E-commerce marketplace Coupang (NYSE:CPNG) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 22.6% year on year to $7.11 billion. It made a non-GAAP profit of $0.05 per share, down from its profit of $0.05 per share in the same quarter last year.

Coupang (CPNG) Q1 CY2024 Highlights:

- Revenue: $7.11 billion vs analyst estimates of $7.01 billion (1.5% beat)

- EPS (non-GAAP): $0.05 vs analyst expectations of $0.06 (10.2% miss)

- Gross Margin (GAAP): 27.1%, up from 24.5% in the same quarter last year

- Free Cash Flow of $105 million, down 72.5% from the previous quarter

- Market Capitalization: $41.71 billion

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is a South Korean e-commerce giant often referred to as the "Amazon of South Korea".

Headquartered in Seoul, Coupang revolutionized the online shopping experience in South Korea with its array of products, rapid delivery services, and customer-centric approach.

The company's extensive product range covers various categories including electronics, home goods, beauty products, fashion, groceries, and more. Coupang also operates its own private label brands to fill product assortment gaps with quality goods at competitive prices. In addition to physical goods, Coupang has expanded into services like video streaming and food delivery, further diversifying its offerings and increasing its appeal to a broad consumer base.

Coupang's rise can be attributed to its logistics and distribution network. The company has invested heavily in its infrastructure, establishing a vast network of warehouses and logistics centers throughout South Korea. This allows Coupang to offer "Rocket Delivery," which guarantees the delivery of millions of items within 24 hours. Unlike other countries, this is possible in South Korea because the country's high population density allows for efficient delivery routes - for example, Seoul only covers about 12% of the country's area but is home to nearly 50% of the population.

A key aspect of Coupang's strategy is its commitment to customer satisfaction. The company offers a no-questions-asked return policy, with most returns picked up directly from customers' homes. This focus on customer service has fostered strong loyalty among Korean consumers and is further amplified by its WOW membership offering, which is similar to Amazon Prime and gives customers additional perks.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Coupang's Korea-based competitors include Naver (KRX:035420), Lotte Shopping (KRX:023530), and Kakao (KRX:035720). Amazon (NASDAQ:AMZN), Pinduoduo’s Temu (NASDAQ:PDD), and Alibaba’s AliExpress (NYSE:BABA) are also big international players in the market.Sales Growth

