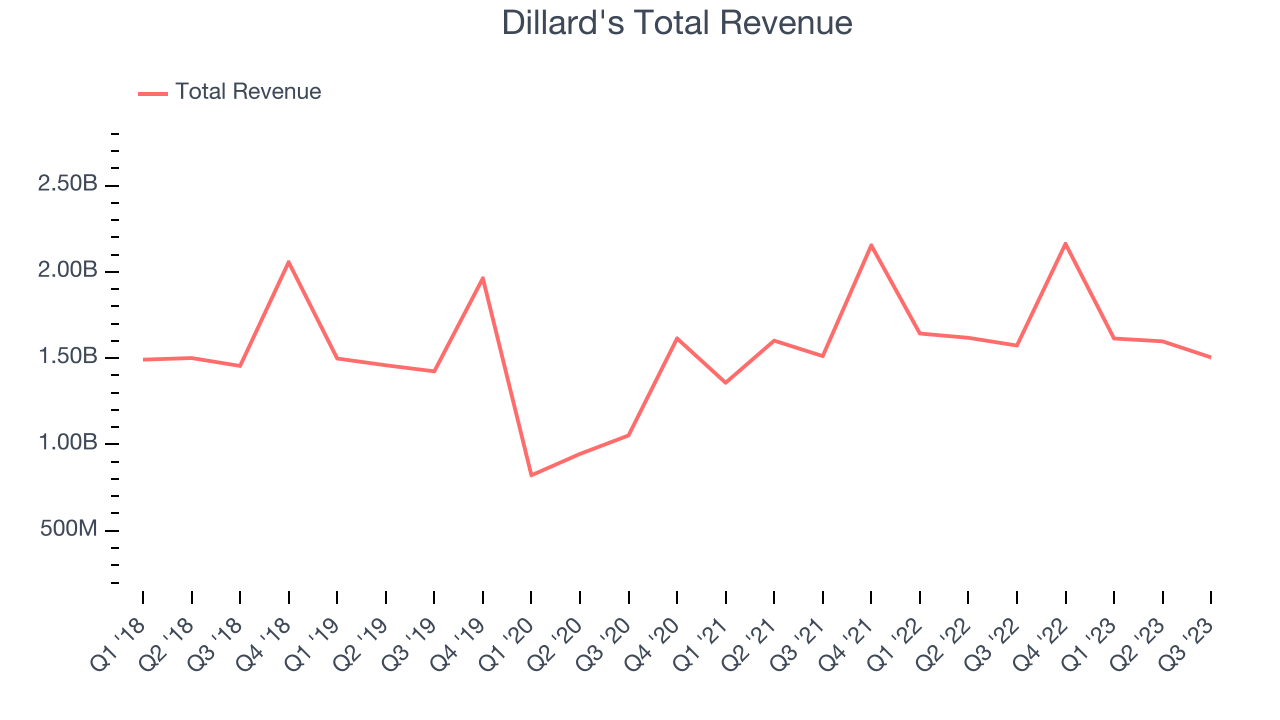

Department store chain Dillard’s (NYSE:DDS) missed analysts' expectations in Q3 FY2023, with revenue down 4.4% year on year to $1.50 billion. Turning to EPS, Dillard's made a GAAP profit of $9.49 per share, down from its profit of $10.96 per share in the same quarter last year.

Dillard's (DDS) Q3 FY2023 Highlights:

- Revenue: $1.50 billion vs analyst estimates of $1.52 billion (1.1% miss)

- EPS: $9.49 vs analyst estimates of $7.19 (31.9% beat)

- Free Cash Flow of $8.3 million, down 96.6% from the same quarter last year (large miss)

- Gross Margin (GAAP): 44.5%, down from 45.6% in the same quarter last year

- Same-Store Sales were down 6% year on year (big miss vs. expectations of down 1.8% year on year)

- Store Locations: 273 at quarter end, increasing by 24 over the last 12 months

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

As the name suggests, a department store offers a wide variety of merchandise organized into different departments or sections. Before the introduction of department stores in the 19th century, consumers would have to visit three different stores to buy an evening dress, a bottle of perfume, and a picture frame.

Today, the Dillard’s customer is a middle to upper-income woman over 35 years old who is looking for high-quality products in a variety of categories. While other department stores may offer products from affordable to luxury, Dillard’s products tend to be in the middle of the price spectrum, with a focus on quality over trendiness. Brands such as Ralph Lauren, Coach, and Lancome can be found in stores or on its e-commerce site.

