Real estate technology company Compass (NYSE:COMP) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 11.7% year on year to $1.49 billion. The company expects next quarter’s revenue to be around $1.28 billion, coming in 1.9% above analysts’ estimates. Its GAAP loss of $0 per share was above analysts’ consensus estimates.

Is now the time to buy Compass? Find out by accessing our full research report, it’s free.

Compass (COMP) Q3 CY2024 Highlights:

- Revenue: $1.49 billion vs analyst estimates of $1.5 billion (in line)

- EPS: $0 vs analyst estimates of -$0.03 ($0.03 beat)

- EBITDA: $52 million vs analyst estimates of $47.28 million (10% beat)

- Revenue Guidance for Q4 CY2024 is $1.28 billion at the midpoint, above analyst estimates of $1.25 billion

- EBITDA guidance for the full year is $114 million at the midpoint, above analyst estimates of $106.9 million

- Gross Margin (GAAP): 17.8%, up from 11.8% in the same quarter last year

- Operating Margin: -0.2%, up from -2.9% in the same quarter last year

- EBITDA Margin: 3.5%, up from 1.6% in the same quarter last year

- Free Cash Flow Margin: 2.2%, up from 0.9% in the same quarter last year

- Transactions: 55,872, up 7,738 year on year

- Market Capitalization: $2.73 billion

"In what remains a challenging environment for the real estate market, we grew Adjusted EBITDA significantly year-over-year and delivered a substantial improvement in free cash flow. Our results this quarter put Compass in a position to deliver meaningful Adjusted EBITDA for 2024 and to be free cash flow positive for the full year despite a multi-decade low for existing home sales, demonstrating our ability to generate significant free cash flow as the market makes its way to mid-cycle levels," said Robert Reffkin, Founder and Chief Executive Officer of Compass.

