Beauty products company Coty (NYSE:COTY) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 7.5% year on year to $1.39 billion. It made a non-GAAP profit of $0.05 per share, down from its profit of $0.19 per share in the same quarter last year.

Coty (COTY) Q1 CY2024 Highlights:

- Revenue: $1.39 billion vs analyst estimates of $1.37 billion (small beat)

- EPS (non-GAAP): $0.05 vs analyst expectations of $0.06 (17% miss)

- Full year EPS (non-GAAP) guidance: maintained from previous, $0.46 at the midpoint roughly in line with analyst expectations (although expected adjusted EBITDA margin increase is higher than previously expected)

- Gross Margin (GAAP): 64.8%, up from 62.9% in the same quarter last year

- Free Cash Flow was -$234.3 million, down from $363 million in the previous quarter

- Market Capitalization: $10.38 billion

With a portfolio boasting many household brands, Coty (NYSE:COTY) is a beauty products powerhouse with offerings in cosmetics, fragrances, and skincare.

The company’s most iconic brands include CoverGirl, Clairol, OPI, and Rimmel London. In addition, Coty has licensing agreements in place to offer fragrances and select other products bearing the Gucci, Calvin Klein, Balenciaga, and Marc Jacobs brands. While there are differences between the brands, the unifying theme is quality at an attainable price.

Given the breadth of its offerings and brand portfolio as well as its mid-tier price points, Coty caters to a broad spectrum of beauty enthusiasts. Their core customer is a middle-income adult woman. She cares about her appearance and has strong brand preferences, but she also doesn’t want to break the bank by buying beauty and personal care products. To meet her needs, the company’s messaging mixes aspiration (celebrity endorsements), inclusivity (products for all ages and races), and trendiness.

Coty products enjoy wide distribution and are most commonly found in beauty retailers such as Ulta Beauty (NASDAQ:ULTA), department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS), and drugstores such as CVS (NYSE:CVS). This mass distribution ensures that the customer base is never far from a Coty product and also reinforces the brand’s attainability and reasonable price points.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors that offer a wide range of beauty and cosmetics products include L’Oreal (ENXTPA:OR), Estée Lauder (NYSE:EL), Proctor & Gamble (NYSE:PG), and private company Revlon.Sales Growth

