Industrial conglomerate Crane (NYSE:CR) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 2.1% year on year to $544.1 million. Its non-GAAP profit of $1.26 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy Crane? Find out by accessing our full research report, it’s free.

Crane (CR) Q4 CY2024 Highlights:

- Revenue: $544.1 million vs analyst estimates of $533.6 million (2.1% year-on-year growth, 2% beat)

- Adjusted EPS: $1.26 vs analyst estimates of $1.21 (4.3% beat)

- Adjusted EBITDA: $107.9 million vs analyst estimates of $107.4 million (19.8% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2025 is $5.45 at the midpoint, missing analyst estimates by 1.2%

- Operating Margin: 15.8%, up from 12.6% in the same quarter last year

- Free Cash Flow Margin: 34.6%, up from 27.5% in the same quarter last year

- Organic Revenue rose 8% year on year (5% in the same quarter last year)

- Market Capitalization: $9.25 billion

Max Mitchell, Crane's Chairman, President and Chief Executive Officer, stated: "Crane Company had an exceptional year with both segments executing at a high level. As a result, we delivered 8% core sales growth with 28% adjusted EPS growth in 2024. Further, we continued to strengthen and focus our portfolio with the acquisitions of Vian, CryoWorks and Technifab, as well as with the divestiture of our Engineered Materials segment."

Company Overview

Based in Connecticut, Crane (NYSE:CR) is a diversified manufacturer of engineered industrial products, including fluid handling, and aerospace technologies.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