Company Overview

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

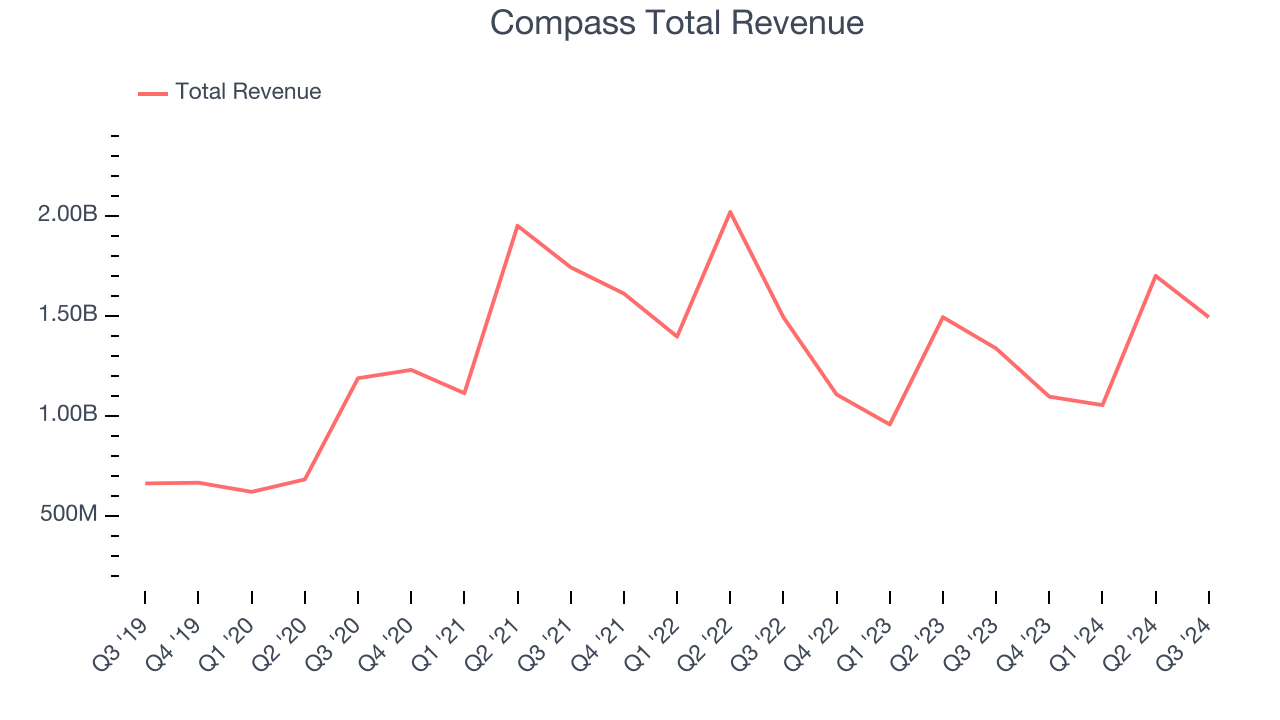

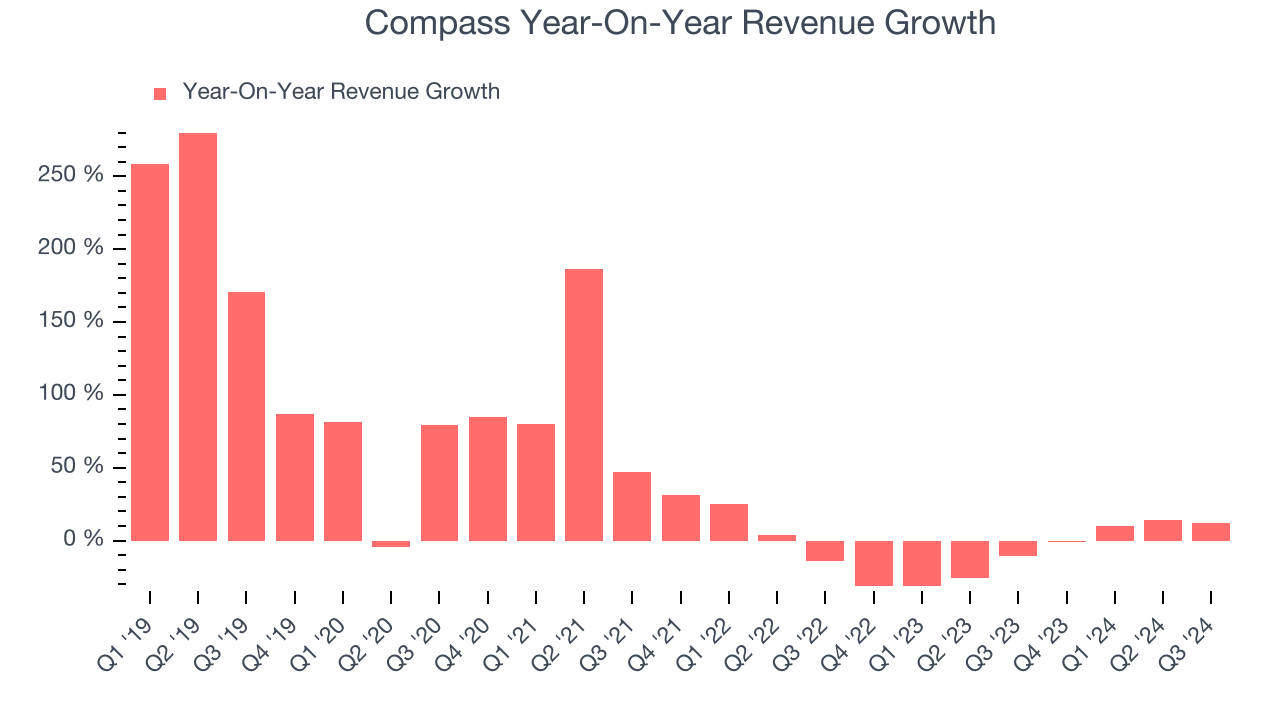

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Compass grew its sales at a solid 20.8% compounded annual growth rate. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Compass’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.5% over the last two years.

