Footwear and accessories discount retailer Designer Brands (NYSE:DBI) fell short of analysts’ expectations in Q2 CY2024, with revenue down 2.6% year on year to $771.9 million. It made a non-GAAP profit of $0.29 per share, down from its profit of $0.59 per share in the same quarter last year.

Is now the time to buy Designer Brands? Find out by accessing our full research report, it’s free.

Designer Brands (DBI) Q2 CY2024 Highlights:

- Revenue: $771.9 million vs analyst estimates of $816.1 million (5.4% miss)

- EPS (non-GAAP): $0.29 vs analyst expectations of $0.53 (45.4% miss)

- EPS (non-GAAP) guidance for the full year is $0.55 at the midpoint, missing analyst estimates by 26.9%

- Gross Margin (GAAP): 32.8%, down from 34.5% in the same quarter last year

- Locations: 676 at quarter end, up from 636 in the same quarter last year

- Same-Store Sales fell 1.4% year on year (-8.9% in the same quarter last year) (miss vs expectations of up 2.0% year on year)

- Market Capitalization: $335.8 million

"This quarter, we further built on our track record of steady improvement as we continued to refine and refresh our strategic initiatives intended to accelerate our ongoing business transformation," stated Doug Howe, Chief Executive Officer.

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

Designer Brands is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s growing off a smaller base than its larger counterparts.

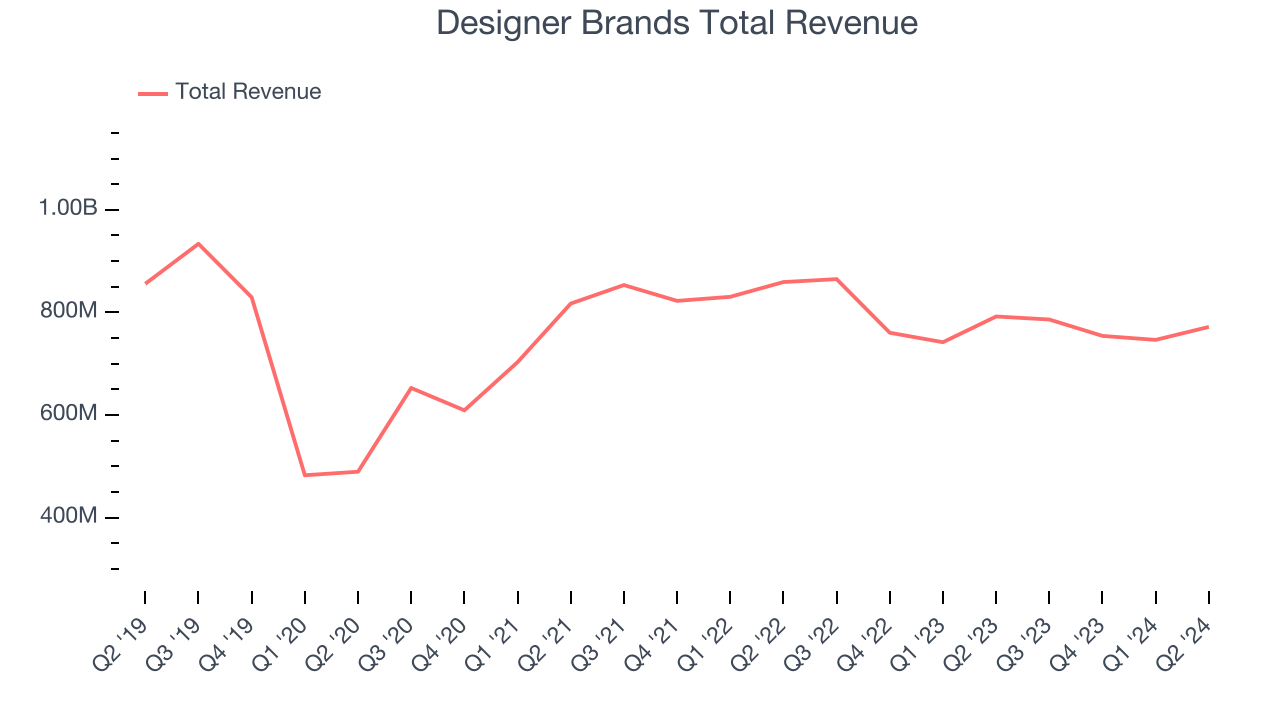

As you can see below, the company’s revenue has declined over the last four years, dropping 2.1% annually as it failed to grow its store footprint meaningfully and observed lower sales at existing, established stores.

