Online learning platform Coursera (NYSE:COUR) reported Q4 FY2023 results topping analysts' expectations, with revenue up 18.8% year on year to $168.9 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $170 million was less impressive, coming in 0.8% below expectations. It made a GAAP loss of $0.13 per share, down from its loss of $0.04 per share in the same quarter last year.

Coursera (COUR) Q4 FY2023 Highlights:

- Revenue: $168.9 million vs analyst estimates of $164.8 million (2.5% beat)

- EPS: -$0.13 vs analyst estimates of -$0.20 ($0.07 beat)

- Revenue Guidance for Q1 2024 is $170 million at the midpoint, below analyst estimates of $171.3 million

- Management's revenue guidance for the upcoming financial year 2024 is $735 million at the midpoint, beating analyst estimates by 1% and implying 15.6% growth (vs 21.5% in FY2023)

- Full year 2024 EBITDA guidance well ahead ($29 million vs. expectations of roughly $11 million)

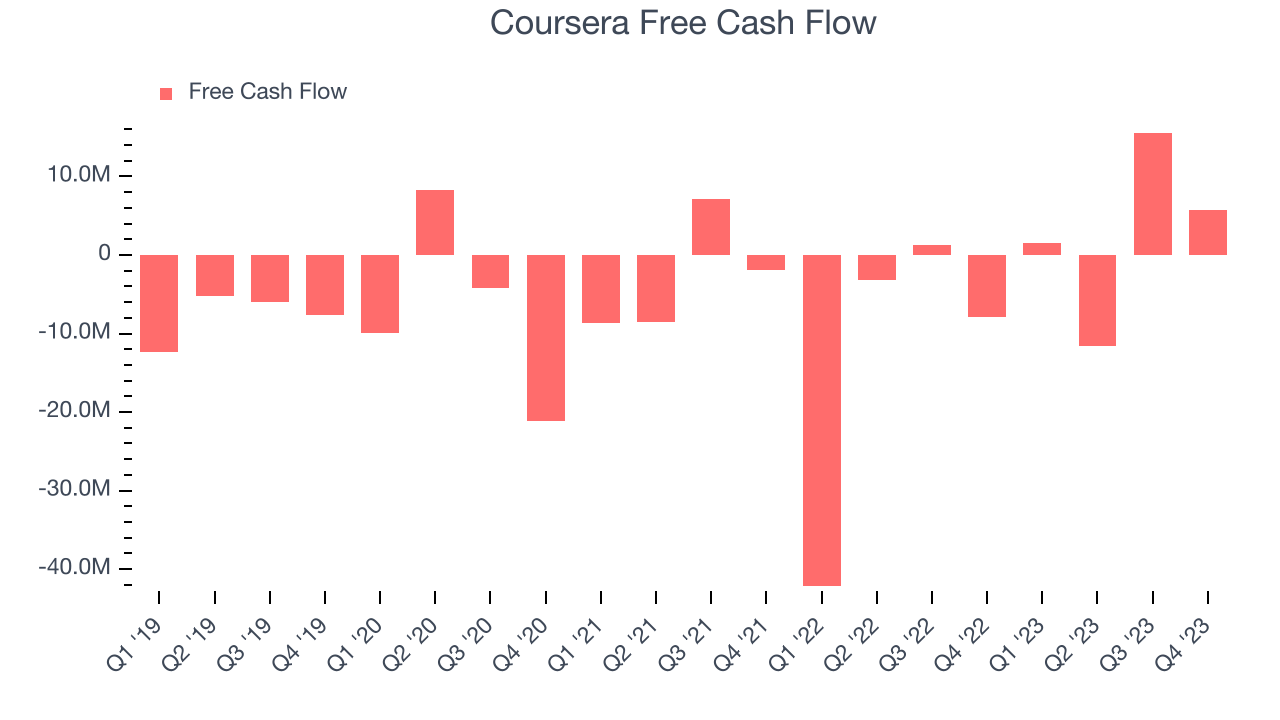

- Free Cash Flow of $5.69 million, down 63.5% from the previous quarter

- Gross Margin (GAAP): 52.9%, down from 61.8% in the same quarter last year

- Paying Users : 142 million, up 24 million year on year (slight beat)