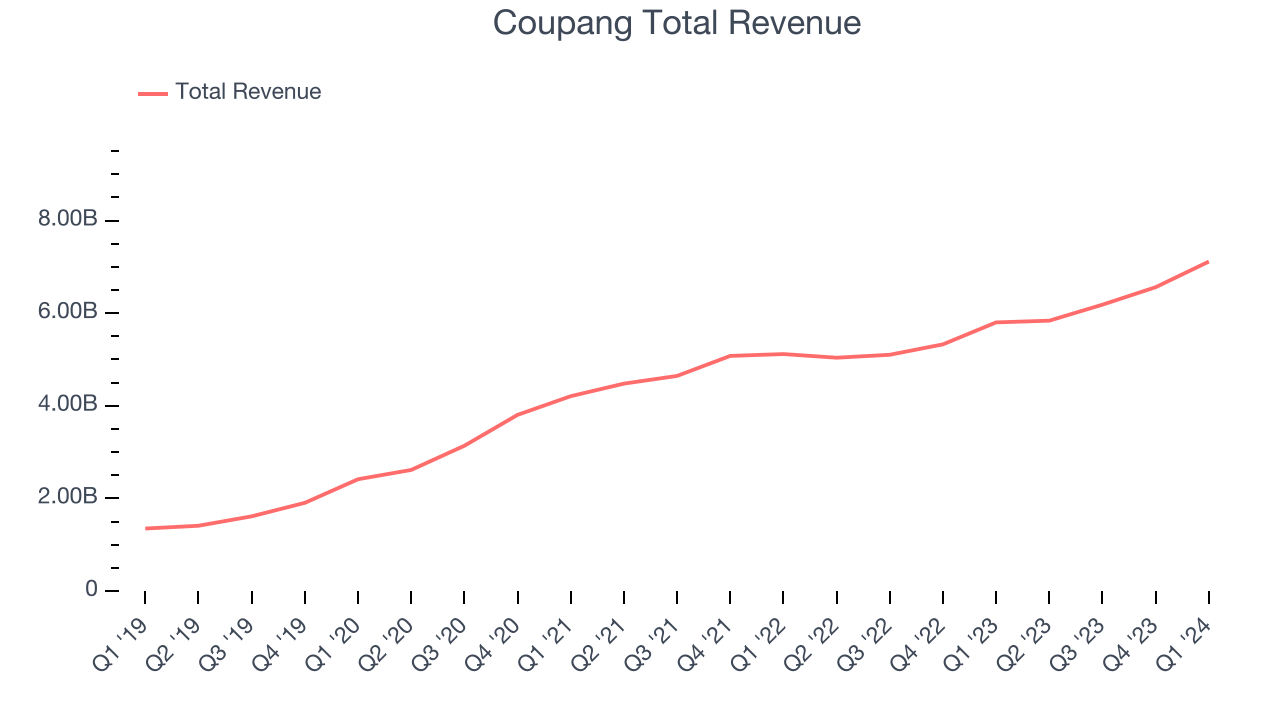

Coupang's revenue growth over the last three years has been strong, averaging 24.8% annually. This quarter, Coupang beat analysts' estimates and reported decent 22.6% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 19.5% over the next 12 months.

Pricing Power

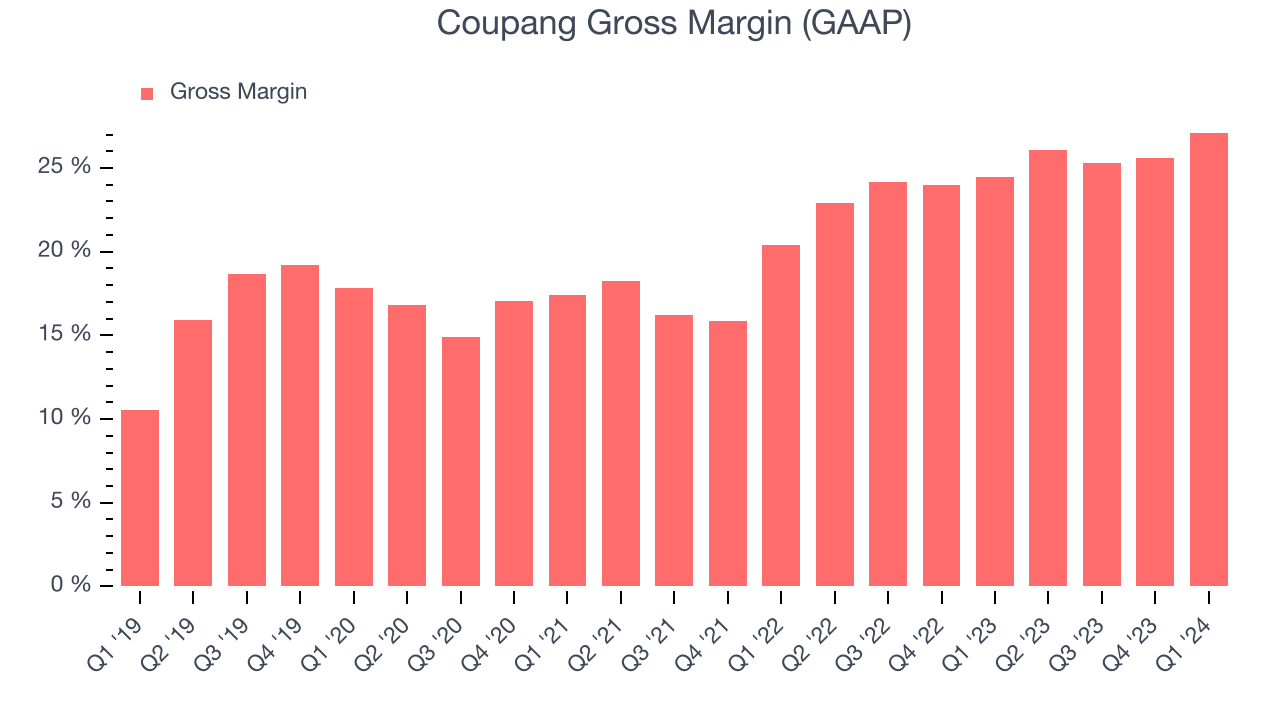

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Coupang's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 27.1% this quarter, up 2.6 percentage points year on year.

