Discount retailer Dollar General (NYSE:DG) fell short of analysts’ expectations in Q2 CY2024, with revenue up 4.2% year on year to $10.21 billion. It made a GAAP profit of $1.70 per share, down from its profit of $2.13 per share in the same quarter last year.

Is now the time to buy Dollar General? Find out by accessing our full research report, it’s free.

Dollar General (DG) Q2 CY2024 Highlights:

- Revenue: $10.21 billion vs analyst estimates of $10.37 billion (1.5% miss)

- EPS: $1.70 vs analyst expectations of $1.79 (4.8% miss)

- EPS (GAAP) guidance for the full year is $5.85 at the midpoint, missing analyst estimates by 17.9%

- Gross Margin (GAAP): 30%, down from 31.1% in the same quarter last year

- EBITDA Margin: 7.5%, down from 9.2% in the same quarter last year

- Free Cash Flow Margin: 6.2%, up from 1.3% in the same quarter last year

- Locations: 20,345 at quarter end, up from 19,488 in the same quarter last year

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $27.23 billion

“We made important progress on our Back to Basics plan in the second quarter,” said Todd Vasos, Dollar General’s CEO.

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Discount Grocery Store

Traditional grocery stores are go-tos for many families, but discount grocers serve those who may not have a traditional grocery store nearby or who may have different spending thresholds. Certain rural or lower-income areas simply don’t have a grocery store. Additionally, some lower-income families would prefer to buy in smaller quantities than available at most stores (think one or two paper towel rolls at a time). While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of buying food. Furthermore, those buying small quantities for immediate need are even less likely to leverage e-commerce for these purposes.

Sales Growth

Dollar General is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

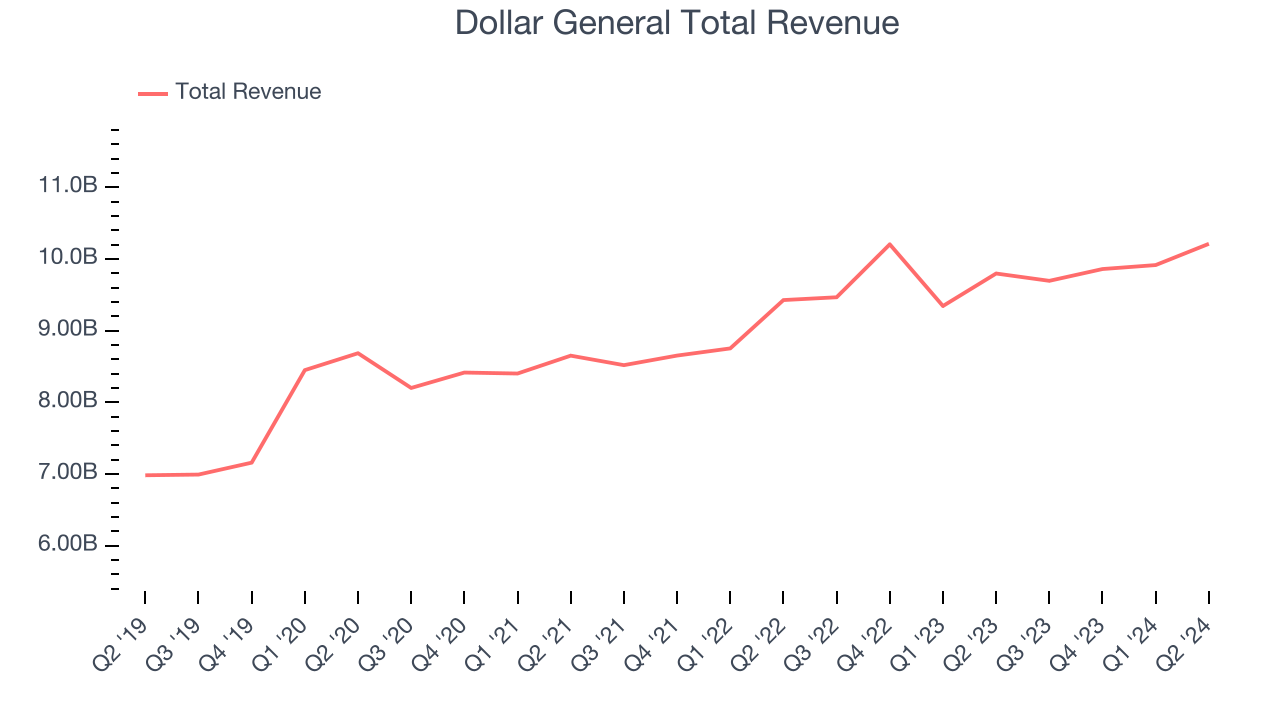

As you can see below, the company’s annualized revenue growth rate of 8.3% over the last five years was mediocre as it opened new stores and grew sales at existing, established stores.

