Real estate technology company Compass (NYSE:COMP) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 10.1% year on year to $1.05 billion. Guidance for next quarter's revenue was also better than expected at $1.65 billion at the midpoint, 1.2% above analysts' estimates. It made a GAAP loss of $0.27 per share, improving from its loss of $0.33 per share in the same quarter last year.

Compass (COMP) Q1 CY2024 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.03 billion (2.2% beat)

- Adjusted EBITDA: ($20.1) million loss vs analyst estimates of ($30.7) million loss (big beat)

- Revenue Guidance for Q2 CY2024 is $1.65 billion at the midpoint, above analyst estimates of $1.63 billion

- Gross Margin (GAAP): 18.2%, up from 10.4% in the same quarter last year

- Free Cash Flow of $5.9 million is up from -$41 million in the previous quarter

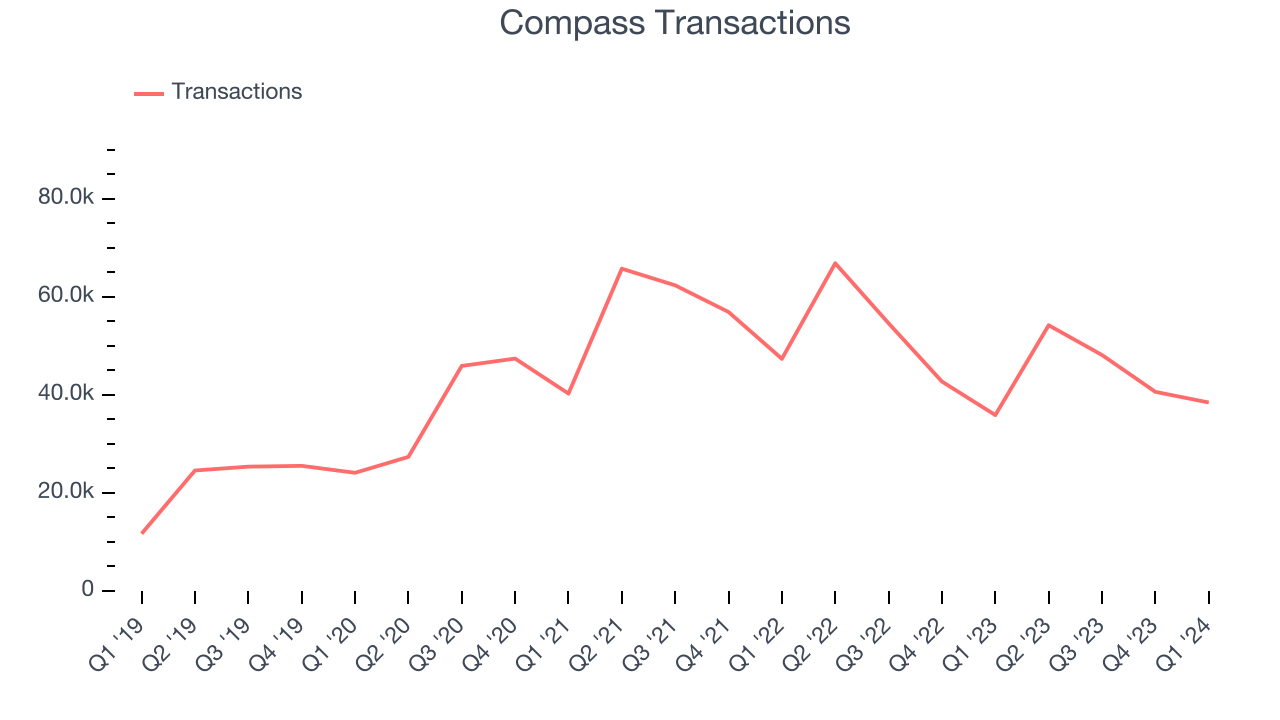

- Transactions: 38,449

- Market Capitalization: $1.68 billion

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

While the company operates like a traditional real estate brokerage on the surface by hiring agents and holding physical offices, Compass prides itself on its proprietary software platform designed to increase the productivity of its agents. Its integrated suite of software applications, from marketing and client relationship management tools to data analytics and workflow automation, aims to simplify the various stages of the real estate transaction process.

Compass’s agent-centric philosophy extends to its support and development programs. The company invests in the professional development of its agents, offering training and support that emphasize real estate expertise and technology utilization. This approach along with the increased efficiency from its software platform has historically attracted agents to the company (which, in theory, should lead to more transactions).

