Footwear and accessories discount retailer Designer Brands (NYSE:DBI) announced better-than-expected results in Q4 CY2023, with revenue flat year on year at $754.3 million. It made a GAAP loss of $0.52 per share, down from its profit of $0.66 per share in the same quarter last year.

Is now the time to buy Designer Brands? Find out by accessing our full research report, it's free.

Designer Brands (DBI) Q4 CY2023 Highlights:

- Revenue: $754.3 million vs analyst estimates of $747.3 million (0.9% beat)

- EPS: -$0.52 vs analyst expectations of -$0.45 (16.4% miss)

- EPS guidance for the full year 2024 of $0.75 at the midpoint missed expectations of $0.87

- Gross Margin (GAAP): 27.5%, down from 29.2% in the same quarter last year

- Same-Store Sales were down 7.3% year on year (miss)

- Store Locations: 642 at quarter end, increasing by 3 over the last 12 months

- Market Capitalization: $655 million

"We ended the year strong, with a solid finish to the fourth quarter above the top end of our revised EPS guidance range, led by strength in our brand portfolio segment as a result of acquiring Keds, Topo, and launching Le Tigre," stated Doug Howe, Chief Executive Officer.

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

Designer Brands is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

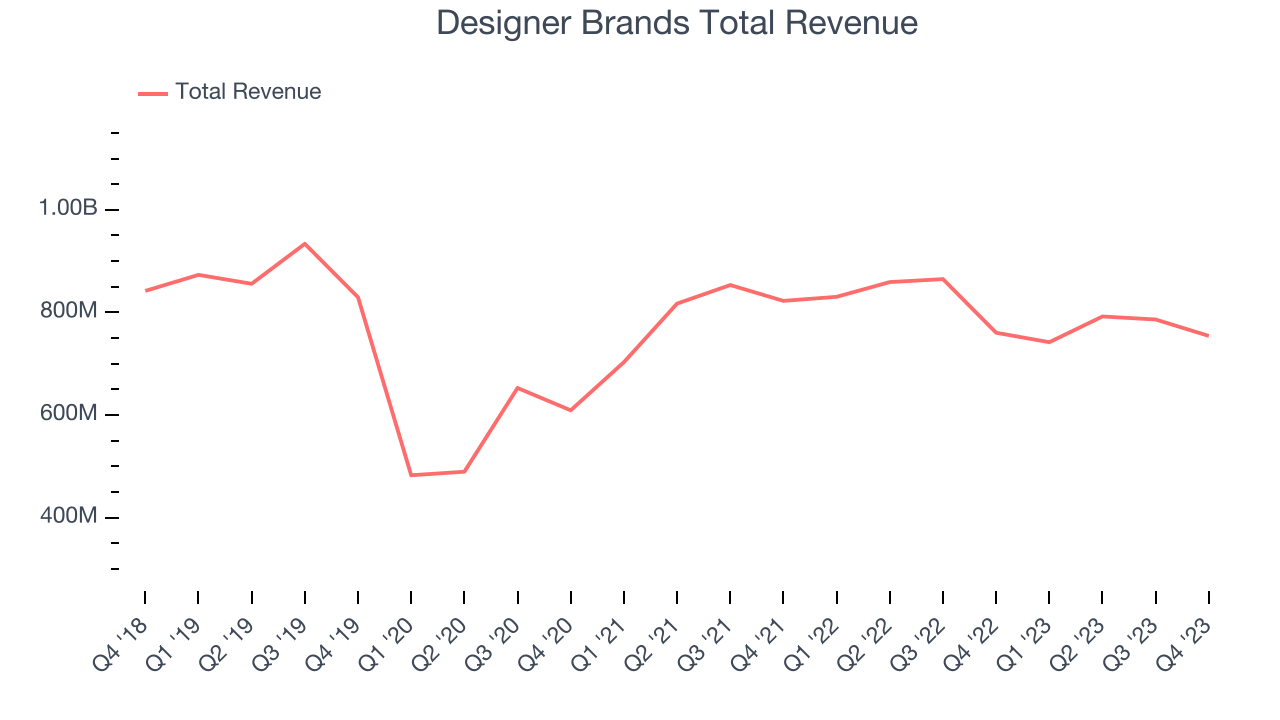

As you can see below, the company's revenue has declined over the last four years, dropping 3.1% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Designer Brands reported a rather uninspiring 0.8% year-on-year revenue decline to $754.3 million in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

