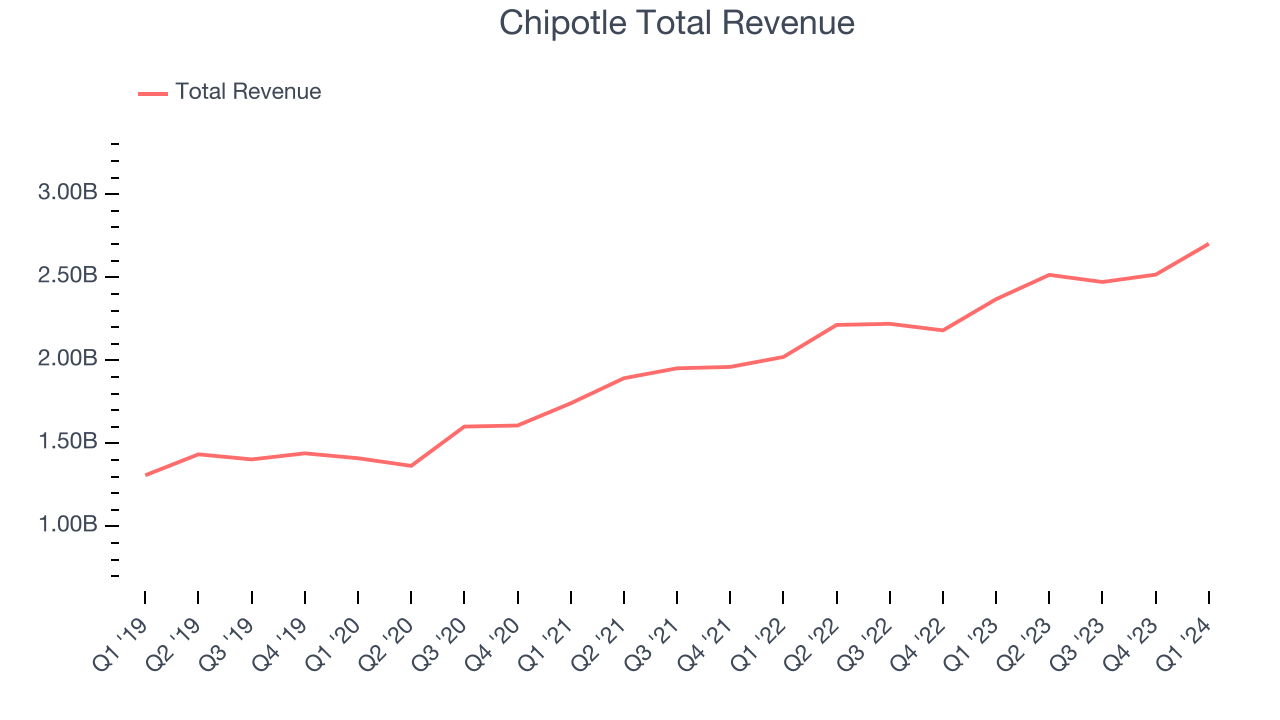

As you can see below, the company's annualized revenue growth rate of 15.2% over the last five years was impressive as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Chipotle reported robust year-on-year revenue growth of 14.1%, and its $2.70 billion in revenue exceeded Wall Street's estimates by 1.2%. Looking ahead, Wall Street expects sales to grow 13.6% over the next 12 months, a deceleration from this quarter.

