Customer relationship management software maker Salesforce (NYSE:CRM) reported strong growth in the Q1 FY2022 earnings announcement, with revenue up 22.5% year on year to $5.96 billion. Salesforce made a GAAP profit of $469 million, improving on its profit of $99 million, in the same quarter last year.

What do these results signal for the future of Salesforce? Get early access our full analysis here

Salesforce (CRM) Q1 FY2022 Highlights:

- Revenue: $5.96 billion vs analyst estimates of $5.88 billion (1.24% beat)

- EPS (non-GAAP): $1.21 vs analyst estimates of $0.88 (36.9% beat)

- Revenue guidance for Q2 2022 is $6.22 billion at the midpoint, above analyst estimates of $6.16 billion

- The company reconfirmed revenue guidance for the full year, at $25.9 billion at the midpoint

- Free cash flow of $3.05 billion, up 50.9% from previous quarter

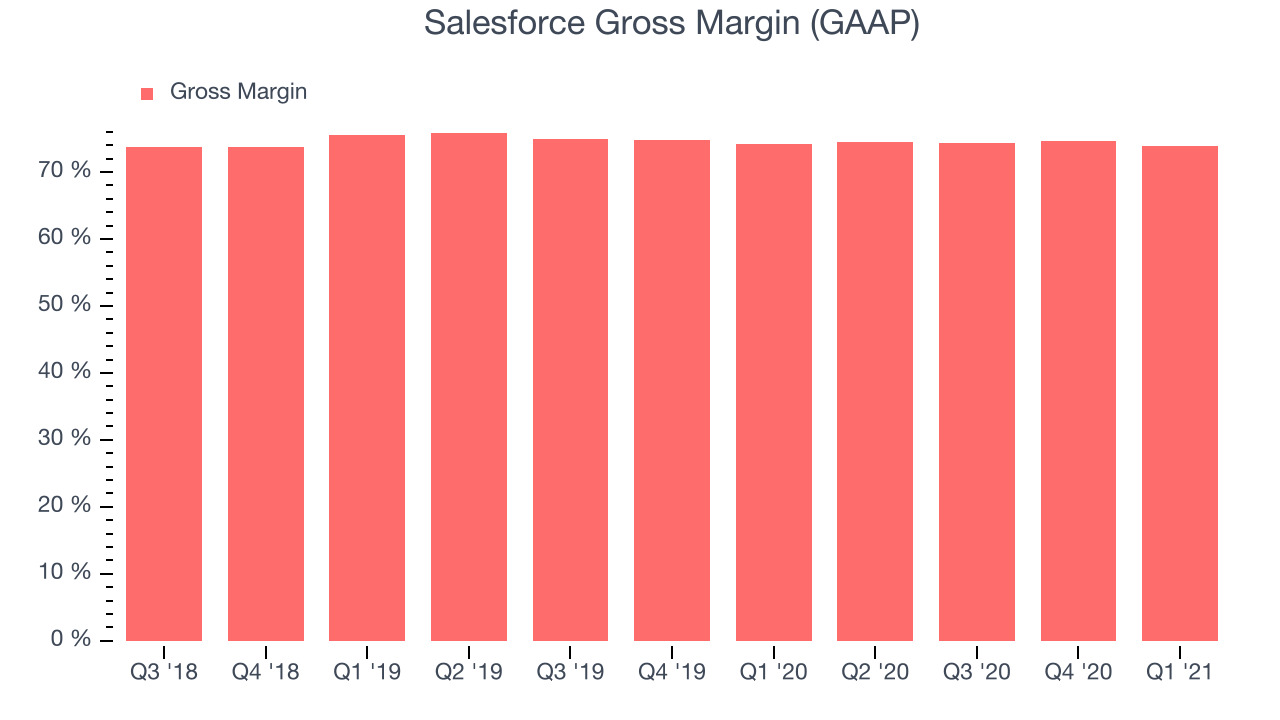

- Gross Margin (GAAP): 73.9%, in line with previous quarter

- Updated valuation: Salesforce is up at $231.89 and now trades at 9.5x price-to-sales (LTM), compared to 10x just before the results.

“We had the best first quarter in our company’s history,” said Marc Benioff, Chair & CEO, Salesforce.

The Biggest Cloud in the Sky

Salesforce was launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders as a software as a service platform to help companies access, manage and share sales information. Over time the company grew into a technology behemoth that now offers tools for complete management of a company’s sales, marketing and customer support efforts. From managing sales teams and designing sales processes, to automating personalised email and digital advertising campaigns over to integrating all the data together in the cloud so the customer service knows what the sales promised to the person they just have on the call, Salesforce has it.