This quarter, Designer Brands missed Wall Street’s estimates and reported a rather uninspiring 2.6% year-on-year revenue decline, generating $771.9 million in revenue. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

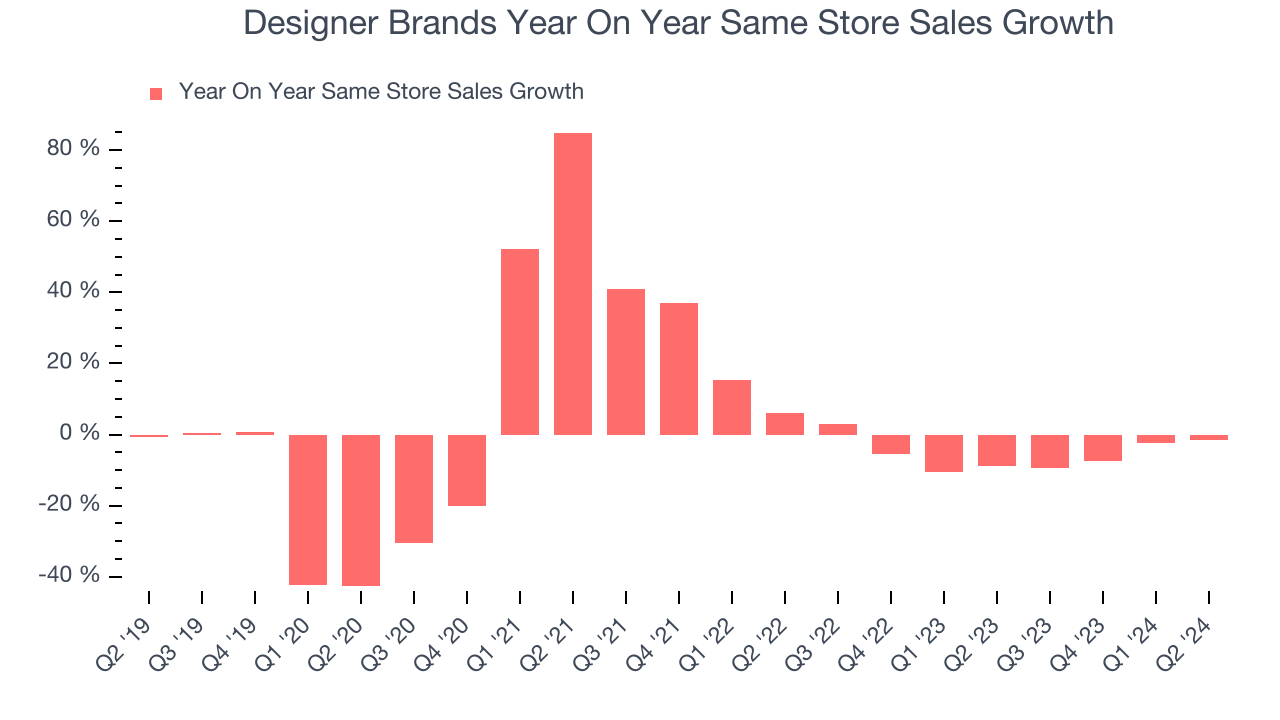

Designer Brands’s demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 5.3% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Designer Brands’s same-store sales fell 1.4% year on year. This decrease was an improvement from the 8.9% year-on-year decline it posted 12 months ago. It’s always great to see a business improve its prospects.

Key Takeaways from Designer Brands’s Q2 Results

We struggled to find many strong positives in these results. Same-store sales, missed, leading to a revenue and EPS miss. Its full-year same-store sales and earnings forecasts were both lowered and both missed analysts’ expectations. Management struck a cautious tone, saying "We saw sustained pressure on challenged categories such as dress and seasonal in the second quarter...". Overall, this quarter could have been better. The stock traded down 15.6% to $4.90 immediately after reporting.

Designer Brands may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.