Compass generates revenue from transaction fees and supplements its core brokerage business with title, escrow, and financing services.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Compass's primary competitors include Zillow (NASDAQ:ZG), Redfin (NASDAQ:RDFN), and eXp World (NASDAQ:EXPI).Sales Growth

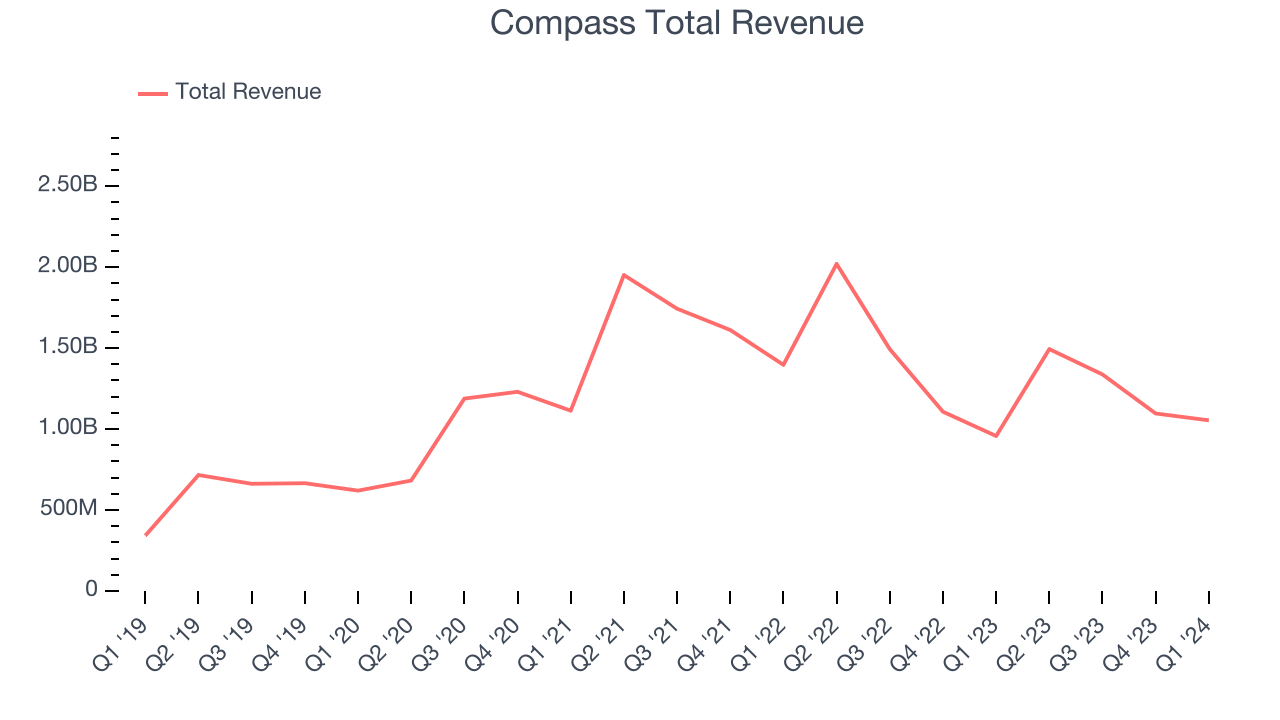

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Compass's annualized revenue growth rate of 34.5% over the last five years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Compass's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 13.8% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Compass's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 13.8% over the last two years.

We can better understand the company's revenue dynamics by analyzing its number of transactions, which reached 38,449 in the latest quarter. Over the last two years, Compass's transactions averaged 11.1% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, Compass reported robust year-on-year revenue growth of 10.1%, and its $1.05 billion of revenue exceeded Wall Street's estimates by 2.2%. The company is guiding for revenue to rise 10.4% year on year to $1.65 billion next quarter, improving from the 26% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 11.3% over the next 12 months, an acceleration from this quarter.