For online retail (separate from online marketplaces) businesses like Coupang, these aforementioned costs typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure expenses. After paying for these expenses, Coupang had $0.27 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Coupang's gross margins have been trending up over the last 12 months, averaging 26.1%. This is a welcome development, as Coupang's margins are below the industry average, and rising margins could suggest improved demand and pricing power.

Profitability & Free Cash Flow

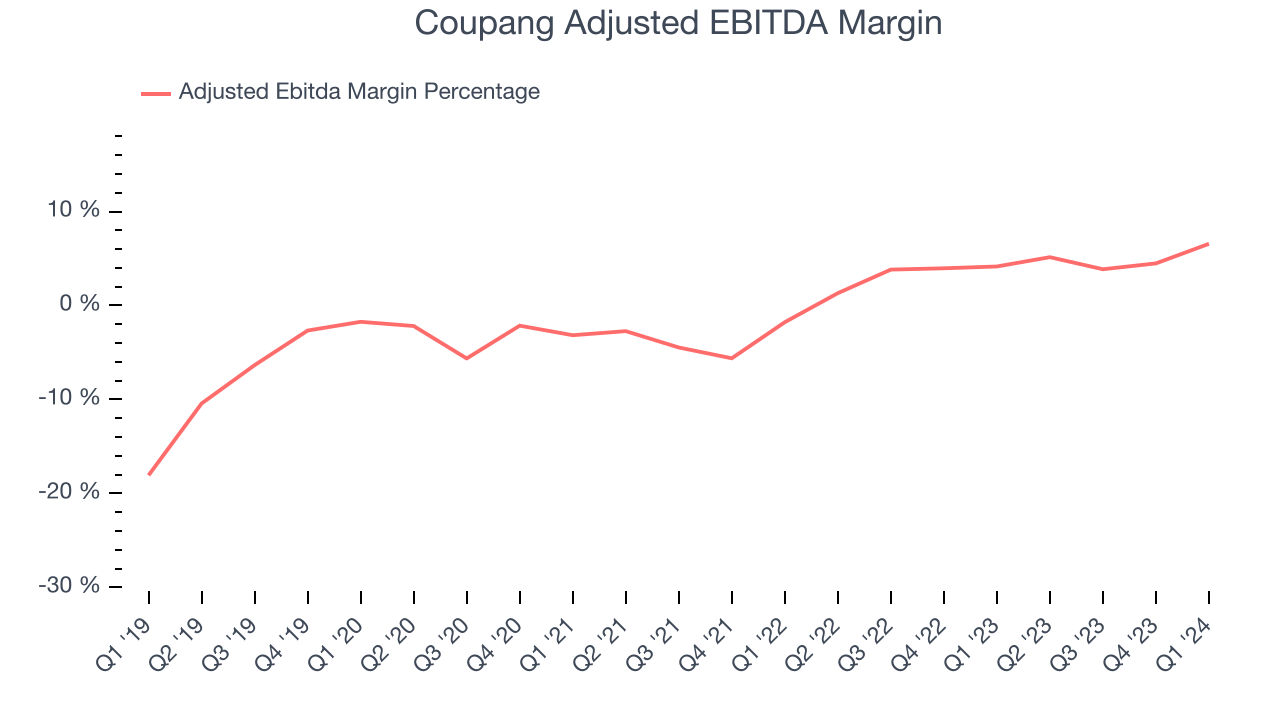

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Coupang's EBITDA was $467 million this quarter, translating into a 6.6% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 5.1%.

