Online payroll and human resource software provider Dayforce (NYSE:DAY) announced better-than-expected results in Q1 CY2024, with revenue up 16.4% year on year to $431.5 million. The company expects next quarter's revenue to be around $416.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.43 per share, improving from its profit of $0.31 per share in the same quarter last year.

Dayforce (DAY) Q1 CY2024 Highlights:

- Revenue: $431.5 million vs analyst estimates of $425.9 million (1.3% beat)

- EPS (non-GAAP): $0.43 vs analyst expectations of $0.42 (in line)

- Revenue Guidance for Q2 CY2024 is $416.5 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $1.74 billion at the midpoint

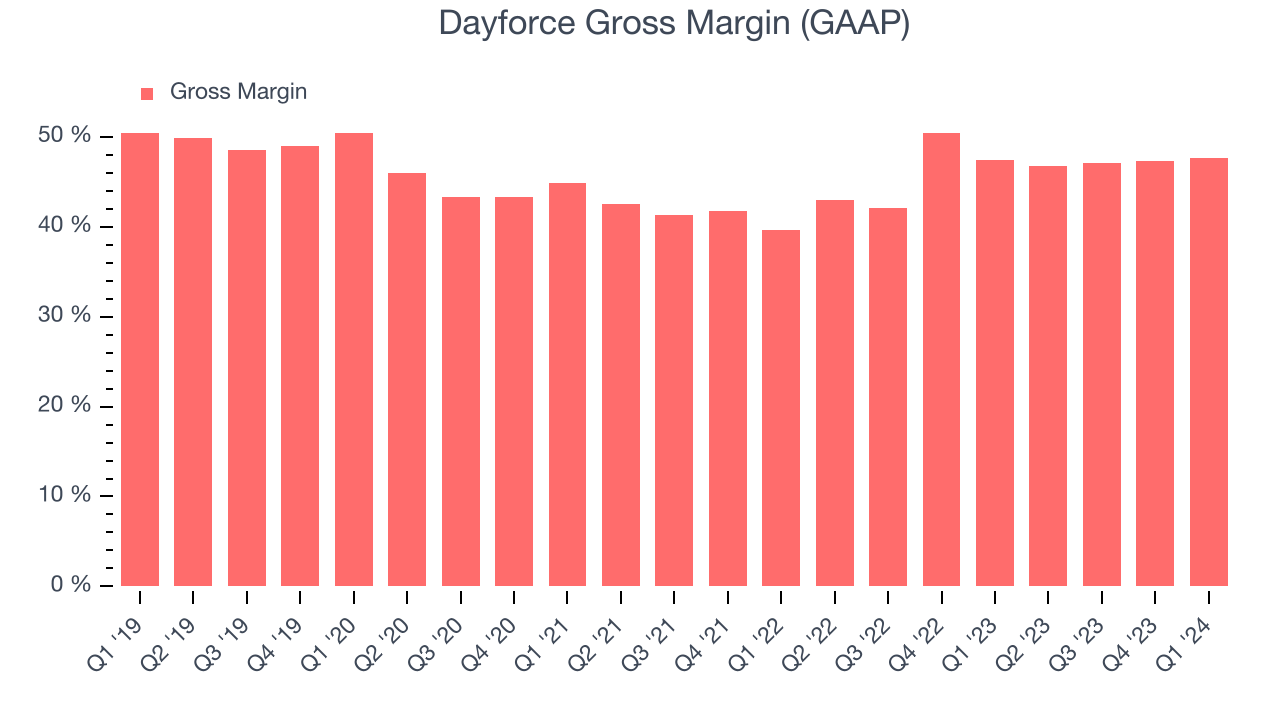

- Gross Margin (GAAP): 47.6%, in line with the same quarter last year

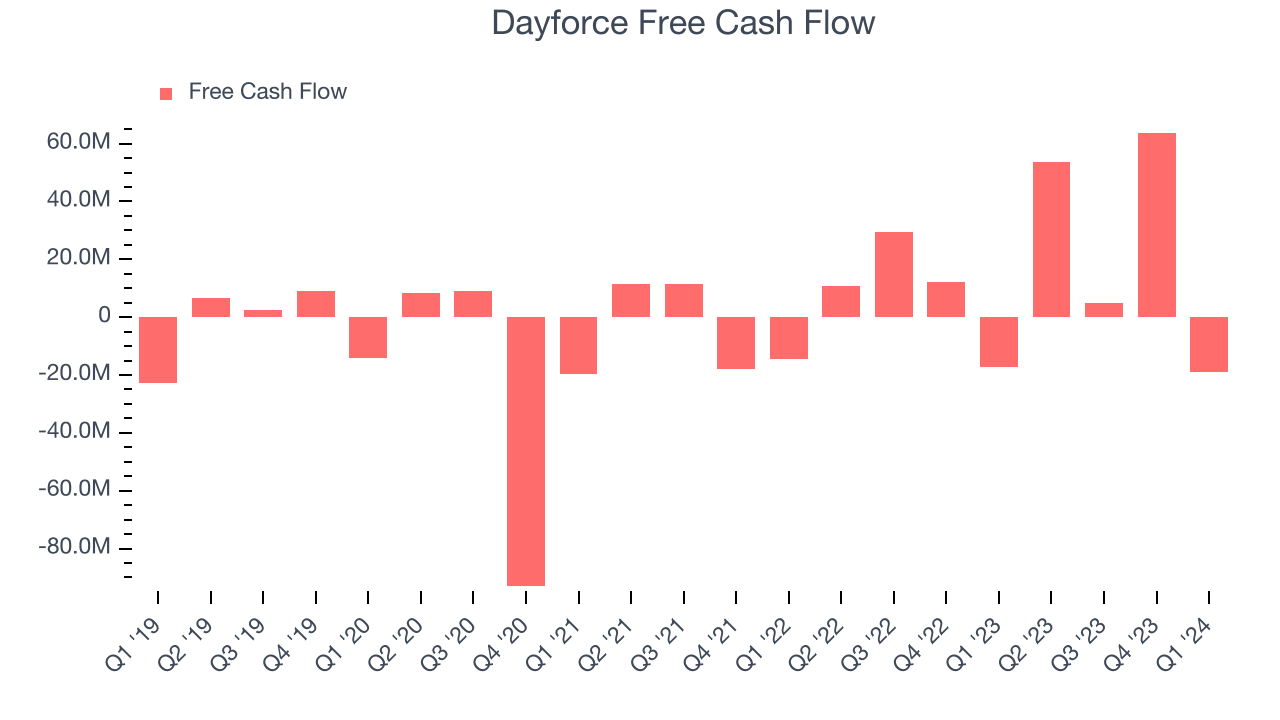

- Free Cash Flow was -$18.8 million, down from $63.8 million in the previous quarter