Coty is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

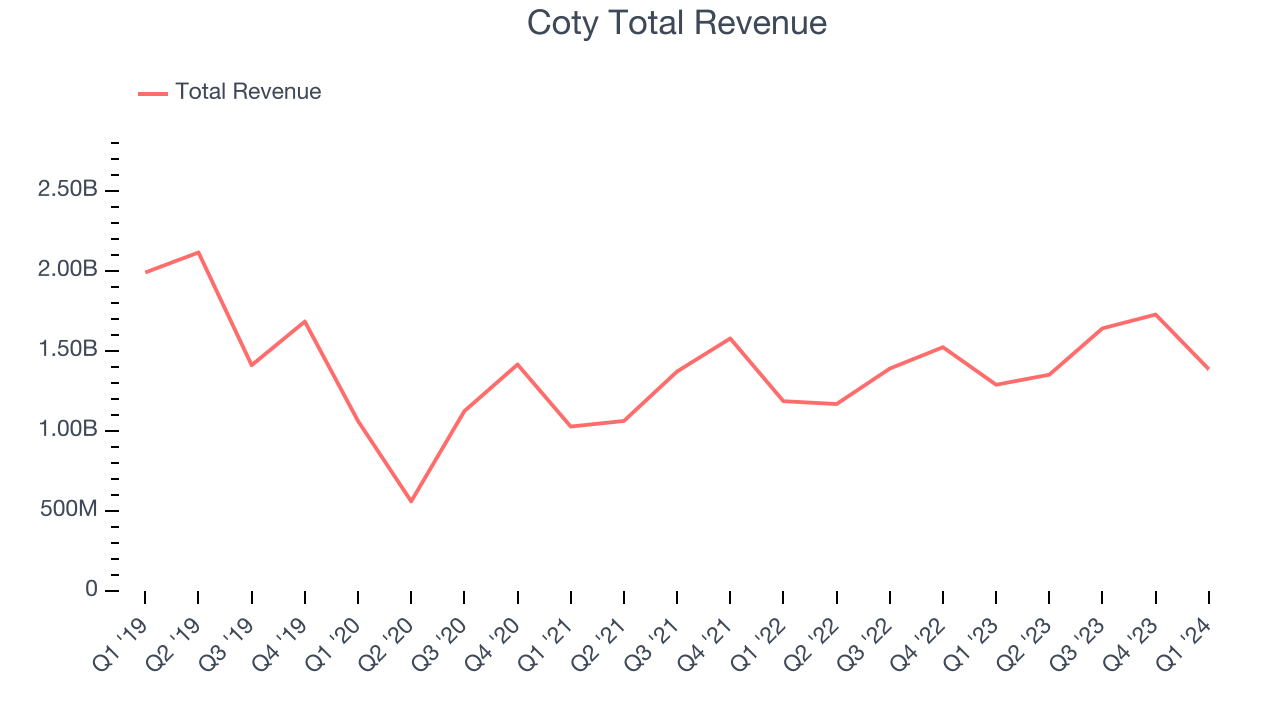

As you can see below, the company's annualized revenue growth rate of 13.9% over the last three years was solid for a consumer staples business.

This quarter, Coty grew its revenue by 7.5% year on year, and its $1.39 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, a deceleration from this quarter.

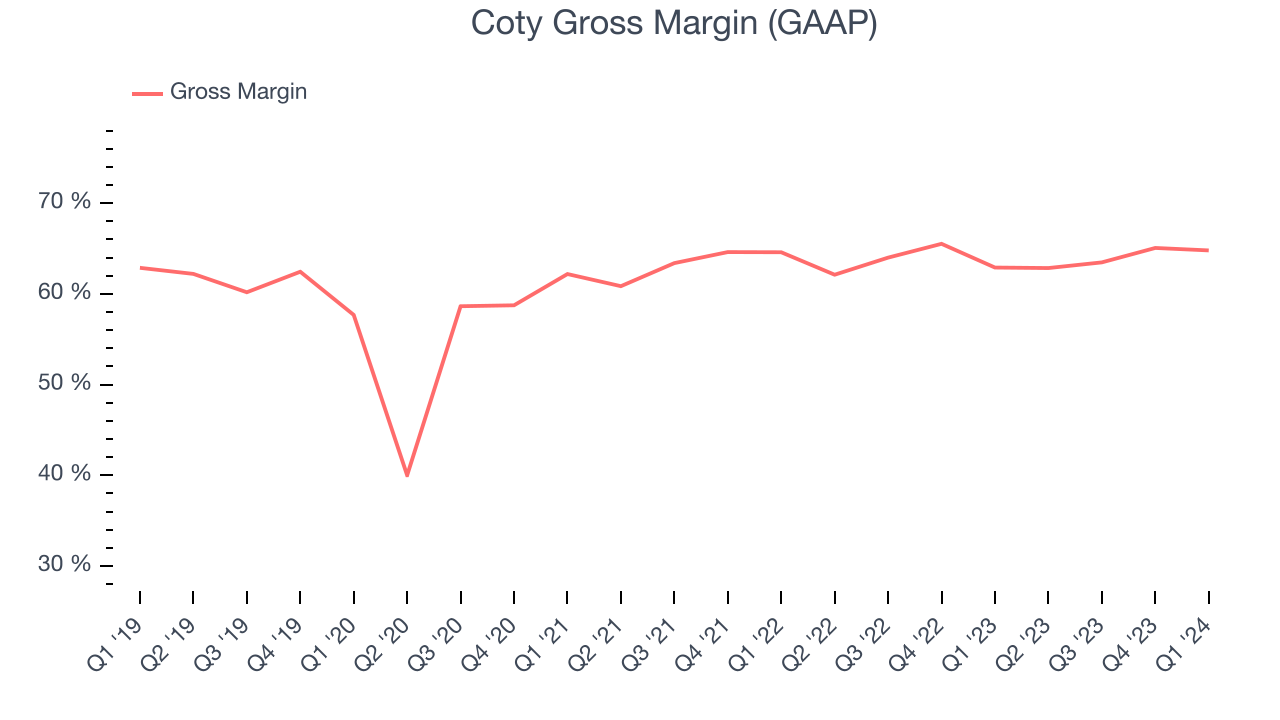

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

This quarter, Coty's gross profit margin was 64.8%, up 1.9 percentage points year on year. That means for every $1 in revenue, only $0.35 went towards paying for raw materials, production of goods, and distribution expenses.

Coty has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 63.9% gross margin over the last two years. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as raw materials).

