Global entertainment and media company Disney (NYSE:DIS) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 6.3% year on year to $22.57 billion. Its non-GAAP profit of $1.14 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy Disney? Find out by accessing our full research report, it’s free.

Disney (DIS) Q3 CY2024 Highlights:

- Revenue: $22.57 billion vs analyst estimates of $22.49 billion (in line)

- Adjusted EPS: $1.14 vs analyst estimates of $1.33 (2.8% beat)

- Combined streaming businesses (Disney+, Hulu, ESPN+) beat on operating profit

- Fiscal 2025 adjusted EPS guidance of high-single digit growth (beat)

- Operating Margin: 12.2%, in line with the same quarter last year

- EBITDA Margin: 23.9%, up from 16.7% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 16.1% in the same quarter last year

- Market Capitalization: $186.5 billion

“This was a pivotal and successful year for The Walt Disney Company, and thanks to the significant progress we’ve made, we have emerged from a period of considerable challenges and disruption well positioned for growth and optimistic about our future,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company.

Company Overview

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

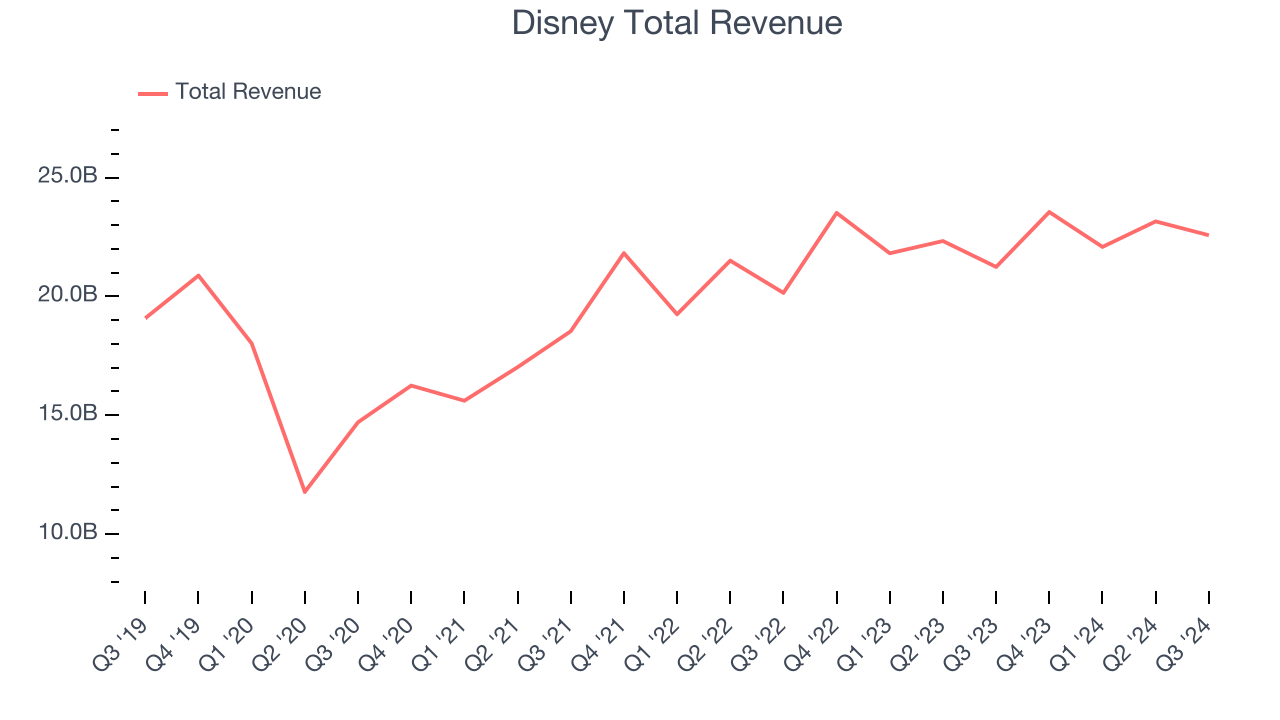

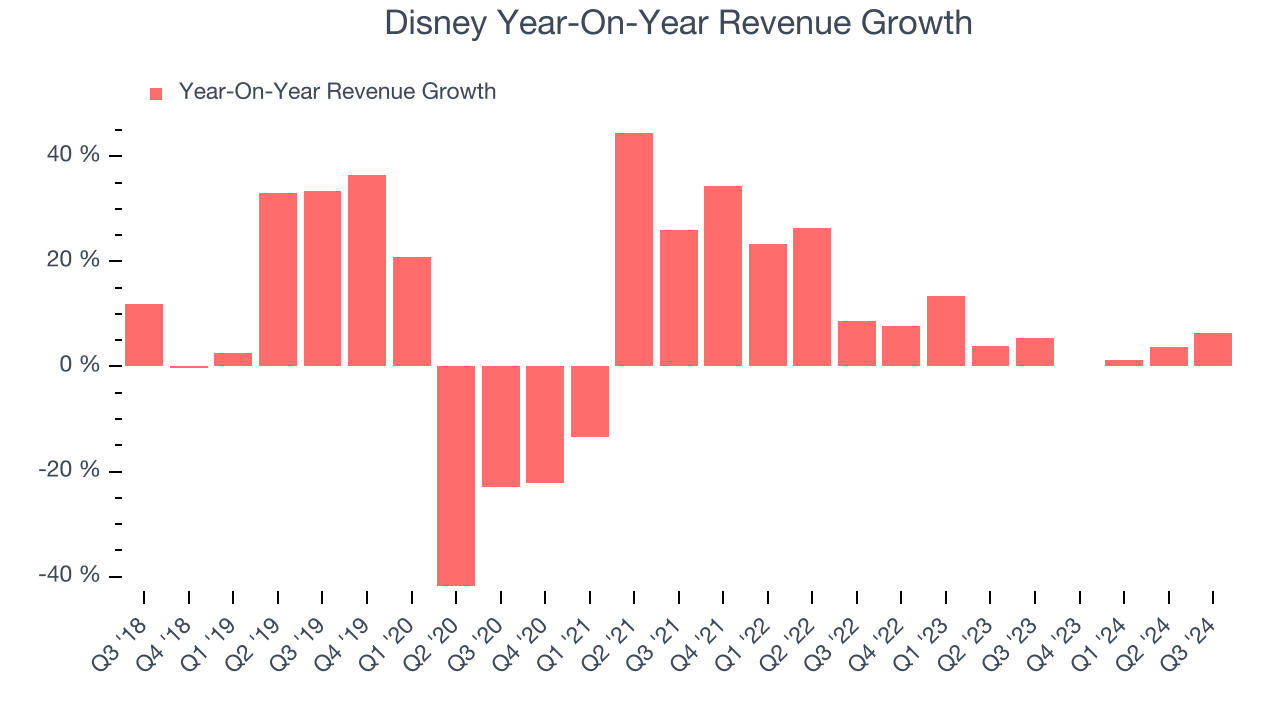