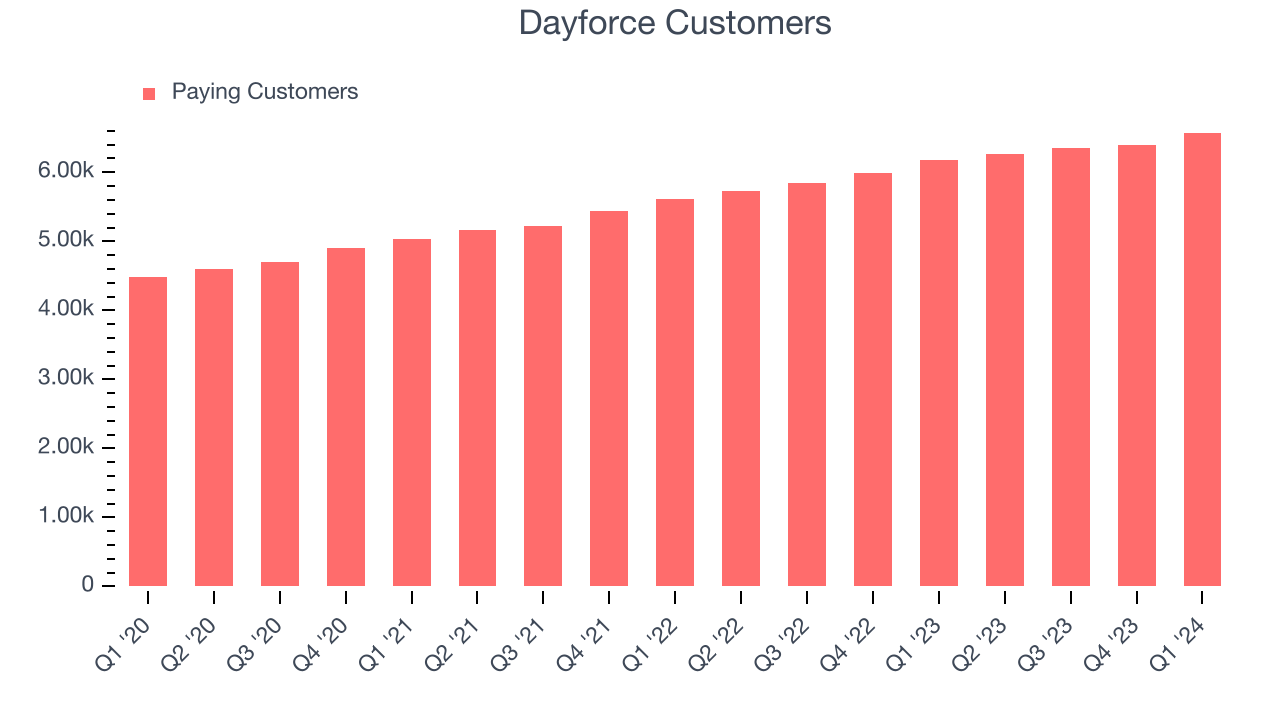

- Customers: 6,575, up from 6,393 in the previous quarter

- Market Capitalization: $9.55 billion

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE:DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Managing basic HR functions like payroll and benefits are requirements for all companies, but are particularly time consuming and expensive for small and medium sized businesses, who have historically used a series of patchwork measures involving spreadsheets, accountants and single purpose software from multiple vendors.

Dayforce’s value proposition for mid-sized businesses is cost savings and greater efficiency that come from being a centralized database that integrates standalone HCM features like set up shifts, process payroll and maintaining HR records, which both simplifies basic HCM tasks while providing the ability to derive insights across the different functions (e.g. are there pay disparities between gender or ethnicity?).

The company's flagship product is Dayforce, a cloud-based software platform that handles human resource functions such as running payroll, managing benefits, and onboarding employees.

For employees, Dayforce offers a single interface for everything from clocking in to managing days off to getting online training. It’s most innovative differentiating feature is Dayforce Wallet, which enables workers to access already-earned wages anytime during a pay period immediately, rather than waiting a standard two weeks.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Dayforce’s main competitors are legacy provider ADP (NASDAQ:ADP) and Ultimate Kronos Group. Other cloud-first providers of HR solutions for small and medium-sized businesses include Asure (NYSE: ASUR), Paycom (NYSE:PAYC), Paycor (NASDAQ:PYCR), Paylocity (NASDAQ:PCTY), and Workday (NASDAQ:WDAY).