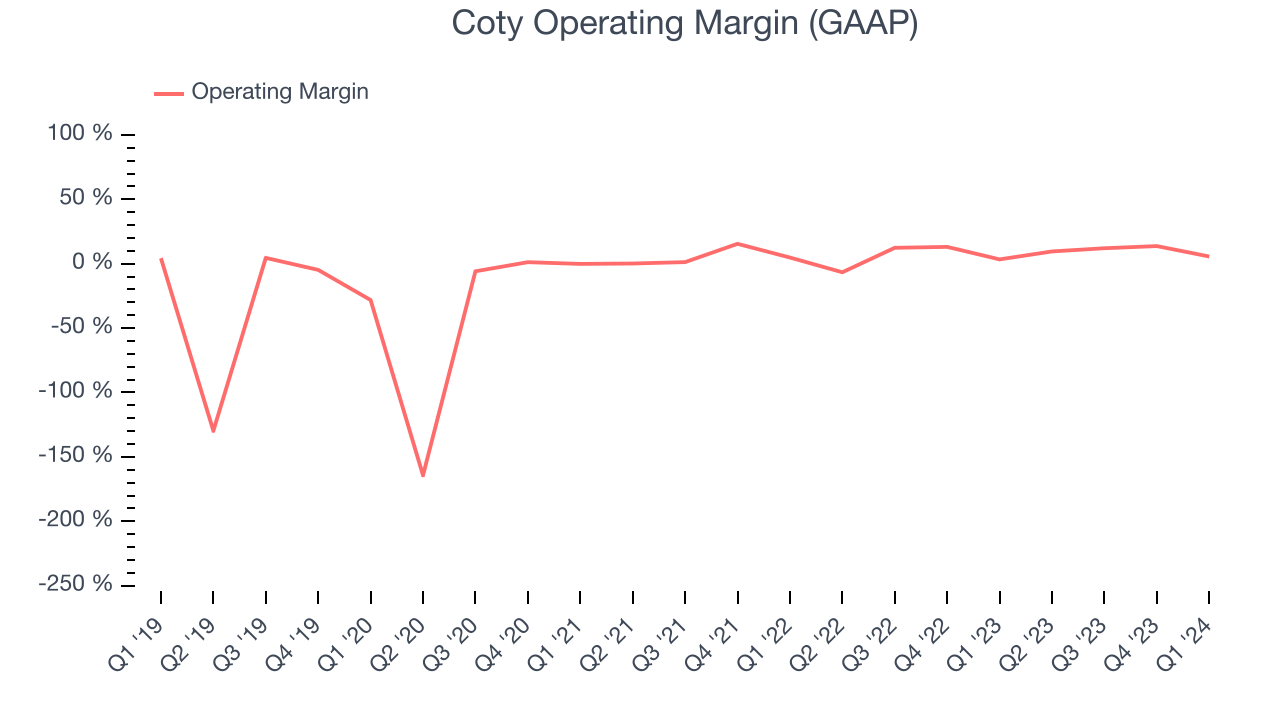

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Coty generated an operating profit margin of 5.6%, up 2.2 percentage points year on year. This increase was encouraging, and we can infer Coty was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Coty has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.5%, higher than the broader consumer staples sector. On top of that, its margin has improved by 4.2 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Coty has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.5%, higher than the broader consumer staples sector. On top of that, its margin has improved by 4.2 percentage points on average over the last year, a great sign for shareholders. EPS