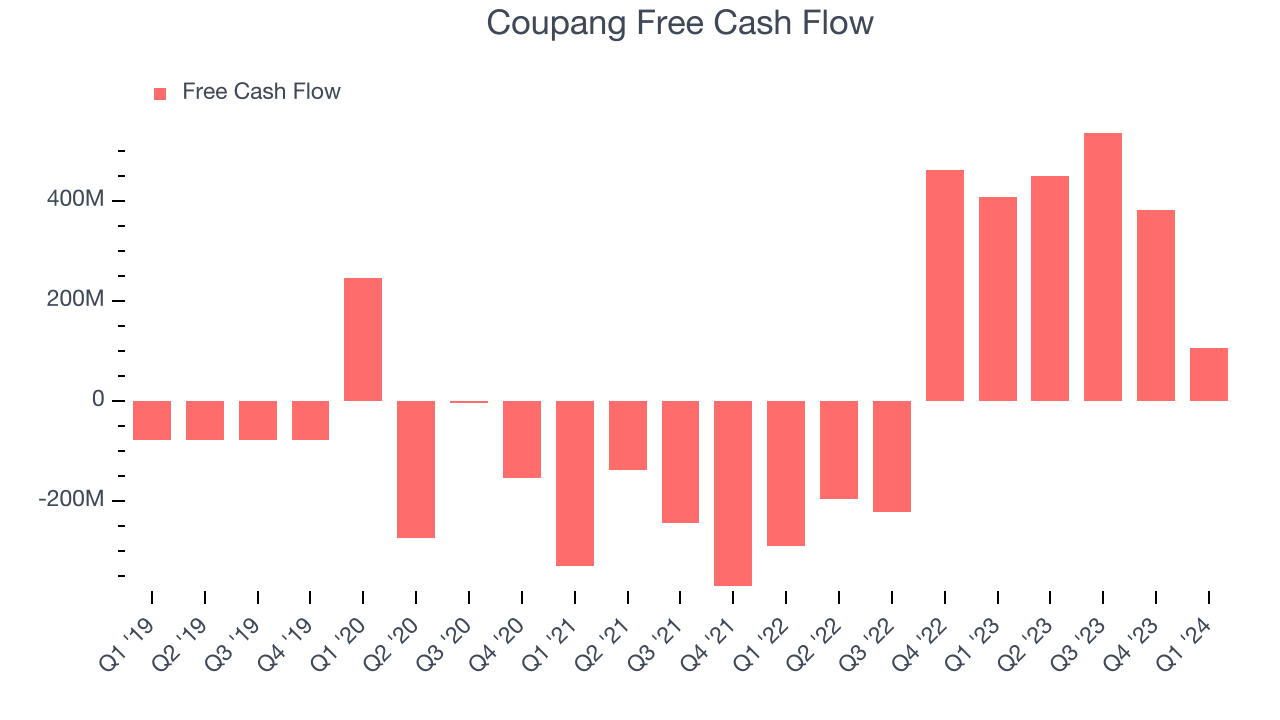

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Coupang's free cash flow came in at $105 million in Q1, down 74.2% year on year.

Coupang has generated $1.47 billion in free cash flow over the last 12 months, or 5.7% of revenue. This FCF margin stems from its efficient business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Coupang's Q1 Results

It was good to see Coupang narrowly top analysts' revenue expectations this quarter as its developing offerings segment, which includes Taiwan and non-e-commerce products, outperformed. On the other hand, its EPS missed. Zooming out, we think this was a decent quarter, showing that the company is staying on target. Investors were likely expecting more given the recent run, and the stock is down 4.6% after reporting, trading at $22.56 per share.

Is Now The Time?

When considering an investment in Coupang, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although Coupang isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been good over the last three years, Wall Street expects growth to deteriorate from here. On top of that, its gross margins make it extremely difficult to reach positive operating profits compared to other consumer internet businesses.

At the moment, Coupang trades at 35.2x next 12 months EV-to-EBITDA. We can find things to like about Coupang and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder whether there might be better opportunities elsewhere.

Wall Street analysts covering the company had a one-year price target of $23.54 per share right before these results (compared to the current share price of $22.56).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.