- Market Capitalization: $2.92 billion

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

The company’s founders wanted to make education accessible to everyone, regardless of location or finances. Coursera addresses two consumer pain points of learning: access and convenience. First, taking courses and especially earning degrees can be financially out of reach for many. Second, learning traditionally involved a teacher and his/her students meeting in the same physical space at the same time.

Coursera digitizes learning and enables affordable, flexible, and self-paced learning. There is a free tier that gives access to select courses, but there are no assignments and certificates upon completion. There are multiple paid tiers that unlock additional courses, assignments, and access to degrees and certifications upon successful completion.

The largest source of revenue for the company is subscriptions for courses. However, Coursera’s revenue isn’t just from the busy working mom completing a statistics degree. Coursera may provide Nike with a social media advertising course to its incoming marketing employees. Nike pays for the courses, and the employees earn credentials. Another example is the Master's in Computer Science program offered by the University of Illinois on Coursera. It allows students to earn a Master's in computer science entirely online at a fraction of the cost of a traditional program.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Competitors offering online legal or document services include Udemy (NASDAQ:UDMY), Microsoft’s LinkedIn Learning (NYSE:MSFT), and Skillsoft (NYSE:SKIL).Sales Growth

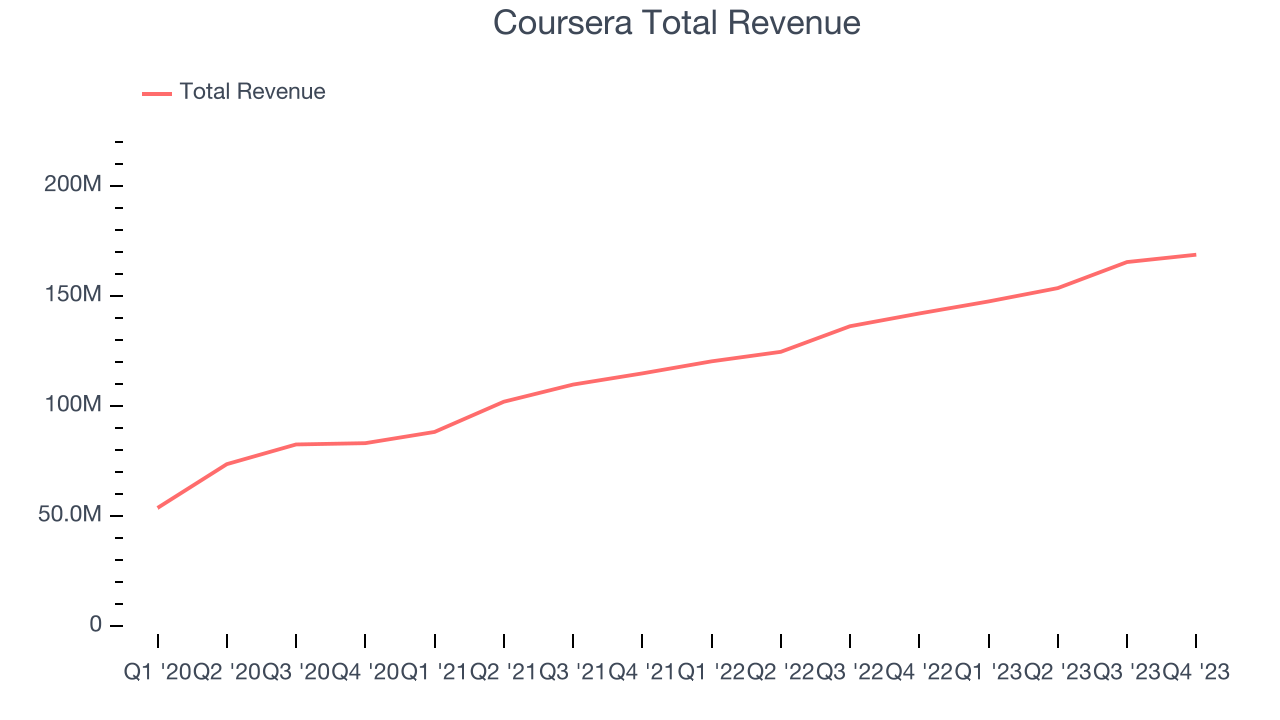

Coursera's revenue growth over the last three years has been very strong, averaging 30.5% annually. This quarter, Coursera beat analysts' estimates and reported 18.8% year-on-year revenue growth.

Guidance for the next quarter indicates Coursera is expecting revenue to grow 15.1% year on year to $170 million, slowing down from the 22.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to reach $735 million at the midpoint, representing 15.6% growth compared to the 21.5% increase in FY2023.

Usage Growth

As a subscription-based app, Coursera generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

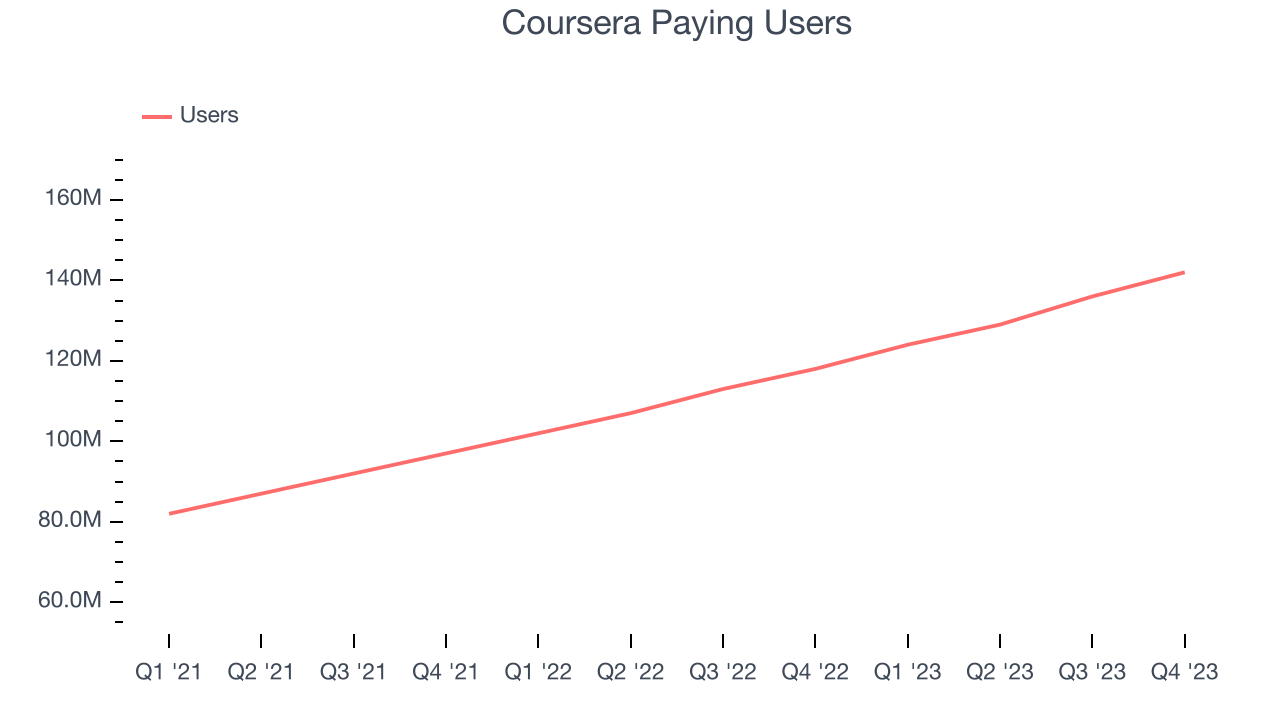

Over the last two years, Coursera's users, a key performance metric for the company, grew 21.8% annually to 142 million. This is strong growth for a consumer internet company.