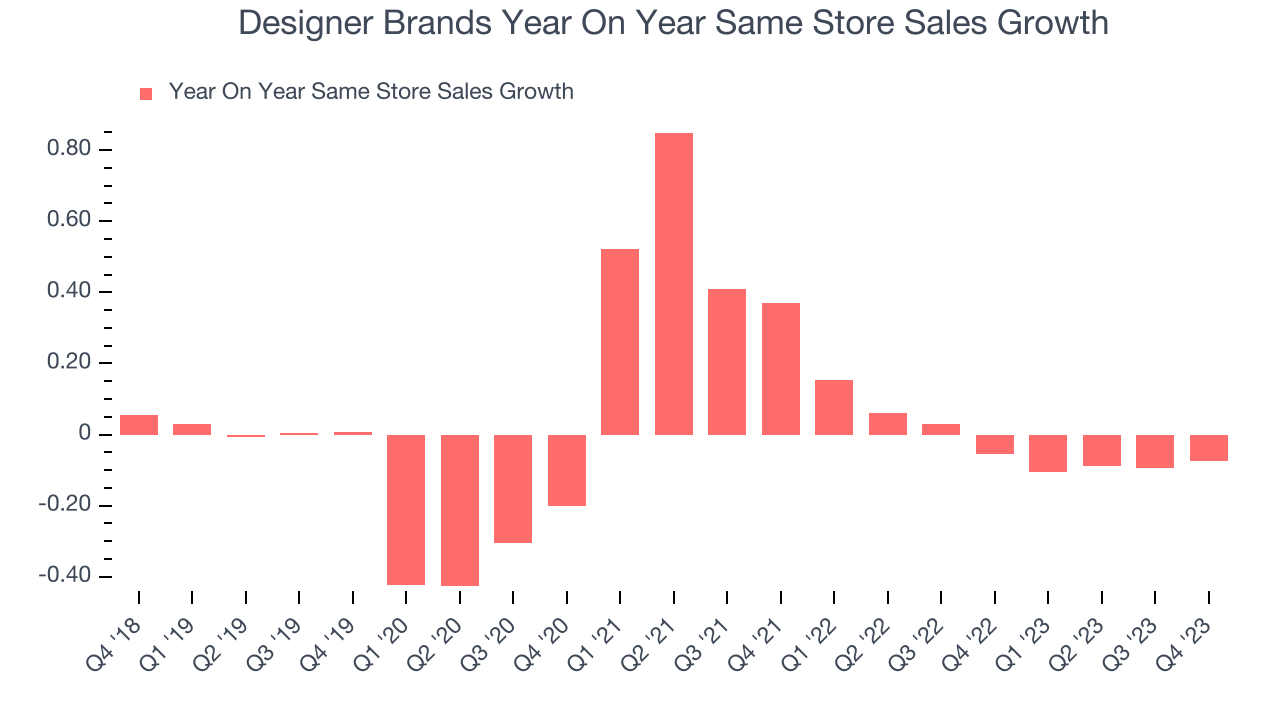

Designer Brands's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.1% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Designer Brands's same-store sales fell 7.3% year on year. This decrease was a further deceleration from the 5.5% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Designer Brands's Q4 Results

It was a tough quarter for the company despite a revenue beat. Full-year earnings guidance missed analysts' expectations and its EPS missed Wall Street's estimates. Overall, this was a mixed quarter for Designer Brands. The company is down 9.6% on the results and currently trades at $10.42 per share.

Designer Brands may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.