E-commerce marketplace Coupang (NYSE:CPNG) missed analysts' expectations in Q2 CY2024, with revenue up 25.4% year on year to $7.32 billion. It made a non-GAAP profit of $0.07 per share, down from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Coupang? Find out by accessing our full research report, it's free.

Coupang (CPNG) Q2 CY2024 Highlights:

- Revenue: $7.32 billion vs analyst estimates of $7.39 billion (small miss)

- EPS (non-GAAP): $0.07 vs analyst estimates of $0 ($0.07 beat)

- Gross Margin (GAAP): 29.3%, up from 26.1% in the same quarter last year

- Adjusted EBITDA Margin: 4.5%, in line with the same quarter last year

- Free Cash Flow of $486 million, up from $107 million in the previous quarter

- Active Customers: 21.7 million, up 1.99 million year on year

- Market Capitalization: $36.39 billion

“This quarter we continued to see deeper levels of engagement from our customers, powered by our relentless focus on providing even greater levels of selection, service, and savings for customers,” said Gaurav Anand, CFO of Coupang.

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is a South Korean e-commerce giant often referred to as the "Amazon of South Korea".

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

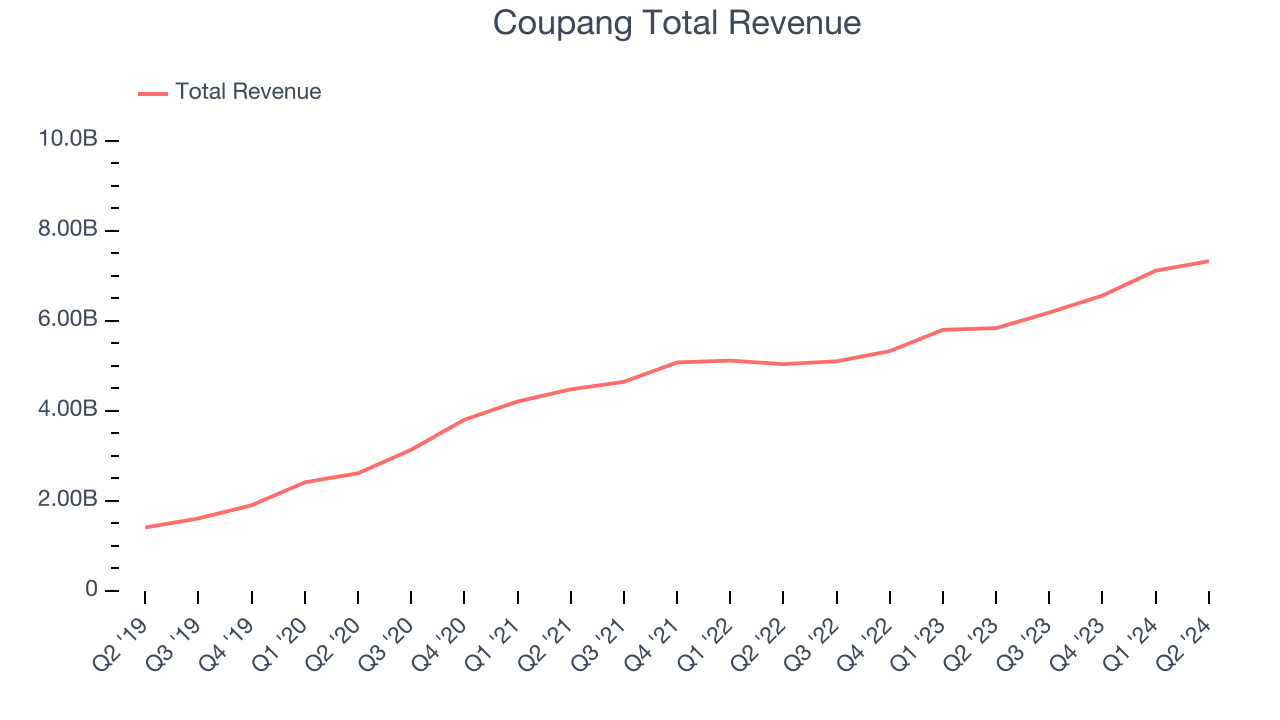

Sales Growth

Coupang's revenue growth over the last three years has been strong, averaging 21% annually. This quarter, Coupang reported decent 25.4% year-on-year revenue growth, falling short of analysts' expectations.

Ahead of the earnings results, analysts were projecting sales to grow 21.1% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