In Q4, Coursera added 24 million users, translating into 20.3% year-on-year growth.

Revenue Per User

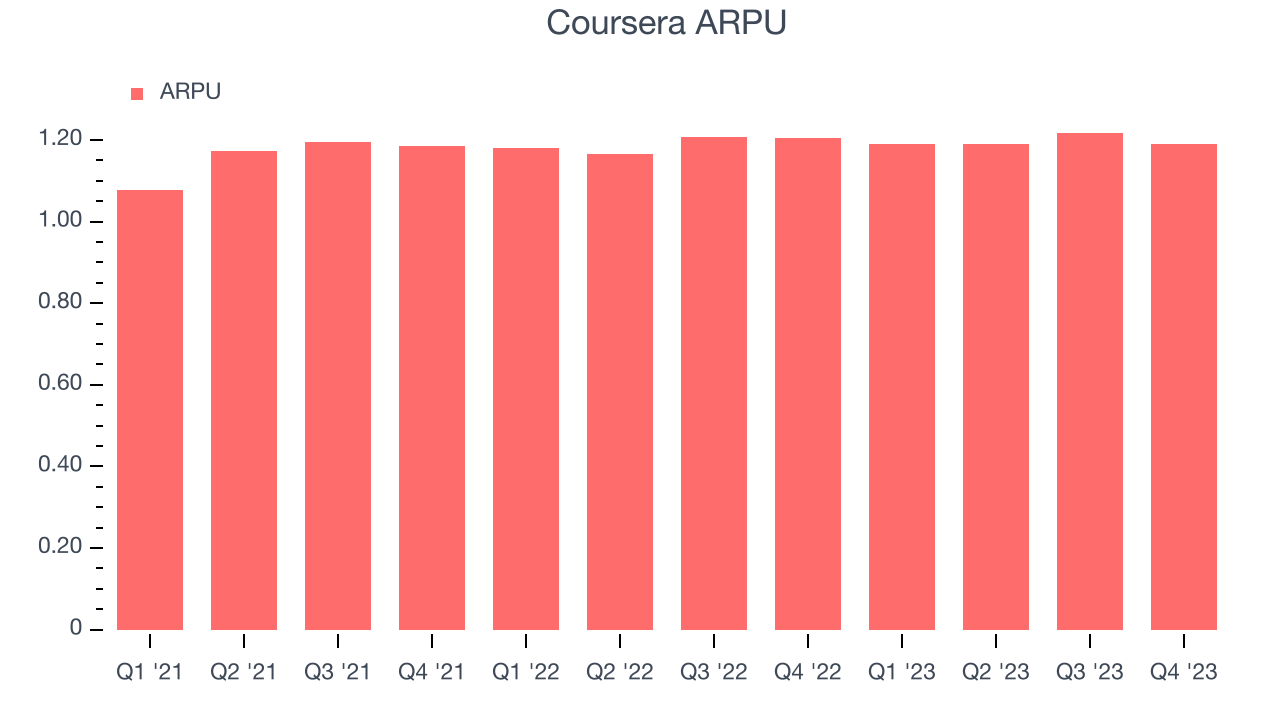

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Coursera because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Coursera's ARPU growth has been subpar over the last two years, averaging 1.8%. The company's ability to increase prices while steadily growing its users,however, shows that users still find value in its platform. This quarter, ARPU declined 1.3% year on year to $1.19 per user.

