Aerospace and defense company Ducommun (NYSE:DCO) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 2.6% year on year to $201.4 million. Its non-GAAP profit of $0.99 per share was also 34% above analysts’ consensus estimates.

Is now the time to buy Ducommun? Find out by accessing our full research report, it’s free.

Ducommun (DCO) Q3 CY2024 Highlights:

- Revenue: $201.4 million vs analyst estimates of $194.1 million (3.8% beat)

- Adjusted EPS: $0.99 vs analyst estimates of $0.74 (34% beat)

- EBITDA: $31.88 million vs analyst estimates of $28.15 million (13.3% beat)

- Gross Margin (GAAP): 26.2%, up from 22.8% in the same quarter last year

- Operating Margin: 7.6%, up from 4.4% in the same quarter last year

- EBITDA Margin: 15.8%, in line with the same quarter last year

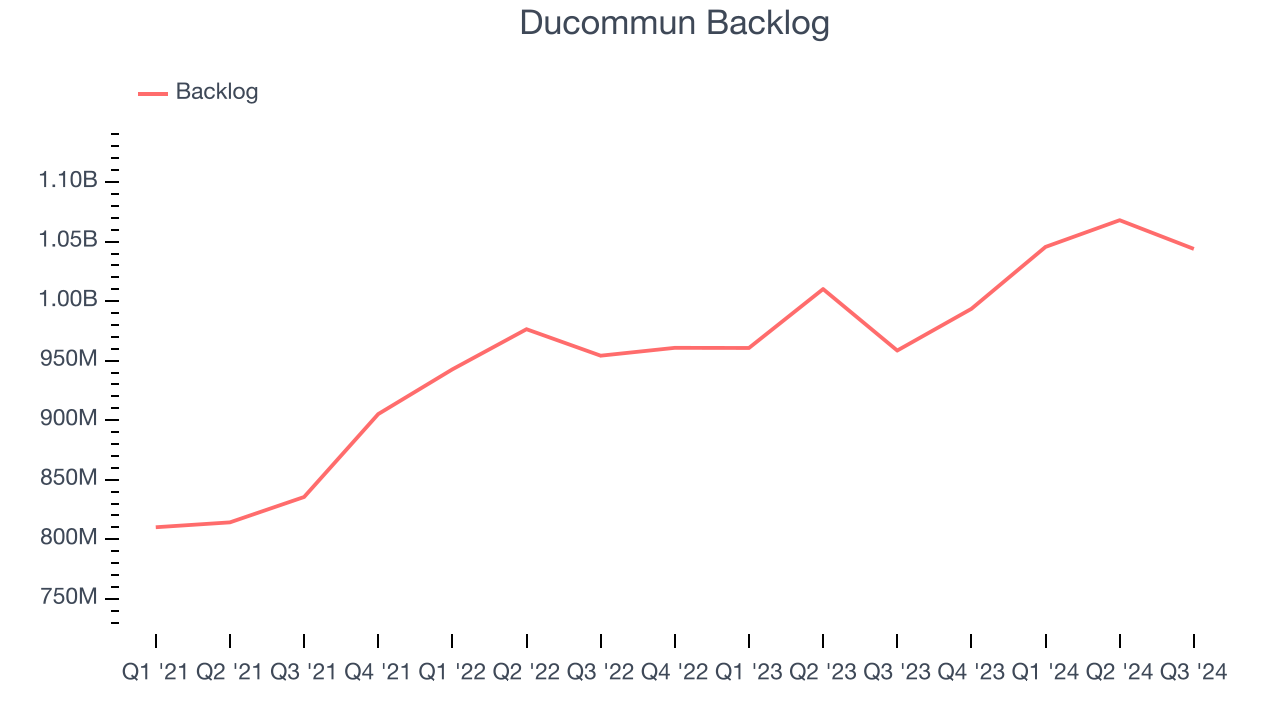

- Backlog: $1.04 billion at quarter end, up 8.9% year on year

- Market Capitalization: $968.2 million

“VISION 2027 again this quarter is taking hold in many areas and especially in our margin growth, as our mix of Engineered Products and Aftermarket revenue continues to climb as a percentage of revenue. Q3 was another outstanding quarter for DCO as we once again grew our topline both year-over-year and sequentially, led by strength in both of our Military and Commercial Aerospace segments along with strong quarterly gross margins and Adjusted EBITDA margins,” said Stephen G. Oswald, CEO.

