Customer experience software provider Sprinklr (NYSE:CXM) beat analysts' expectations in Q3 FY2024, with revenue up 18.5% year on year to $186.3 million. The company expects next quarter's revenue to be around $188.5 million, in line with analysts' estimates. It made a GAAP profit of $0.06 per share, improving from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy Sprinklr? Find out by accessing our full research report, it's free.

Sprinklr (CXM) Q3 FY2024 Highlights:

- Revenue: $186.3 million vs analyst estimates of $180.4 million (3.3% beat)

- EPS (non-GAAP): $0.11 vs analyst estimates of $0.07 ($0.04 beat)

- Revenue Guidance for Q4 2024 is $188.5 million at the midpoint, roughly in line with what analysts were expecting

- Free Cash Flow of $15.9 million, up 82.2% from the previous quarter

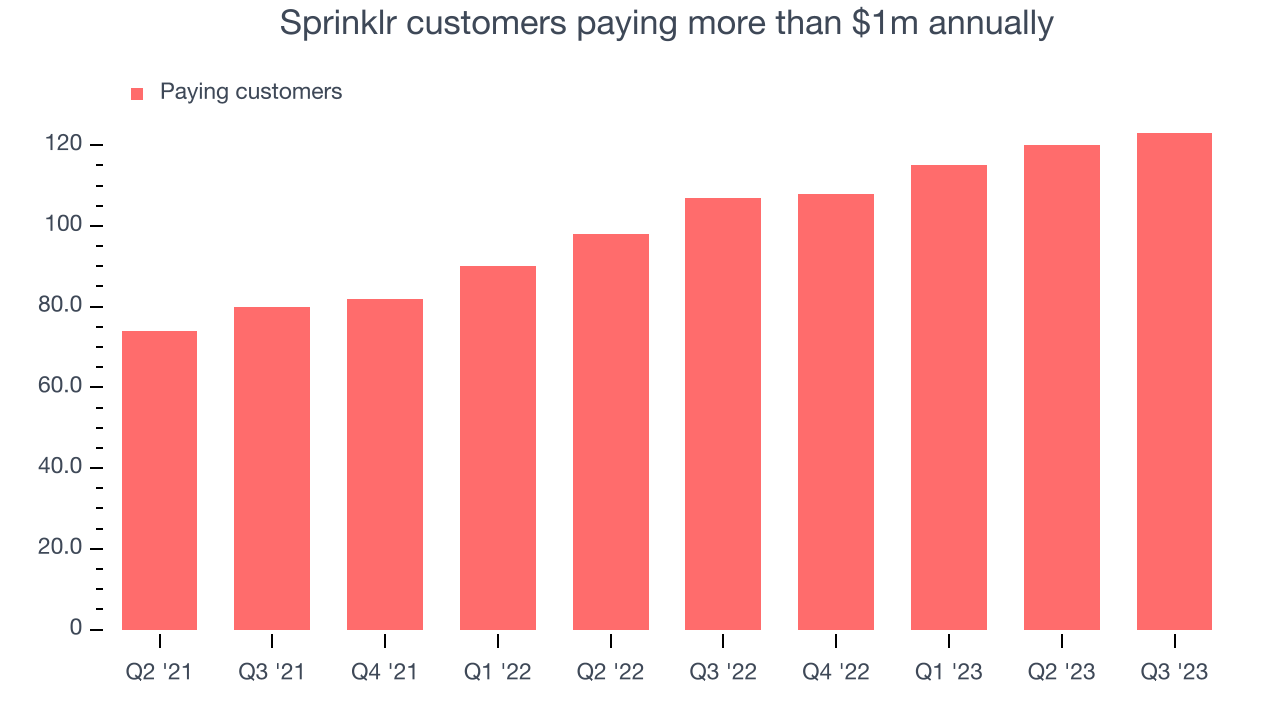

- Customers: 123 customers paying more than $1m annually

- Gross Margin (GAAP): 75.1%, up from 74.2% in the same quarter last year

“We had another solid quarter across the board with record levels of profitability supported by strength in our Sprinklr Service product suite. We're committed to helping customers achieve productivity gains across their front office through leveraging generative AI, turning vast amounts of unstructured data into actionable insights, and unifying their customer-facing teams that result in superior customer experiences,” said Ragy Thomas, Founder and CEO at Sprinklr.