Stores vary in size but are roughly 150,000 square feet. They are typically located in suburban malls and shopping centers. Common departments in a store include women’s/men’s/children’s apparel, beauty/cosmetics, and home goods. Additionally, Dillard's has an active e-commerce presence, which was launched in 1998 and made Dillard’s a fairly early adopter in the department store category at the time.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Department store competitors include Macy’s (NYSE:M), Kohl’s (NYSE:KSS), and Nordstrom (NYSE:JWN).Sales Growth

Dillard's is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's annualized revenue growth rate of 1.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, Dillard's reported a rather uninspiring 4.4% year-on-year revenue decline, missing analysts' expectations. Looking ahead, Wall Street expects revenue to decline 6% over the next 12 months.

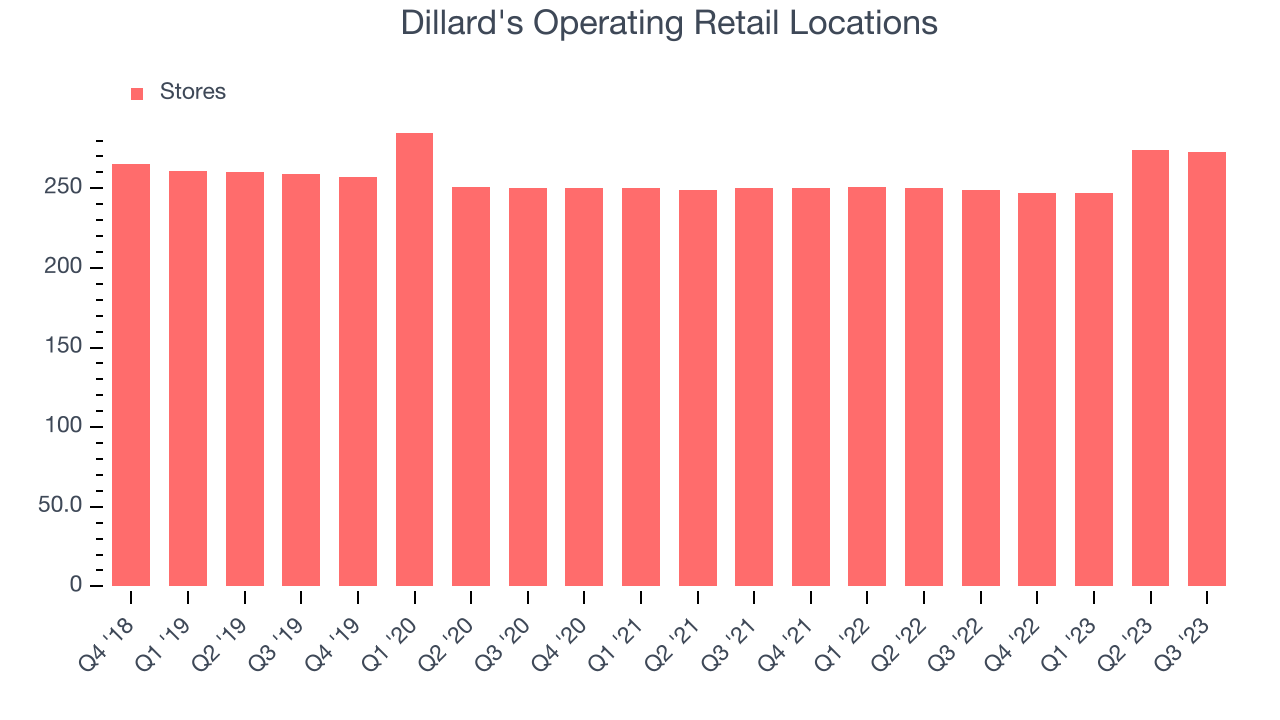

Number of Stores

When a retailer like Dillard's keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Since last year, Dillard's store count increased by 24 locations, or 9.6%, to 273 total retail locations in the most recently reported quarter.