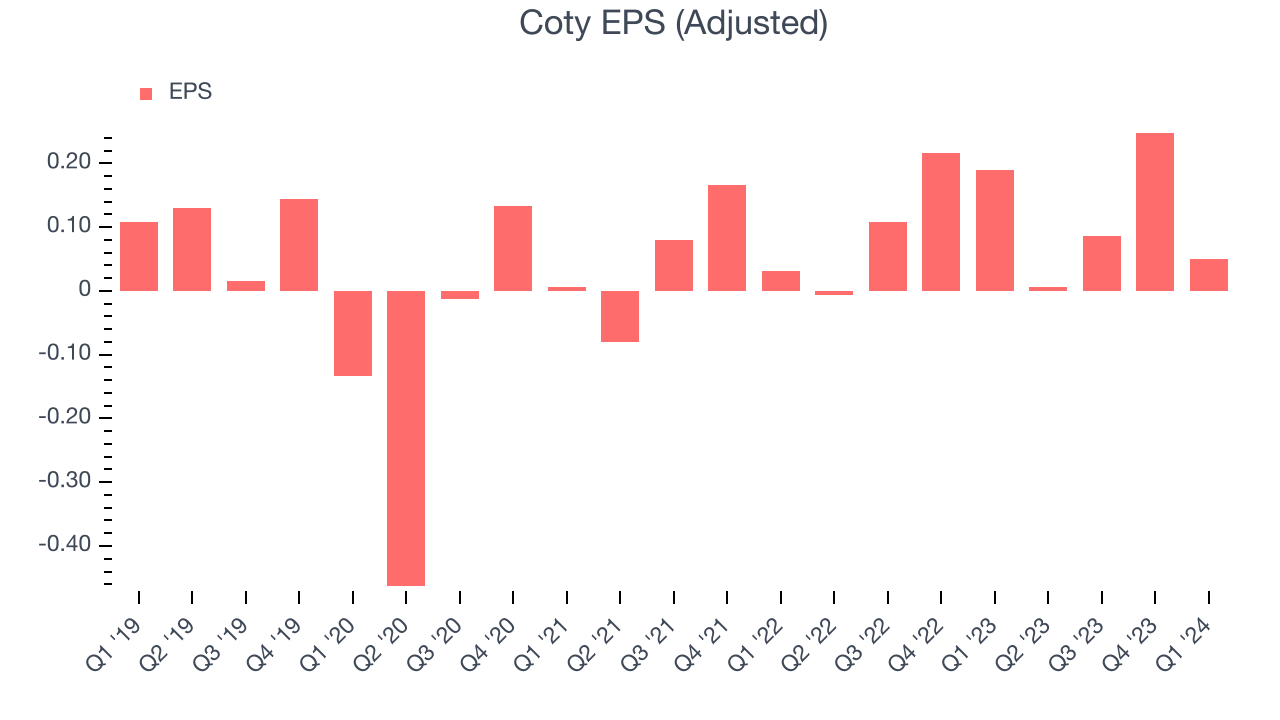

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Coty reported EPS at $0.05, down from $0.19 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Coty cut its earnings losses. Its EPS has improved by 46.7% on average each year.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 39.9% year-on-year increase in EPS.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

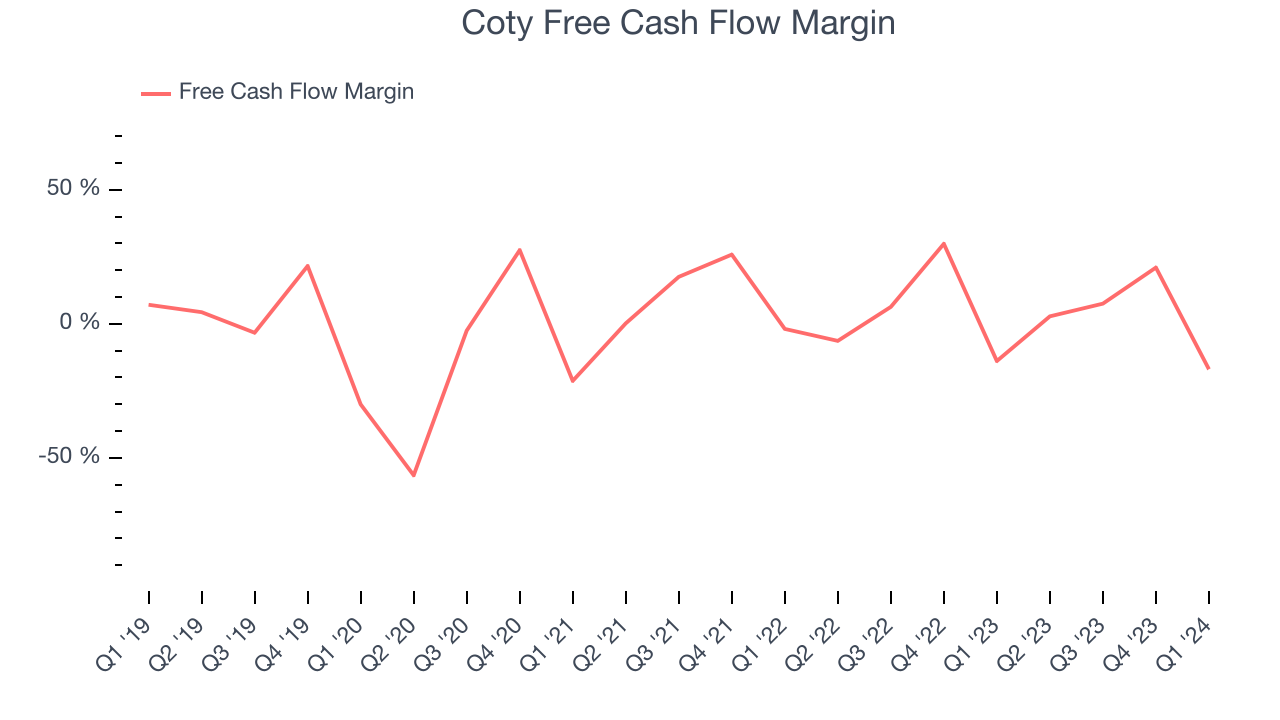

Coty burned through $234.3 million of cash in Q1, representing a negative 16.9% free cash flow margin. The company reduced its cash burn by 31.3% year on year.

