Customer relationship management software maker Salesforce (NYSE:CRM) reported Q2 CY2024 results exceeding Wall Street analysts’ expectations, with revenue up 8.4% year on year to $9.33 billion. On the other hand, the company expects next quarter’s revenue to be around $9.34 billion, slightly below analysts’ estimates. It made a non-GAAP profit of $2.56 per share, improving from its profit of $2.12 per share in the same quarter last year.

Is now the time to buy Salesforce? Find out by accessing our full research report, it’s free.

Salesforce (CRM) Q2 CY2024 Highlights:

- Revenue: $9.33 billion vs analyst estimates of $9.23 billion (small beat)

- Adjusted Operating Income: $3.14 billion vs analyst estimates of $2.97 billion (6% beat)

- EPS (non-GAAP): $2.56 vs analyst estimates of $2.36 (8.6% beat)

- The company reconfirmed its revenue guidance for the full year of $37.85 billion at the midpoint

- EPS (non-GAAP) guidance for the full year is $10.07 at the midpoint, beating analyst estimates by 1.7%

- Gross Margin (GAAP): 76.8%, up from 75.4% in the same quarter last year

- Free Cash Flow Margin: 8.1%, down from 66.6% in the previous quarter

- Billings: $8.49 billion at quarter end, up 9.9% year on year (beat)

- Market Capitalization: $256 billion

“In Q2, we delivered strong performance across revenue, cash flow, margin and cRPO, and raised our fiscal year non-GAAP operating margin and cash flow growth guidance,” said Marc Benioff, Chair and CEO, Salesforce.

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

Sales Growth

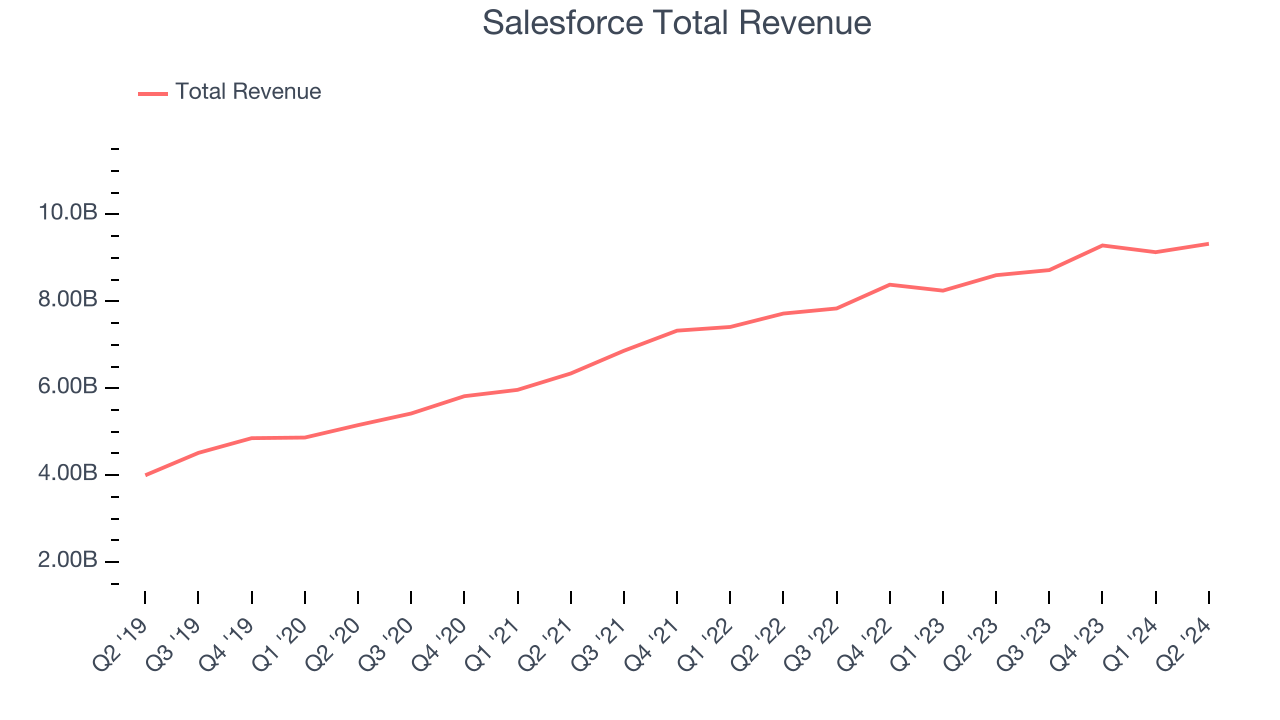

As you can see below, Salesforce’s 15.7% annualized revenue growth over the last three years has been sluggish, and its sales came in at $9.33 billion this quarter.