This quarter, Dollar General’s revenue grew 4.2% year on year to $10.21 billion, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

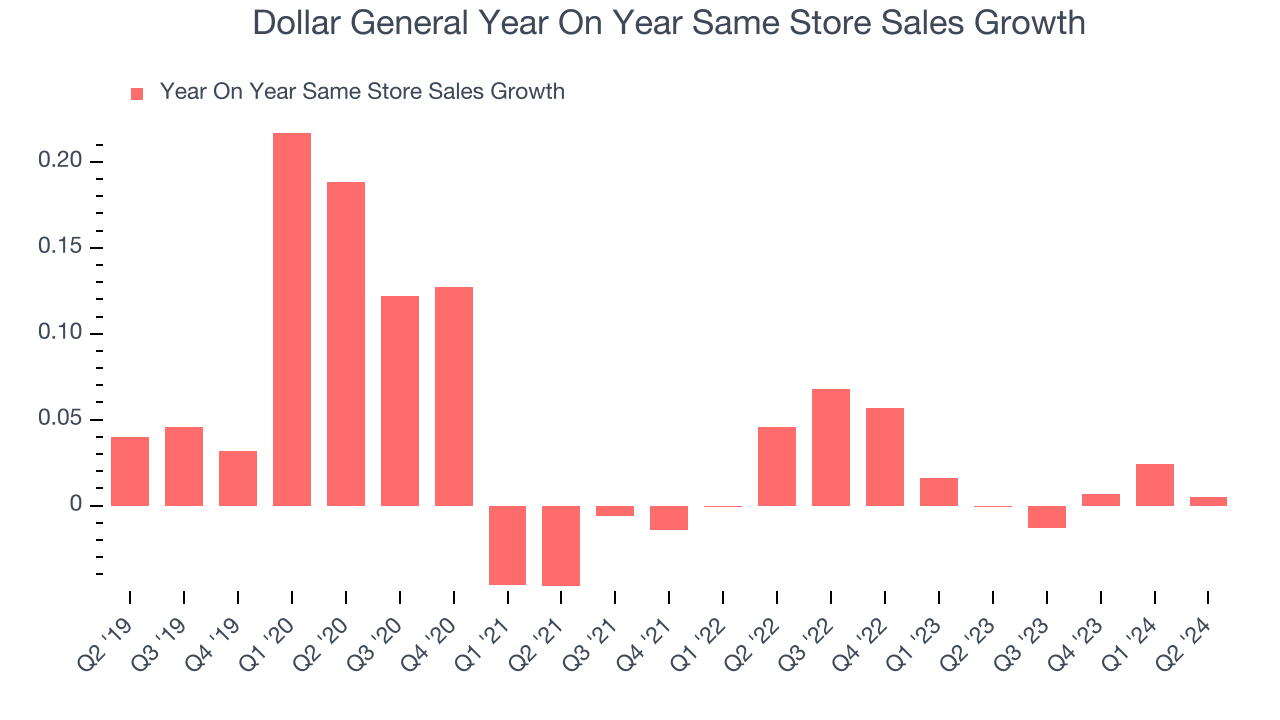

A company’s same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Dollar General’s demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company’s same-store sales have grown by 2% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Dollar General is reaching more customers and growing sales.

In the latest quarter, Dollar General’s year on year same-store sales were flat. This performance was more or less in line with the same quarter last year.

Key Takeaways from Dollar General’s Q2 Results

We struggled to find many strong positives in these results. Its full-year earnings forecast significantly missed analysts’ expectations and this quarter's revenue and EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 20.8% to $98 immediately following the results.

Dollar General may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.