As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the vehicle retailer industry, including Camping World (NYSE:CWH) and its peers.

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

The 4 vehicle retailer stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.6%.

Luckily, vehicle retailer stocks have performed well with share prices up 10.4% on average since the latest earnings results.

Best Q3: Camping World (NYSE:CWH)

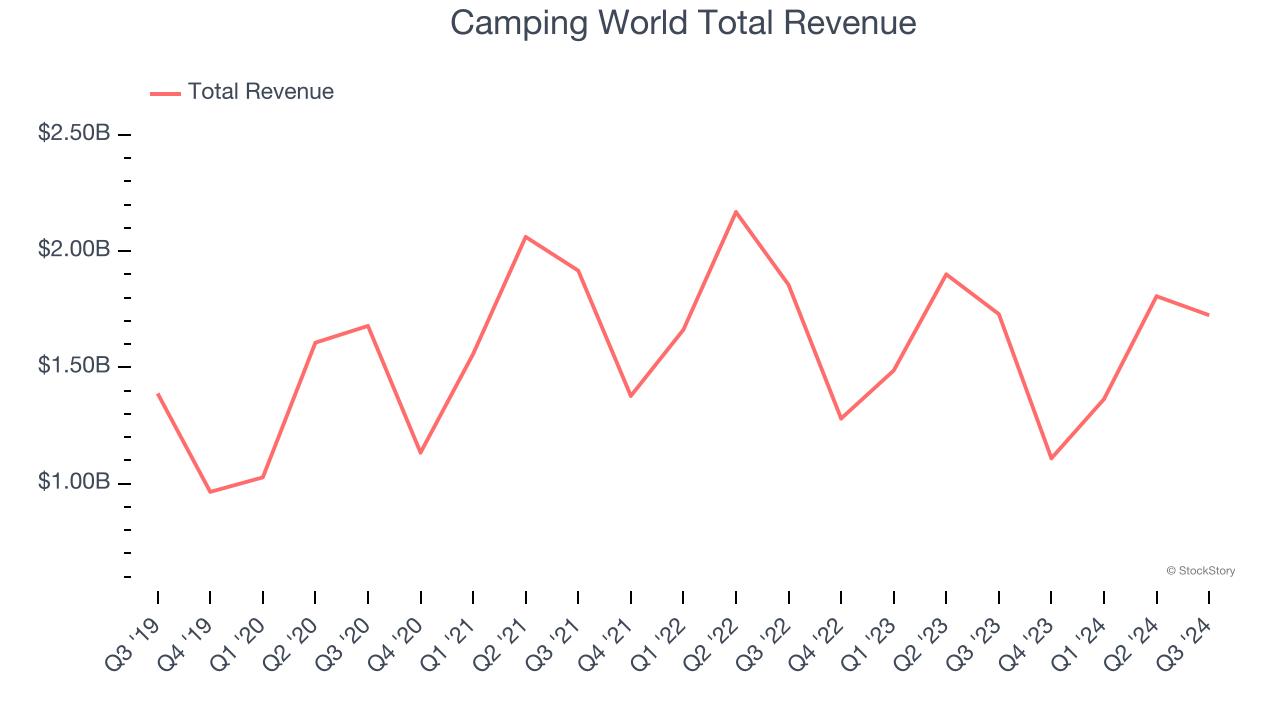

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.72 billion, flat year on year. This print exceeded analysts’ expectations by 5.4%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Marcus Lemonis, Chairman and Chief Executive Officer of Camping World Holdings, Inc. stated, “Our combined new and used same store unit sales returned to positive growth for the first time in 10 quarters, with our record new unit market share(1) a direct result of our relentless focus on product development and affordability. I’m very encouraged by our October-to-date same store volume trends, with used units tracking to flat year-over-year, and new units remaining solidly up by a double-digit percentage, providing significant momentum as we focus on an improved 2025.”

Camping World pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 2.6% since reporting and currently trades at $21.96.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it’s free.

