Women’s plus-size apparel retailer Torrid Holdings (NYSE:CURV) announced better-than-expected results in Q4 CY2023, with revenue down 2.6% year on year to $293.5 million. On the other hand, next quarter's revenue guidance of $279.5 million was less impressive, coming in 5.7% below analysts' estimates. It made a GAAP loss of $0.04 per share, improving from its loss of $0.04 per share in the same quarter last year.

Torrid (CURV) Q4 CY2023 Highlights:

- Revenue: $293.5 million vs analyst estimates of $276.2 million (6.3% beat)

- Adjusted EBITDA: $16.4 million vs analyst estimates of $10.8 million (52% beat)

- EPS: -$0.04 vs analyst estimates of -$0.07 (40% beat)

- Revenue Guidance for Q1 CY2024 is $279.5 million at the midpoint, below analyst estimates of $296.5 million

- Management's revenue guidance for the upcoming financial year 2024 is $1.15 billion at the midpoint, missing analyst estimates by 2.1% and implying -0.6% growth (vs -10.2% in FY2023) (adjusted EBITDA guidance for the period also missed expectations)

- Gross Margin (GAAP): 34.5%, up from 31.9% in the same quarter last year

- Free Cash Flow was -$1.73 million compared to -$6.88 million in the same quarter last year

- Same-Store Sales were down 9% year on year (miss vs. estimates of own 7% year on year)

- Store Locations: 655 at quarter end, increasing by 16 over the last 12 months

- Market Capitalization: $477.8 million

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

Specifically, the company sells tops, bottoms, dresses, lingerie, shoes, and accessories, in sizes ranging from 10 to 30 under its namesake brand. The Torrid aesthetic is trendy, fashionable, and body-positive. The brand offers clothing and accessories that are designed to flatter a larger frame, while also keeping up with the latest fashion trends. Bold prints, bright colors, and unique designs are common.

Torrid clothing is mid-priced. It’s more expensive than fast fashion, which reflects higher-quality fabrics and construction. However, Torrid items are much more affordable than comparable luxury brand merchandise. The core customer is therefore a plus-size, middle income woman who may be underserved by traditional apparel retailers and brands.

The average Torrid store is approximately 3,000 square feet and is located in a mall or shopping center. The entrance usually features new arrivals and promotions while the center features sections such as dresses, tops, and bottoms. The back is usually devoted to accessories, shoes, and sale items. Torrid has an ecommerce presence that was launched in 2005. The company's website also features a blog and social media accounts that provide customers with fashion inspiration and body-positive messaging.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Retail competitors offering some selection of plus-size women’s apparel and accessories include department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS) as well as off-price concepts such as TJX (NYSE:TJX) and Ross Stores (NASDAQ:ROST).Sales Growth

