Footwear and apparel conglomerate Deckers (NYSE:DECK) beat analysts' expectations in Q3 FY2024, with revenue up 16% year on year to $1.56 billion. The company's full-year revenue guidance of $4.15 billion at the midpoint also came in 1.1% above analysts' estimates. It made a GAAP profit of $15.11 per share, improving from its profit of $10.48 per share in the same quarter last year.

Deckers (DECK) Q3 FY2024 Highlights:

- Revenue: $1.56 billion vs analyst estimates of $1.45 billion (7.3% beat)

- EPS: $15.11 vs analyst estimates of $11.66 (29.6% beat)

- The company lifted its revenue guidance for the full year from $4.03 billion to $4.15 billion at the midpoint, a 3.1% increase (also lifted EPS guidance)

- Gross Margin (GAAP): 58.7%, up from 53% in the same quarter last year

- Market Capitalization: $19.39 billion

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

The company's most famous brand, UGG, is a household name known for its sheepskin boots that blend luxury and comfort. These boots have amassed international recognition and are synonymous with a casual, relaxed style.

Deckers also owns Hoka, a brand that has gained popularity in the running community for its innovative approach. Hoka’s running shoes emphasize enhanced cushioning and a unique sole design that provides a distinctive running experience. This brand has captured a customer base beyond the running niche, appealing to people seeking comfortable, performance-oriented footwear.

In the outdoor footwear market, Teva offers a variety of sandals and shoes that combine durability, functionality, and environmental consciousness. The brand appeals to outdoor enthusiasts who value adventure and an active lifestyle, aligning with a growing trend towards outdoor recreation and eco-friendly products.

In addition to these flagship brands, Deckers operates other smaller lines that contribute to its diversified brand portfolio including Sanuk and Koolaburra.

The company sells its offerings in a variety of footwear retailers, including ones focused on the general public with many styles as well as more focused retailers that emphasize sportswear or fashion-forward offerings. The typical customer is a consumer that spans different generations and income brackets but seeks a combination of comfort and trendiness.

Footwear

In addition to practical purposes, footwear has been a way for people to communicate status or express themselves throughout history. Before the advent of the internet, styles changed, but consumers mainly bought clothing and accessories by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Deckers primary competitors include Nike (NYSE:NKE), Vans and Timberland (owned by VF Corporation NYSE:VFC), Columbia Sportswear Company (NASDAQ:COLM), Merrell (owned by Wolverine World WideNYSE:WWW), and Skechers (NYSE:SKX).Sales Growth

