Global airline Delta Air Lines (NYSE:DAL) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 9.4% year on year to $15.56 billion. On top of that, next quarter’s revenue guidance ($14.85 billion at the midpoint) was surprisingly good and 12.7% above what analysts were expecting. Its GAAP profit of $1.29 per share was 27.4% below analysts’ consensus estimates.

Is now the time to buy Delta Air Lines? Find out by accessing our full research report, it’s free.

Delta Air Lines (DAL) Q4 CY2024 Highlights:

- Revenue: $15.56 billion vs analyst estimates of $14.48 billion (9.4% year-on-year growth, 7.4% beat)

- Adjusted EPS: $1.29 vs analyst expectations of $1.78 (27.4% miss)

- Adjusted EBITDA: $2.35 billion vs analyst estimates of $2.48 billion (15.1% margin, 5.2% miss)

- Revenue Guidance for Q1 CY2025 is $14.85 billion at the midpoint, above analyst estimates of $13.17 billion

- EPS (GAAP) guidance for the upcoming financial year 2025 is $7.35 at the midpoint, in line with analyst estimates

- Operating Margin: 11%, up from 9.3% in the same quarter last year

- Free Cash Flow was $584 million, up from -$991.7 million in the same quarter last year

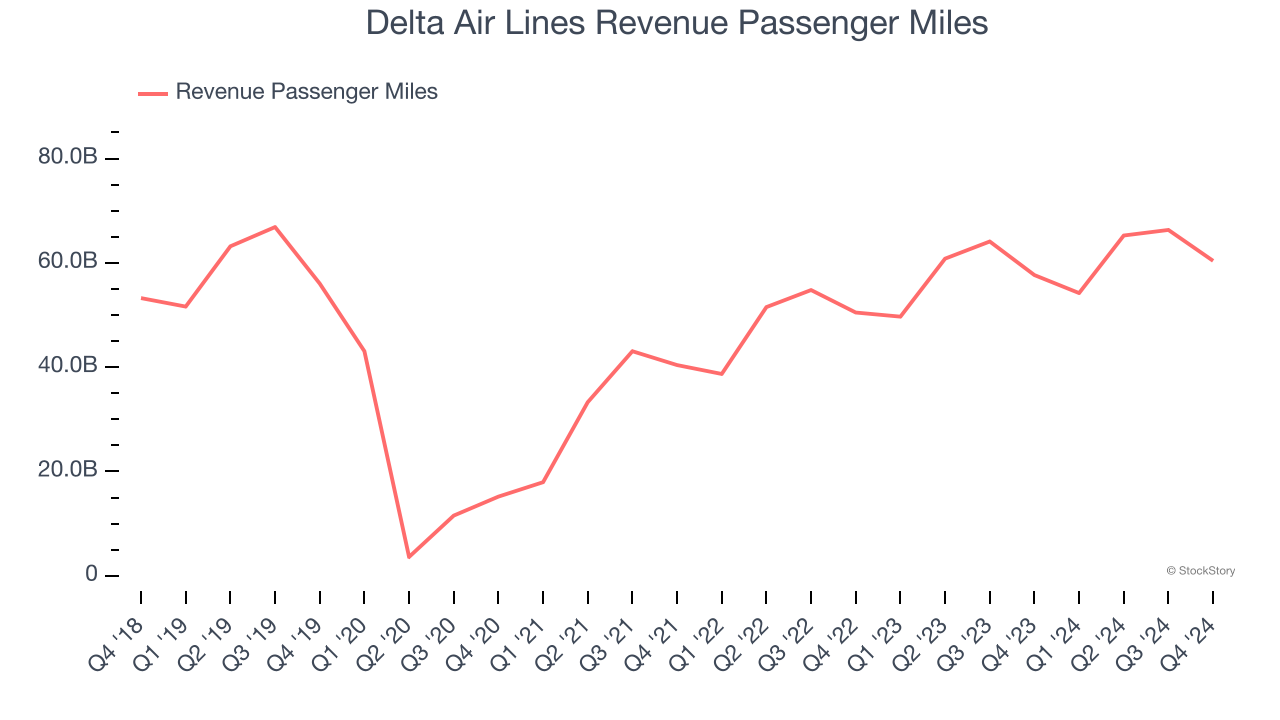

- Revenue Passenger Miles: 60.39 billion, up 2.73 billion year on year

- Market Capitalization: $39.38 billion

Company Overview

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE:DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

