Footwear and accessories discount retailer Designer Brands (NYSE:DBI) reported Q4 CY2023 results exceeding Wall Street analysts' expectations, with revenue flat year on year at $754.3 million. It made a GAAP loss of $0.52 per share, down from its profit of $0.66 per share in the same quarter last year.

Designer Brands (DBI) Q4 CY2023 Highlights:

- Revenue: $754.3 million vs analyst estimates of $747.3 million (0.9% beat)

- EPS: -$0.52 vs analyst expectations of -$0.45 (16.4% miss)

- EPS guidance for the full year 2024 of $0.75 at the midpoint missed expectations of $0.87

- Gross Margin (GAAP): 27.5%, down from 29.2% in the same quarter last year

- Same-Store Sales were down 7.3% year on year (miss)

- Store Locations: 642 at quarter end, increasing by 3 over the last 12 months

- Market Capitalization: $655 million

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

The company operates under various banners including DSW (Designer Shoe Warehouse), The Shoe Company, and Shoe Warehouse. In addition to footwear, Designer Brands also carries a broad selection of handbags. A customer can find Nike, Converse, Clarks and other shoe brands as well as Michael Kors, Kate Spade, and Marc Jacobs bags. Prices on this merchandise are typically meaningfully lower than prices at traditional department stores and other specialty retailers.

Designer Brands can offer these low prices because the company typically purchases overstocks, closeouts, and discontinued styles directly from manufacturers, as well as from other retailers and distributors ridding themselves of unwanted stock. The typical customer is therefore someone who cares about brands and fashion but loves a good deal and doesn’t mind somewhat inconsistent selection.

The company’s stores vary, but the average size across the different banners is roughly 20,000 square feet. They are generally located in shopping centers and malls alongside other retailers and are laid out with sections dedicated to different categories such as women's footwear, children's footwear, and women’s accessories. In addition to the physical store footprint, Designer Brands has an e-commerce site for each banner.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Retail competitors offering discount or mid-priced footwear and accessories include Foot Locker (NYSE:FL), Genesco (NYSE:GCO), and TJX (NYSE:TJX).Sales Growth