CarMax (NYSE:KMX)

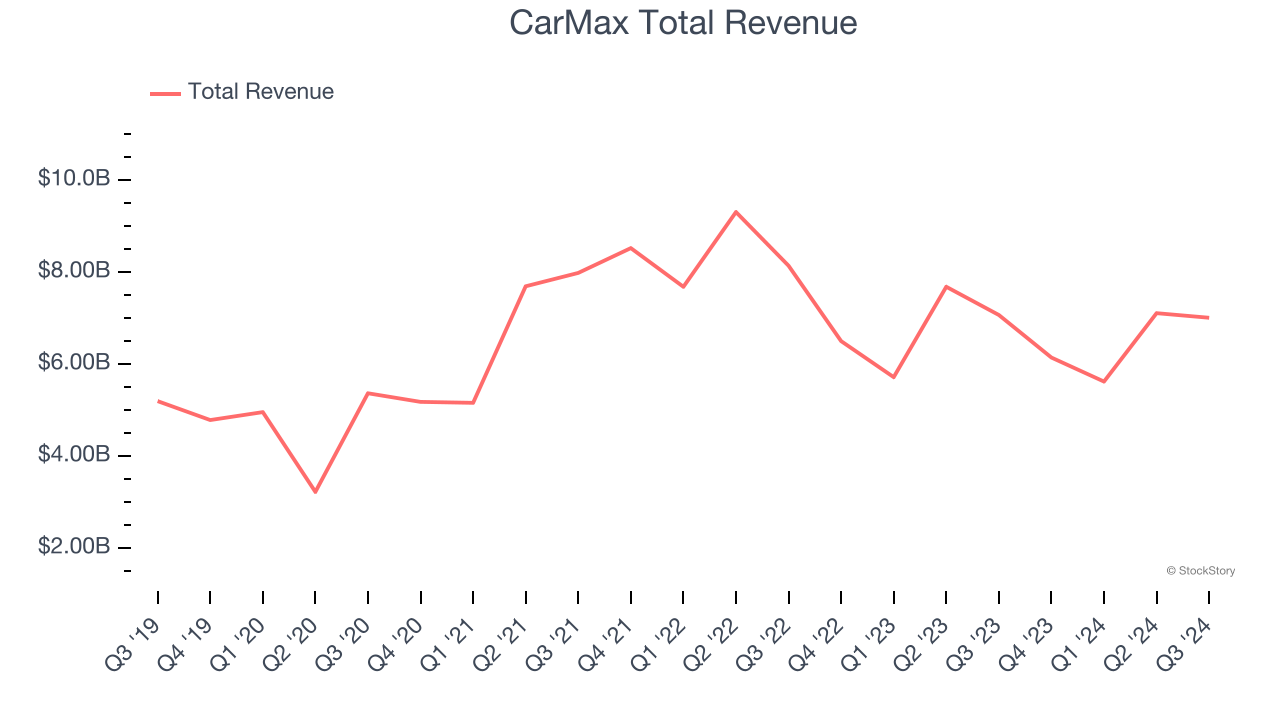

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

CarMax reported revenues of $7.01 billion, flat year on year, outperforming analysts’ expectations by 2.7%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ gross margin estimates.

The market seems happy with the results as the stock is up 9.7% since reporting. It currently trades at $81.75.

Is now the time to buy CarMax? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: America's Car-Mart (NASDAQ:CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $347.3 million, down 3.6% year on year, exceeding analysts’ expectations by 0.8%. It was a a satisfactory quarter as it also posted an impressive beat of analysts’ gross margin estimates but a significant miss of analysts’ EPS estimates.

America's Car-Mart delivered the slowest revenue growth in the group. Interestingly, the stock is up 12.6% since the results and currently trades at $51.46.

Read our full analysis of America's Car-Mart’s results here.

Lithia (NYSE:LAD)

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Lithia reported revenues of $9.22 billion, up 11.4% year on year. This number missed analysts’ expectations by 2.5%. In spite of that, it was a strong quarter as it recorded an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Lithia scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 16.5% since reporting and currently trades at $355.

Read our full, actionable report on Lithia here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.