Same-Store Sales

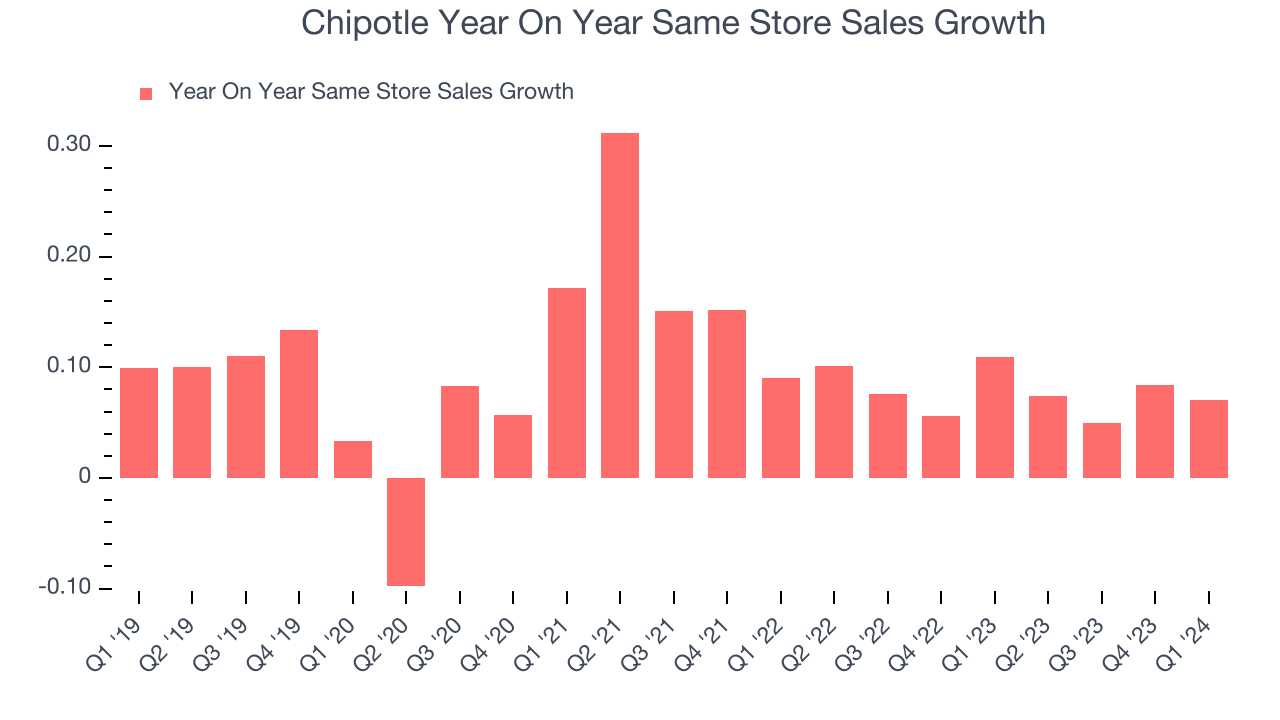

Chipotle's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 7.8% year on year. With positive same-store sales growth amid an increasing number of restaurants, Chipotle is reaching more diners and growing sales.

In the latest quarter, Chipotle's same-store sales rose 7% year on year. This growth was a deceleration from the 10.9% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Number of Stores

