E-commerce marketplace Coupang (NYSE:CPNG) beat analysts' expectations in Q1 CY2024, with revenue up 22.6% year on year to $7.11 billion. It made a non-GAAP profit of $0.05 per share, down from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Coupang? Find out by accessing our full research report, it's free.

Coupang (CPNG) Q1 CY2024 Highlights:

- Revenue: $7.11 billion vs analyst estimates of $7.01 billion (1.5% beat)

- EPS (non-GAAP): $0.05 vs analyst expectations of $0.06 (10.2% miss)

- Gross Margin (GAAP): 27.1%, up from 24.5% in the same quarter last year

- Free Cash Flow of $105 million, down 72.5% from the previous quarter

- Market Capitalization: $41.71 billion

“Our results are a reflection of our commitment to customer experience and operational excellence,” said Gaurav Anand, CFO of Coupang.

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is a South Korean e-commerce giant often referred to as the "Amazon of South Korea".

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

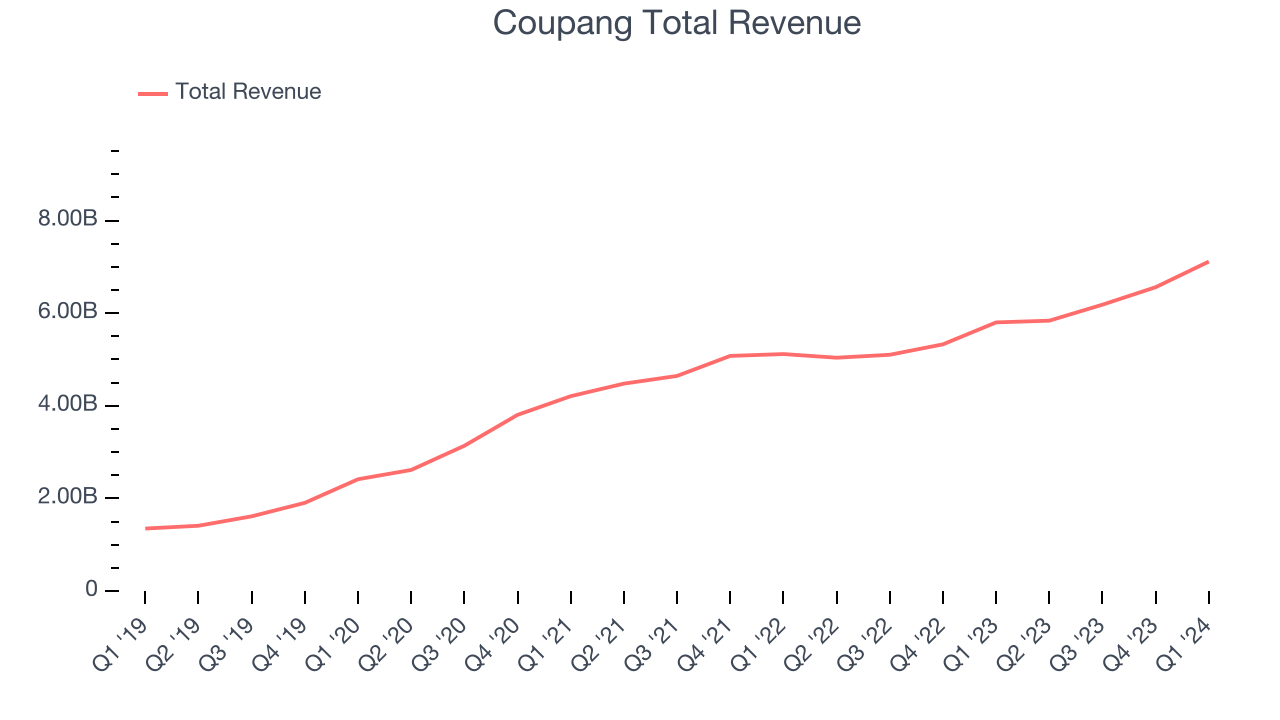

Sales Growth

Coupang's revenue growth over the last three years has been strong, averaging 24.8% annually. This quarter, Coupang beat analysts' estimates and reported decent 22.6% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 19.5% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Key Takeaways from Coupang's Q1 Results

It was good to see Coupang narrowly top analysts' revenue expectations this quarter as its developing offerings segment, which includes Taiwan and non-e-commerce products, outperformed. On the other hand, its EPS missed. Zooming out, we think this was a decent quarter, showing that the company is staying on target. Investors were likely expecting more given the recent run, and the stock is down 4.6% after reporting, trading at $22.56 per share.

So should you invest in Coupang right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.