Global entertainment and media company Disney (NYSE:DIS) missed analysts' expectations in Q1 FY2024, with revenue flat year on year at $23.55 billion. It made a GAAP profit of $1.04 per share, improving from its profit of $0.99 per share in the same quarter last year.

Is now the time to buy Disney? Find out by accessing our full research report, it's free.

Disney (DIS) Q1 FY2024 Highlights:

- Revenue: $23.55 billion vs analyst estimates of $23.77 billion (0.9% miss)

- Operating Income: $3,876 million vs. analyst estimates of $3,527 million (9.9% beat)

- EPS: $1.04 vs analyst estimates of $0.88 (18.7% beat)

- Free Cash Flow of $886 million, down 74.2% from the previous quarter

- Gross Margin (GAAP): 12.5%, down from 30.3% in the same quarter last year

- Market Capitalization: $182.1 billion

“Just one year ago, we outlined an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company.

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Movies and Entertainment

The internet changed how shows, films, music, and overall information flow, and many companies in the movie and entertainment industries were forced to contend with the resulting tectonic shifts. Those who haven’t adapted quickly enough face secular headwinds as attention and dollars shift online. Those who have made concerted efforts to adapt by introducing streaming platforms and digital subscriptions are fighting a good fight. Time will tell which companies emerge as the long-term winners and which fall behind or are gobbled up via M&A.

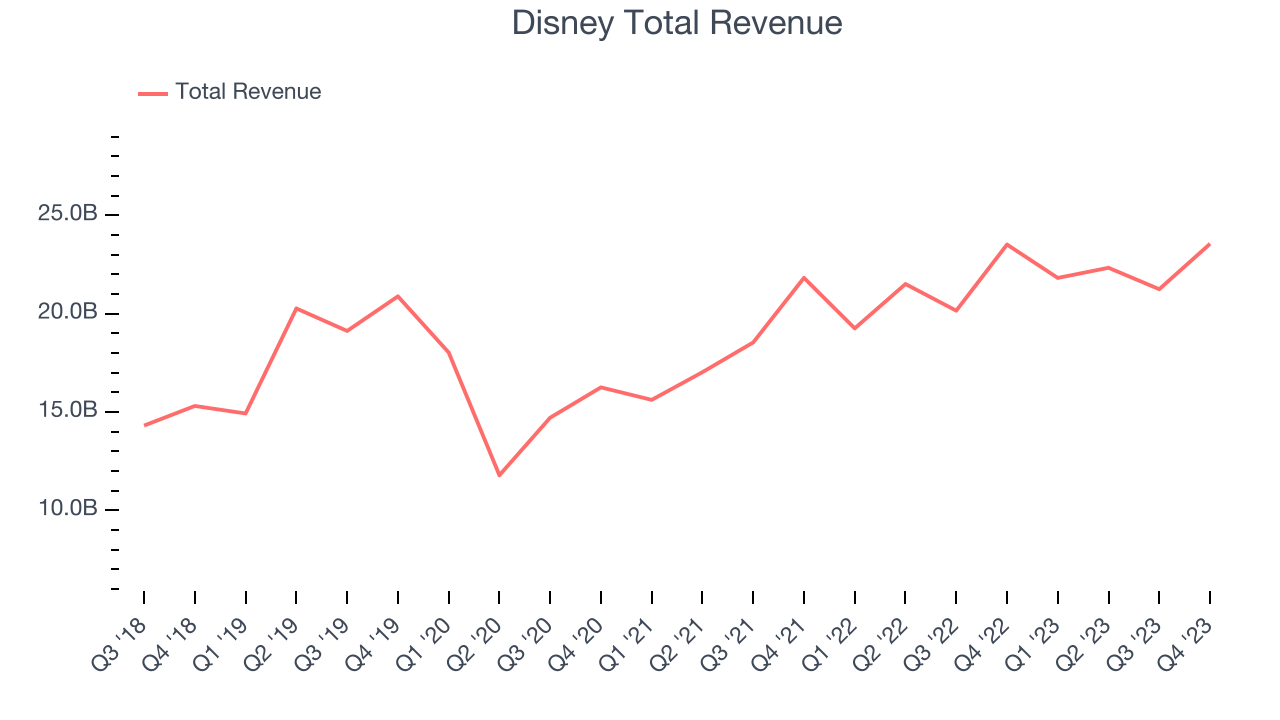

Sales Growth

Exploring a company's long-term performance can offer valuable insights into its business quality. Any business can experience brief periods of success, but distinguished ones maintain steady growth over time. Disney's annualized revenue growth rate of 8.4% over the last 5 years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Disney's annualized revenue growth of 10.4% over the last 2 years is above its 5-year trend, suggesting there are some bright spots.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Disney's annualized revenue growth of 10.4% over the last 2 years is above its 5-year trend, suggesting there are some bright spots.