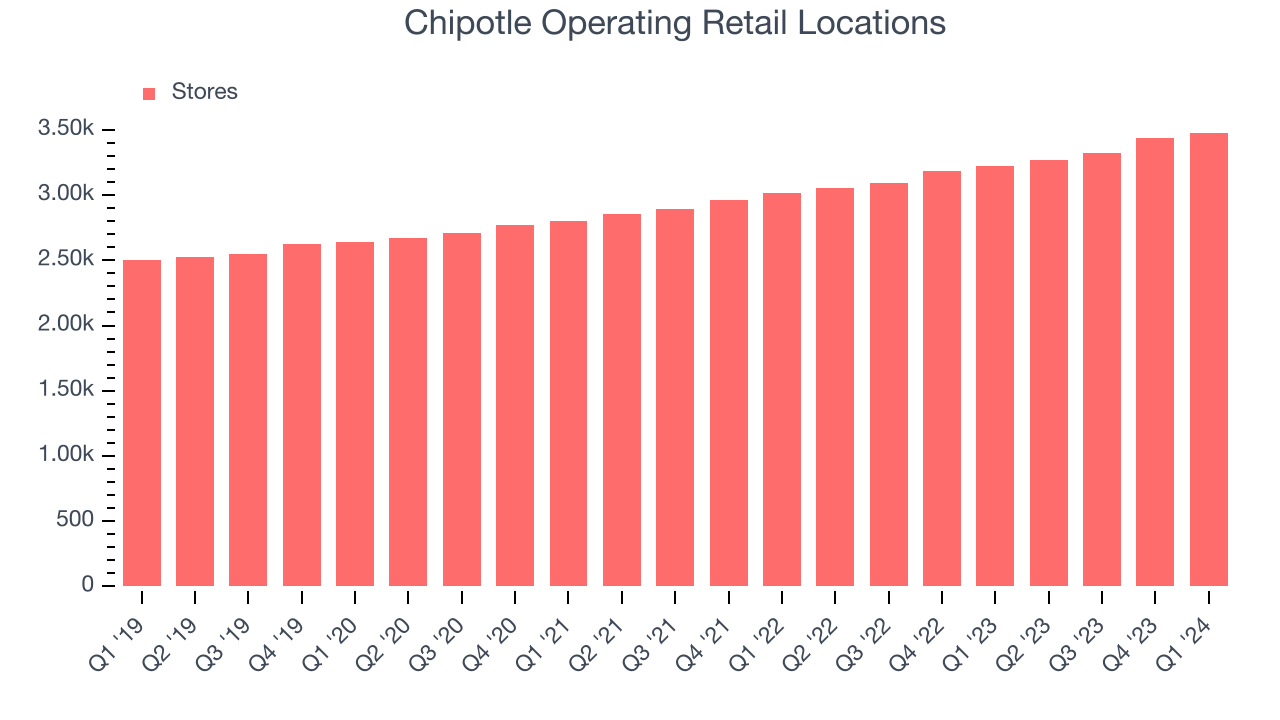

When a chain like Chipotle is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Chipotle's restaurant count increased by 255, or 7.9%, to 3,479 locations in the most recently reported quarter.

Taking a step back, Chipotle has rapidly opened new restaurants over the last eight quarters, averaging 7.3% annual increases in new locations. This growth is much higher than other restaurant businesses. Analyzing a restaurant's location growth is important because expansion means Chipotle has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

In Q1, Chipotle's gross profit margin was 41.7%. in line with the same quarter last year. This means the company makes $0.40 for every $1 in revenue before accounting for its operating expenses.

Chipotle has great unit economics for a restaurant company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 40.5% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 2.2% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more stable input costs (such as ingredients and transportation expenses).

Operating Margin

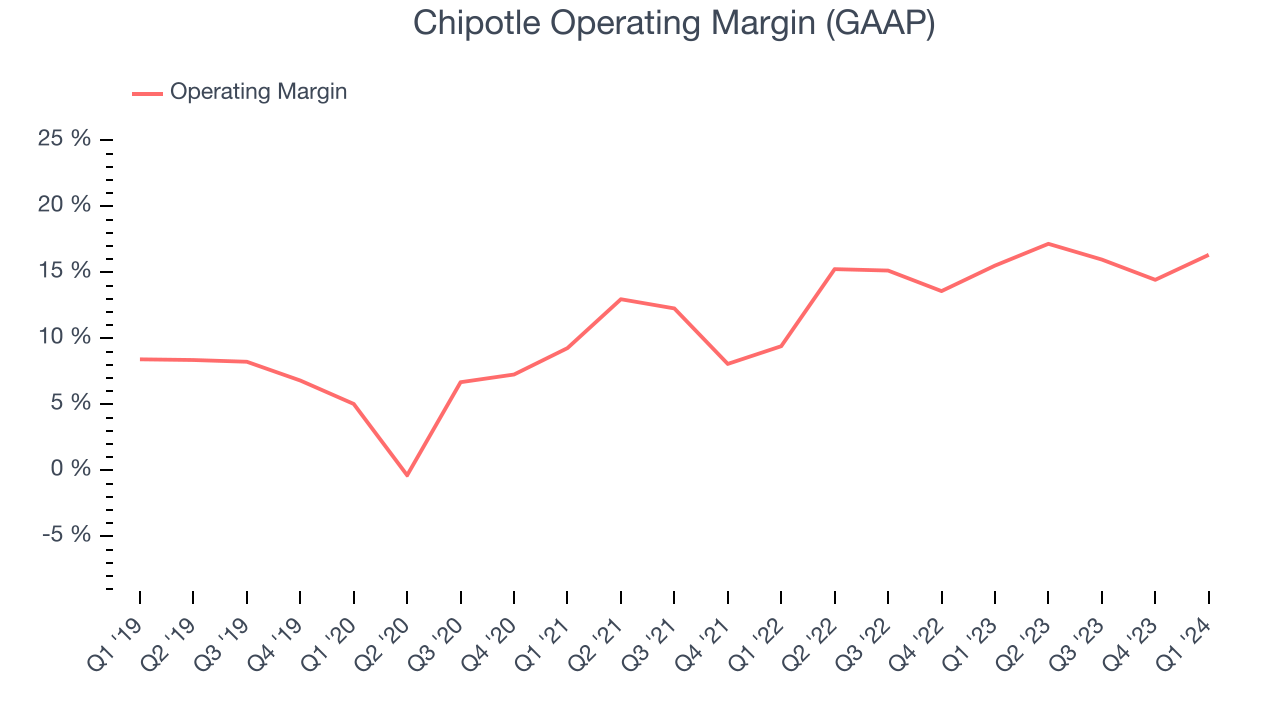

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Chipotle generated an operating profit margin of 16.3%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Chipotle has managed its expenses well over the last two years. It's demonstrated solid profitability for a restaurant business, producing an average operating margin of 15.5%. On top of that, its margin has improved, on average, by 1.1 percentage points each year, showing the company is strengthening its fundamentals.