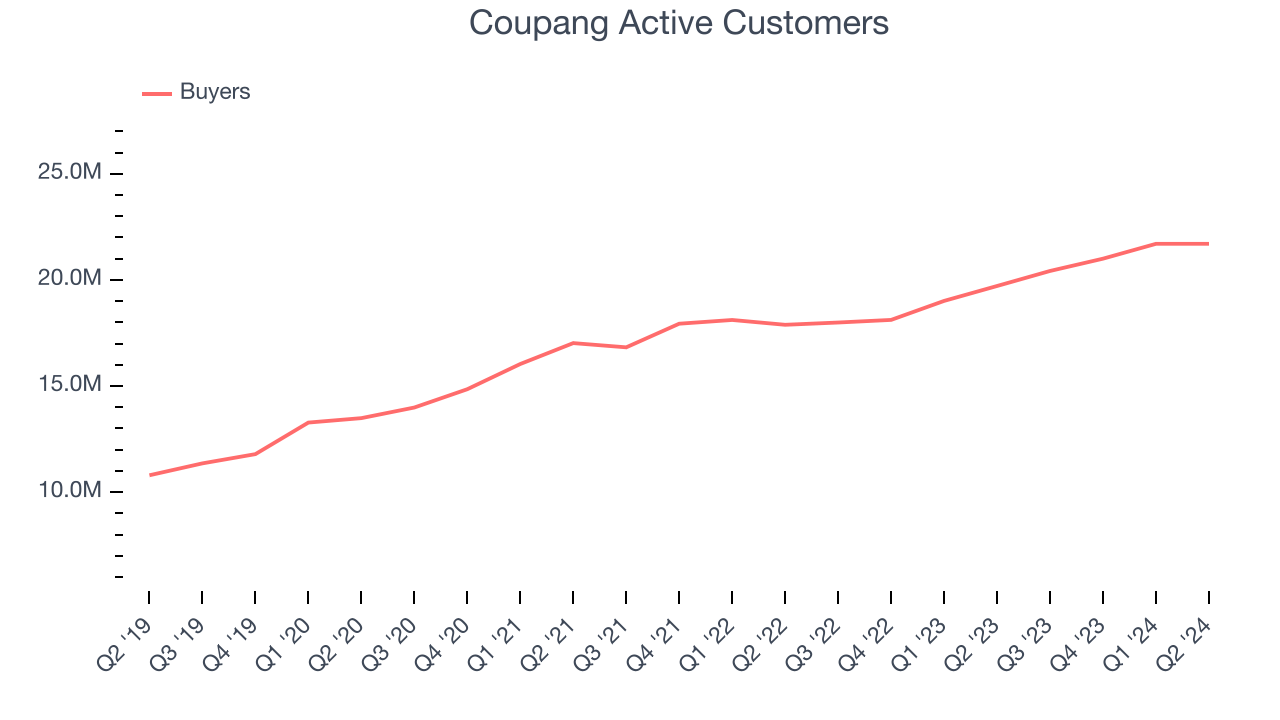

Usage Growth

As an online retailer, Coupang generates revenue growth by expanding its number of buyers and the average order size in dollars.

Over the last two years, Coupang's active buyers, a key performance metric for the company, grew 9.6% annually to 21.7 million. This is decent growth for a consumer internet company.

In Q2, Coupang added 1.99 million active buyers, translating into 10.1% year-on-year growth.

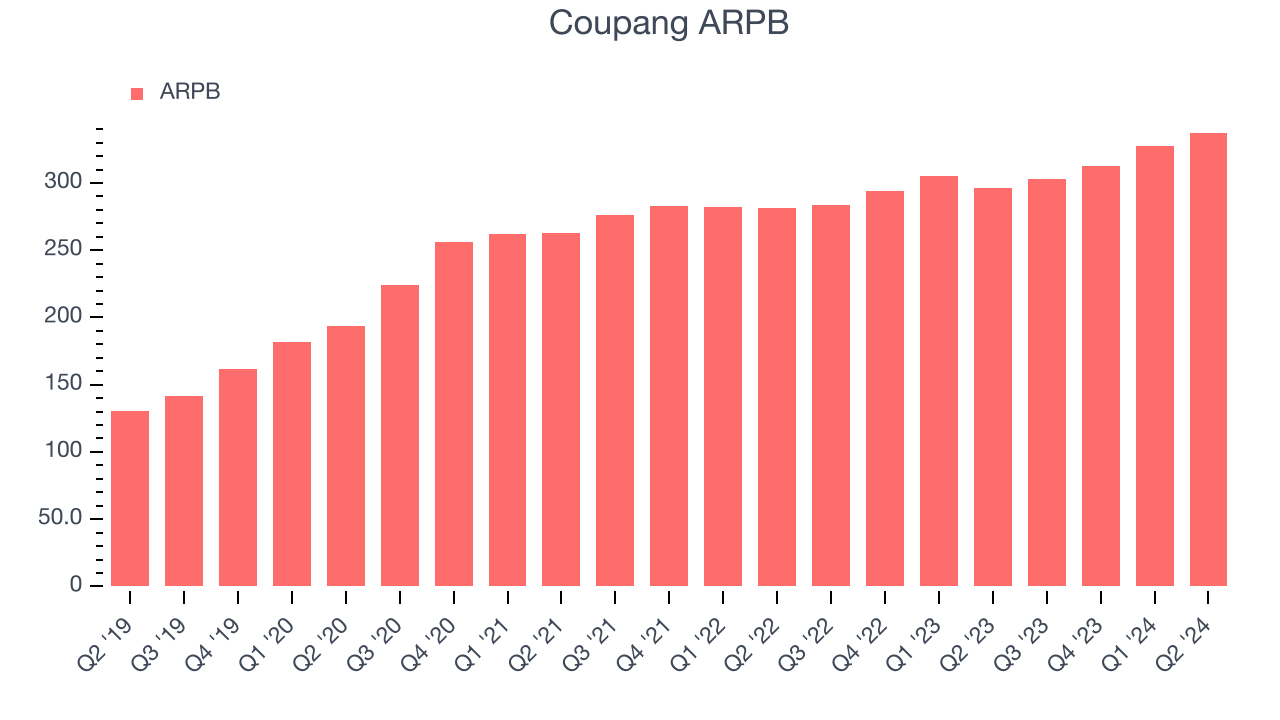

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Coupang because it measures how much customers spend per order.

Coupang's ARPB growth has been decent over the last two years, averaging 6.8%. The company's ability to increase prices while growing its active buyers demonstrates the value of its platform. This quarter, ARPB grew 14% year on year to $337.47 per buyer.

Key Takeaways from Coupang's Q2 Results

Although Coupang beat analysts' EPS expectations this quarter, its number of customers and revenue missed Wall Street's estimates. Overall, this was a bad quarter for Coupang. The stock traded down 4.5% to $19.75 immediately following the results.

Coupang may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.