Customer relationship management software maker Salesforce (NYSE:CRM) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 10.8% year on year to $9.29 billion. The company expects next quarter's revenue to be around $9.15 billion, in line with analysts' estimates. It made a non-GAAP profit of $2.29 per share, improving from its profit of $1.68 per share in the same quarter last year.

Salesforce (CRM) Q4 FY2024 Highlights:

- Revenue: $9.29 billion vs analyst estimates of $9.22 billion (small beat)

- EPS (non-GAAP): $2.29 vs analyst estimates of $2.27 (1.1% beat)

- Revenue Guidance for Q1 2025 is $9.15 billion at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2025 is $37.85 billion at the midpoint, missing analyst estimates by 2% and implying 8.6% growth (vs 11.2% in FY2024)

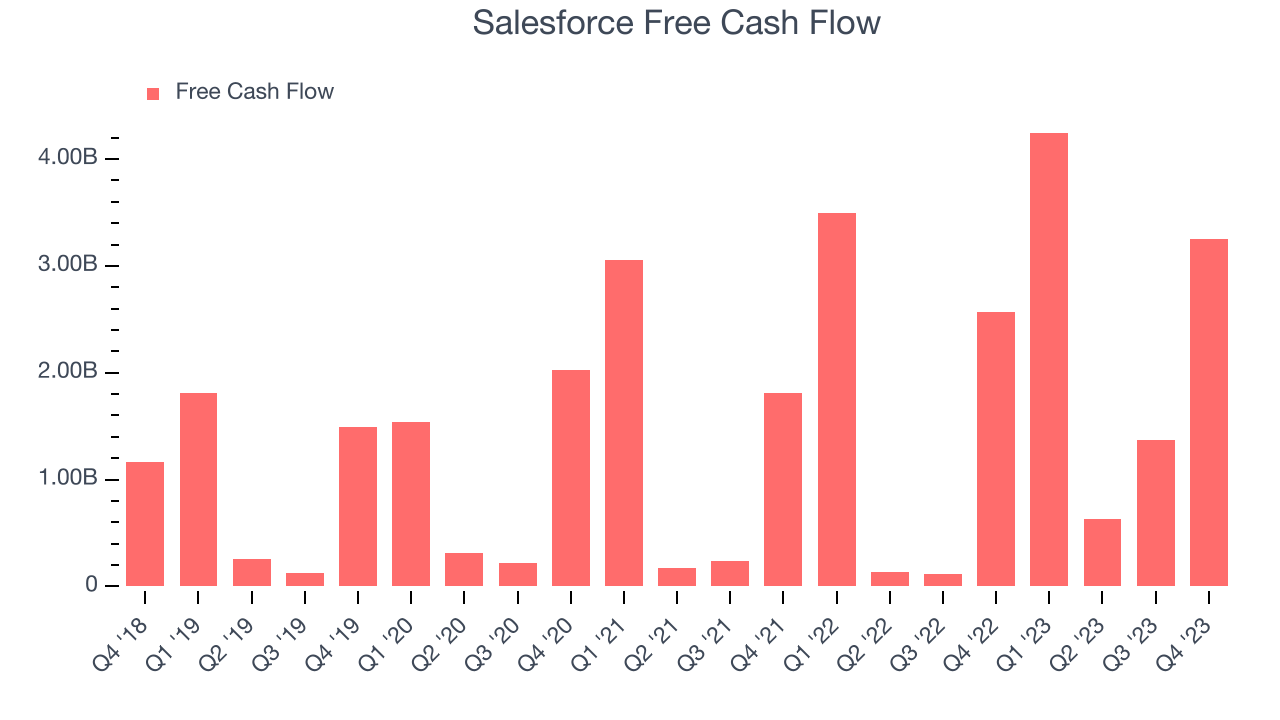

- Free Cash Flow of $3.26 billion, up 138% from the previous quarter

- Gross Margin (GAAP): 76.9%, up from 75% in the same quarter last year

- Market Capitalization: $289.9 billion

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Over time the company grew into a technology behemoth that now offers tools for complete management of a company’s sales, marketing and customer support efforts. From managing sales teams and designing sales processes, to automating personalised email and digital advertising campaigns to integrating all the data together in the cloud so the customer service knows what the sales promised to the person they just have on the call, Salesforce has it.