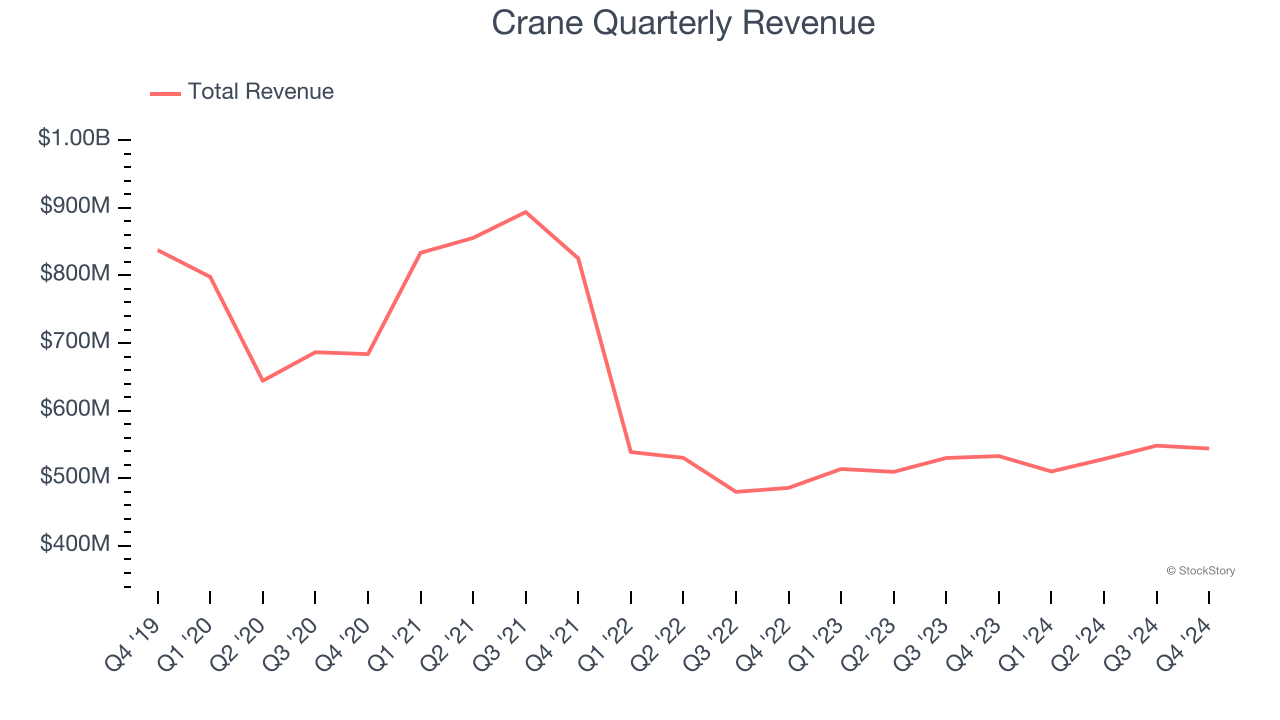

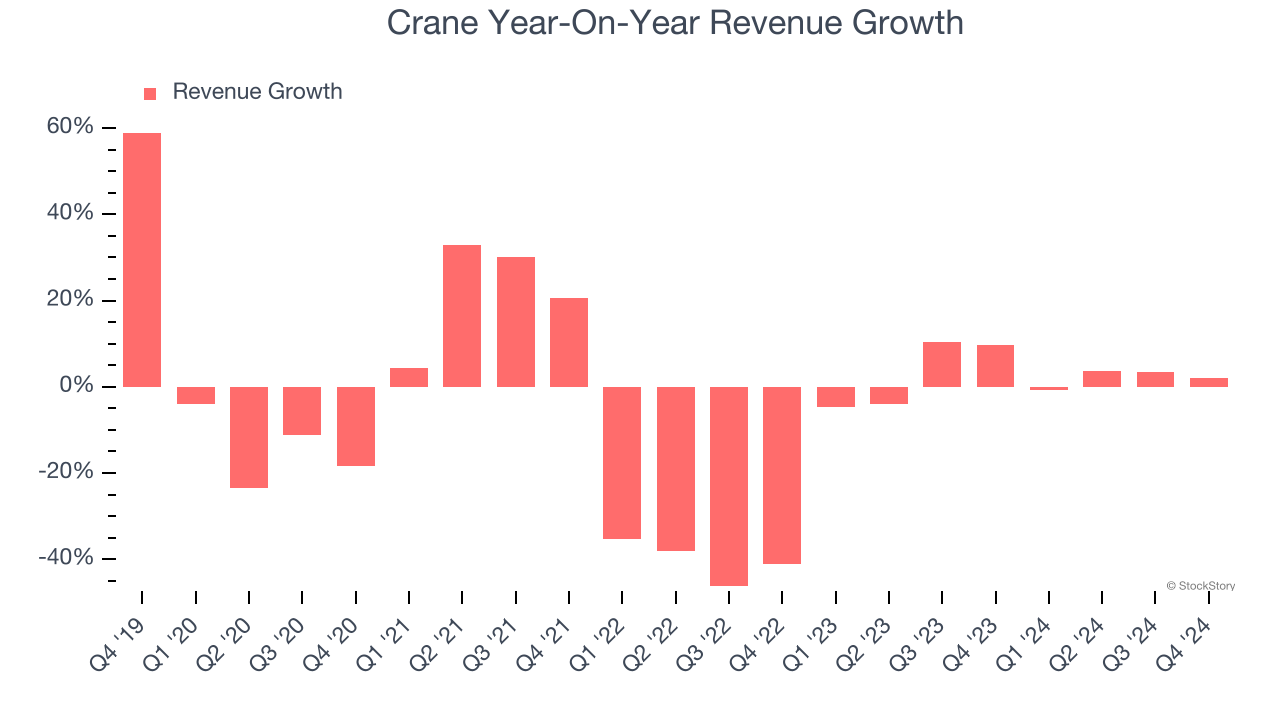

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Crane struggled to consistently generate demand over the last five years as its sales dropped at a 8.3% annual rate. This fell short of our benchmarks and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Crane’s annualized revenue growth of 2.3% over the last two years is above its five-year trend, but we were still disappointed by the results. We also note many other General Industrial Machinery businesses have faced declining sales because of cyclical headwinds. While Crane grew slower than we’d like, it did perform better than its peers.