Over the last two years, the company has only opened a few new stores, averaging 2.1% annual growth in new locations. This sluggish pace lags the broader sector. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

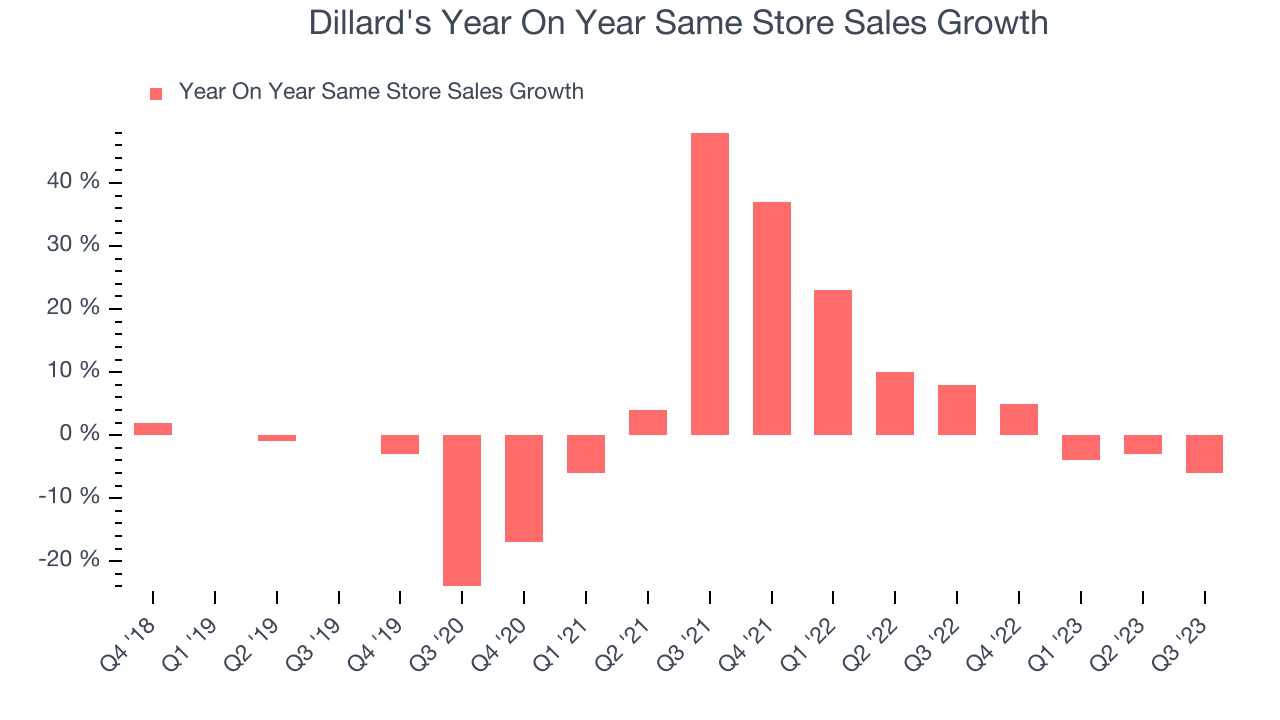

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Dillard's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 8.8% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Dillard's is reaching more customers and growing sales.

In the latest quarter, Dillard's same-store sales fell 6% year on year. This decline was a reversal from the 8% year-on-year increase it posted 12 months ago. A one quarter hiccup isn't material for the long-term prospects of a business, but we'll keep a close eye on the company.

