Sporting goods retailer Dick’s Sporting Goods (NYSE:DKS) beat analysts' expectations in Q4 FY2023, with revenue up 7.8% year on year to $3.88 billion. The company expects the full year's revenue to be around $13.07 billion, in line with analysts' estimates. It made a GAAP profit of $3.57 per share, improving from its profit of $2.60 per share in the same quarter last year.

Dick's (DKS) Q4 FY2023 Highlights:

- Revenue: $3.88 billion vs analyst estimates of $3.79 billion (2.2% beat)

- EPS: $3.57 vs analyst estimates of $3.33 (7.2% beat)

- Management's EPS guidance for the upcoming financial year 2024 is $13.05 at the midpoint, above analyst expectations of $12.86

- Gross Margin (GAAP): 34.4%, up from 32.4% in the same quarter last year

- Free Cash Flow of $584.7 million, down 26.6% from the same quarter last year

- Same-Store Sales were up 2.8% year on year (beat .vs expectations of up 0.5% year on year)

- Store Locations: 855 at quarter end, increasing by 2 over the last 12 months

- Market Capitalization: $15.35 billion

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

The core customer is anyone in need of balls, bats, rackets, or other equipment for traditional sports such as basketball, baseball, or tennis. Dick’s also addresses the needs of fitness and outdoor enthusiasts due to their selection of exercise equipment such as weights and hunting, fishing, and camping equipment such as binoculars. The breadth of sports and activities covered and the depth of product in each category is what differentiates Dick’s. Sporting goods can be large and cumbersome, so general merchandise retailers who devote limited space will have limited selection.

A Dick's store ranges from around 30,000 to 70,000 square feet, with some larger flagship locations exceeding 100,000 square feet. At the entrance is usually a large, open space that features seasonal displays and promotions. The store is then typically divided into sections such as athletic/casual apparel, sneakers/footwear, then sections based on specific sports. The company also has a developed e-commerce presence, which Dick’s launched in 1997 as an early adopter of online shopping. Many customers choose to order online and pick up at their nearest store.

Athletic Apparel and Footwear Retailer

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

Retailers offering sporting and outdoor goods include Academy Sports and Outdoor (NASDAQ:ASO), Sportsman’s Warehouse (NASDAQ:SPWH), and Hibbett (NASDAQ:HIBB).Sales Growth

