E-commerce marketplace Coupang (NYSE:CPNG) beat analysts' expectations in Q4 FY2023, with revenue up 23.2% year on year to $6.56 billion. It made a non-GAAP profit of $0.08 per share, improving from its profit of $0.06 per share in the same quarter last year.

Is now the time to buy Coupang? Find out by accessing our full research report, it's free.

Coupang (CPNG) Q4 FY2023 Highlights:

- Revenue: $6.56 billion vs analyst estimates of $6.41 billion (2.4% beat)

- EPS (non-GAAP): $0.08 vs analyst estimates of $0.06 (30.2% beat)

- Free Cash Flow of $375.6 million, down 30% from the previous quarter

- Gross Margin (GAAP): 25.6%, up from 24% in the same quarter last year

- Active Customers: 21 million

- Market Capitalization: $29.3 billion

“Our accelerating growth in revenues, active customers, and WOW members reflect our unrelenting focus on creating ‘wow’ for our customers across selection, price, and service ,” said Bom Kim, Founder and CEO of Coupang.

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is a South Korean e-commerce giant often referred to as the "Amazon of South Korea".

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

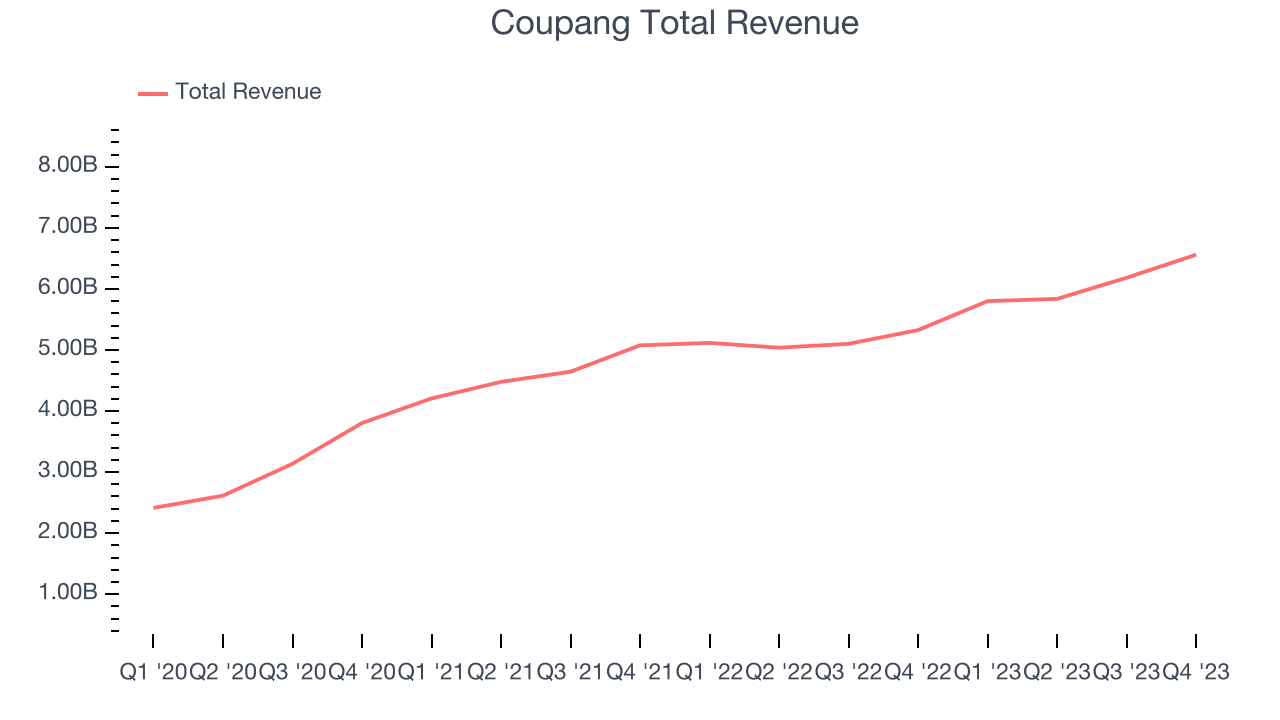

Sales Growth

Coupang's revenue growth over the last three years has been strong, averaging 29.1% annually. This quarter, Coupang beat analysts' estimates and reported decent 23.2% year-on-year revenue growth.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Key Takeaways from Coupang's Q4 Results

It was great to see Coupang beat analysts' revenue expectations this quarter, driven by strong outperformance in its Developing Offerings segment ($273 million of revenue vs estimates of $234 million), which includes its Taiwan operations, food delivery, video streaming, and fintech. We were also glad its 21 million active customers (14 million WOW members) topped Wall Street's estimates of 20.6 million. Coupang noted its revenue growth would have been 9.4% higher without the accounting change it made in Q2 2023 concerning its fulfillment and logistics revenue.

On the profitability side, Coupang blew past analysts' EBITDA, EPS, and free cash flow projections. The company has now posted five quarters of positive free cash flow in a row, showing it's gaining leverage on its fixed cost base.

During the quarter, Coupang acquired Farfetch, the leading e-commerce platform for luxury goods, by extending it a $500 million bridge loan that wiped out its equity holders. CEO Bom Kim noted he wasn't actively seeking to acquire a company, but the deal was too attractive to pass up as Coupang bought Farfetch for pennies on the dollar because it faced bankruptcy risk. In the aftermath of the deal, Coupang has stripped out redundant costs and removed Farfetch executives, making progress on its plan to make Farfetch break even from a profit perspective with no additional investments. Management implied that the Farfetch integration is not detracting from the company's focus on its core business.

Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 5.6% after reporting and currently trades at $17.82 per share.

So should you invest in Coupang right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.