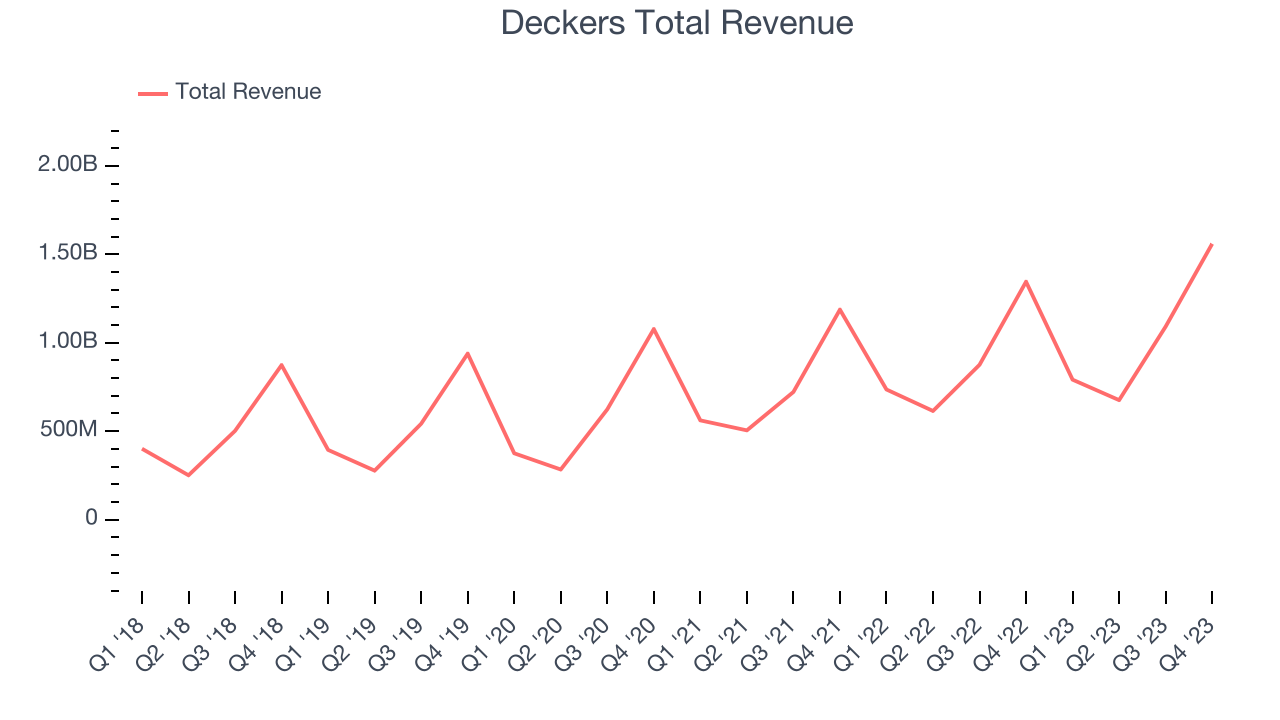

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Deckers's annualized revenue growth rate of 15.2% over the last 5 years was solid for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Deckers's healthy annualized revenue growth of 17.7% over the last 2 years is above its 5-year trend, suggesting its brand resonates with consumers.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Deckers's healthy annualized revenue growth of 17.7% over the last 2 years is above its 5-year trend, suggesting its brand resonates with consumers.

Deckers also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last 2 years, its constant currency sales averaged 19.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that macroeconomic challenges hindered Deckers's top-line performance.

This quarter, Deckers reported robust year-on-year revenue growth of 16%, and its $1.56 billion of revenue exceeded Wall Street's estimates by 7.3%. Looking ahead, Wall Street expects sales to grow 7.6% over the next 12 months, a deceleration from this quarter.

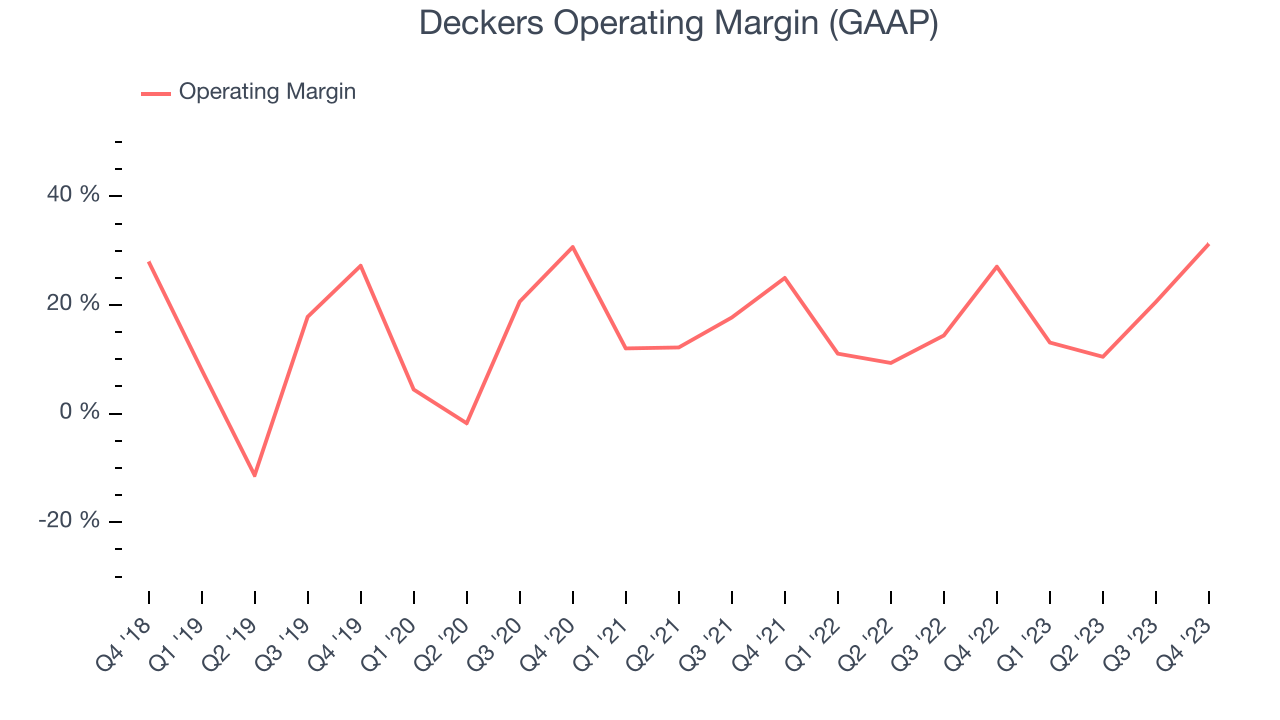

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Deckers has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 17.2%.

In Q3, Deckers generated an operating profit margin of 31.3%, up 4.2 percentage points year on year. This increase indicates the company was more efficient with its expenses over the last year, spending less money in areas like corporate overhead and advertising.