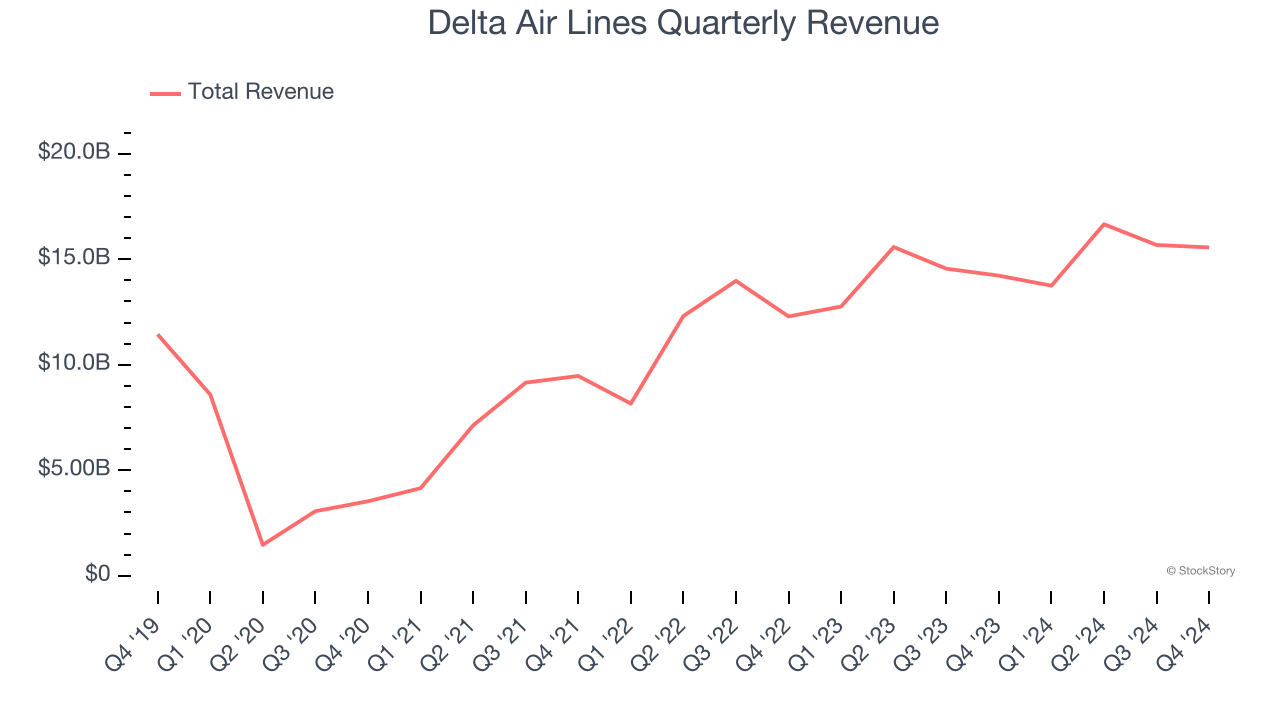

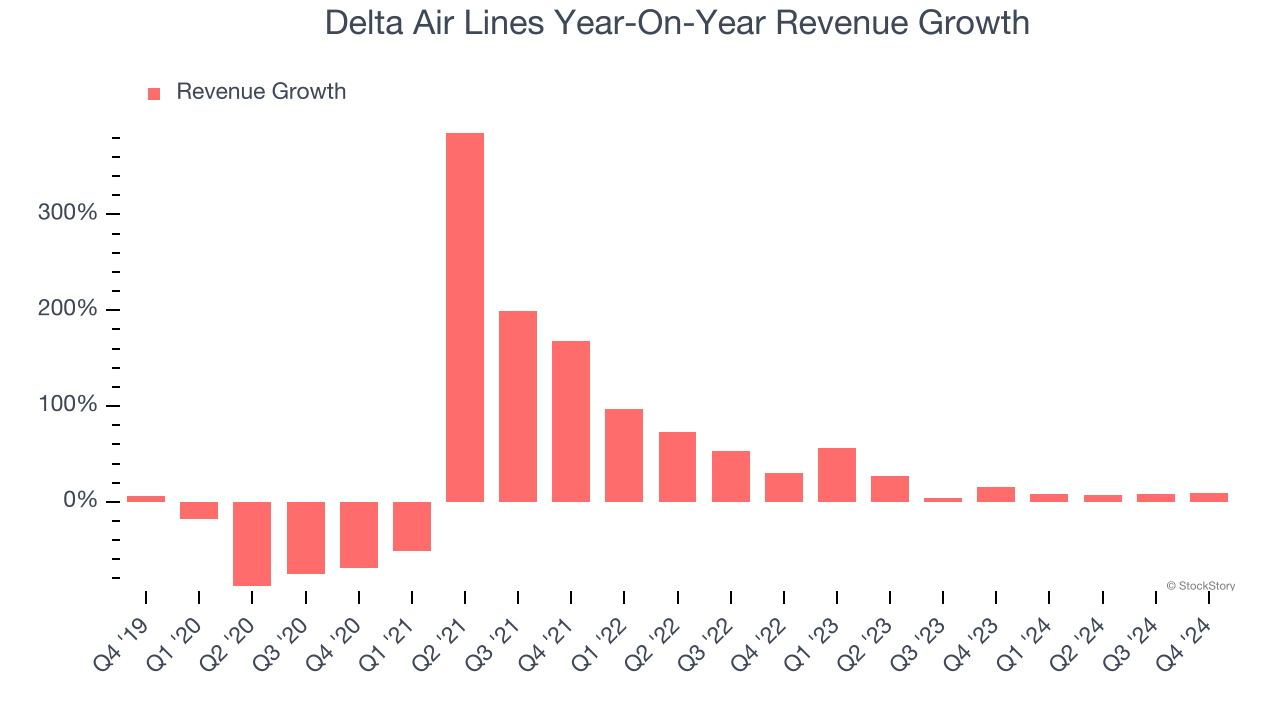

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Delta Air Lines’s 5.6% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Delta Air Lines’s annualized revenue growth of 14.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its number of revenue passenger miles, which reached 60.39 billion in the latest quarter. Over the last two years, Delta Air Lines’s revenue passenger miles averaged 12.8% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Delta Air Lines reported year-on-year revenue growth of 9.4%, and its $15.56 billion of revenue exceeded Wall Street’s estimates by 7.4%. Company management is currently guiding for a 8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 3.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