The power of Salesforce lies in that it becomes a de-facto operating system of the company’s sales and marketing function, centralising all the data and offering extreme customization, so that companies can adjust the software to exactly fit their internal processes. It now even offers the ability for customers to build new applications on top of the platform using building blocks that Salesforce have pre-made or their own.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

While it remains a strong brand in the cloud software space, Salesforce faces competition from Oracle (NYSE:ORCL), SAP (NYSE:SAP), HubSpot (NYSE:HUBS), and Zoho.

Sales Growth

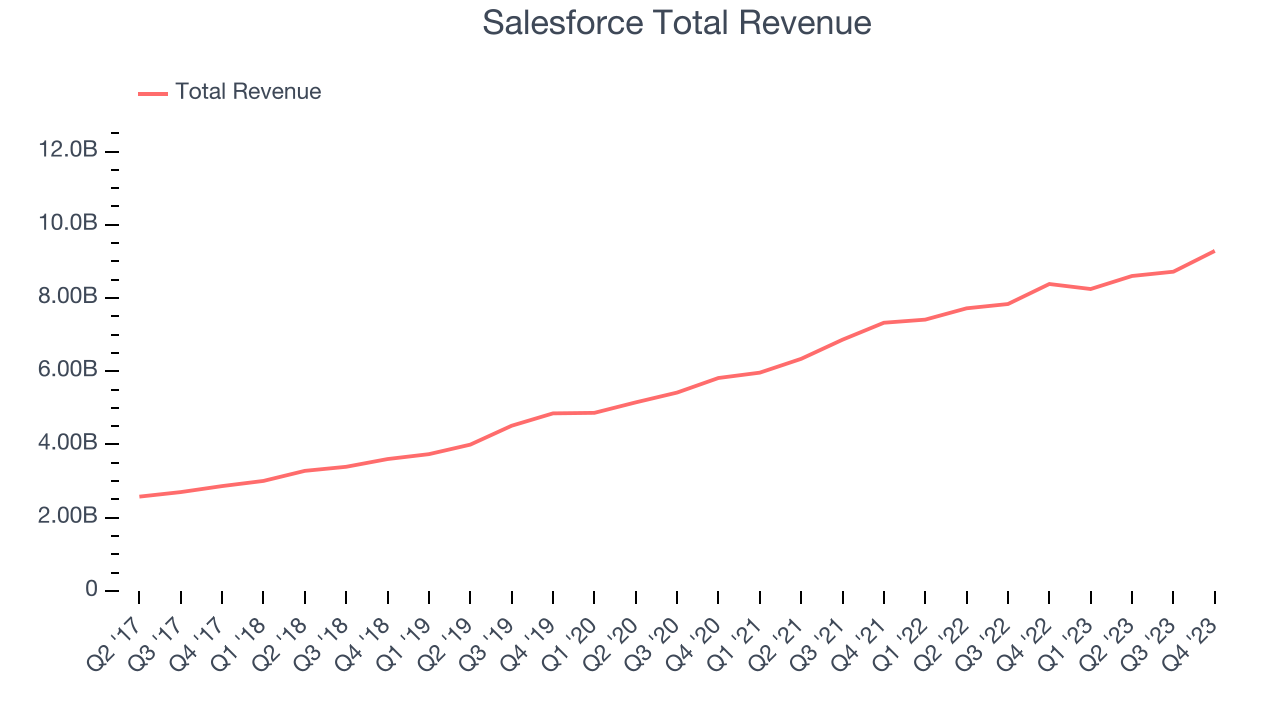

As you can see below, Salesforce's revenue growth has been mediocre over the last two years, growing from $7.33 billion in Q4 FY2022 to $9.29 billion this quarter.

This quarter, Salesforce's quarterly revenue was once again up 10.8% year on year. We can see that Salesforce's revenue increased by $567 million quarter on quarter, which is a solid improvement from the $117 million increase in Q3 2024. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that Salesforce is expecting revenue to grow 10.9% year on year to $9.15 billion, in line with the 11.3% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $37.85 billion at the midpoint, growing 8.6% year on year compared to the 11.2% increase in FY2024.