Over the next 12 months, Wall Street expects Deckers to become less profitable. Analysts are expecting the company’s LTM operating margin of 21.5% to decline to 19%.EPS

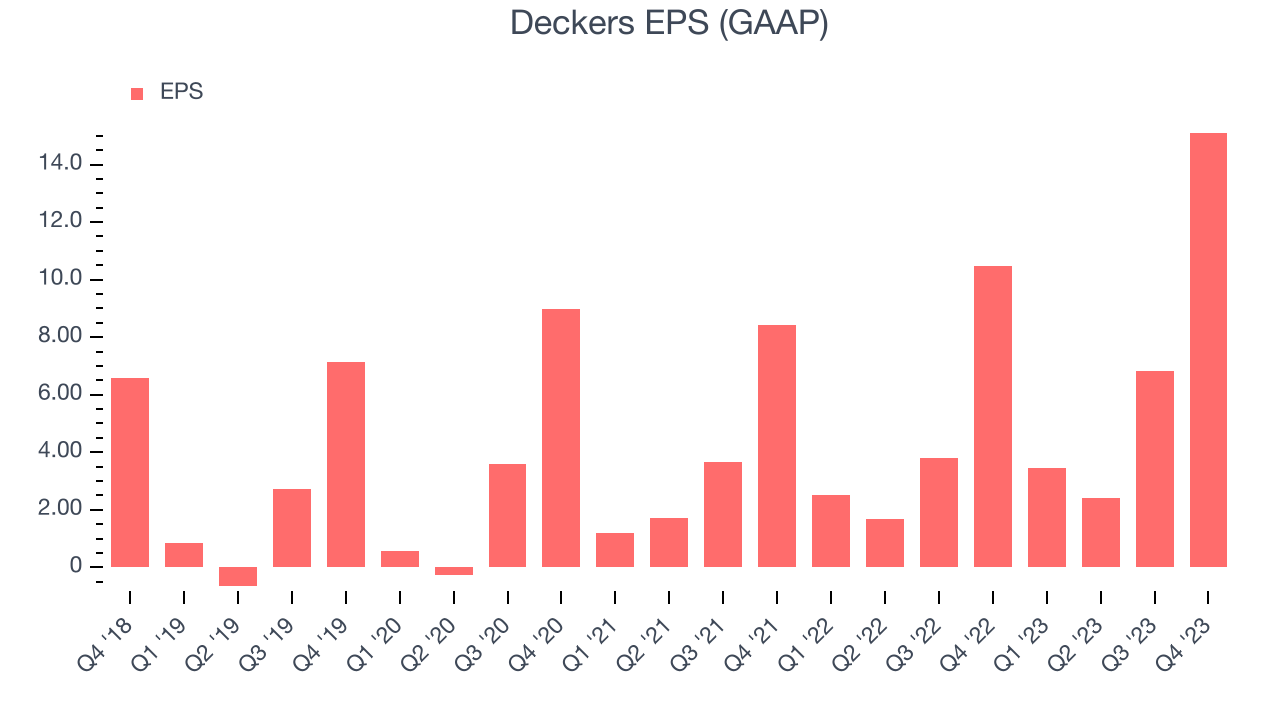

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last 5 years, Deckers's EPS grew 215%, translating into an astounding 25.8% compounded annual growth rate. This performance is materially higher than its 15.2% annualized revenue growth over the same period. Let's dig into why.

Deckers's operating margin has expanded 3.3 percentage points over the last 5 years, leading to higher profitability and earnings. Taxes and interest expenses can also cause differences between revenue and EPS growth, but they don't tell us as much about a company's fundamentals.In Q3, Deckers reported EPS at $15.11, up from $10.48 in the same quarter a year ago. This print beat analysts' estimates by 29.6%.

Over the next 12 months, Wall Street expects Deckers to perform poorly. Analysts are projecting its LTM EPS of $27.81 to shrink to $25.27.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company's revenue growth was profitable. But was it capital-efficient? If two companies had equal growth, we’d prefer the one with lower reinvestment requirements.

Enter ROIC, a metric showing how much operating profit a company generates relative to its invested capital (debt and equity). ROIC not only gauges the ability to grow profits but also a management team's ability to allocate limited resources.

Although Deckers hasn't been the highest-quality company lately, it historically did a wonderful job investing in profitable growth initiatives. Its five-year average return on invested capital was 86.4%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price.

Key Takeaways from Deckers's Q3 Results

We were impressed by how significantly Deckers blew past analysts' constant currency revenue expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Icing on the cake was the company raising its revenue and EPS guidance in a backdrop where some companies selling discretionary consumer goods have stumbled. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 6.9% after reporting and currently trades at $823.7 per share.

Is Now The Time?

Deckers may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Deckers isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been solid over the last five years, its projected EPS for the next year is lacking. And while its average annual EPS growth over the last five years has been fantastic, the downside is its low free cash flow margins give it little breathing room.

Deckers's price-to-earnings ratio based on the next 12 months is 28.9x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Deckers, it seems to be trading at a reasonable price.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.