Company Overview

California’s oldest company, Ducommun (NYSE:DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Sales Growth

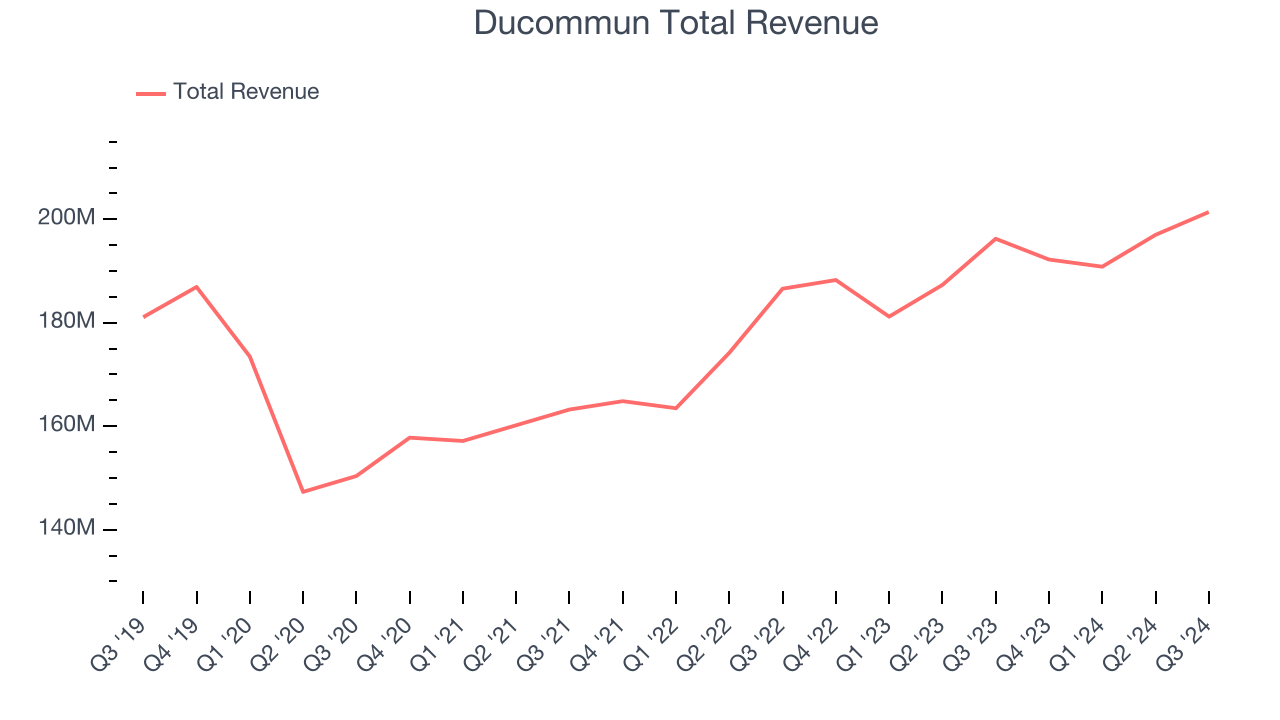

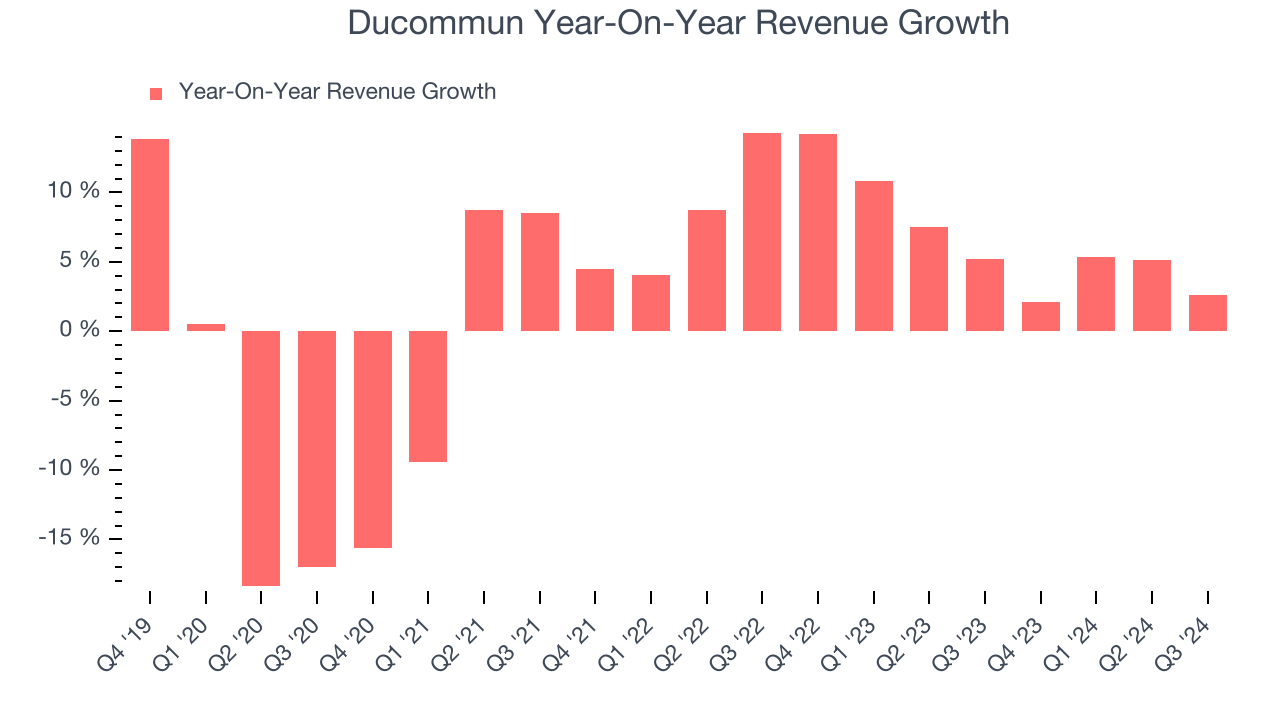

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Ducommun grew its sales at a sluggish 2.3% compounded annual growth rate. This fell short of our expectations and is a sign of lacking business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Ducommun’s annualized revenue growth of 6.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

Ducommun also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Ducommun’s backlog reached $1.04 billion in the latest quarter and averaged 4.9% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, Ducommun reported modest year-on-year revenue growth of 2.6% but beat Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