Torrid is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

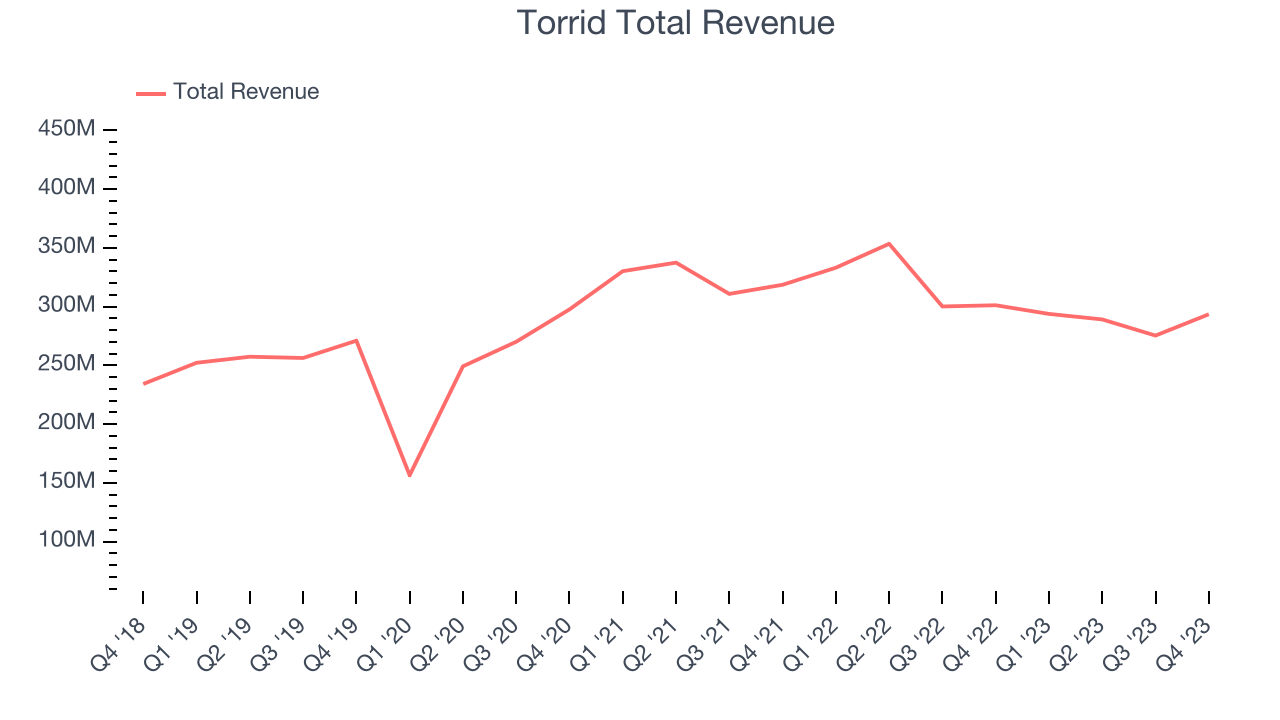

As you can see below, the company's annualized revenue growth rate of 2.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, Torrid's revenue fell 2.6% year on year to $293.5 million but beat Wall Street's estimates by 6.3%. The company is guiding for a 4.9% year-on-year revenue decline next quarter to $279.5 million, an improvement from the 11.8% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.5% over the next 12 months, an acceleration from this quarter.