Dick's is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

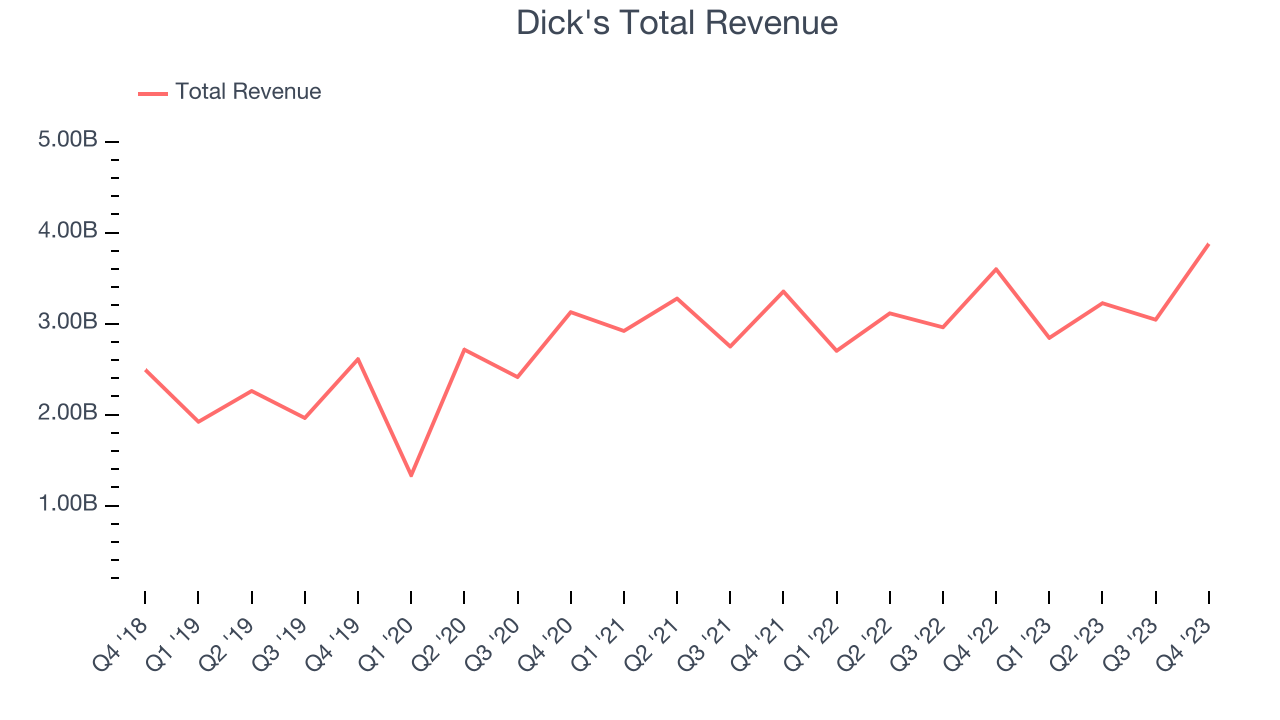

As you can see below, the company's annualized revenue growth rate of 10.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent despite not opening many new stores, implying that growth was driven by higher sales at existing, established stores.

This quarter, Dick's reported solid year-on-year revenue growth of 7.8%, and its $3.88 billion in revenue outperformed Wall Street's estimates by 2.2%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

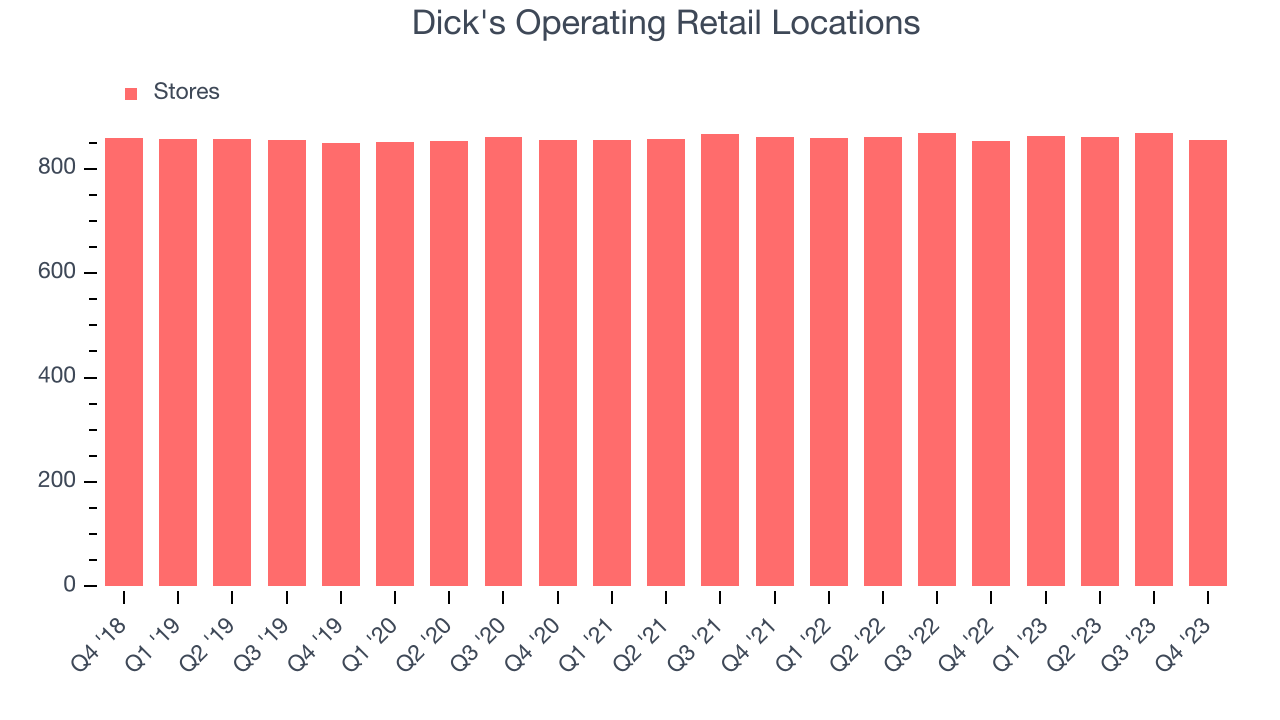

Number of Stores

When a retailer like Dick's keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Dick's operated 855 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