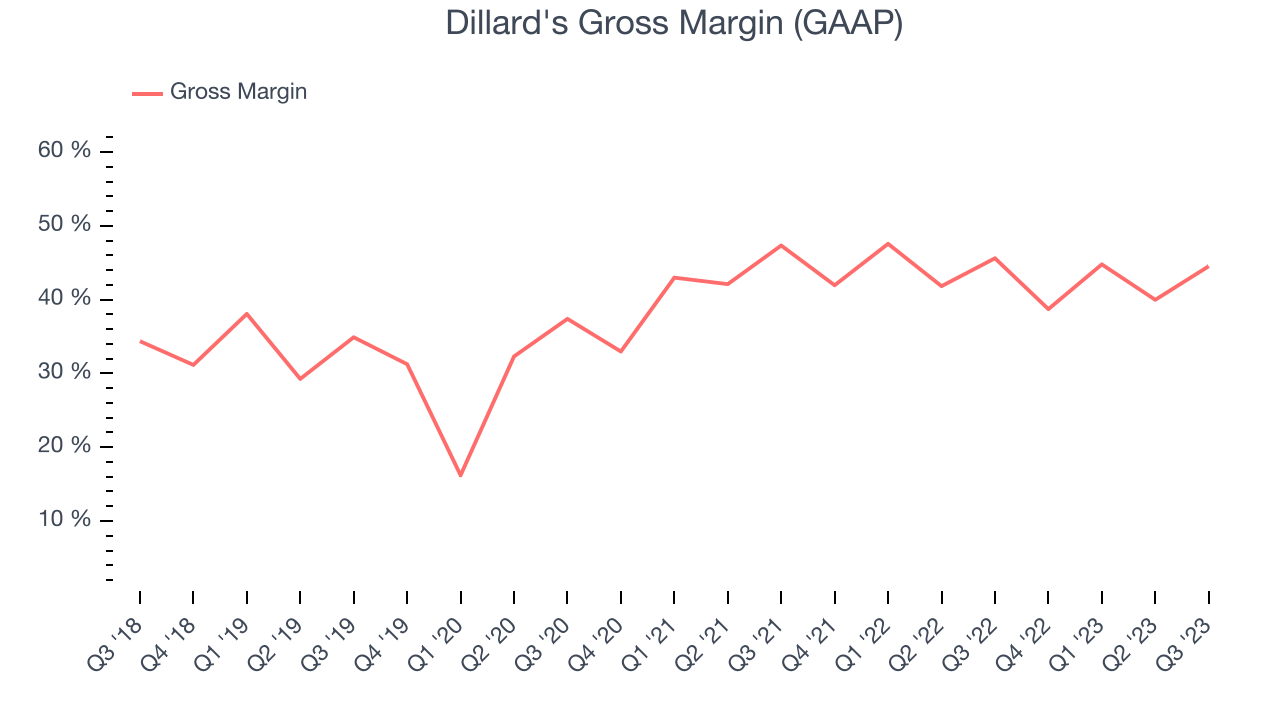

Gross Margin & Pricing Power

Dillard's has great unit economics for a retailer, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged an impressive 43.1% gross margin over the last eight quarters. This means the company makes $0.43 for every $1 in revenue before accounting for its operating expenses.

Dillard's gross profit margin came in at 44.5% this quarter, marking a 1.1 percentage point decrease from 45.6% in the same quarter last year. One quarter of margin contraction shouldn't worry investors as a retailers' gross margins can often change due to factors such as product discounting and dynamic input costs (think distribution and freight expenses to move goods).

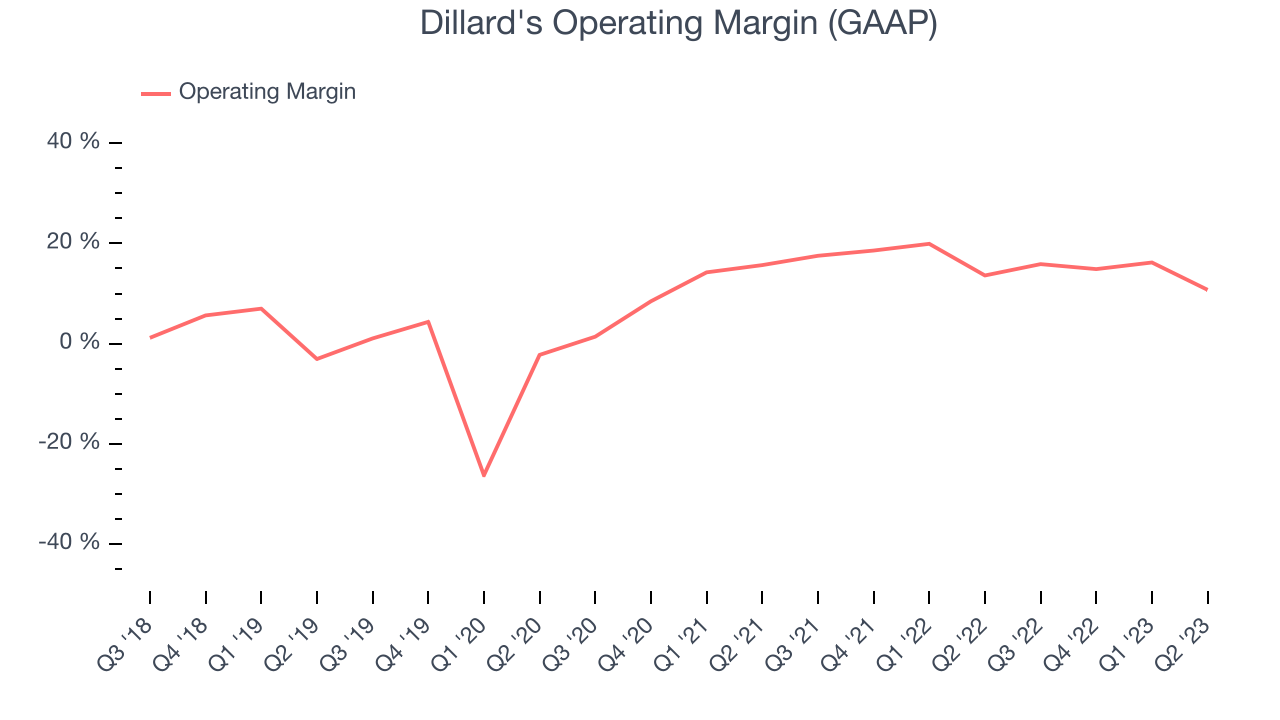

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Dillard's has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 15.7%.