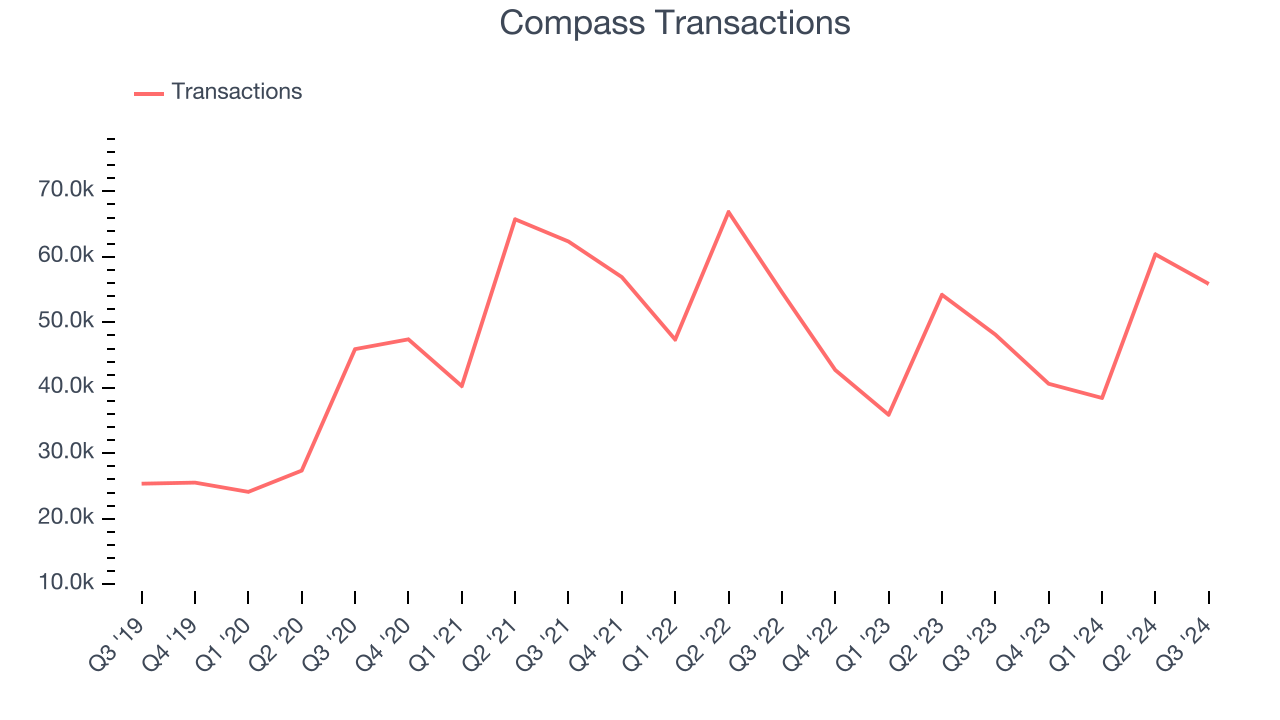

We can better understand the company’s revenue dynamics by analyzing its number of transactions, which reached 55,872 in the latest quarter. Over the last two years, Compass’s transactions averaged 6.3% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Compass’s year-on-year revenue growth was 11.7%, and its $1.49 billion of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 16.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.3% over the next 12 months, an improvement versus the last two years. This projection is admirable and shows the market believes its newer products and services will spur faster growth.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

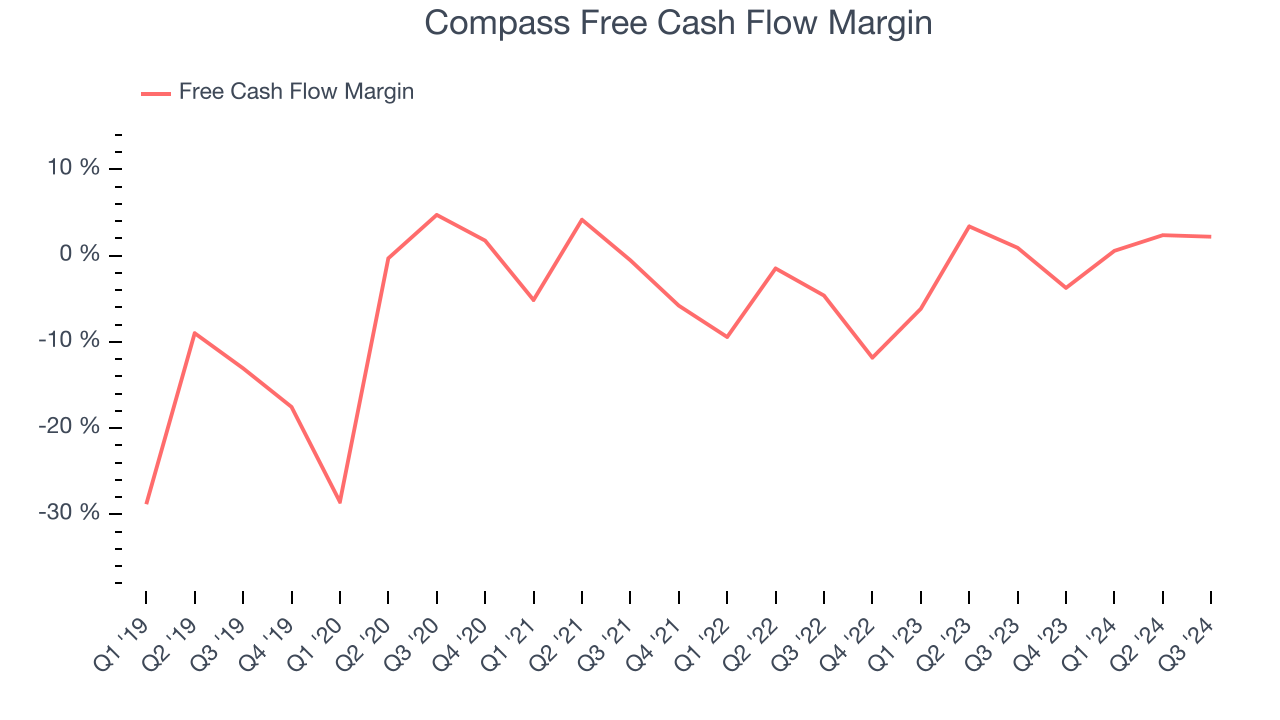

Compass broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Compass’s free cash flow clocked in at $32.8 million in Q3, equivalent to a 2.2% margin. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Key Takeaways from Compass’s Q3 Results

We were impressed by Compass’s optimistic EBITDA forecast for next quarter, which blew past analysts’ expectations. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 9.1% to $6.07 immediately following the results.

Sure, Compass had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.