Number of Stores

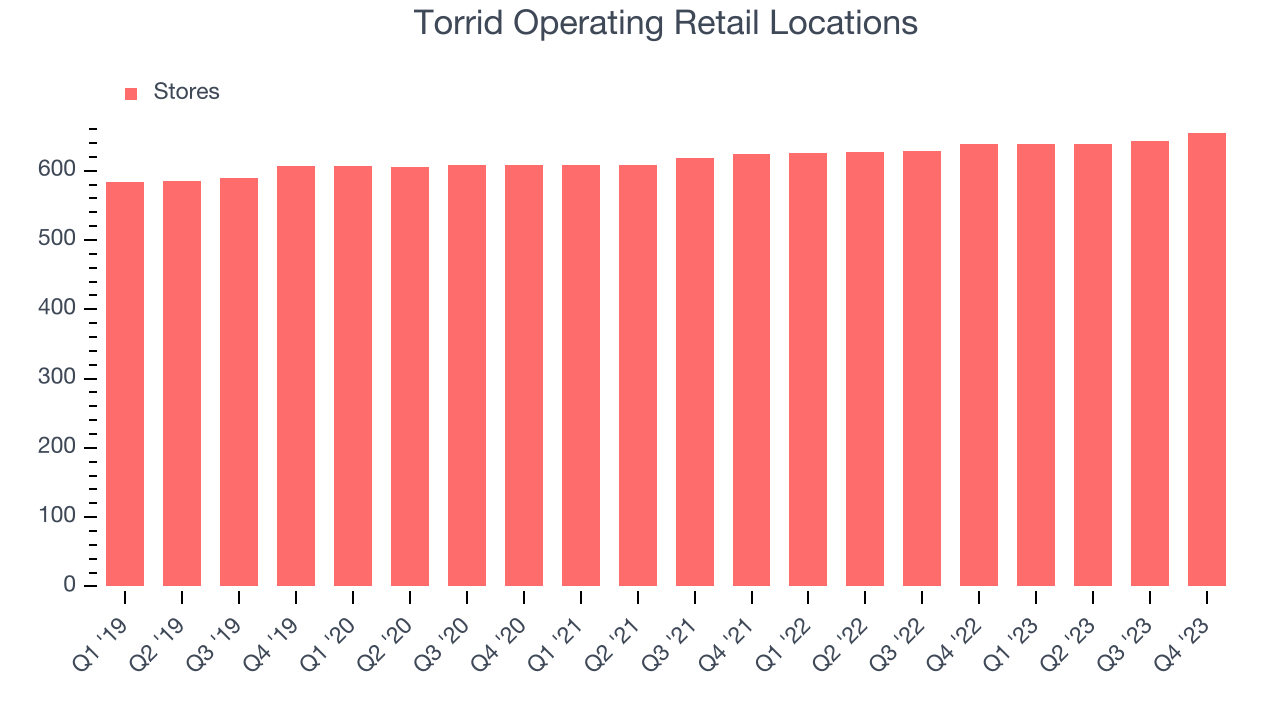

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like Torrid keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Torrid's store count increased by 16 locations, or 2.5%, over the last 12 months to 655 total retail locations in the most recently reported quarter.

Taking a step back, the company has only opened a few new stores over the last eight quarters, averaging 2.3% annual growth in new locations. Although it's expanded its presence, this sluggish store growth lags other retailers. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Torrid's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 7.9% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Torrid's same-store sales fell 9% year on year. This decrease was a further deceleration from the 5.4% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer's pricing power, product differentiation, and negotiating leverage.

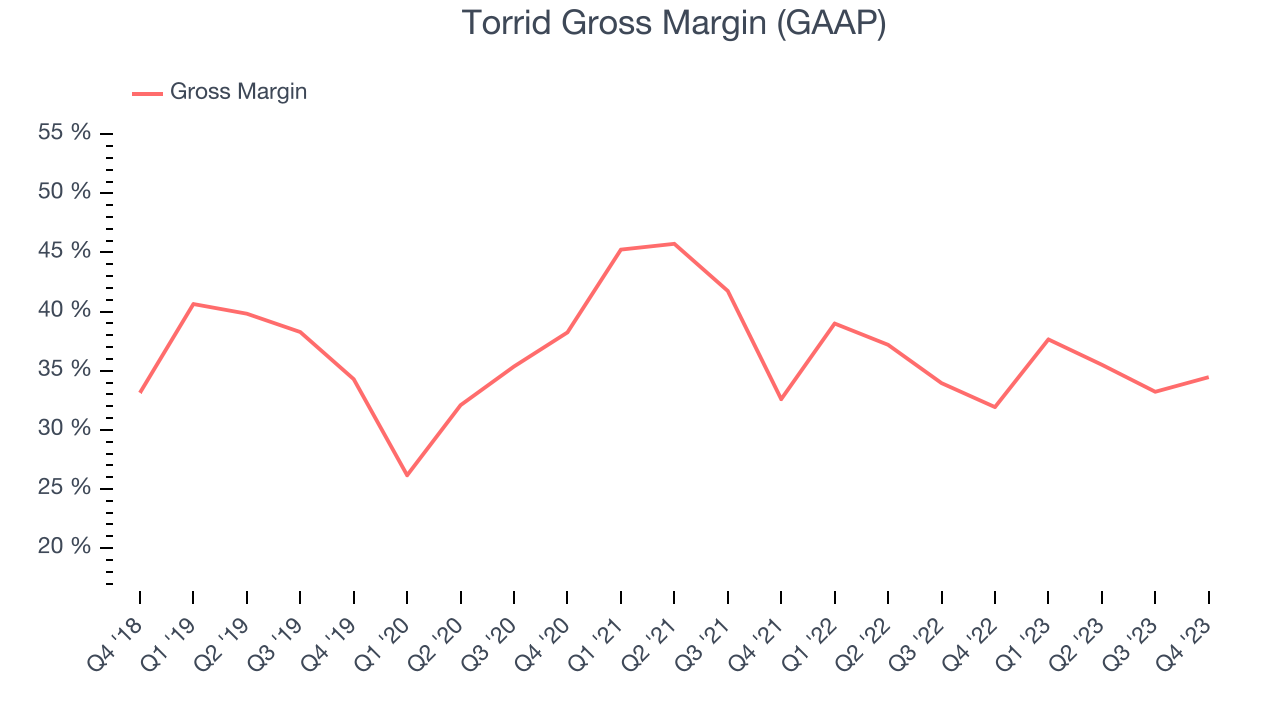

Torrid's unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it's averaged a decent 35.5% gross margin over the last eight quarters. This means the company makes $0.35 for every $1 in revenue before accounting for its operating expenses.