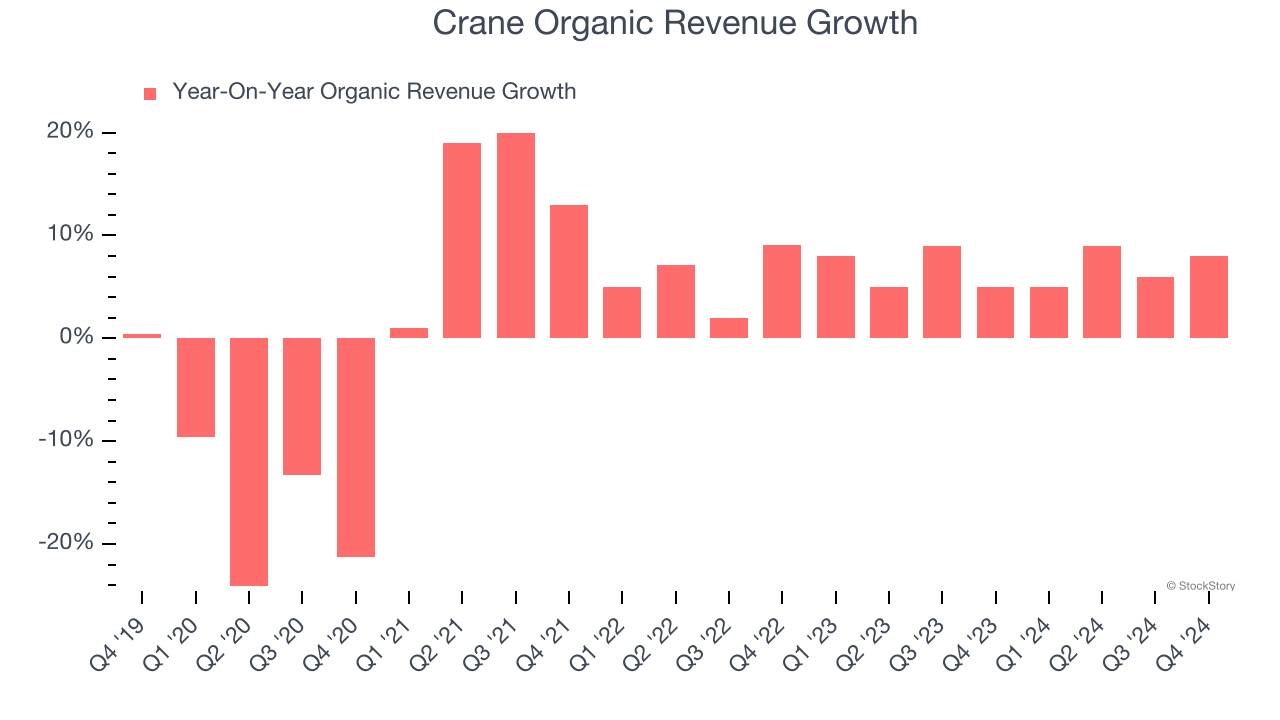

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Crane’s organic revenue averaged 6.9% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Crane reported modest year-on-year revenue growth of 2.1% but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