Designer Brands is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

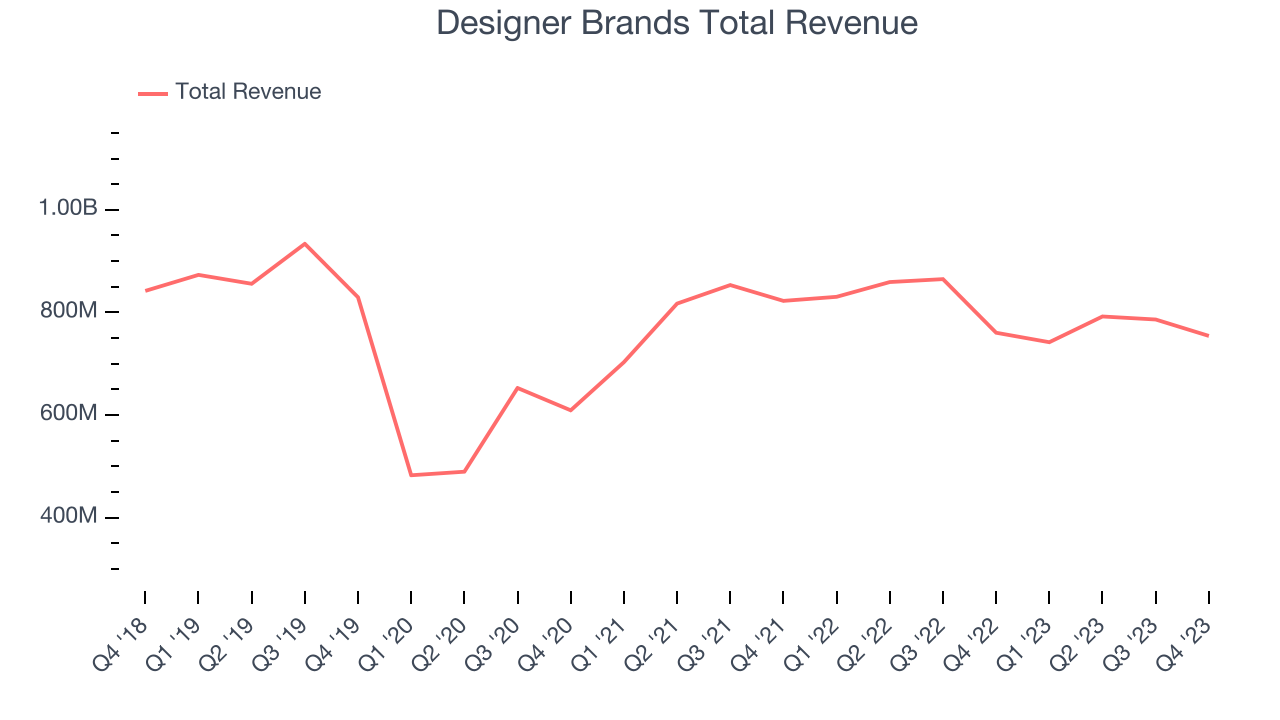

As you can see below, the company's revenue has declined over the last four years, dropping 3.1% annually as its store count and sales at existing, established stores have both shrunk.

This quarter, Designer Brands reported a rather uninspiring 0.8% year-on-year revenue decline to $754.3 million in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Number of Stores

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

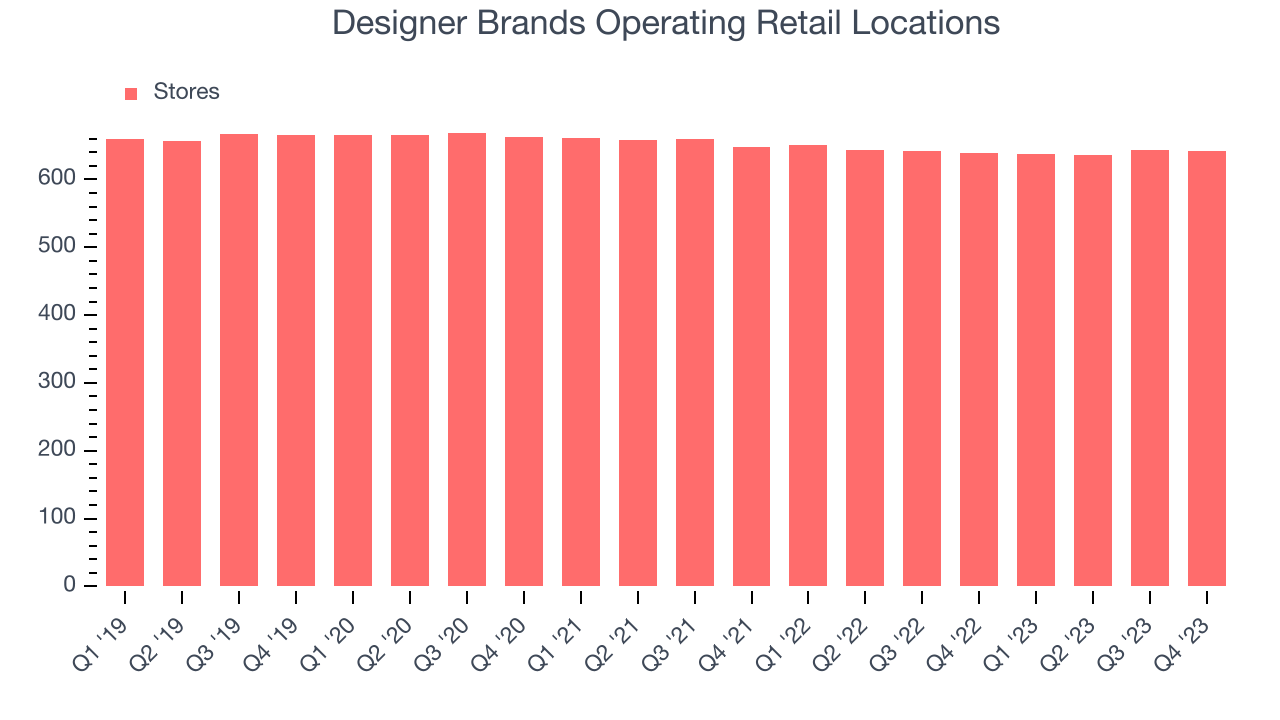

When a retailer like Designer Brands is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. As of the most recently reported quarter, Designer Brands operated 642 total retail locations, in line with its store count a year ago.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 1.3% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