Zooming out, Chipotle has managed its expenses well over the last two years. It's demonstrated solid profitability for a restaurant business, producing an average operating margin of 15.5%. On top of that, its margin has improved, on average, by 1.1 percentage points each year, showing the company is strengthening its fundamentals. EPS

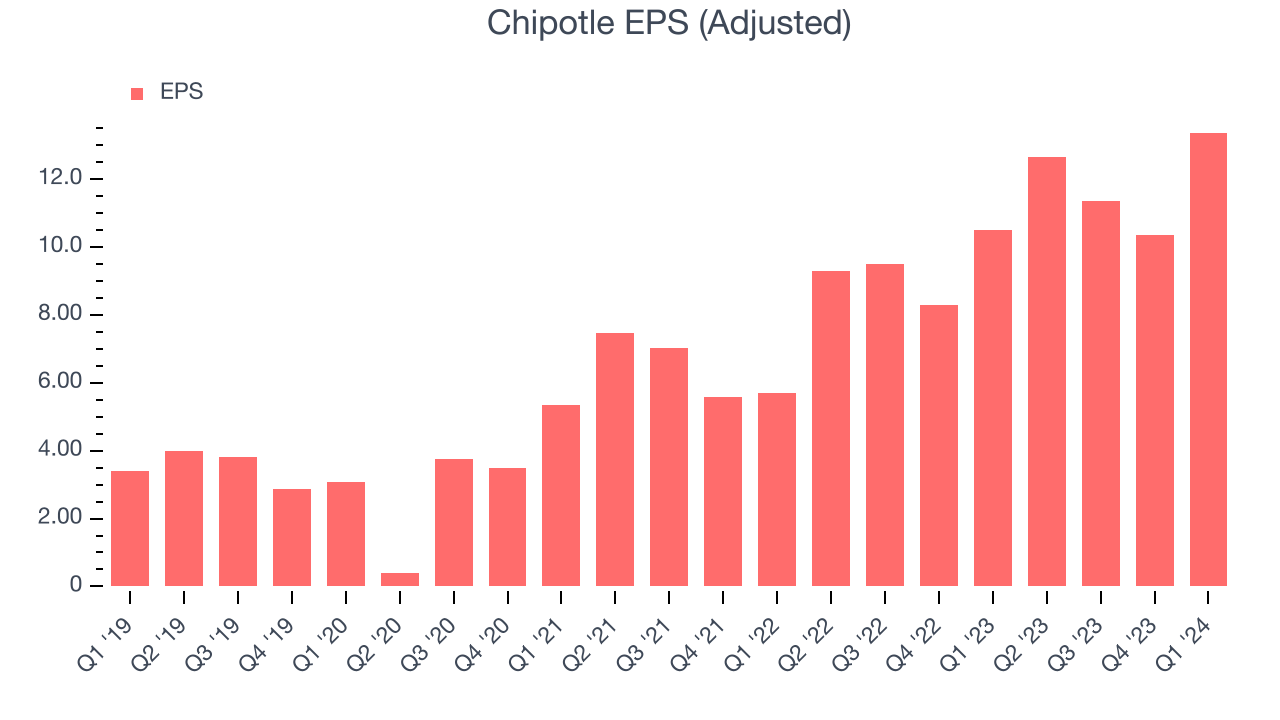

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Chipotle reported EPS at $13.37, up from $10.50 in the same quarter a year ago. This print beat Wall Street's estimates by 14.5%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 18.5% year-on-year increase in EPS.