Zooming out, Dillard's has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 15.7%. EPS

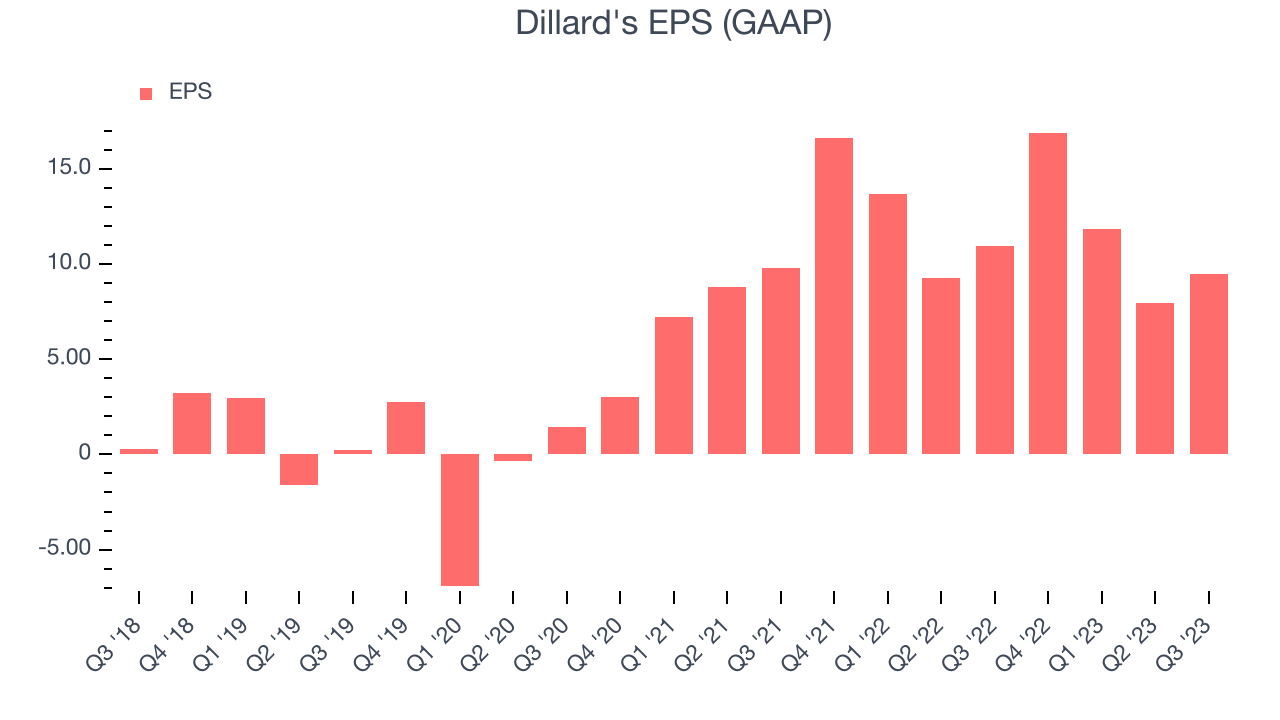

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q3, Dillard's reported EPS at $9.49, down from $10.96 in the same quarter a year ago. This print beat Wall Street's estimates by 31.9%.

Between FY2019 and FY2023, Dillard's adjusted diluted EPS grew 304%, translating into an astounding 75.9% average annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Over the next 12 months, however, Wall Street is projecting an average 49.3% year-on-year decline in EPS each quarter.

