Online learning platform Coursera (NYSE:COUR) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 10.8% year on year to $170.3 million. On the other hand, next quarter's revenue guidance of $173 million was less impressive, coming in 3.3% below analysts' estimates. It made a GAAP loss of $0.15 per share, improving from its loss of $0.21 per share in the same quarter last year.

Is now the time to buy Coursera? Find out by accessing our full research report, it's free.

Coursera (COUR) Q2 CY2024 Highlights:

- Revenue: $170.3 million vs analyst estimates of $164.6 million (3.5% beat)

- Adjusted EBITDA: $10.4 million vs analyst estimates of $1.2 million (large beat)

- EPS: -$0.15 vs analyst estimates of -$0.17 (9.6% beat)

- Revenue Guidance for Q3 CY2024 is $173 million at the midpoint, below analyst estimates of $178.8 million

- The company reconfirmed its revenue guidance for the full year of $700 million at the midpoint

- Gross Margin (GAAP): 52.9%, up from 51.9% in the same quarter last year

- Free Cash Flow of $17.04 million, similar to the previous quarter

- Paying Users : 155 million, up 26 million year on year

- Market Capitalization: $1.13 billion

“We are excited to surpass more than two million enrollments in our generative AI catalog of courses, credentials, and hands-on projects created by the world’s top technology companies and research universities,” said Coursera CEO Jeff Maggioncalda.