Over the last two years, Coty has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 5.1%, slightly better than the broader consumer staples sector. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

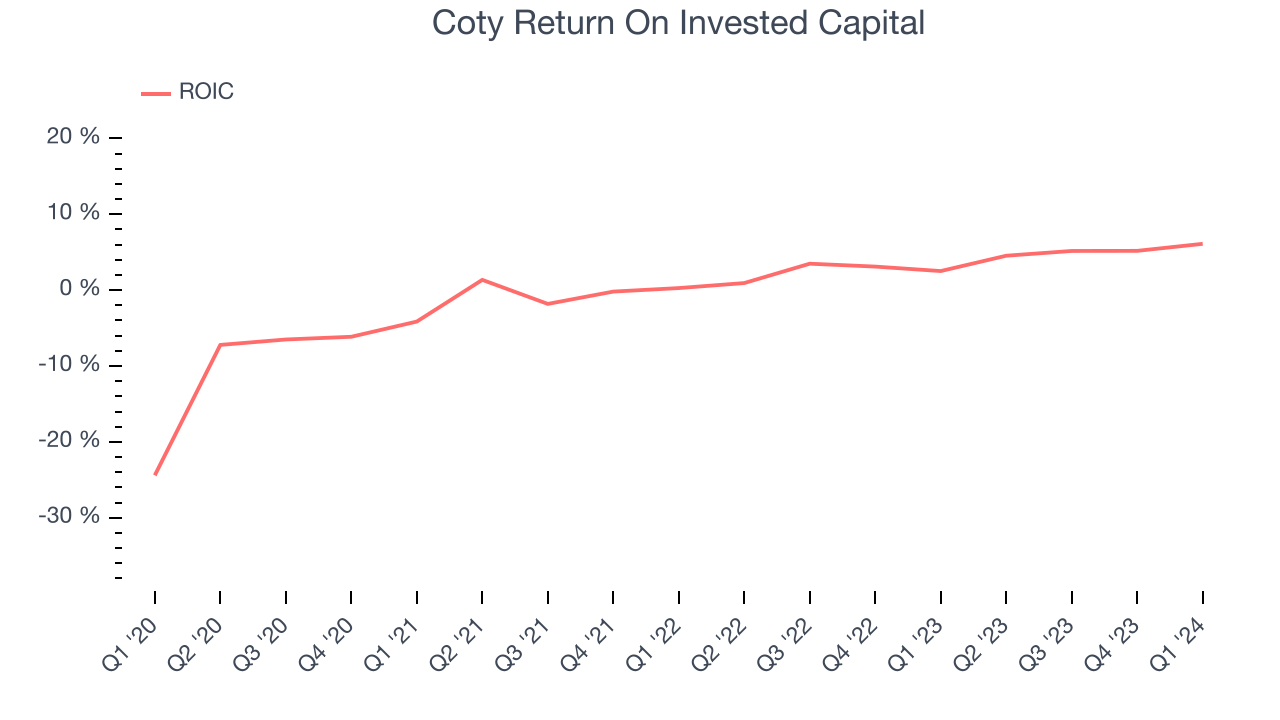

Coty's five-year average ROIC was negative 3.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Coty's ROIC has significantly increased. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Coty reported $260.2 million of cash and $4.14 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $1.07 billion of EBITDA over the last 12 months, we view Coty's 3.6x net-debt-to-EBITDA ratio as safe. We also see its $129.5 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Coty's Q1 Results

It was encouraging to see Coty narrowly top analysts' revenue and gross margin expectations this quarter. On the other hand, its operating margin missed analysts' expectations and its EPS missed Wall Street's estimates. The company raised its full year adjusted EBITDA margin expectations but maintained its previous EPS guidance. Overall, the results were mixed. The stock is up 2.9% after reporting and currently trades at $11.84 per share.

Is Now The Time?

Coty may have had a mixed quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Coty isn't a bad business. First off, its revenue growth has been good over the last three years. And while its relatively low ROIC suggests it has struggled to grow profits historically, its impressive gross margins are a wonderful starting point for the overall profitability of the business.

Coty's price-to-earnings ratio based on the next 12 months is 21.1x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Coty, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $11.37 per share right before these results (compared to the current share price of $11.84).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.