Cash Is King

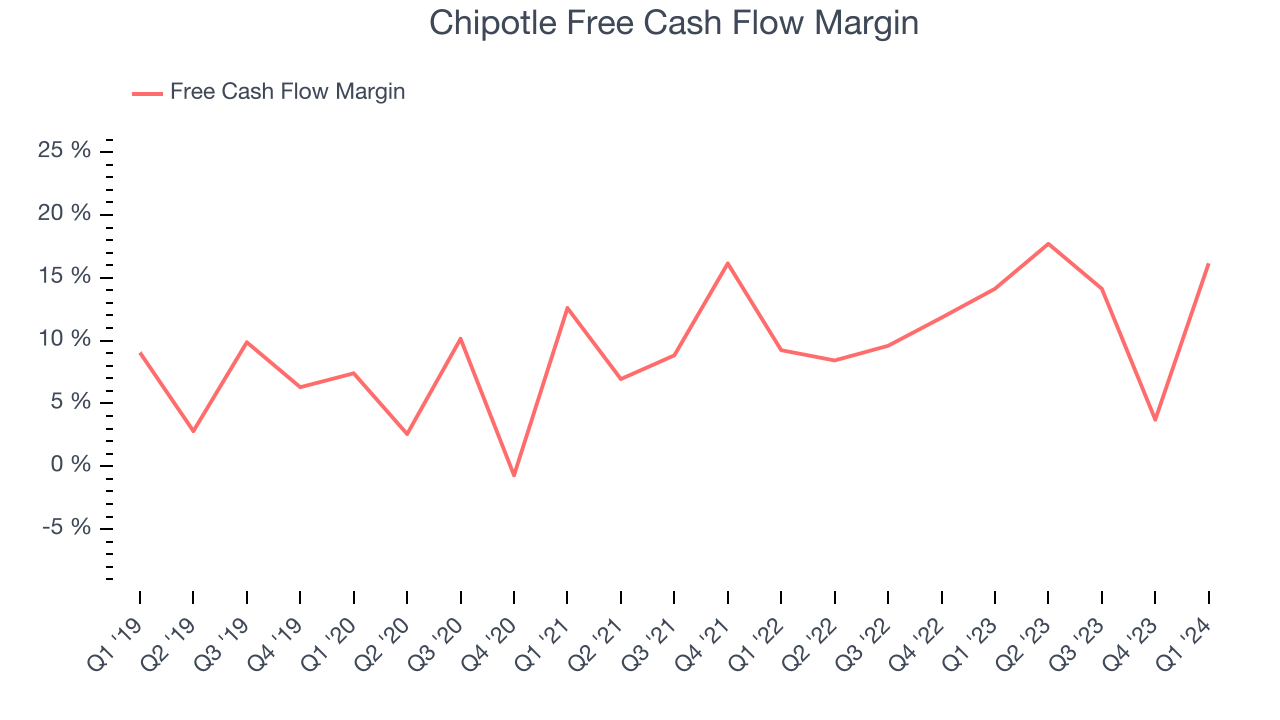

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Chipotle's free cash flow came in at $436.5 million in Q1, up 30.4% year on year. This result represents a 16.2% margin.

Over the last eight quarters, Chipotle has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the restaurant sector, averaging 12.1%. Furthermore, its margin has averaged year-on-year increases of 1.9 percentage points. This likely pleases the company's investors.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Chipotle's five-year average ROIC was 14.9%, beating other restaurant companies by a wide margin. Just as you’d like your investment dollars to generate returns, Chipotle's invested capital has produced robust profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Chipotle's ROIC averaged 11 percentage point increases. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Chipotle reported $1.42 billion of cash and $4.16 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $1.97 billion of EBITDA over the last 12 months, we view Chipotle's 1.4x net-debt-to-EBITDA ratio as safe. We also see its $73.11 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Chipotle's Q1 Results

We liked that Chipotle beat same store sales, revenue, gross margin, and EPS expectations. Full year guidance for comparable store sales was raised from mid-single digit year on year percentage increase to mid to high-single digit percentage increase. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 4.1% after reporting and currently trades at $3,045 per share.

Is Now The Time?

Chipotle may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Chipotle is a great business. For starters, its revenue growth has been impressive over the last five years. On top of that, its new restaurant openings have increased its brand equity, and its unparalleled reputation makes it a household name consumers consistently turn to.

Chipotle's price-to-earnings ratio based on the next 12 months is 51.7x. Looking at the consumer landscape today, Chipotle's qualities as one of the best businesses really stand out, and there's no doubt it's a bit of a market darling. We don't mind paying a small premium for a high-quality business and would argue that it's often wise to hold them over the long term even if expectations are high, but we do note that there seems to be a lot of optimism priced into the stock.

Wall Street analysts covering the company had a one-year price target of $2,966 per share right before these results (compared to the current share price of $3,045).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.