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Sales Growth

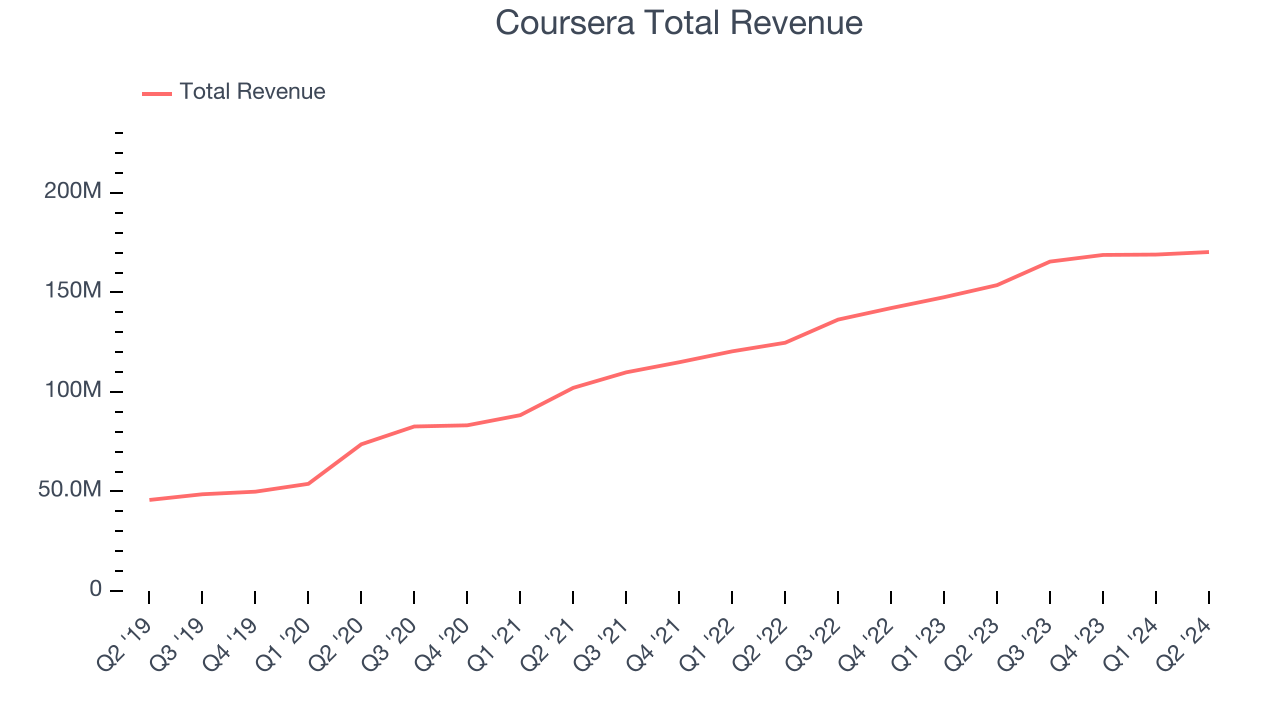

Coursera's revenue growth over the last three years has been strong, averaging 24% annually. This quarter, Coursera beat analysts' estimates but reported mediocre 10.8% year-on-year revenue growth.

Guidance for the next quarter indicates Coursera is expecting revenue to grow 4.5% year on year to $173 million, slowing from the 21.4% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 10.6% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Usage Growth

As a subscription-based app, Coursera generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

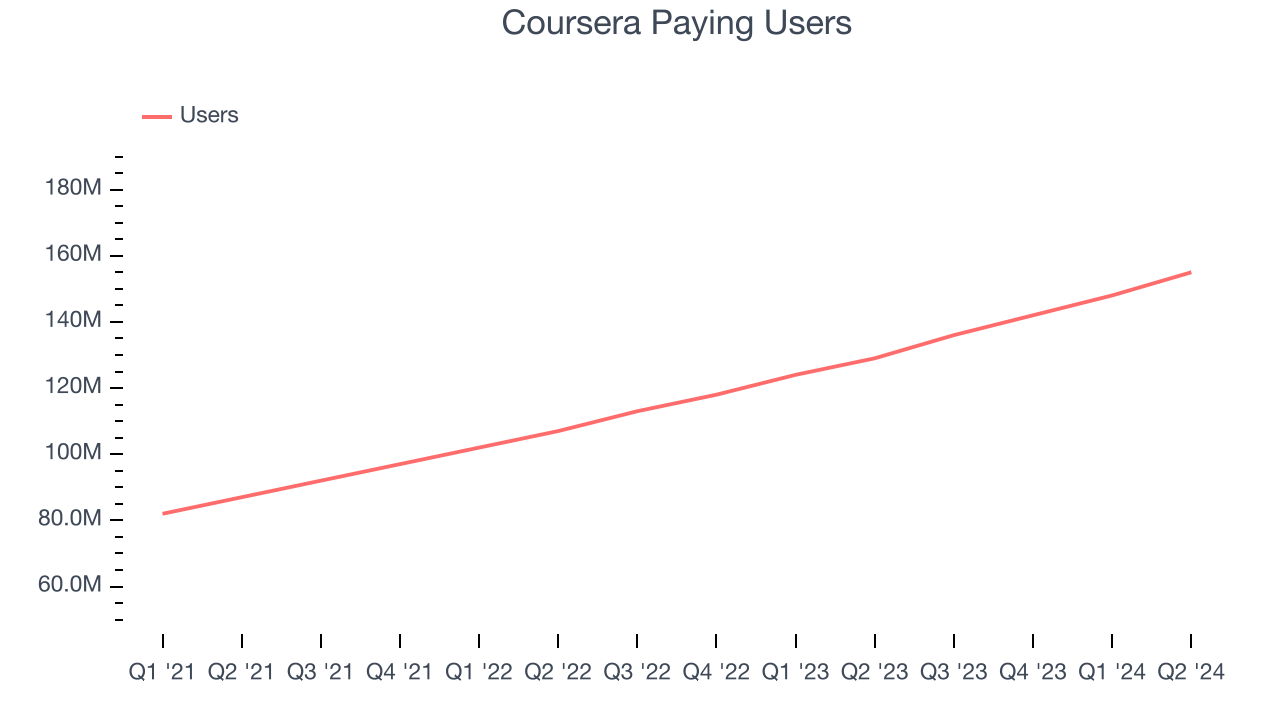

Over the last two years, Coursera's users, a key performance metric for the company, grew 20.9% annually to 155 million. This is strong growth for a consumer internet company.