Salesforce’s quarterly revenue was only up 8.4% year on year, which might disappoint some shareholders. However, its revenue increased $192 million quarter on quarter, a strong improvement from the $154 million decrease in Q1 CY2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter’s guidance suggests that Salesforce is expecting revenue to grow 7.1% year on year to $9.34 billion, slowing down from the 11.3% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 8.2% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

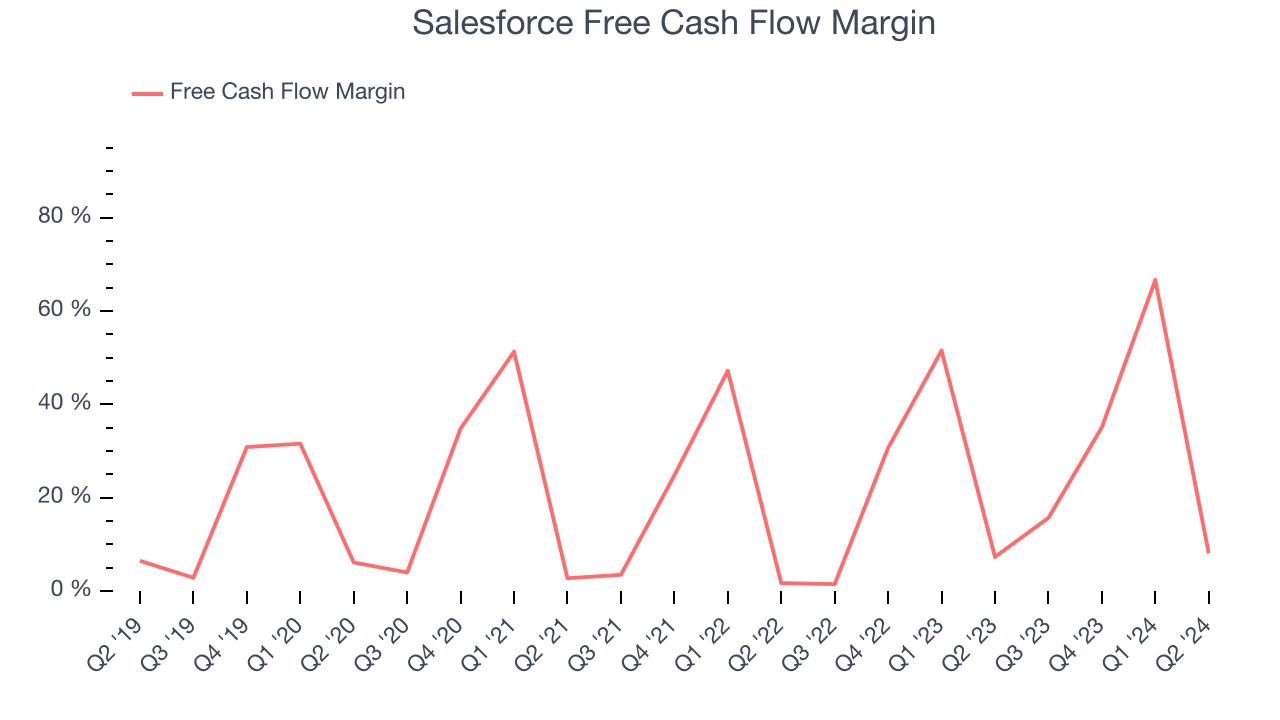

Salesforce has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.4% over the last year.

Salesforce’s free cash flow clocked in at $755 million in Q2, equivalent to a 8.1% margin. This quarter’s cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Salesforce’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 31.4% for the last 12 months will decrease to 30.1%.

Key Takeaways from Salesforce’s Q2 Results

It was good to see Salesforce beat analysts’ billings expectations this quarter. While revenue guidance for next quarter missed analysts’ expectations, full year revenue guidance was reconfirmed and full year EPS is above expectations. Overall, this quarter was fine. The stock traded up 1% to $261.60 immediately following the results.

So should you invest in Salesforce right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.