Torrid's gross profit margin came in at 34.5% this quarter, marking a 2.5 percentage point increase from 31.9% in the same quarter last year. This margin expansion is a good sign in the near term. If this trend continues, it could signal a less competitive environment where the company has better pricing power, less pressure to discount products, and more stable input costs (such as distribution expenses to move goods).

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

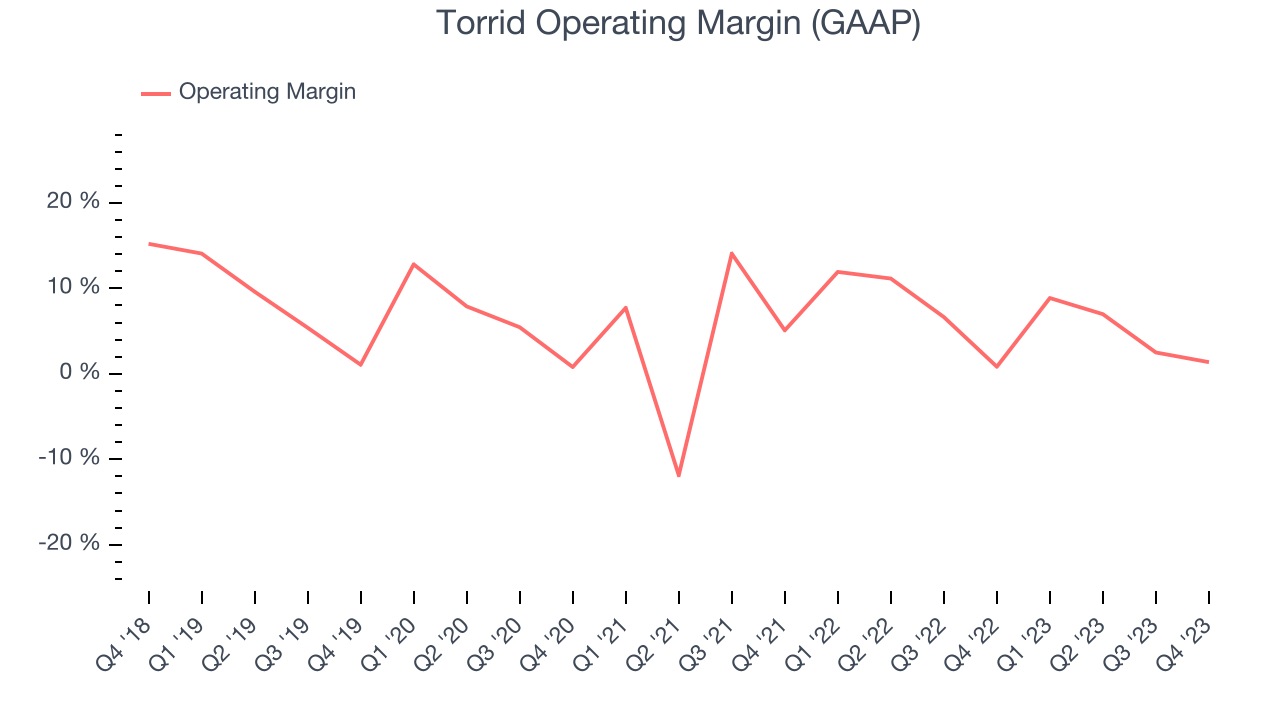

This quarter, Torrid generated an operating profit margin of 1.4%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Torrid was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer retail business, producing an average operating margin of 6.5%. On top of that, Torrid's margin has slightly declined, on average, by 2.9 percentage points year on year. This shows Torrid has faced some speed bumps.