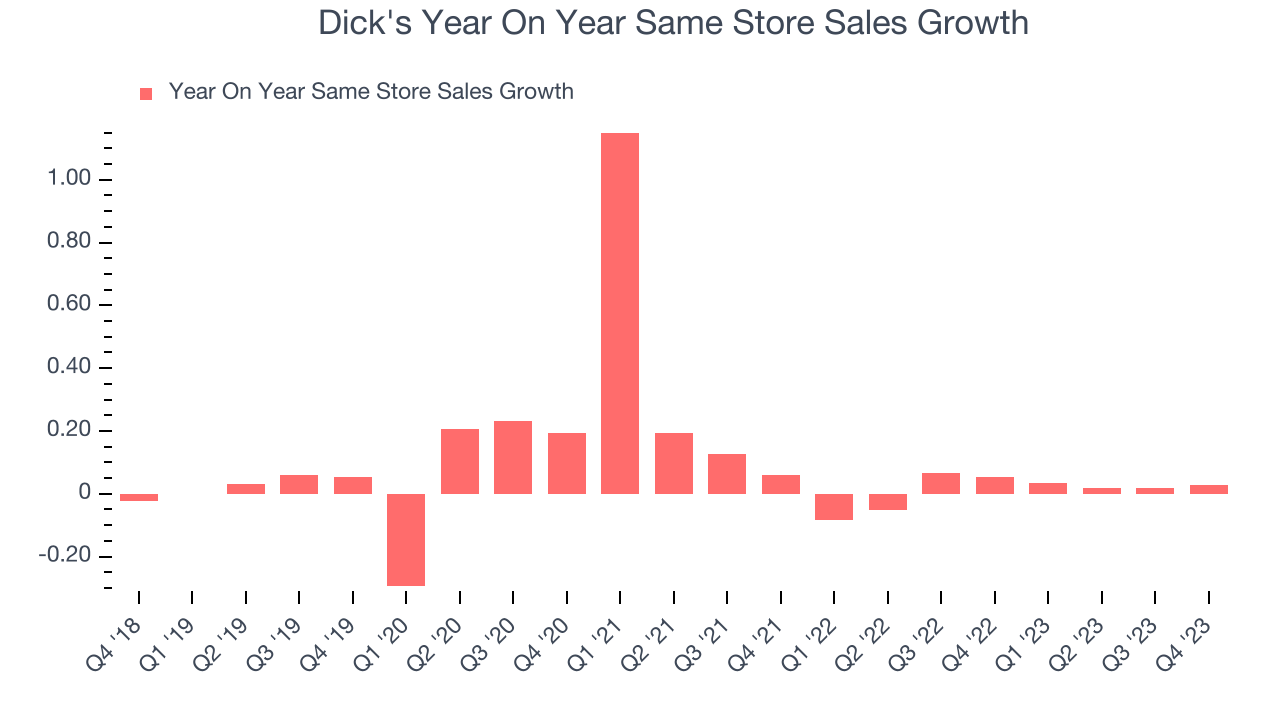

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Dick's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Dick's same-store sales rose 2.8% year on year. This growth was a deceleration from the 5.3% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Gross Margin & Pricing Power