Pricing Power

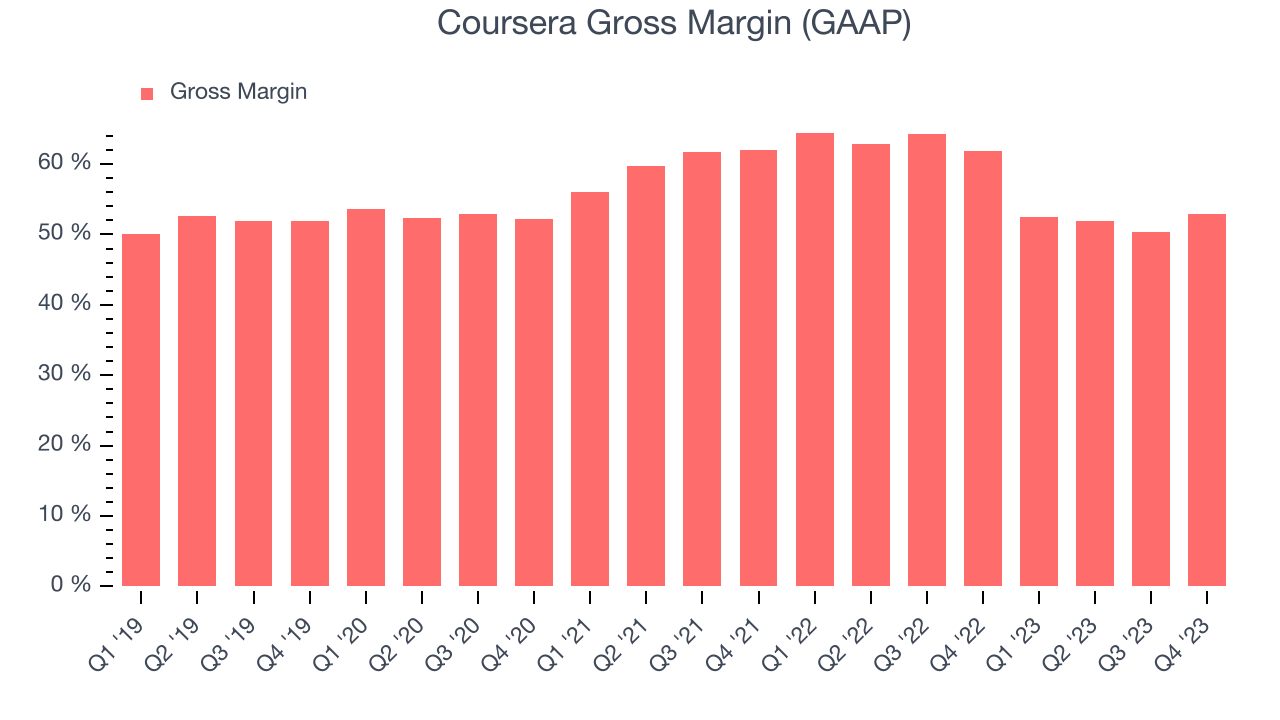

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor. Coursera's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 52.9% this quarter, down 8.9 percentage points year on year.

For internet subscription businesses like Coursera, these aforementioned costs typically include customer service, data center and infrastructure expenses, and royalties and other content-related costs if the company's offering includes features such as video or music services. After paying for these expenses, Coursera had $0.53 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Coursera's gross margins have been trending down over the past year, averaging 51.9%. This weakness isn't great as Coursera's margins are already slightly below other consumer internet companies and falling margins point to potentially deteriorating pricing power.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Coursera grow from a combination of product virality, paid advertisement, and incentives.

It's very expensive for Coursera to acquire new users as the company has spent 67.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Coursera and its peers.