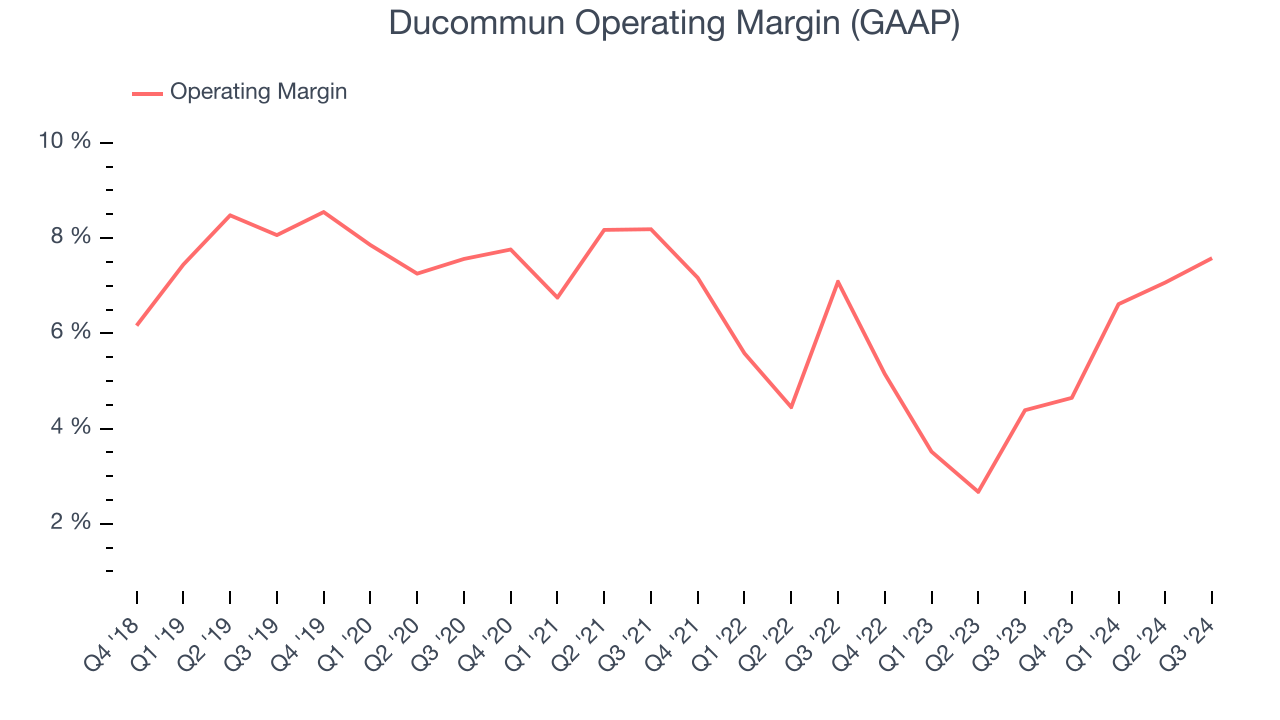

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Ducommun was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.3% was weak for an industrials business.

Looking at the trend in its profitability, Ducommun’s annual operating margin decreased by 1.4 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Ducommun generated an operating profit margin of 7.6%, up 3.2 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

