Online payroll and human resource software provider Dayforce (NYSE:DAY) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 18.9% year on year to $399.7 million. The company expects next quarter's revenue to be around $425.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.50 per share, improving from its profit of $0.23 per share in the same quarter last year.

Is now the time to buy Dayforce? Find out by accessing our full research report, it's free.

Dayforce (DAY) Q4 FY2023 Highlights:

- Revenue: $399.7 million vs analyst estimates of $399.4 million (small beat)

- EPS (non-GAAP): $0.50 vs analyst estimates of $0.32 (57.9% beat)

- Revenue Guidance for Q1 2024 is $425.5 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $1.73 billion at the midpoint, missing analyst estimates by 0.9% and implying 14% growth (vs 21.6% in FY2023)

- Free Cash Flow of $63.8 million, up from $4.8 million in the previous quarter

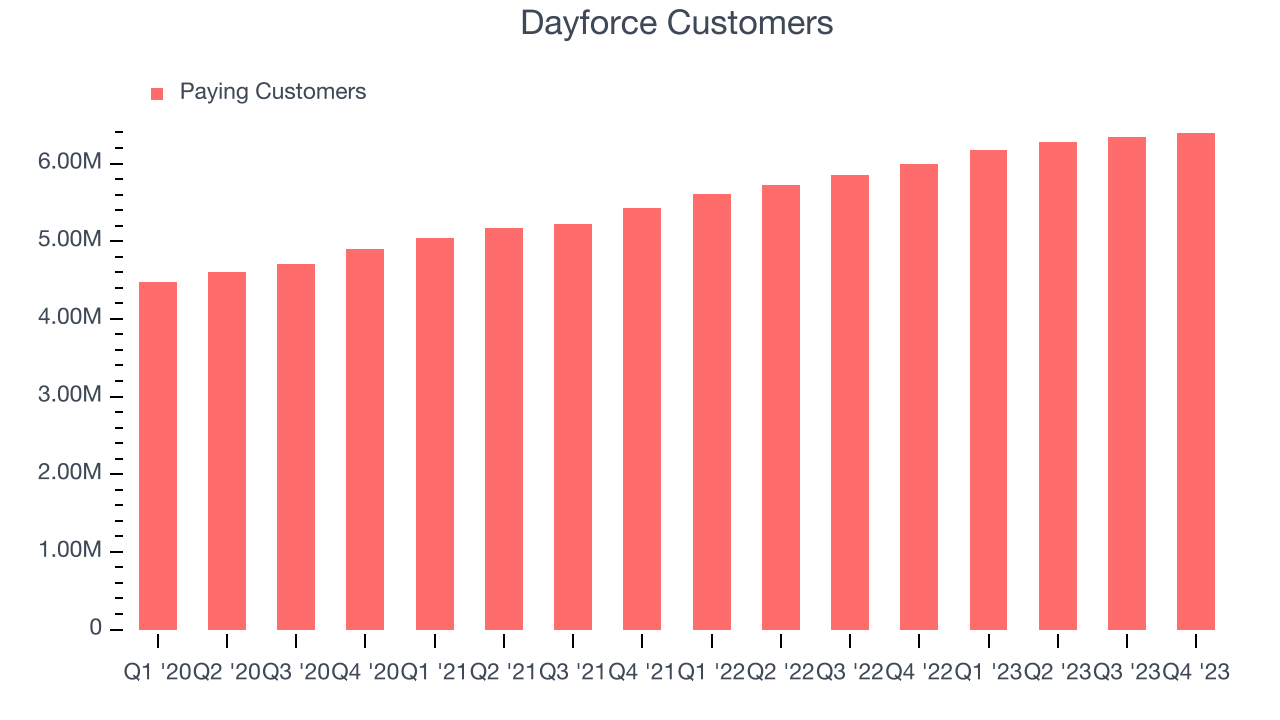

- Customers: 6.39 million, up from 6.35 million in the previous quarter (miss vs. expectations of 6.56 million)

- Gross Margin (GAAP): 42.5%, down from 45.7% in the same quarter last year

- Market Capitalization: $11 billion

“Dayforce delivered another strong quarter underpinned by record enterprise go-lives and operating cash flows,” said David Ossip, Chair and CEO of Dayforce.