Operating Margin

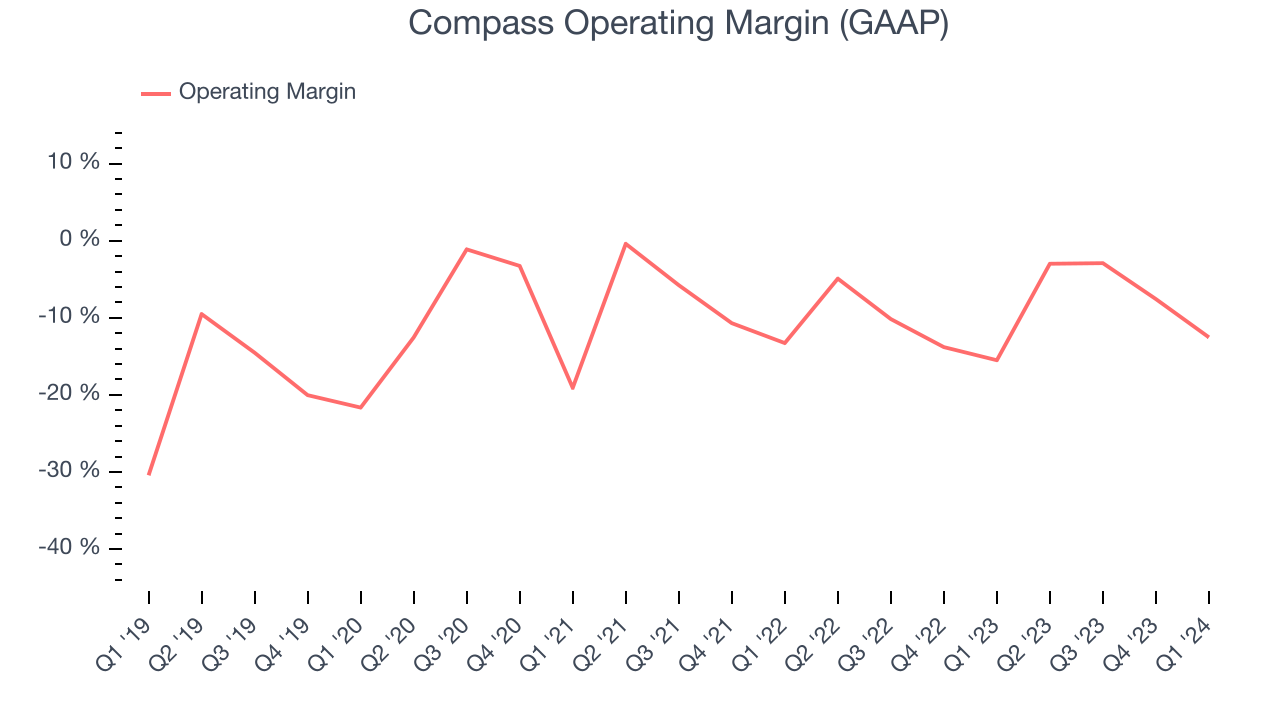

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Given the consumer discretionary industry's volatile demand characteristics, unprofitable companies should be scrutinized. Over the last two years, Compass's high expenses have contributed to an average operating margin of negative 8.1%.

This quarter, Compass generated an operating profit margin of negative 12.5%, up 3 percentage points year on year.

Over the next 12 months, Wall Street expects Compass to shrink its losses but remain unprofitable. Analysts are expecting the company’s LTM operating margin of negative 6% to rise to negative 1.7%.EPS

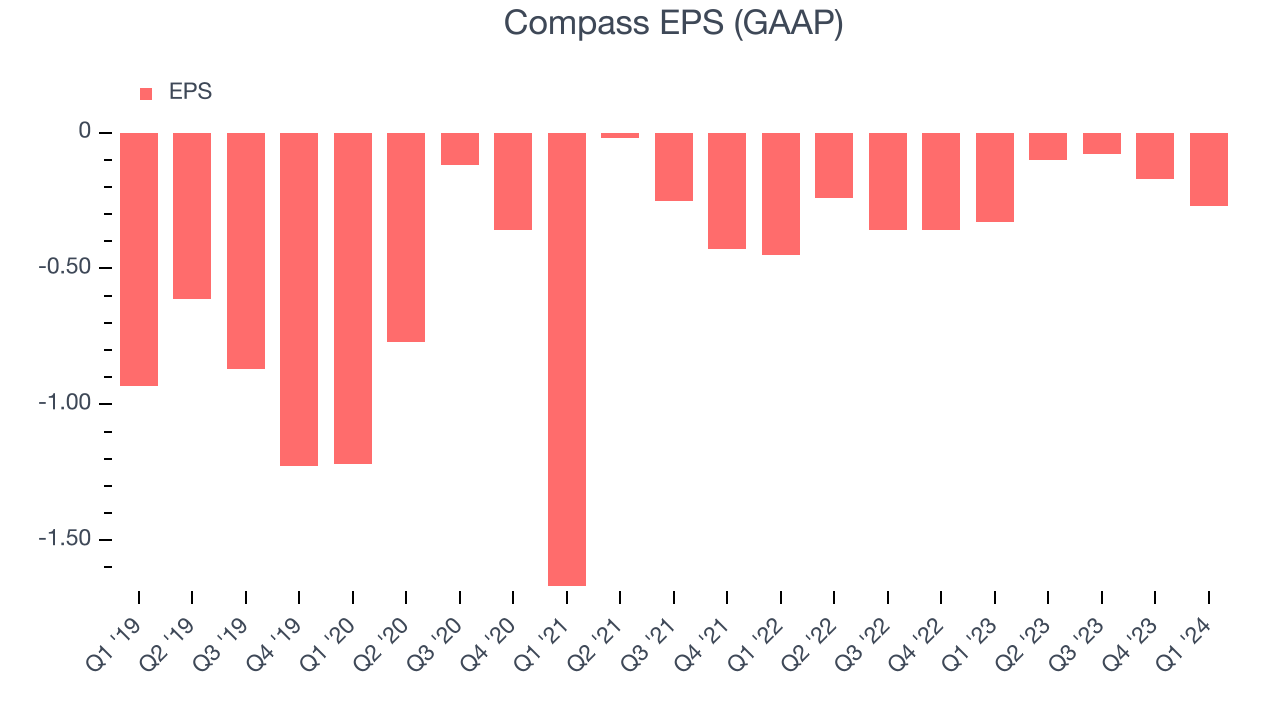

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Compass cut its earnings losses and improved its EPS by 26.8% each year. This performance, however, is worse than its 34.5% annualized revenue growth over the same period. Let's dig into why.

