Discount retailer Dollar General (NYSE:DG) reported results in line with analysts' expectations in Q3 FY2023, with revenue up 2.4% year on year to $9.69 billion. It made a GAAP profit of $1.26 per share, down from its profit of $2.33 per share in the same quarter last year.

Is now the time to buy Dollar General? Find out by accessing our full research report, it's free.

Dollar General (DG) Q3 FY2023 Highlights:

- Revenue: $9.69 billion vs analyst estimates of $9.68 billion (small beat)

- EPS: $1.26 vs analyst estimates of $1.21 (4.4% beat)

- Guidance for fiscal 2023: revenue growth of 2.0% year on year at the midpoint, a slight reduction from 2.3% previously (vs analyst estimates of 2.3%)

- Guidance for fiscal 2023: EPS of $7.35 at the midpoint, a reduction from $7.70 previously (vs analyst estimates of $7.45)

- Free Cash Flow of $242.7 million is up from -$119.3 million in the same quarter last year

- Gross Margin (GAAP): 29%, down from 30.5% in the same quarter last year

- Same-Store Sales were down 1.3% year on year (beat vs. expectations of down 2.2% year on year)

- Store Locations: 19,726 at quarter end, increasing by 908 over the last 12 months

“While we are not satisfied with our financial results for the third quarter, including a significant headwind from inventory shrink, we are pleased with the momentum in some of the underlying sales trends, including positive customer traffic, as well as market share gains in both dollars and units. We continue to believe our model is relevant in all economic cycles, and we are working diligently to further enhance our unique combination of value and convenience,” said Todd Vasos, Dollar General’s chief executive officer.

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Discount Grocery Store

Traditional grocery stores are go-tos for many families, but discount grocers serve those who may not have a traditional grocery store nearby or who may have different spending thresholds. Certain rural or lower-income areas simply don’t have a grocery store. Additionally, some lower-income families would prefer to buy in smaller quantities than available at most stores (think one or two paper towel rolls at a time). While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of buying food. Furthermore, those buying small quantities for immediate need are even less likely to leverage e-commerce for these purposes.