We can dig even further into the company's revenue dynamics by analyzing its three largest segments: Entertainment, Sports, and Experiences, which are 42.4%, 20.5%, and 38.8% of revenue. Over the last 2 years, Disney's Entertainment revenue (movies, Disney+) averaged 1.4% year-on-year declines, but its Sports (ESPN) and Experiences (theme parks) revenues averaged 10.1% and 34.5% growth.

This quarter, Disney's $23.55 billion of revenue was flat year on year, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 5% over the next 12 months, an acceleration from this quarter.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

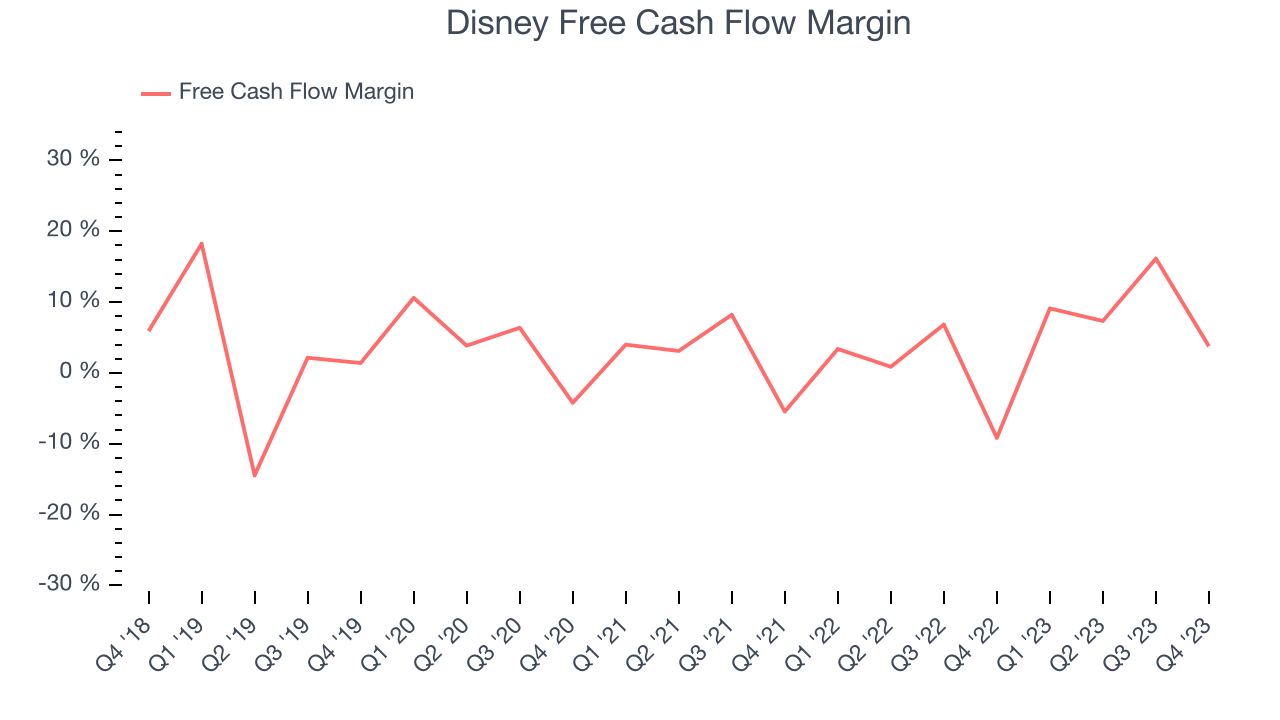

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Disney has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4.8%, subpar for a consumer discretionary business.

Disney's free cash flow came in at $886 million in Q1, equivalent to a 3.8% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter. Over the next year, analysts predict Disney's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 8.9% will decrease to 7.1%.

Key Takeaways from Disney's Q1 Results

It was good to see Disney beat analysts' operating income and operating margin expectations this quarter, leading to a convincing EPS beat. Free cash flow in the quarter also beat convincingly. Lastly on the positives, streaming subs beat by a small margin and guidance for net adds to the Disney+ platform next quarter was solid. On the other hand, its Sports revenue unfortunately missed analysts' expectations, leading to a consolidated revenue miss. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 7.7% after reporting and currently trades at $106.88 per share.

So should you invest in Disney right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.