The power of Salesforce lays in that it becomes a de-facto operating system of the company’s sales and marketing function, centralising all the data and offering extreme customization, so that companies can adjust the software to exactly fit their internal processes. It now even offers the ability for customers to build new applications on top of the platform using building blocks that Salesforce have pre-made or their own.

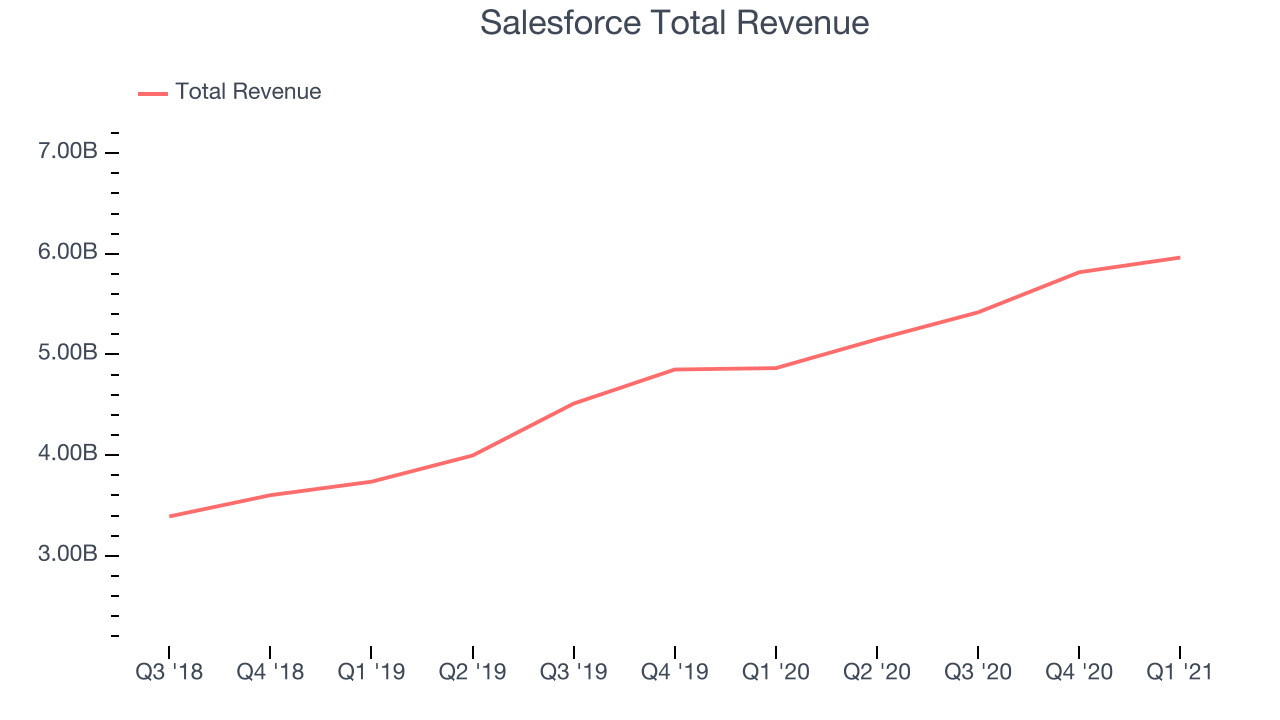

As you can see below, Salesforce's revenue growth has been strong over the last twelve months, growing from $4.86 billion to $5.96 billion.

This quarter, Salesforce's quarterly revenue was once again up a very solid 22.5% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $146 million in Q1, compared to $398 million in Q4 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

“We had the best first quarter in our company’s history,” said Marc Benioff, Chair & CEO, Salesforce.

The End of On-premise Software

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Salesforce was the original company that pioneered the cloud software-as-a-service model and kicked off the cloud revolution that is still going on today.

Salesforce's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 73.9% in Q1. That means that for every $1 in revenue the company had $0.73 left to spend on developing new products, marketing & sales and the general administrative overhead. This is around the average of what we typically see in SaaS businesses, but it is good to see that the gross margin is staying stable which indicates that Salesforce is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Salesforce's Q1 Results

With market capitalisation of $211 billion, more than $15 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

It was good to see Salesforce beat on earnings so strongly. And we were also happy to see it provided next quarter revenue outlook exceeding analysts’ expectations. Zooming out, we think this was a very good quarter. Salesforce is a reliable compounder and one of the best run SaaS companies out there, and these results once again confirmed that.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.