Zooming out, Torrid was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer retail business, producing an average operating margin of 6.5%. On top of that, Torrid's margin has slightly declined, on average, by 2.9 percentage points year on year. This shows Torrid has faced some speed bumps.EPS

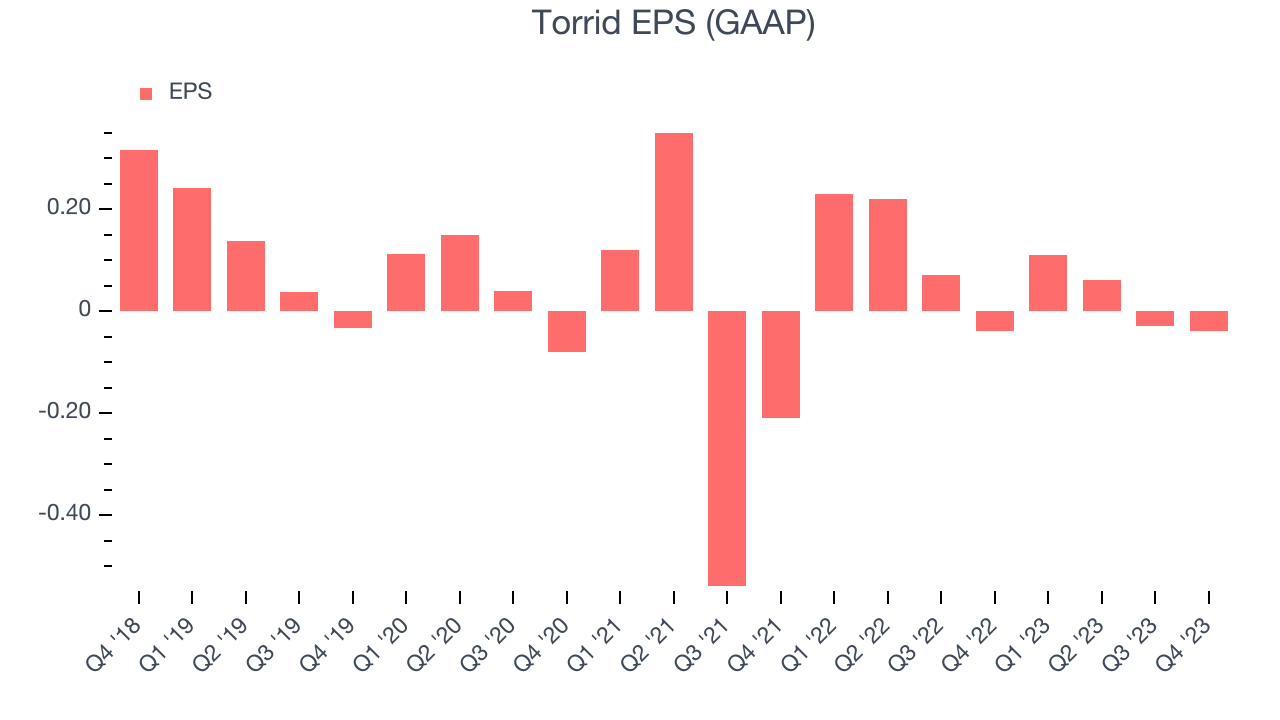

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Torrid reported EPS at negative $0.04, up from negative $0.04 in the same quarter a year ago. This print beat Wall Street's estimates by 40%.

Between FY2019 and FY2023, Torrid's adjusted diluted EPS dropped 73.8%, translating into 28.5% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 150% year-on-year increase in EPS.