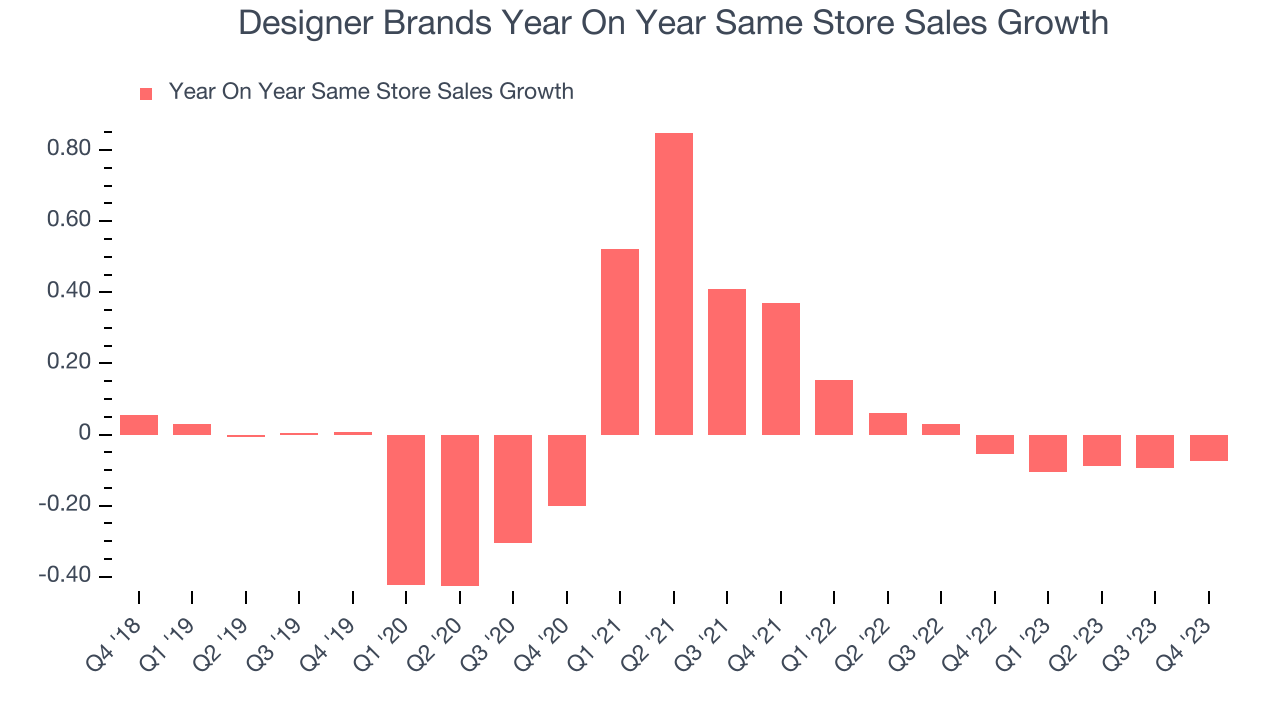

Designer Brands's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.1% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Designer Brands's same-store sales fell 7.3% year on year. This decrease was a further deceleration from the 5.5% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