Profitability & Free Cash Flow

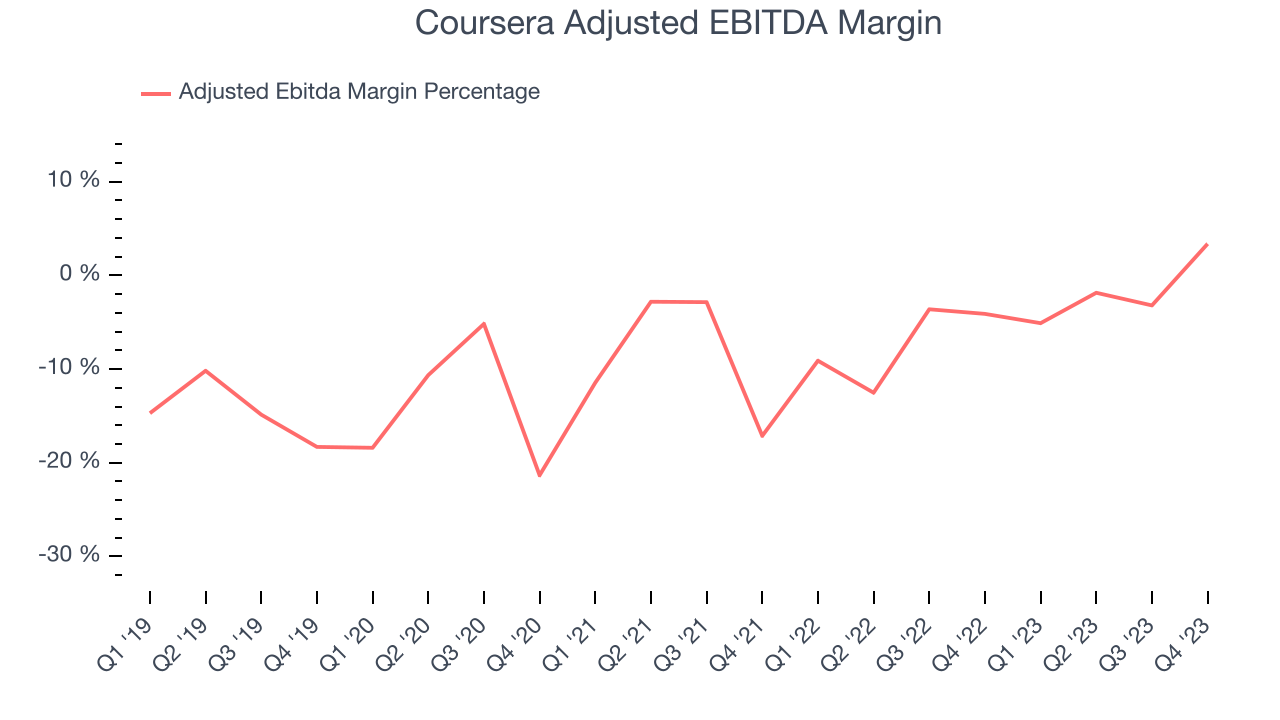

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Coursera reported EBITDA of $5.69 million this quarter, resulting in a 3.4% margin. The company's performance has been rather mediocre for a consumer internet business over the last four quarters, with average EBITDA margins of negative 1.7%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Coursera's free cash flow came in at $5.69 million in Q4, turning positive year on year.

Coursera has generated $11.27 million in free cash flow over the last 12 months, or 1.6% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Coursera's Q4 Results

It was great to see Coursera's strong user growth this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its revenue guidance for next quarter missed analysts' expectations, although a mitigating factor was that full year guidance was better than expectations and full year adjusted EBITDA guidance was way ahead. Zooming out, we think this was still a solid quarter, showing that the company is staying on track on the topline and outperforming on profits. The stock is up 3.5% after reporting and currently trades at $19.82 per share.

Is Now The Time?

When considering an investment in Coursera, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Coursera isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been good over the last three years, Wall Street expects growth to deteriorate from here. And while its growth in users has been strong, the downside is its sales and marketing spend is very high compared to other consumer internet businesses. On top of that, its ARPU has grown slowly over the last two years.

Coursera's price/gross profit ratio based on the next 12 months is 7.8x. We don't really see a big opportunity in the stock at the moment, but in the end beauty is in the eye of the beholder. And if you like the company, it seems that Coursera doesn't trade at a completely unreasonable price point.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.