Profitability

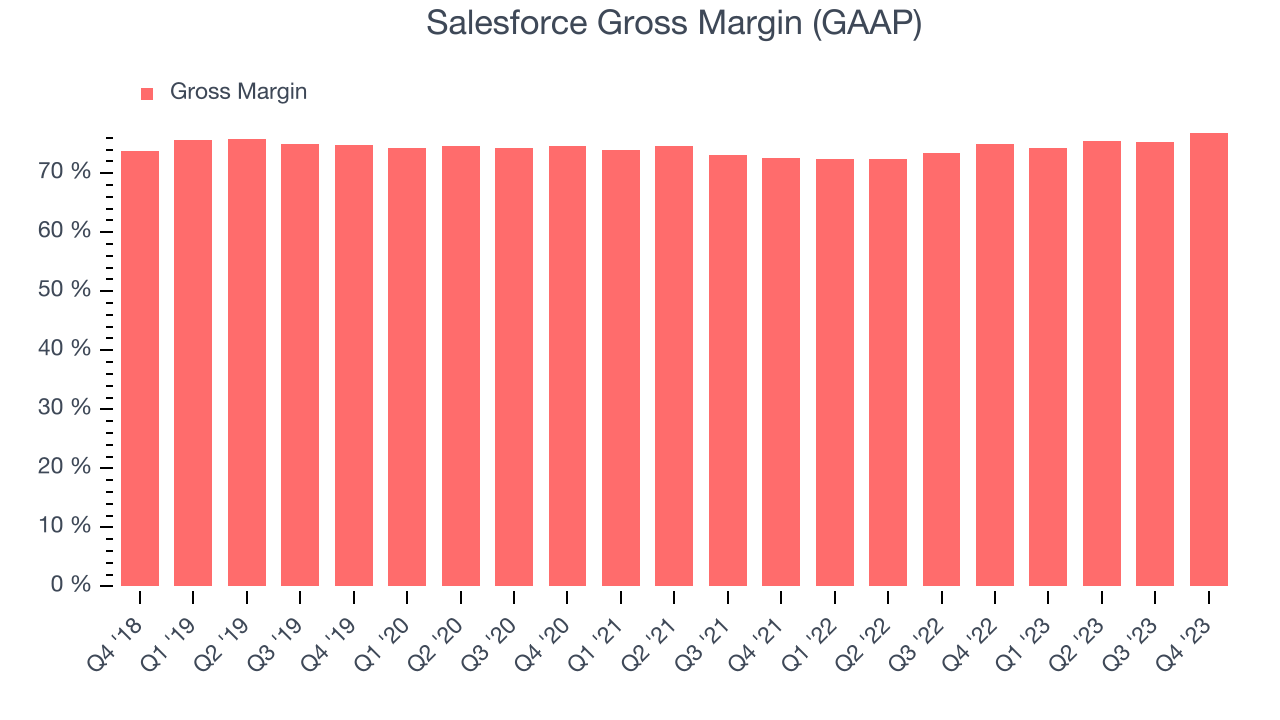

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Salesforce's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 76.9% in Q4.

That means that for every $1 in revenue the company had $0.77 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Salesforce's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Salesforce's free cash flow came in at $3.26 billion in Q4, up 26.7% year on year.

Salesforce has generated $9.50 billion in free cash flow over the last 12 months, an eye-popping 27.2% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Salesforce's Q4 Results

It was great to see Salesforce to grow free cash flow and improve its gross margin this quarter. On the other hand, its full-year revenue guidance was below expectations and suggests growth will slow down. Overall, this was a mediocre quarter for Salesforce. The company is down 3.7% on the results and currently trades at $289 per share.

Is Now The Time?

When considering an investment in Salesforce, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that Salesforce isn't a bad business. Although its with analysts expecting growth to slow from here, its very efficient customer acquisition hints at the potential for strong profitability.

The market is certainly expecting long-term growth from Salesforce given its price-to-sales ratio based on the next 12 months is 7.7x. There are things to like about Salesforce and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $299.98 per share right before these results (compared to the current share price of $289).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.