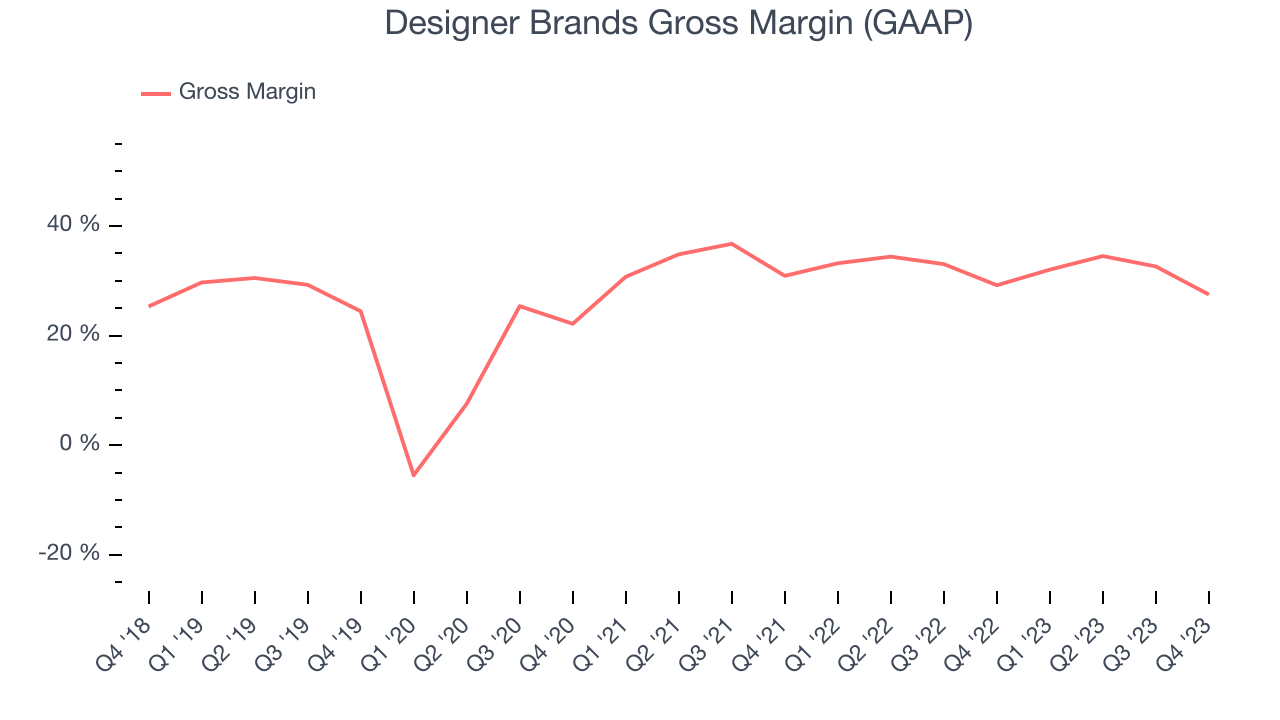

Designer Brands has weak unit economics for a retailer, making it difficult to reinvest in the business. As you can see below, it's averaged a 32.1% gross margin over the last eight quarters. This means the company makes $0.32 for every $1 in revenue before accounting for its operating expenses.

Designer Brands produced a 27.5% gross profit margin in Q4, marking a 1.7 percentage point decrease from 29.2% in the same quarter last year. One quarter of margin contraction shouldn't worry investors as a retailer's gross margin can often change due to factors such as product discounting and dynamic input costs (think distribution and freight expenses to move goods).

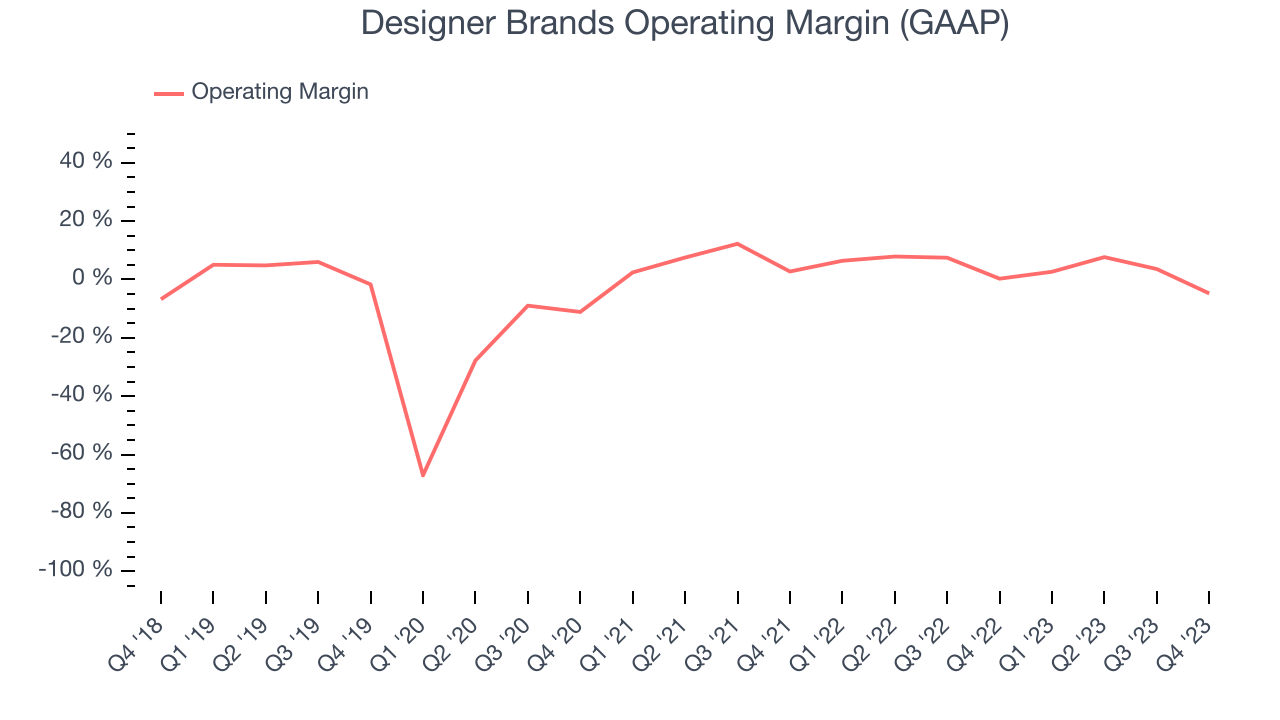

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Designer Brands generated an operating profit margin of negative 4.8%, down 5 percentage points year on year. We can infer Designer Brands was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Designer Brands was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.1%. On top of that, Designer Brands's margin has declined, on average, by 3.3 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, Designer Brands was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer retail business, producing an average operating margin of 4.1%. On top of that, Designer Brands's margin has declined, on average, by 3.3 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