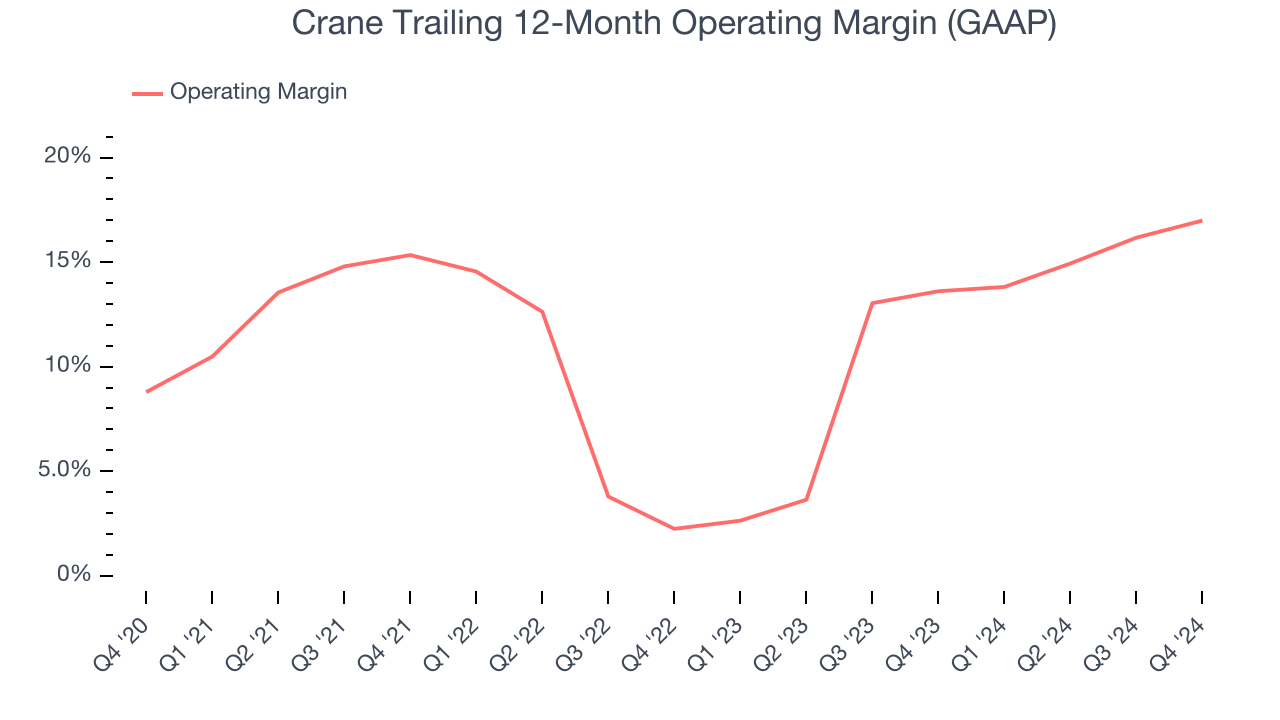

Crane has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Crane’s operating margin rose by 8.2 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, Crane generated an operating profit margin of 15.8%, up 3.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

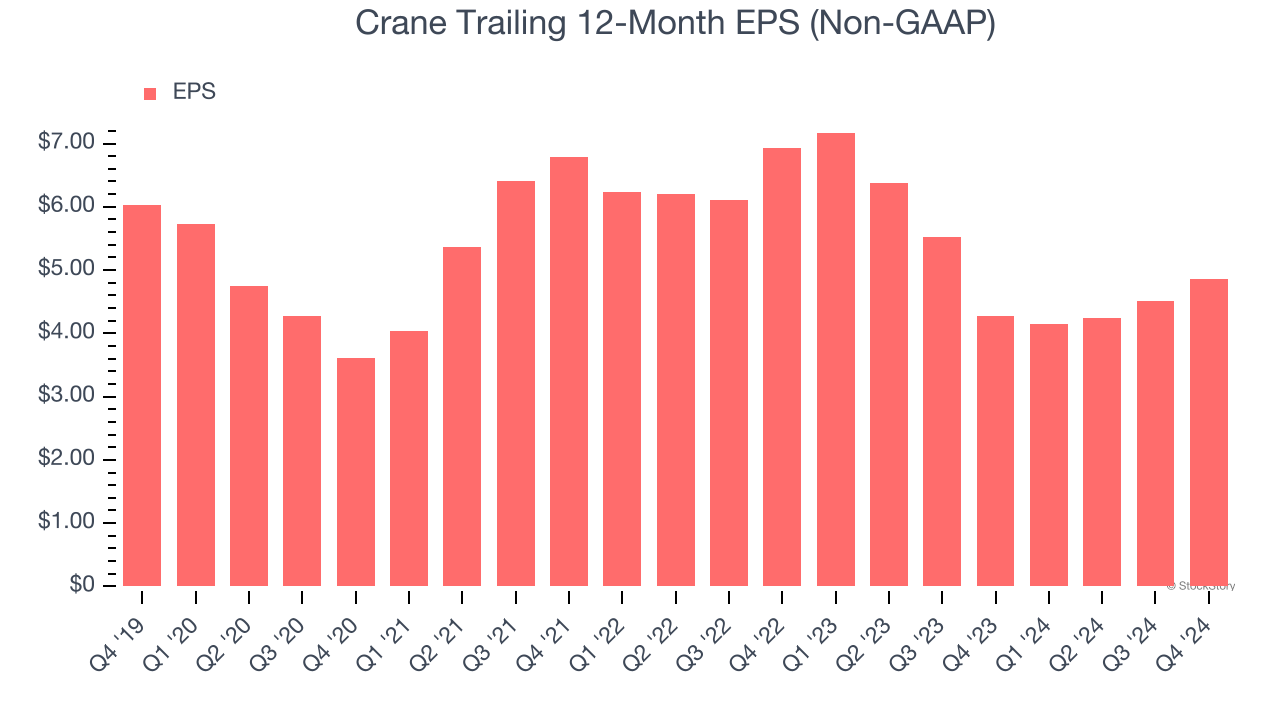

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Crane, its EPS and revenue declined by 4.2% and 8.3% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Crane’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Crane, its two-year annual EPS declines of 16.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Crane reported EPS at $1.26, up from $0.90 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects Crane’s full-year EPS of $4.86 to grow 14.3%.

Key Takeaways from Crane’s Q4 Results

We enjoyed seeing Crane exceed analysts’ organic revenue growth, total revenue, and EPS expectations this quarter. On the other hand, its full-year EPS guidance slightly missed. Overall, this quarter was mixed, but the market seems to be focusing on the positives. The stock traded up 3.4% to $161.98 immediately following the results.

Indeed, Crane had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.