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Customer Experience Software

The Internet has given customers more choice on whom to conduct business with and has also given them the power to easily share their experiences with other customers. These twin dynamics effectively have increased pressure on companies to both improve their customer service and also monitor their brand reputation online, driving the need for customer experience software offerings.

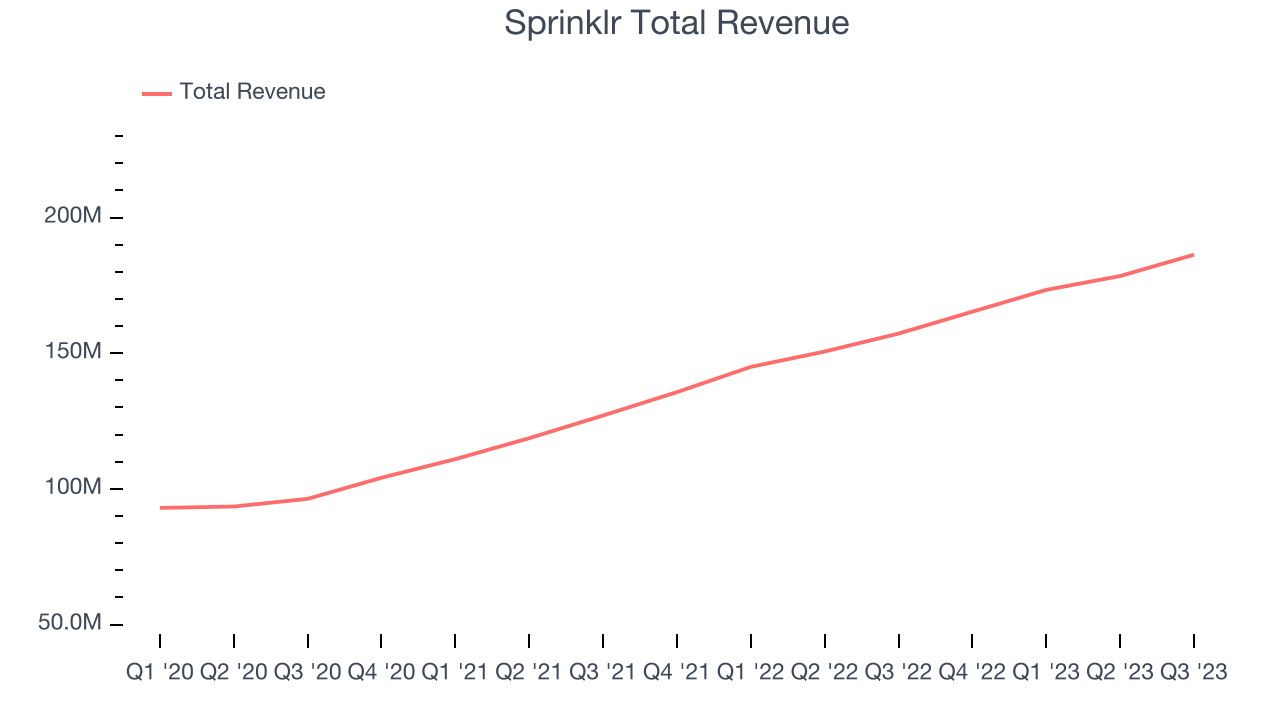

Sales Growth

As you can see below, Sprinklr's revenue growth has been strong over the last two years, growing from $127.1 million in Q3 FY2022 to $186.3 million this quarter.

This quarter, Sprinklr's quarterly revenue was once again up 18.5% year on year. We can see that Sprinklr's revenue increased by $7.86 million quarter on quarter, which is a solid improvement from the $5.10 million increase in Q2 2024. Shareholders should applaud the acceleration of growth.

Next quarter, Sprinklr is guiding for a 12.3% year-on-year revenue decline to $188.5 million, a further deceleration from the 21.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 14.1% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Large Customers Growth

This quarter, Sprinklr reported 123 enterprise customers paying more than $1m annually, an increase of 3 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from Sprinklr's Q3 Results

Sporting a market capitalization of $4.53 billion, Sprinklr is among smaller companies, but its more than $656.4 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was good to see Sprinklr beat analysts' revenue expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. On the other hand, its new large contract wins slowed. Overall, the results we mostly in line, showing the company is staying on target. The stock is up 1.2% after reporting and currently trades at $16.9 per share.

So should you invest in Sprinklr right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.