Compass recently raised equity capital, and in the process, grew its share count by 360% over the last five years. This has resulted in muted earnings per share growth but doesn't tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.In Q1, Compass reported EPS at negative $0.27, up from negative $0.33 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Compass's LTM EPS of negative $0.62 to reach break even.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

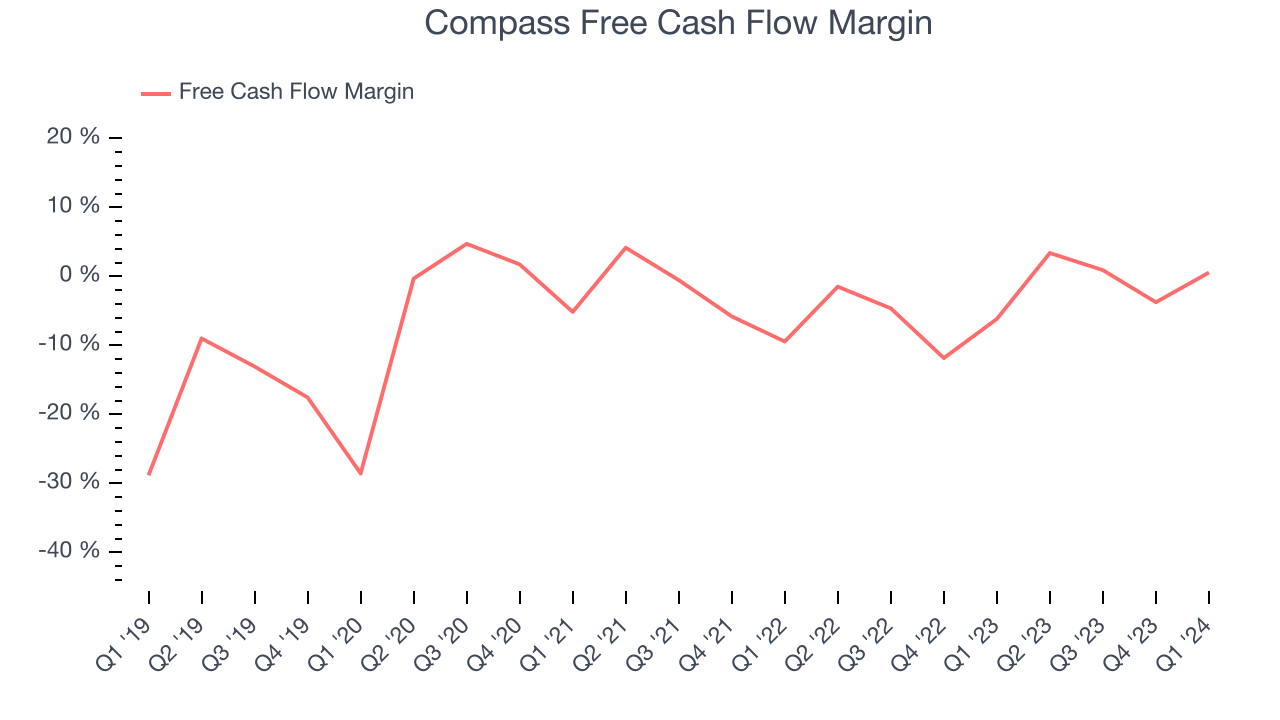

While Compass posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Compass's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 2.5%.

Compass broke even from a free cash flow perspective in Q1. This quarter's result was great for the business as its margin was 6.7 percentage points higher than in the same period last year.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Compass's $517.3 million of debt exceeds the $165.9 million of cash on its balance sheet. Furthermore, its 43x net-debt-to-EBITDA ratio (based on its EBITDA of $8.1 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Compass could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Compass can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Compass's Q1 Results

It was good to see Compass beat analysts' revenue and adjusted EBITDA expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, this was a solid quarter for Compass. The stock is up 6.7% after reporting and currently trades at $3.5 per share.

Is Now The Time?

Compass may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Compass, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last five years, its number of transactions has been disappointing. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

While we've no doubt one can find things to like about Compass, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.04 per share right before these results (compared to the current share price of $3.50).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.