Sales Growth

Dollar General is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

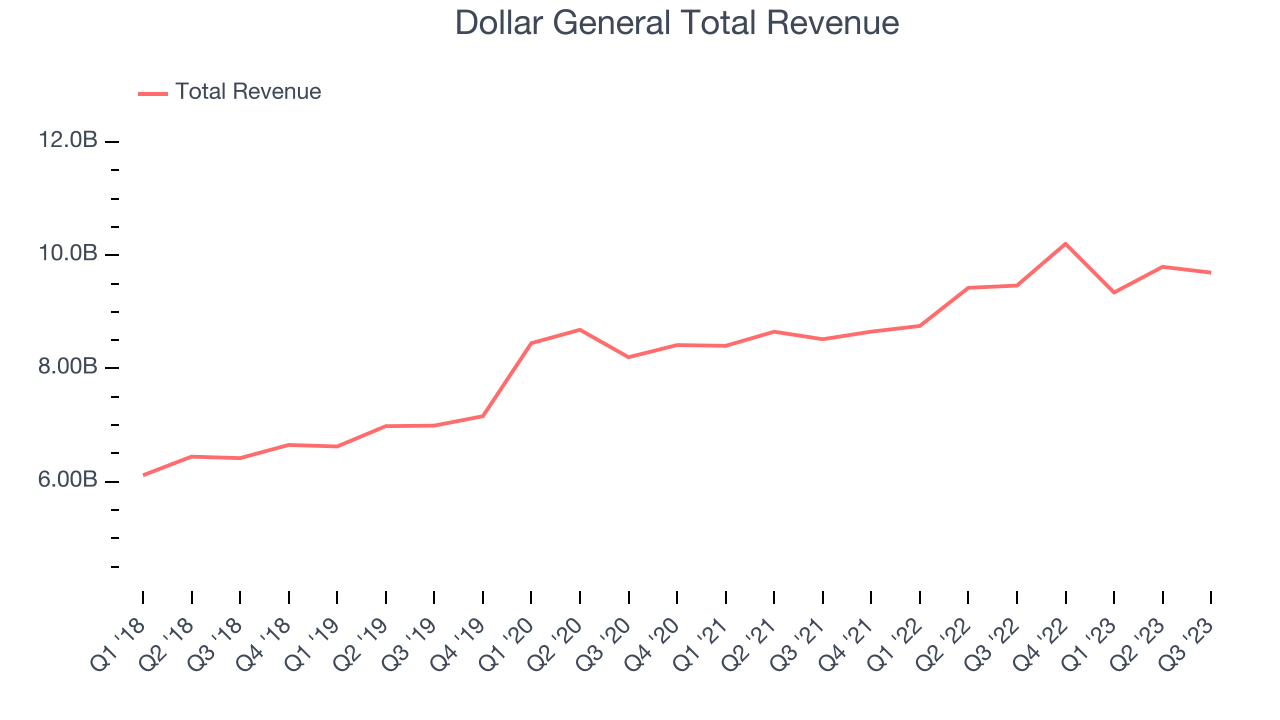

As you can see below, the company's annualized revenue growth rate of 9.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Dollar General grew its revenue by 2.4% year on year, in line with Wall Street's estimates. Looking ahead, analysts expect sales to grow 2.8% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

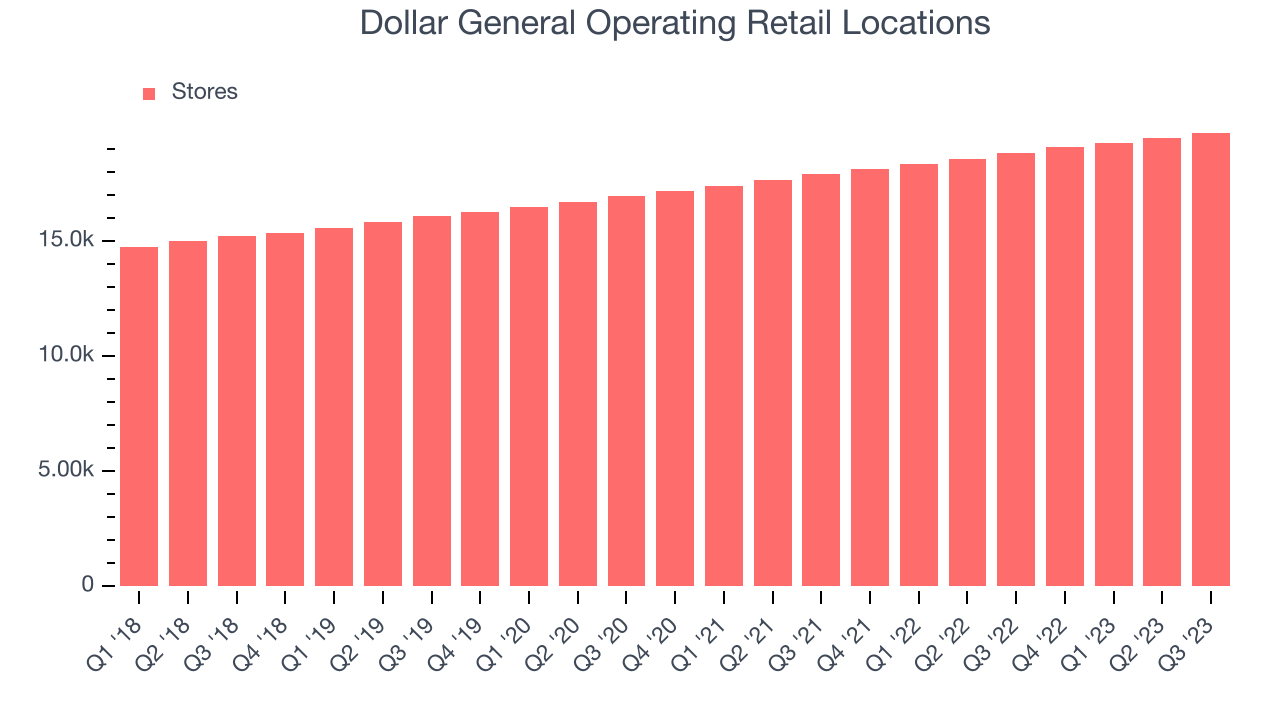

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Dollar General is opening new stores, it usually means it's investing for growth because demand is greater than supply. Dollar General's store count increased by 908 locations, or 4.8%, over the last 12 months to 19,726 total retail locations in the most recently reported quarter.