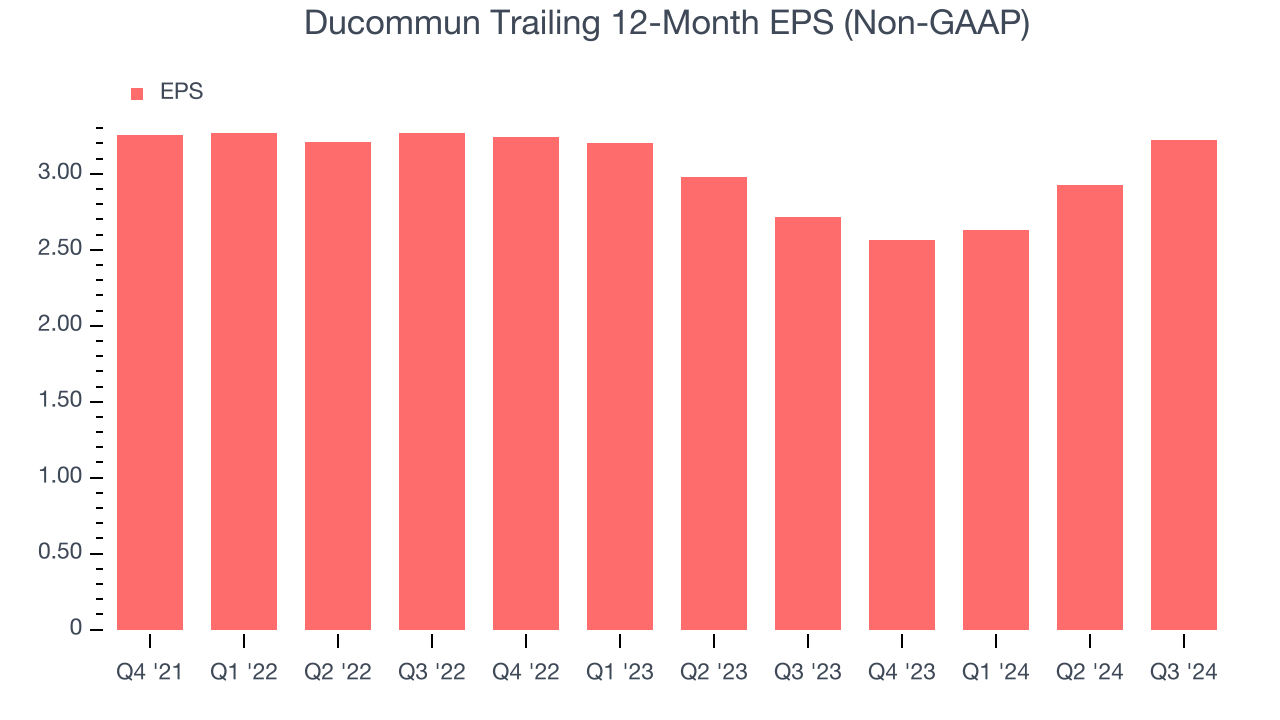

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

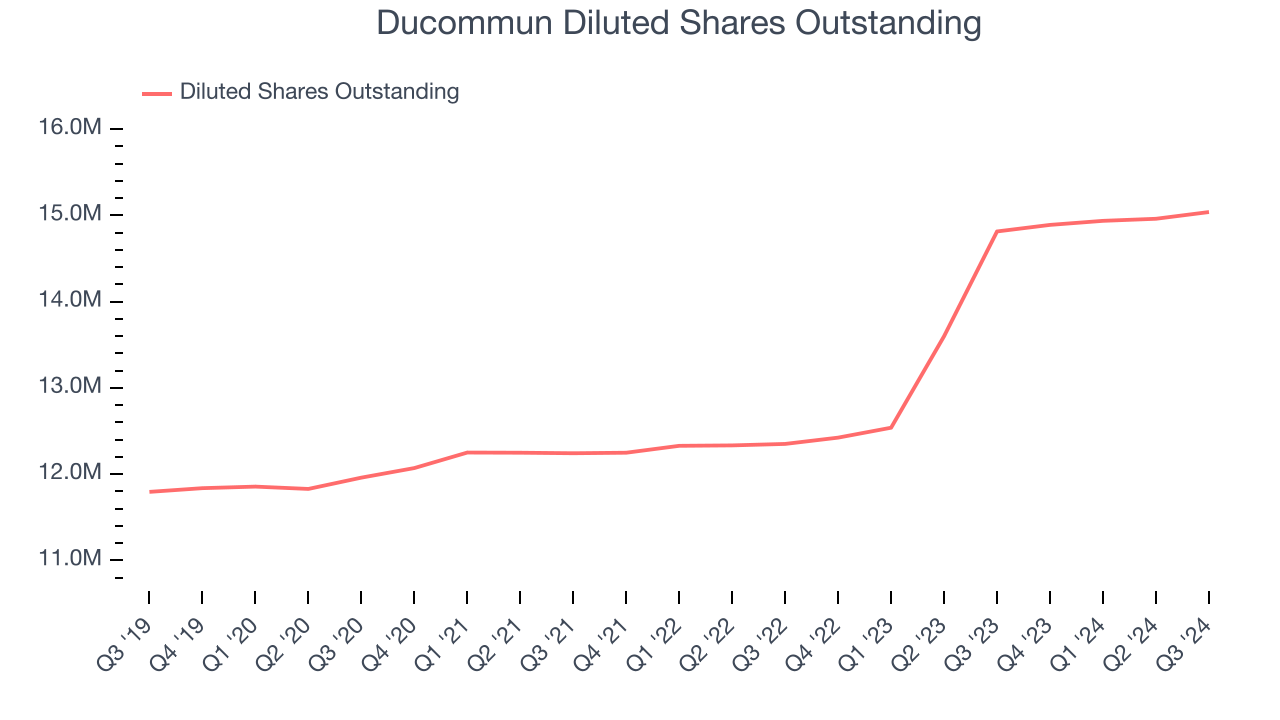

Ducommun’s flat EPS over the last two years was worse than its 6.5% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

We can take a deeper look into Ducommun’s earnings to better understand the drivers of its performance. A two-year view shows Ducommun has diluted its shareholders, growing its share count by 21.8%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Ducommun reported EPS at $0.99, up from $0.70 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Ducommun’s full-year EPS of $3.22 to grow by 11%.

Key Takeaways from Ducommun’s Q3 Results

We were impressed by how significantly Ducommun blew past analysts’ EPS expectations this quarter. We were also excited its revenue and EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 2.5% to $67 immediately after reporting.

Indeed, Ducommun had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.