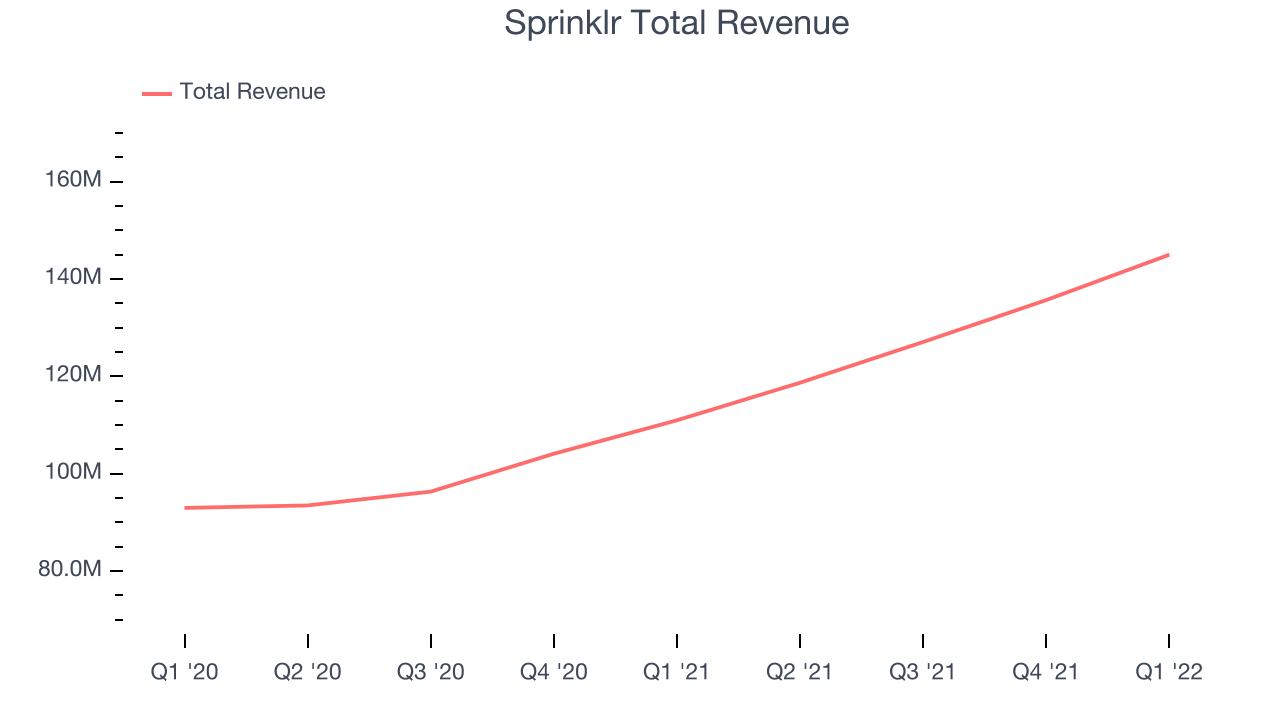

Customer experience software provider Sprinklr (NYSE:CXM) will be reporting results tomorrow after market close. Here's what to look for.

Last quarter Sprinklr reported revenues of $144.9 million, up 30.6% year on year, beating analyst revenue expectations by 2.84%. It was a decent quarter for the company, with a strong top line growth. The company added 8 enterprise customers paying more than $1m annually to a total of 90.

Is Sprinklr buy or sell heading into the earnings? Read our full analysis here, it's free.

This quarter analysts are expecting Sprinklr's revenue to grow 24.2% year on year to $147.4 million, slowing down from the 26.9% year-over-year increase in revenue the company had recorded in the same quarter last year. Adjusted loss is expected to come in at -$0.06 per share.

Majority of analysts covering the company have reconfirmed their estimates over the last thirty days, suggesting they are expecting the business to stay the course heading into the earnings. The company has a history of exceeding Wall St's expectations, beating revenue estimates every single time since going public on average by 5.77%.

Looking at Sprinklr's peers in the sales and marketing software segment, some of them have already reported Q2 earnings results, giving us a hint of what we can expect. Momentive delivered top-line growth of 9.84% year on year, missing analyst estimates by 1.01% and SEMrush reported revenues up 39.1% year on year, exceeding estimates by 4.32%. Momentive traded down 8.98% on the results, and SEMrush was up 2.39%. Read our full analysis of Momentive's results here and SEMrush's results here.

Tech stocks have been under pressure since the end of last year and while some of the software stocks have fared somewhat better, they have not been spared, with share price declining 14.2% over the last month. Sprinklr is down 11.6% during the same time, and is heading into the earnings with analyst price target of $14.9, compared to share price of $11.27.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.