Over the last two years, the company has opened new stores quickly and averaged 5.1% annual growth in new locations, meaningfully higher than other consumer retail businesses. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

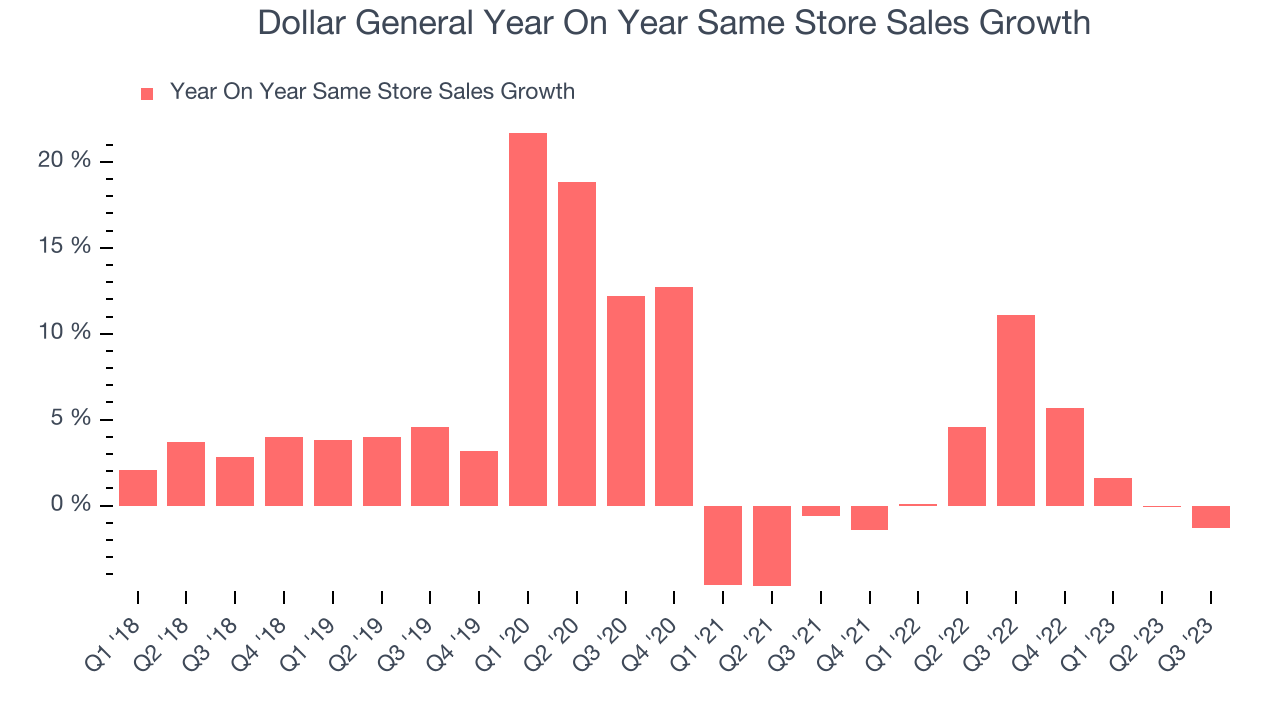

Dollar General's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.5% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Dollar General is reaching more customers and growing sales.

In the latest quarter, Dollar General's same-store sales fell 1.3% year on year. This decline was a reversal from the 11.1% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Dollar General's Q3 Results

With a market capitalization of $29.39 billion, a $365.4 million cash balance, and positive free cash flow over the last 12 months, we're confident that Dollar General has the resources needed to pursue a high-growth business strategy.

It was encouraging to see Dollar General slightly top analysts' same-store sales, revenue, and EPS expectations this quarter. On the other hand, its gross margin missed analysts' expectations. Guidance was also underwhelming, with the company lowering its sales growth and EPS outlooks, both of which came in below Consensus. Lastly, management commentary was positive, calling out "positive customer traffic, as well as market share gains in both dollars and units." Given the uncertain macro backdrop, management added that the Dollar General "model is relevant in all economic cycles". Overall, the results were mixed. The stock is flat after reporting and currently trades at $135 per share.

So should you invest in Dollar General right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.