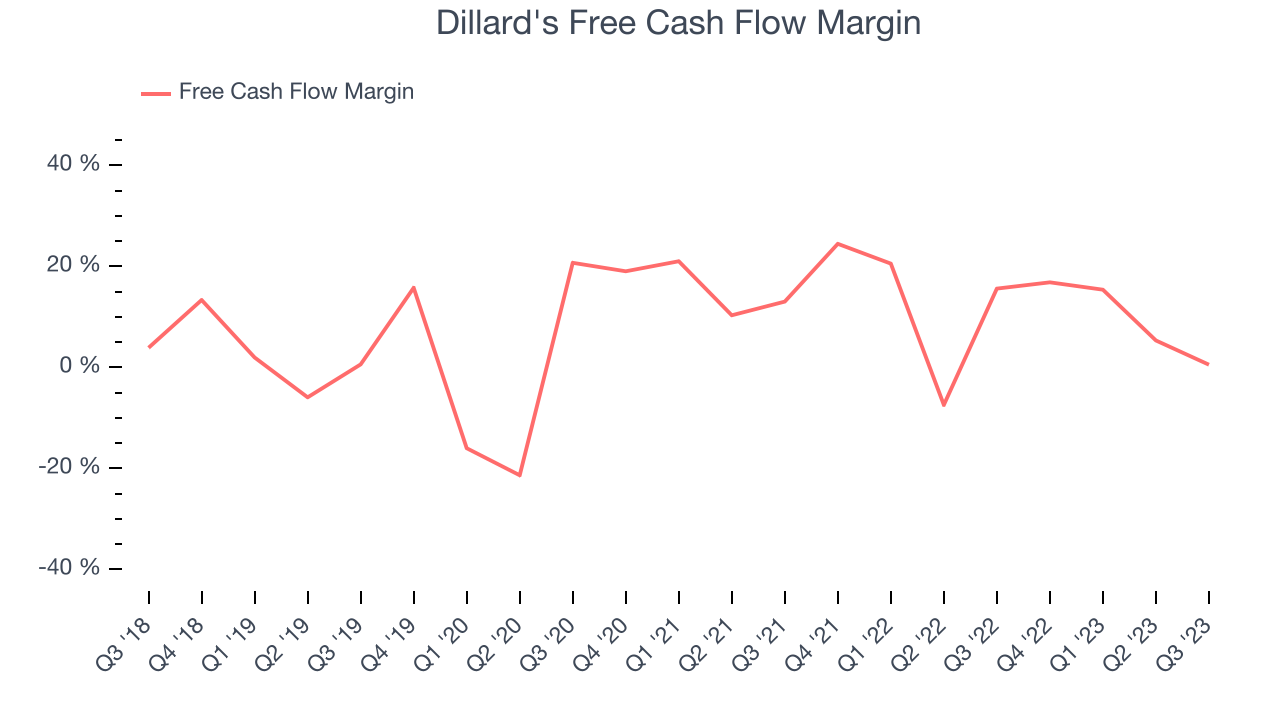

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Dillard's broke even from a free cash flow perspective in Q3. The company's margin regressed this quarter as it was 15.1 percentage points lower than in the same period last year.

Over the last eight quarters, Dillard's has shown terrific cash profitability, enabling it to stay ahead of the competition by investing organically, acquiring other businesses, paying down debt, or returning capital to shareholders via share buybacks or dividends while maintaining a robust cash balance. The company's free cash flow margin has been among the best in consumer retail, averaging 11.4%. However, its margin has averaged year-on-year declines of 3.8 percentage points. Although we'd rather see free cash flow conversion increase, short-term fluctuations like this aren't a big deal.

Return on Invested Capital (ROIC)

Dillard's has a strong competitive position and its management team has a stellar track record of successfully investing in profitable growth initiatives. Its five-year average return on invested capital (ROIC) is 33.2%, firmly placing it among the best consumer retail companies.

We like to track ROIC because it tells us about a company’s prospects for profitable growth and its management team's ability to achieve it through capital allocation decisions such as organic investments, acquisitions, and share buybacks. ROIC is also a helpful tool to benchmark performance versus peers, and just like how we focus on long-term investment returns, we care more about a company's long-term ROIC because short-term market volatility can distort results.

Key Takeaways from Dillard's Q3 Results

Sporting a market capitalization of $5.07 billion, Dillard's is among smaller companies, but its more than $893.3 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

Same store sales missed fairly meaningfully, leading to a revenue miss. Gross margin was better than expectations and operating expenses were lower than expected though, allowing for operating profit and EPS to beat. The company did not give revenue or EPS guidance. Overall, this was a mixed quarter for Dillard's. The stock is up 2% after reporting and currently trades at $315 per share.

Is Now The Time?

When considering an investment in Dillard's, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Dillard's isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been uninspiring over the last four years, and analysts expect growth to deteriorate from here.

Dillard's price-to-earnings ratio based on the next 12 months is 8.3x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Dillard's, it seems that it's trading at a reasonable price.

To get the best start with StockStory, check out our most recent stock picks and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.