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE:DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

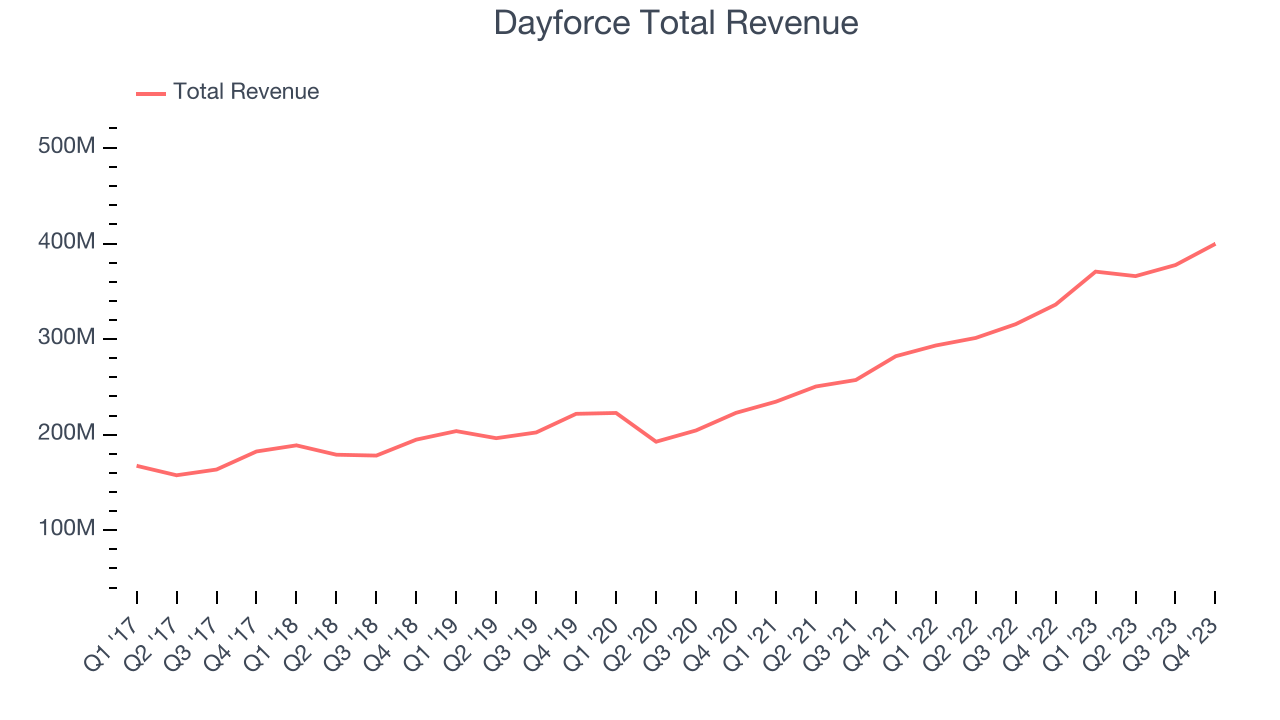

As you can see below, Dayforce's revenue growth has been strong over the last two years, growing from $282.1 million in Q4 FY2021 to $399.7 million this quarter.

This quarter, Dayforce's quarterly revenue was once again up 18.9% year on year. We can see that Dayforce's revenue increased by $22.2 million quarter on quarter, which is a solid improvement from the $11.6 million increase in Q3 2023. Shareholders should applaud the re-acceleration of growth.

Next quarter's guidance suggests that Dayforce is expecting revenue to grow 14.8% year on year to $425.5 million, slowing down from the 26.4% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.73 billion at the midpoint, growing 14% year on year compared to the 21.5% increase in FY2023.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Growth

Dayforce reported 6.39 million customers at the end of the quarter, an increase of 47,000 from the previous quarter. That's a little slower customer growth than what we've observed in past quarters, suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Dayforce's Q4 Results

Although total customer count missed expectations, revenue beat slightly. On the other hand, the company's full year revenue guidance was below Wall Street analysts' estimates. Overall, this was a mixed quarter for Dayforce. The stock is flat after reporting and currently trades at $71.12 per share.

Dayforce may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.