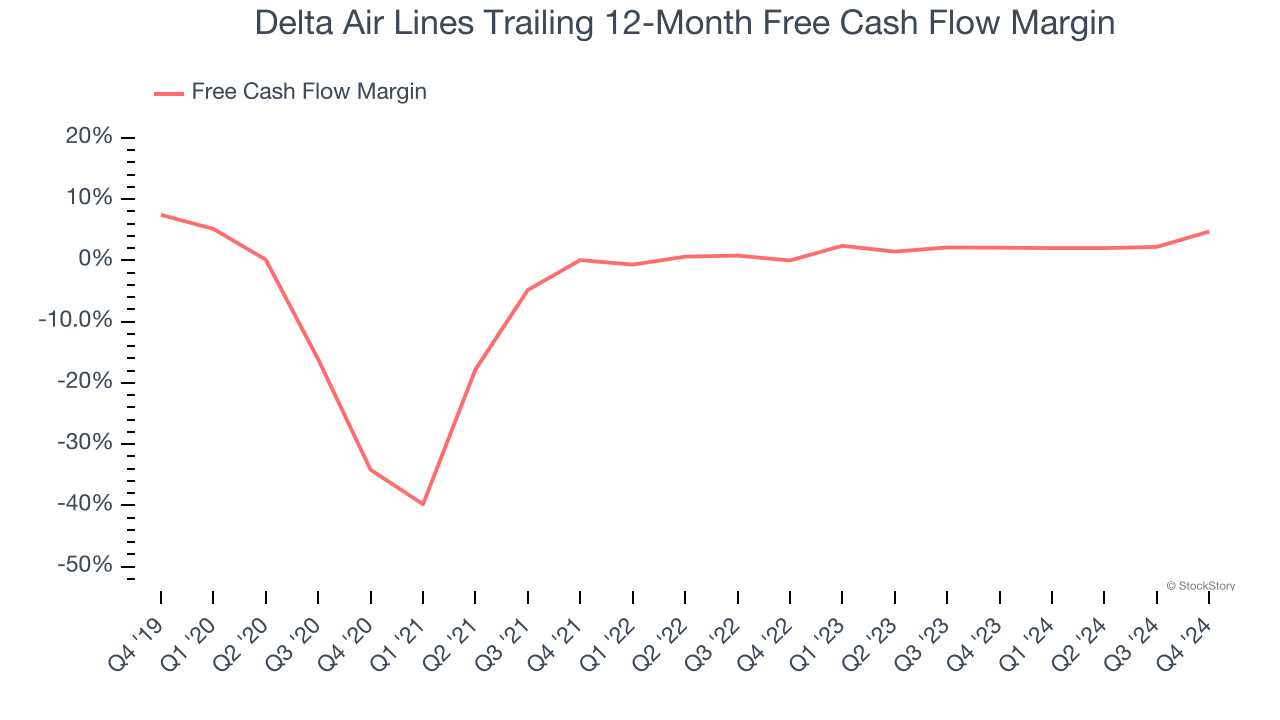

Delta Air Lines has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, lousy for a consumer discretionary business.

Delta Air Lines’s free cash flow clocked in at $584 million in Q4, equivalent to a 3.8% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Key Takeaways from Delta Air Lines’s Q4 Results

We were impressed by Delta Air Lines’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter was mixed but still had some key positives. The stock traded up 4.5% to $64.19 immediately following the results.

Indeed, Delta Air Lines had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.