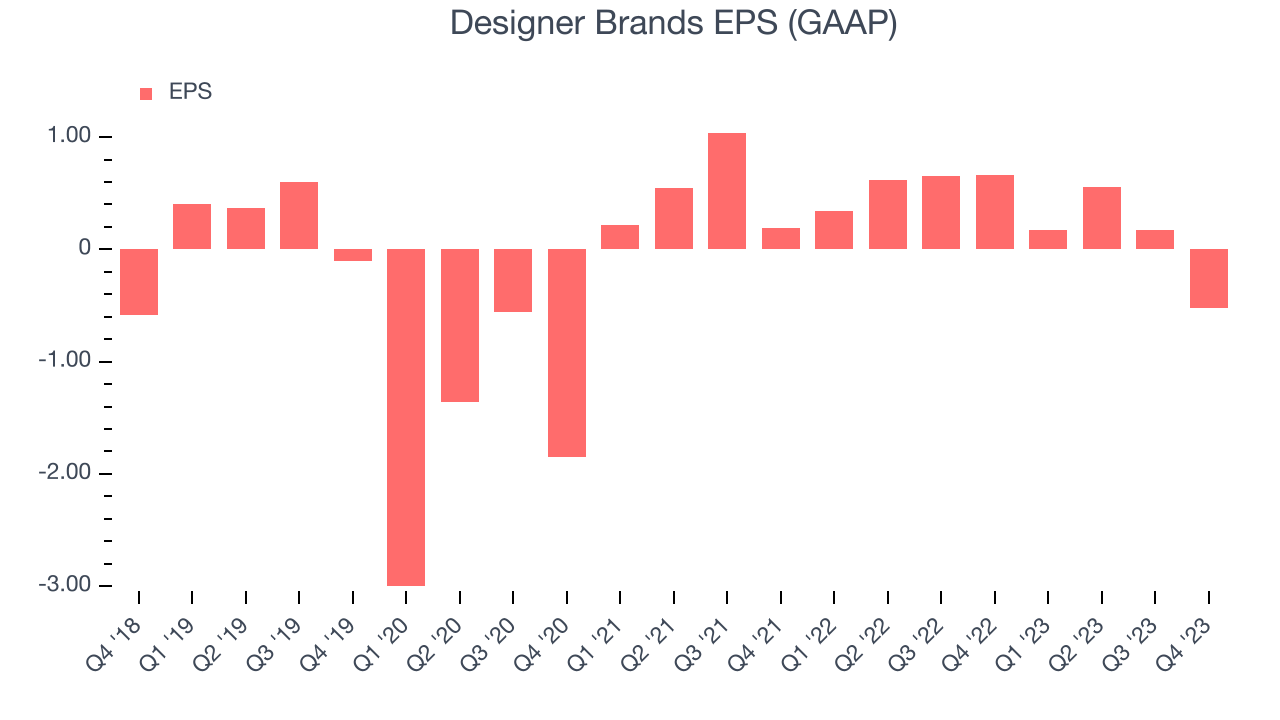

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Designer Brands reported EPS at negative $0.52, down from $0.66 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, Designer Brands's adjusted diluted EPS dropped 70%, translating into 26% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 128% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Designer Brands's five-year average ROIC was 0.7%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last five years, Designer Brands's ROIC averaged 19.8 percentage point increases each year, although this was likely helped by low ROICs during the COVID period. This is a good sign and we hope the company can continue to improving.

Key Takeaways from Designer Brands's Q4 Results

It was a tough quarter for the company despite a revenue beat. Full-year earnings guidance missed analysts' expectations and its EPS missed Wall Street's estimates. Overall, this was a mixed quarter for Designer Brands. The company is down 9.6% on the results and currently trades at $10.42 per share.

Is Now The Time?

Designer Brands may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Designer Brands, we'll be cheering from the sidelines. Its revenue has declined over the last four years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last four years makes it hard to trust. On top of that, its relatively low ROIC suggests it has struggled to grow profits historically.

Designer Brands's price-to-earnings ratio based on the next 12 months is 13.3x. While we've no doubt one can find things to like about Designer Brands, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $9.33 per share right before these results (compared to the current share price of $10.42), implying they didn't see much short-term potential in Designer Brands.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.