Sales Growth

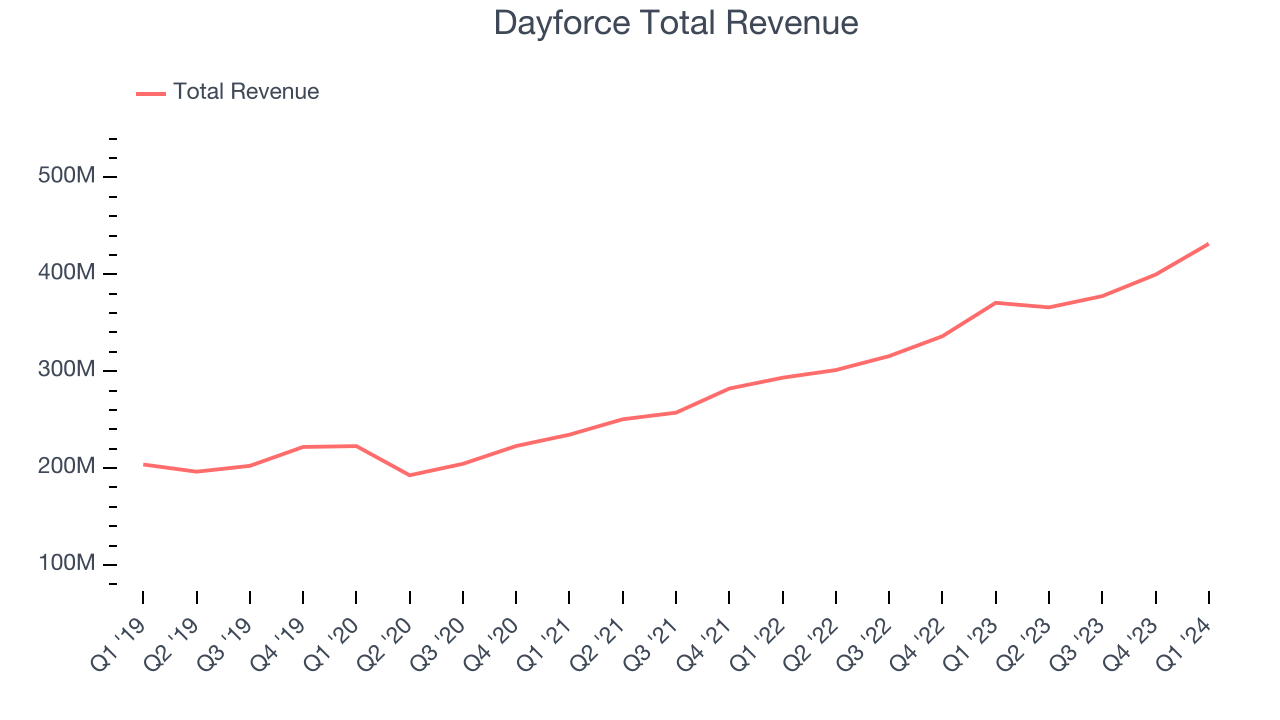

As you can see below, Dayforce's revenue growth has been strong over the last three years, growing from $234.5 million in Q1 2021 to $431.5 million this quarter.

This quarter, Dayforce's quarterly revenue was once again up 16.4% year on year. We can see that Dayforce's revenue increased by $31.8 million quarter on quarter, which is a solid improvement from the $22.2 million increase in Q4 CY2023. Shareholders should applaud the re-acceleration of growth.

Next quarter's guidance suggests that Dayforce is expecting revenue to grow 13.8% year on year to $416.5 million, slowing down from the 21.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 13% over the next 12 months before the earnings results announcement.

Customer Growth

Dayforce reported 6,575 customers at the end of the quarter, an increase of 182 from the previous quarter. That's a little better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that Dayforce's go-to-market strategy is working very well.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Dayforce's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 47.6% in Q1.

That means that for every $1 in revenue the company had $0.48 left to spend on developing new products, sales and marketing, and general administrative overhead. Dayforce's gross margin is poor for a SaaS business and we'd like to see it start improving.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Dayforce burned through $18.8 million of cash in Q1 , reducing its cash burn by 9.9% year on year.

Dayforce has generated $103.4 million in free cash flow over the last 12 months, or 6.6% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Dayforce's Q1 Results

We were impressed by Dayforce's strong growth in customers this quarter, enabling it to narrowly top Wall Street's revenue estimates. On the other hand, its revenue and EBITDA guidance for next quarter underwhelmed, although its full-year outlook remained intact. Overall, this quarter's results seemed fine. The stock is flat after reporting and currently trades at $61.61 per share.

Is Now The Time?

When considering an investment in Dayforce, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Dayforce, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last three years, Wall Street expects growth to deteriorate from here. And while its efficient customer acquisition hints at the potential for strong profitability, the downside is its gross margins show its business model is much less lucrative than the best software businesses. On top of that, its low free cash flow margins give it little breathing room.

Given its price-to-sales ratio of 5.5x based on the next 12 months, Dayforce is priced with expectations for long-term growth. While there are some things to like about Dayforce and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $86.11 right before these results (compared to the current share price of $61.61).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.