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Disney grew its sales at a sluggish 5.6% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Disney’s annualized revenue growth of 5.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Entertainment, Sports, and Experiences, which are 48%, 17.3%, and 36.5% of revenue. Over the last two years, Disney’s revenues in all three segments increased. Its Entertainment revenue (movies, Disney+) averaged year-on-year growth of 2.2% while its Sports (ESPN, SEC Network) and Experiences (theme parks) revenues averaged 1% and 10.5%.

This quarter, Disney grew its revenue by 6.3% year on year, and its $22.57 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

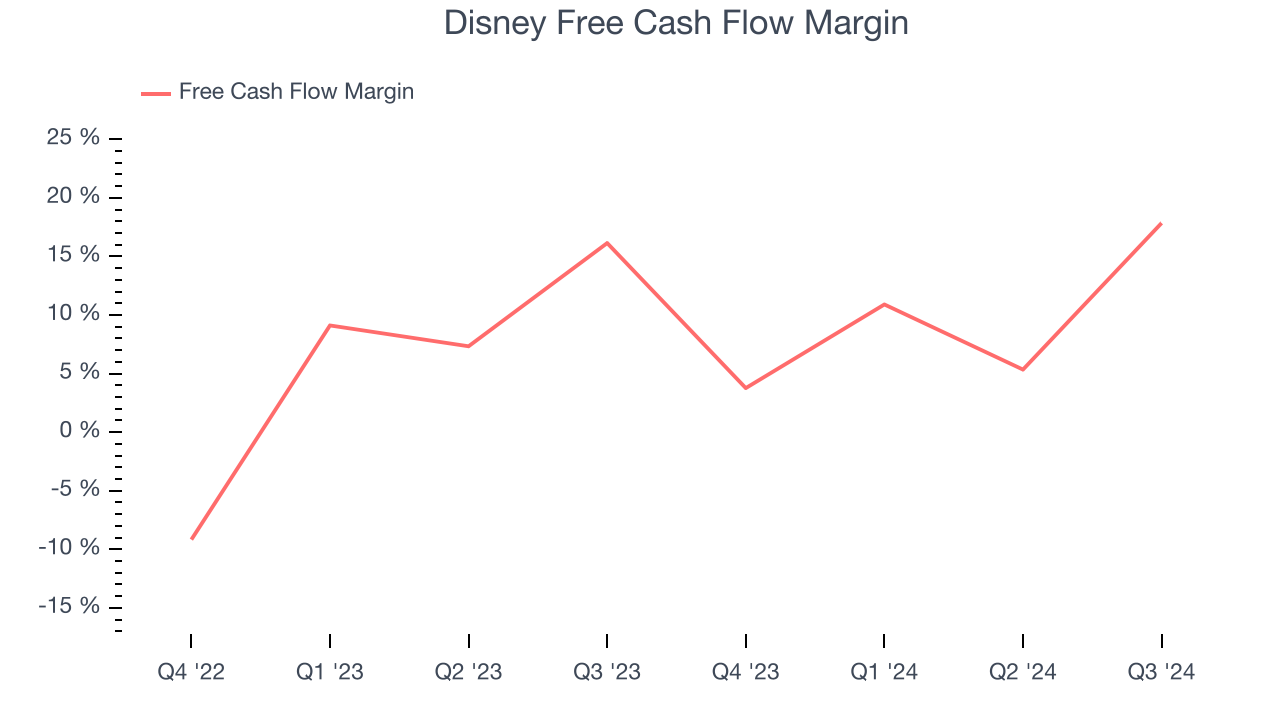

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Disney has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Disney to make large cash investments in working capital and capital expenditures.

Disney’s free cash flow clocked in at $4.03 billion in Q3, equivalent to a 17.8% margin. This result was good as its margin was 1.7 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts’ consensus estimates show they’re expecting Disney’s free cash flow margin of 9.4% for the last 12 months to remain the same.

Key Takeaways from Disney’s Q3 Results

Revenue beat slightly, leading to an EPS beat. The streaming business was more profitable than expected, a big positive since this is an area of focus for the market. Lastly, EPS guidance for fiscal 2025 came in ahead of expectations. On the other hand, its Entertainment revenue missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 8.4% to $111.31 immediately after reporting.

Disney had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.