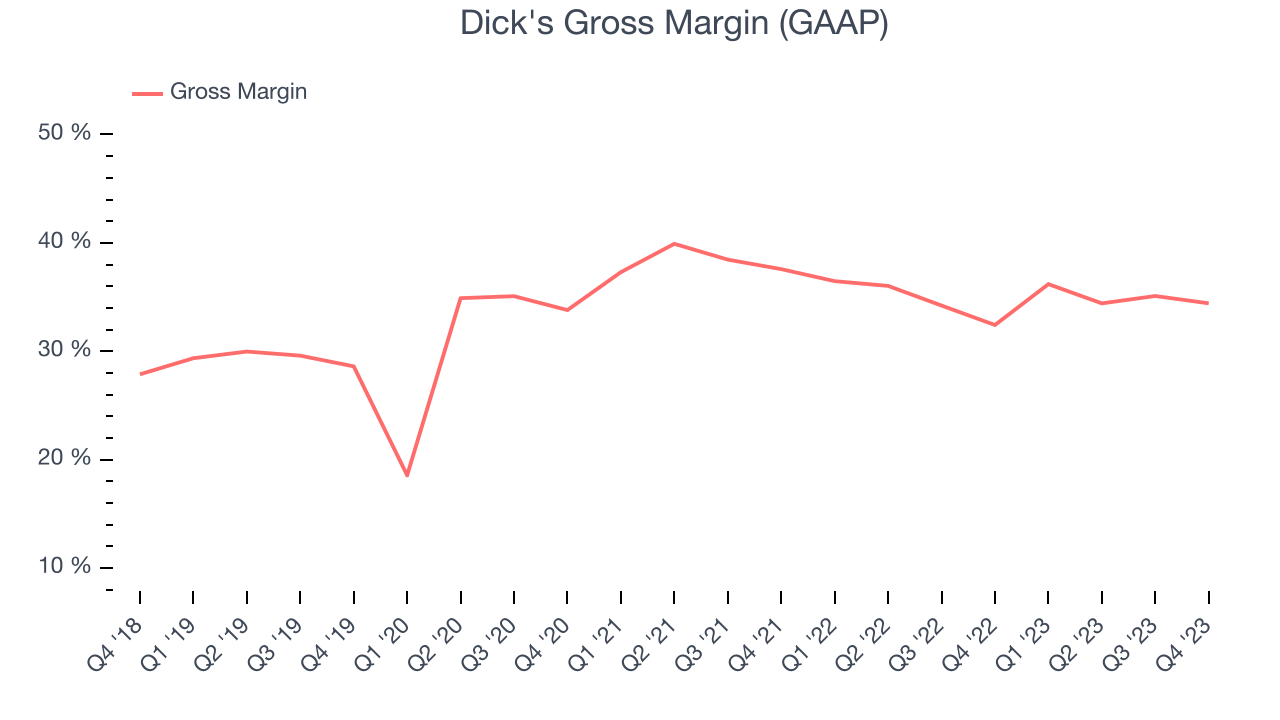

We prefer higher gross margins because they make it easier to generate more operating profits.

Dick's has subpar unit economics for a retailer, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged a paltry 34.8% gross margin over the last two years. This means the company makes $0.35 for every $1 in revenue before accounting for its operating expenses.

Dick's gross profit margin came in at 34.4% this quarter, marking a 2 percentage point increase from 32.4% in the same quarter last year. This margin expansion is a good sign in the near term. If this trend continues, it could signal a less competitive environment where the company has better pricing power, less pressure to discount products, and more stable input costs (such as distribution expenses to move goods).