In Q2, Coursera added 26 million users, translating into 20.2% year-on-year growth.

Revenue Per User

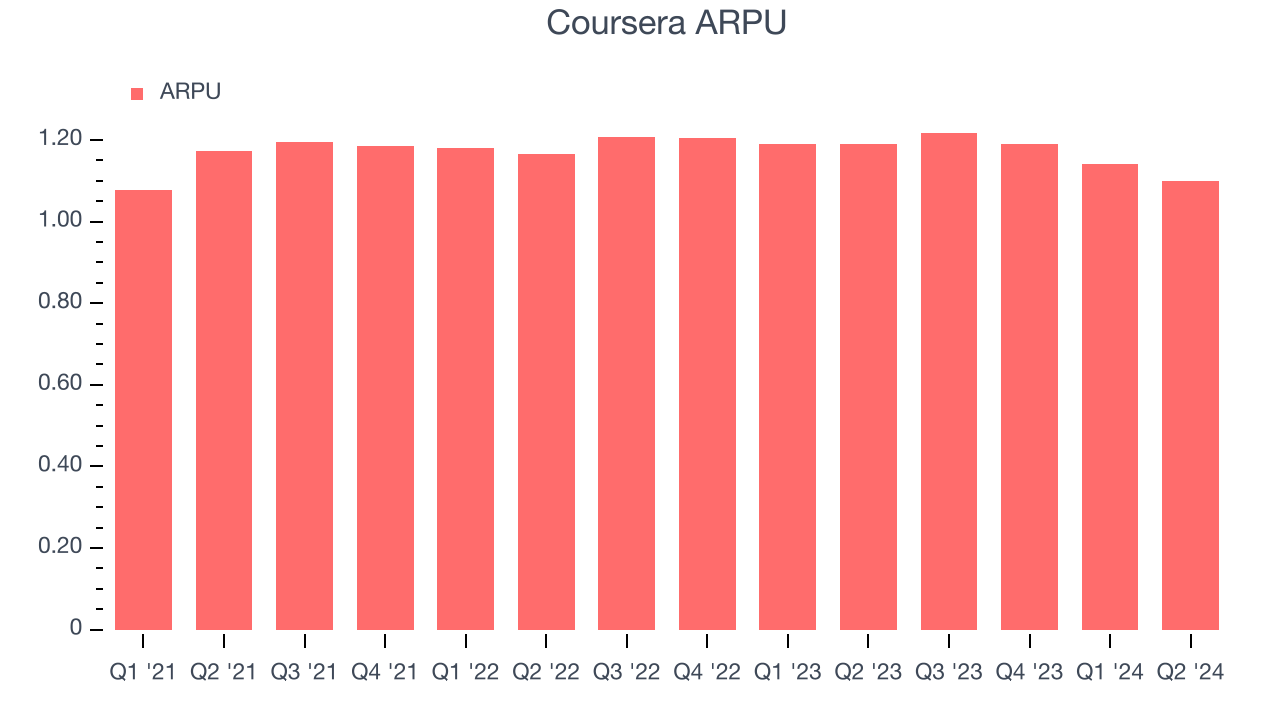

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Coursera because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Coursera's ARPU has declined over the last two years, averaging 0.8%. Although it's unfortunate to see the company lose its pricing power, it was still able to achieve strong user growth. This quarter, ARPU declined 7.8% year on year to $1.10 per user.

Key Takeaways from Coursera's Q2 Results

It was great to see Coursera increase its number of users this quarter. We were also glad its revenue and adjusted EBITDA outperformed Wall Street's estimates. That the company maintained full year guidance for revenue and adjusted EBITDA means it's squarely on track. Overall, this quarter was solid. The stock traded up 16.8% to $8.64 immediately after reporting.

So should you invest in Coursera right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.