Cash Is King

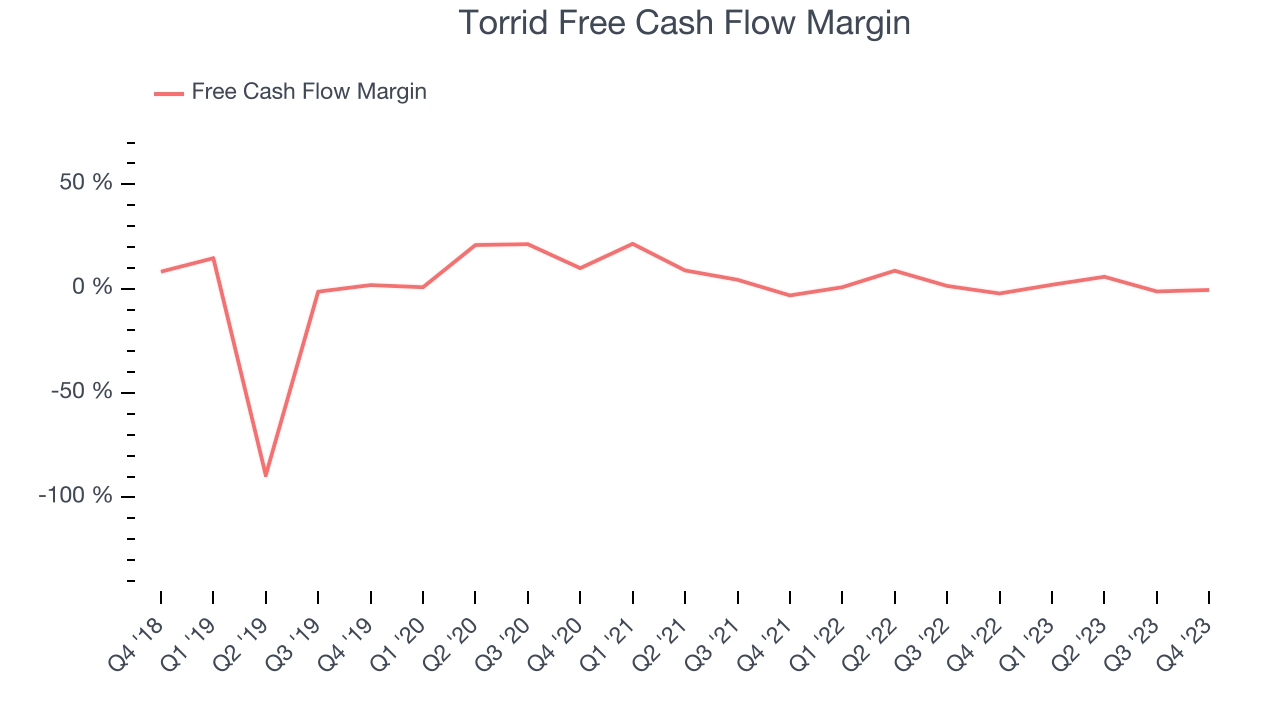

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Torrid broke even from a free cash flow perspective in Q4. This quarter's result was great for the business as its margin was 1.7 percentage points higher than in the same period last year.

Over the last eight quarters, Torrid has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1.9%, subpar for a consumer retail business. Torrid's margin has also been flat during that time, showing the company needs to take action and improve its cash profitability.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Torrid's five-year average ROIC was 2.2%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last five years, Torrid's ROIC averaged meaningful increases, although this was aided by a low base due to the COVID year as a starting point. This is still a good sign and we hope the company can continue to improving.

Key Takeaways from Torrid's Q4 Results

We were impressed by how significantly Torrid blew past analysts' adjusted EBITDA and EPS expectations this quarter. On the other hand, its revenue guidance for next quarter and the full year missed analysts' expectations. Overall, we think this was a really good quarter with tepid guidance. However, it seems that the guidance was better than feared considering that some small retailers have been struggling with choppy demand this earnings season. Finally, management struck an optimistic tone, calling out efforts at "enhancing our assortment while reducing overall inventory levels, improving product costs, and optimizing our marketing investments." The result is that the company is seeing "improving trends in sales and margins as customers responded to our new merchandise collections." The stock is up 22.4% after reporting and currently trades at $6 per share.

Is Now The Time?

Torrid may have had a mixed quarter with a favorable stock reaction, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Torrid, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last four years. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last four years makes it hard to trust. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

Torrid's price-to-earnings ratio based on the next 12 months is 22.2x. While we've no doubt one can find things to like about Torrid, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $4.59 per share right before these results (compared to the current share price of $6), implying they didn't see much short-term potential in Torrid.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.