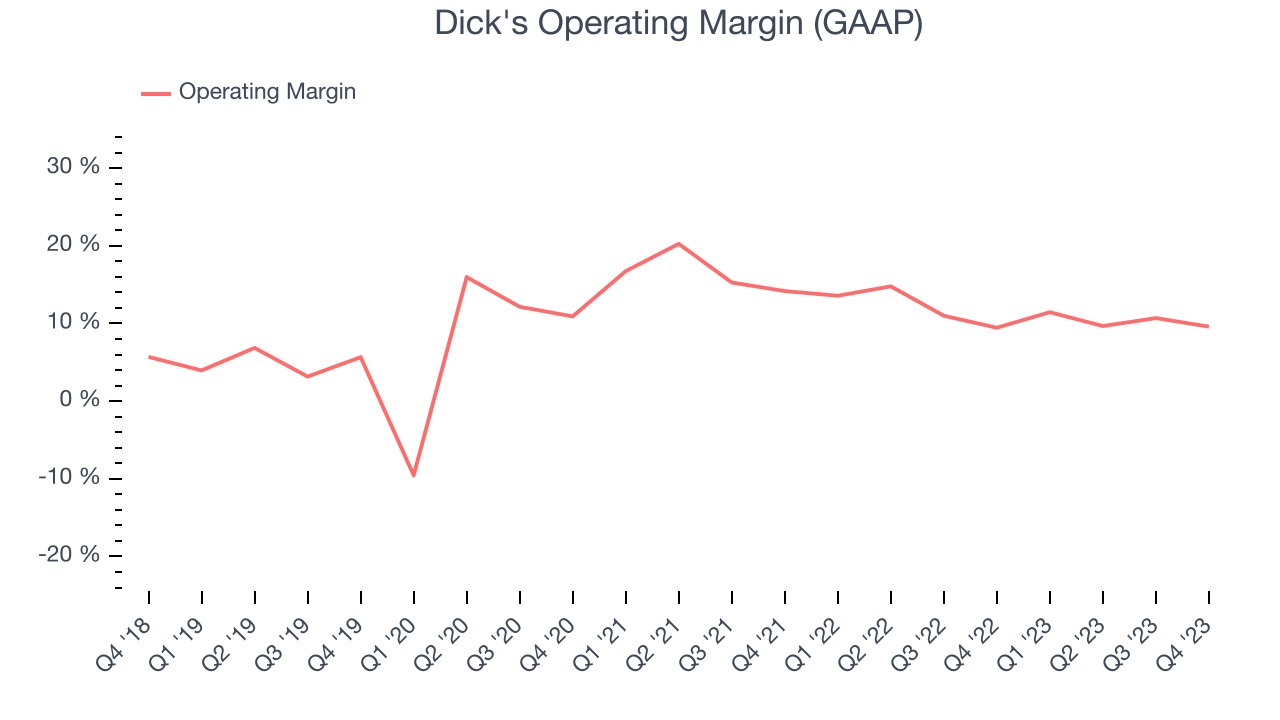

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q4, Dick's generated an operating profit margin of 9.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Dick's has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer retail business, producing an average operating margin of 11.2%. However, Dick's margin has slightly declined by 1.8 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way. The company's operating profitability was particularly impressive because of its low gross margin. This margin is mostly a factor of what Dick's sells and takes fundamental shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Dick's).

Zooming out, Dick's has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer retail business, producing an average operating margin of 11.2%. However, Dick's margin has slightly declined by 1.8 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way. The company's operating profitability was particularly impressive because of its low gross margin. This margin is mostly a factor of what Dick's sells and takes fundamental shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Dick's).EPS

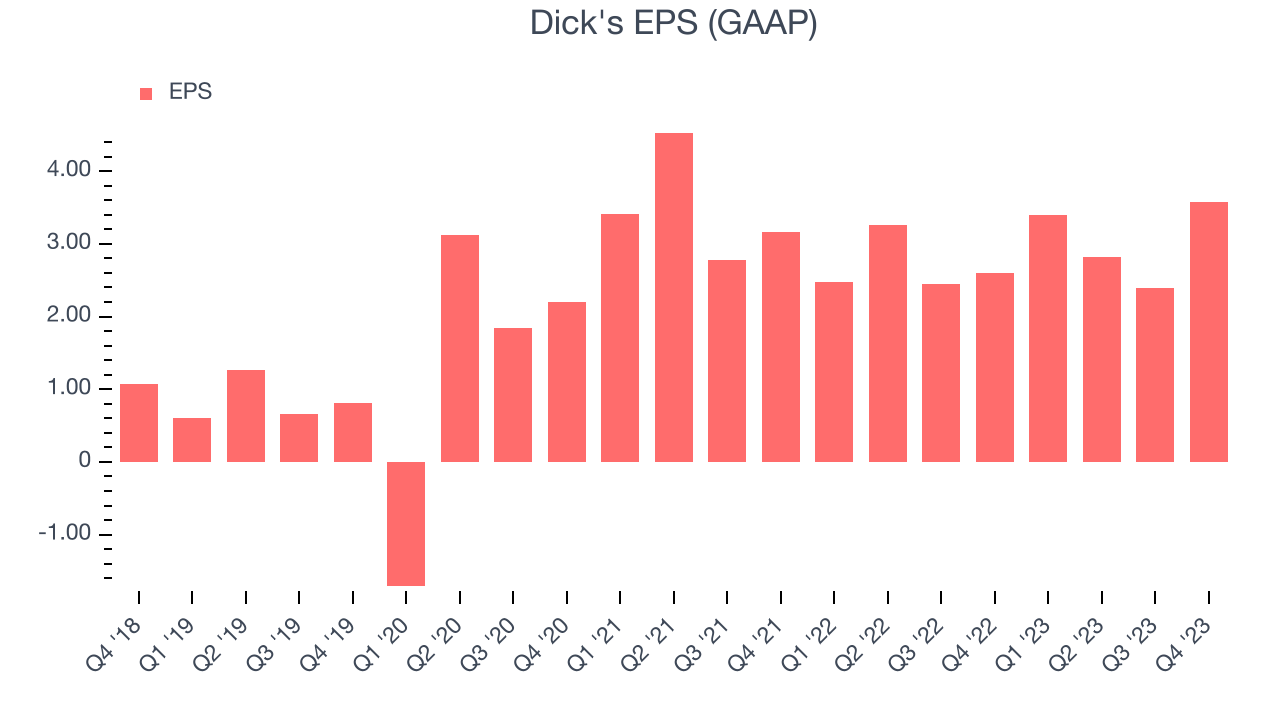

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Dick's reported EPS at $3.57, up from $2.60 in the same quarter a year ago. This print beat Wall Street's estimates by 7.2%.

Between FY2019 and FY2023, Dick's adjusted diluted EPS grew 265%, translating into a remarkable 38.2% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 4.7% year-on-year increase in EPS.

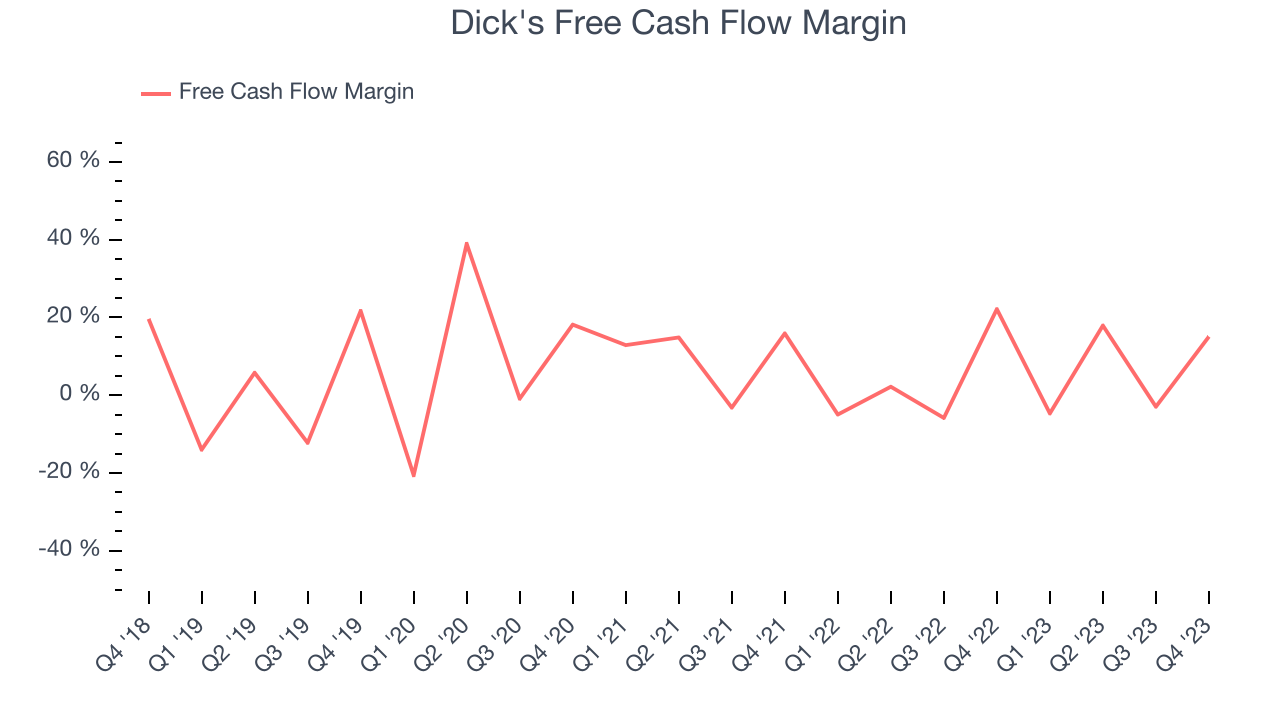

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Dick's free cash flow came in at $584.7 million in Q4, down 26.6% year on year. This result represents a 15.1% margin.

Over the last eight quarters, Dick's has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 5.9%, well above the broader consumer retail sector. Furthermore, its margin has averaged year-on-year increases of 2.7 percentage points. This likely pleases the company's investors.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Dick's hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 20.6%, higher than most retailers.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Dick's ROIC averaged 10.1 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Dick's Q4 Results

We enjoyed seeing Dick's exceed analysts' revenue expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 3.2% after reporting and currently trades at $194 per share.

Is Now The Time?

Dick's may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Dick's isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been decent over the last four years, its poor same-store sales performance has been a headwind. And while its EPS growth over the last four years has significantly beat its peer group average, the downside is its low growth in new store openings show it's focused on existing locations.

Dick's price-to-earnings ratio based on the next 12 months is 14.6x. We can find things to like about Dick's and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $168.71 per share right before these results (compared to the current share price of $194), implying they didn't see much short-term potential in Dick's.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.