Cloud computing provider DigitalOcean (NYSE: DOCN) announced better-than-expected results in Q4 FY2023, with revenue up 11% year on year to $180.9 million. The company expects next quarter's revenue to be around $182.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.44 per share, improving from its profit of $0.27 per share in the same quarter last year.

DigitalOcean (DOCN) Q4 FY2023 Highlights:

- Revenue: $180.9 million vs analyst estimates of $178.1 million (1.6% beat)

- EPS (non-GAAP): $0.44 vs analyst estimates of $0.37 (20.5% beat)

- Revenue Guidance for Q1 2024 is $182.5 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $765 million at the midpoint, in line with analyst expectations and implying 10.4% growth (vs 21% in FY2023)

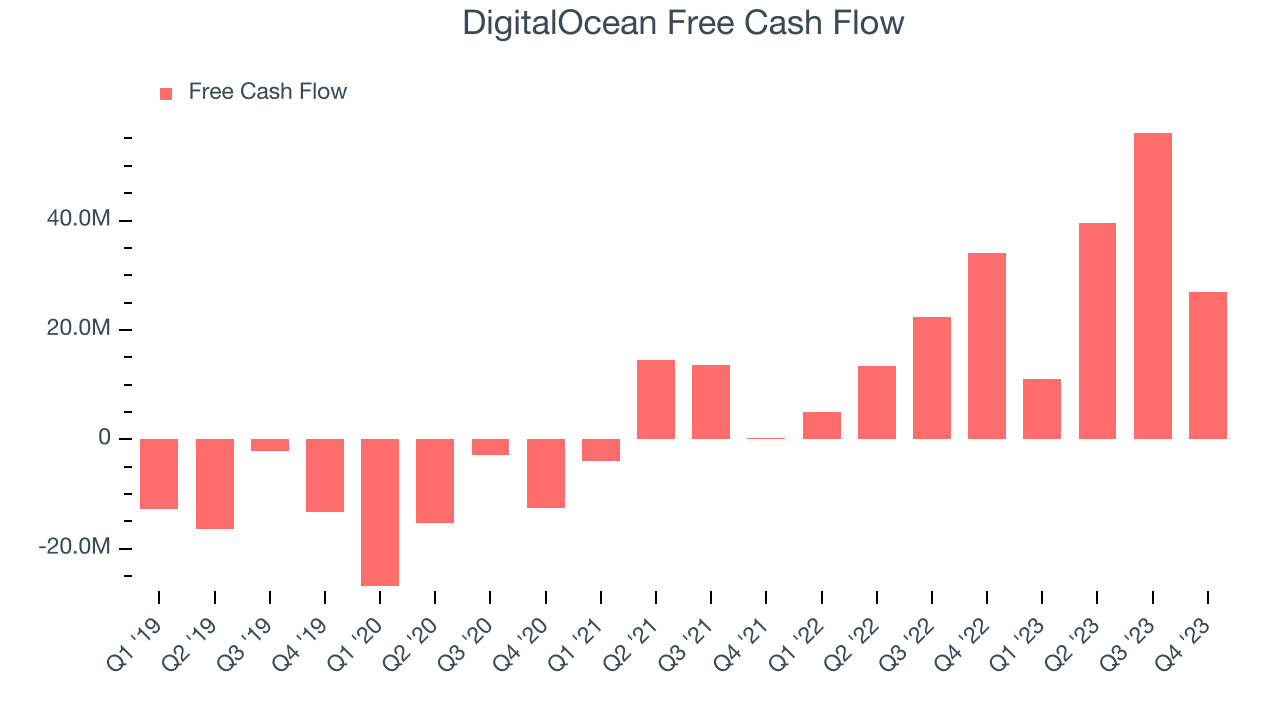

- Free Cash Flow of $26.86 million, down 52.1% from the previous quarter

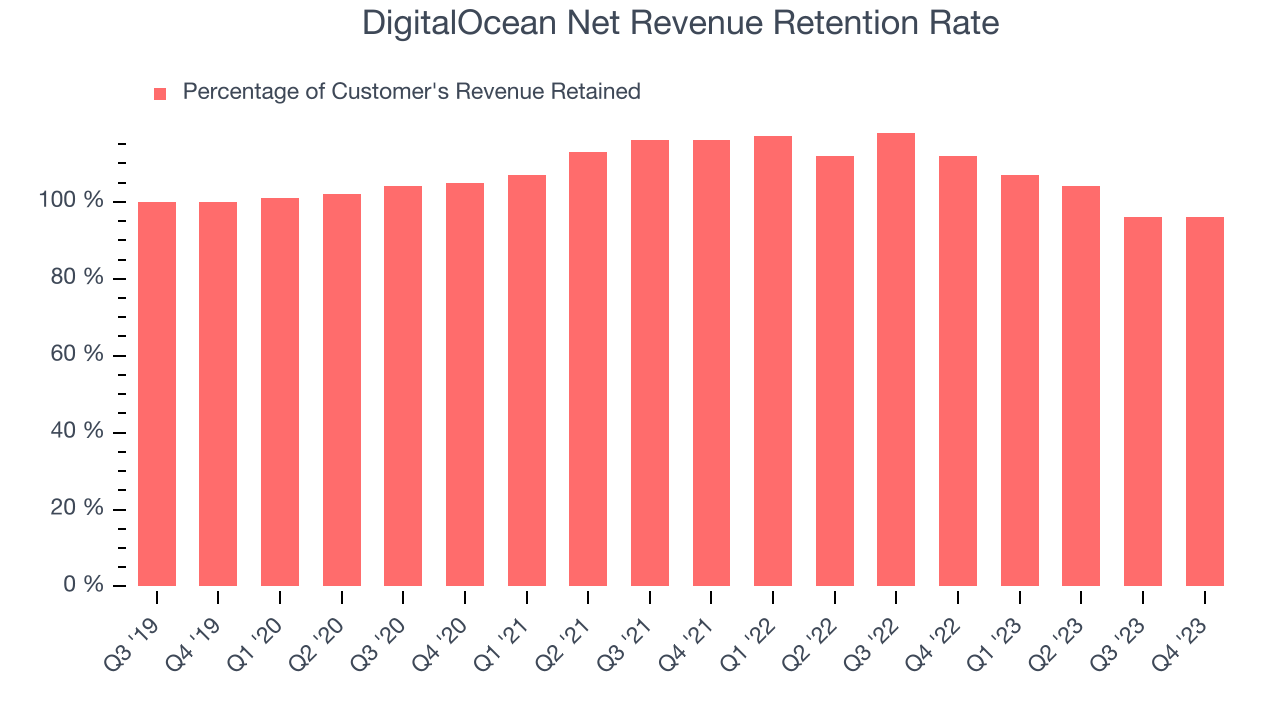

- Net Revenue Retention Rate: 96%, in line with the previous quarter

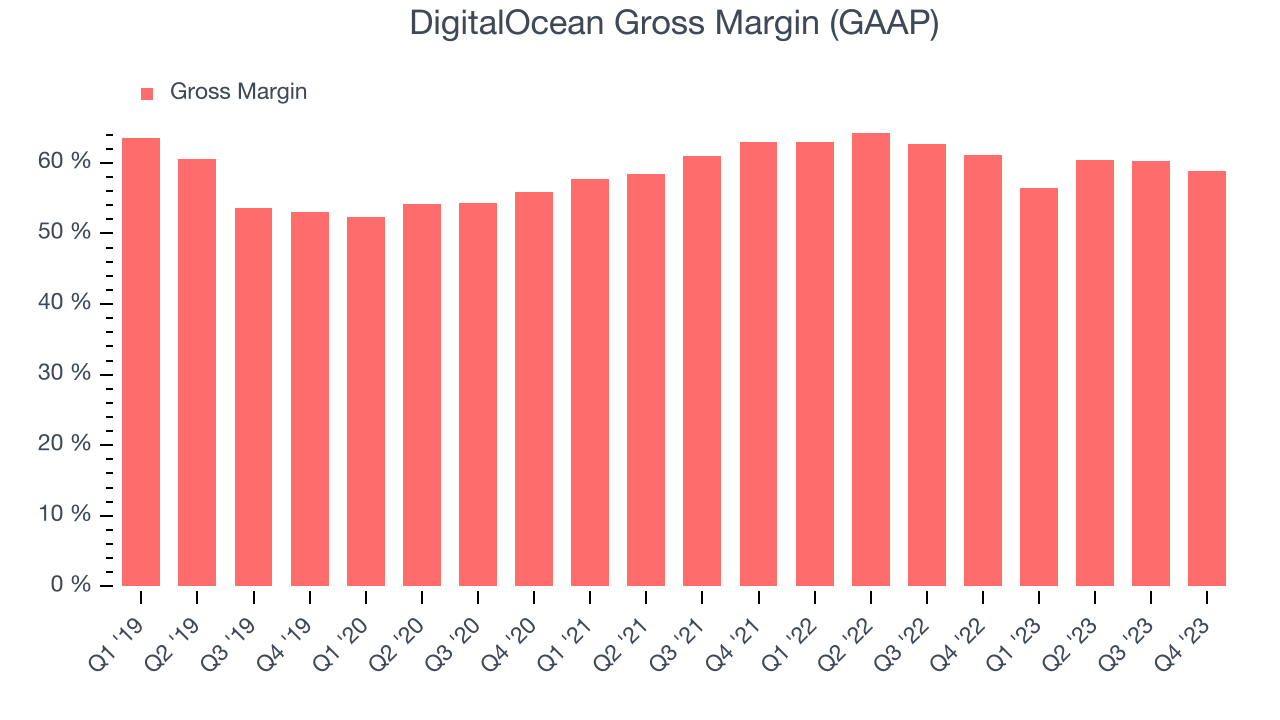

- Gross Margin (GAAP): 58.9%, down from 61.1% in the same quarter last year

- Market Capitalization: $3.18 billion

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

DigitalOcean offers a range of cloud computing options for developers and small businesses. Hyperscalers Amazon Web Services, Microsoft Azure, and Google Cloud Platform are the dominant providers of the cloud infrastructure that has become the standard for companies today.

For individual developers and small and medium businesses, the large cloud platforms present some hurdles to adoption: the actual onboarding and implementation processes can be difficult, pricing models can be complex and at times unpredictable, and there is a relatively low level of support for SMBs, as the cloud giants are focused on serving enterprise customers.

DigitalOcean focuses mainly on less application and website hosting use cases and differentiates itself from the hyperscale platforms through the intuitive simplicity of its user interface, which allows customers to spin up “Droplets” (their term for a virtual machine) in under a minute. The company offers a high level of live-person customer support regardless of spend levels, and utilizes open source software to keep costs low. For context, DigitalOcean’s bandwidth prices are a fraction of its hyperscale rivals.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Digital Ocean’s main competitors are the hyperscale cloud providers: Amazon (NASDAQ:AMZN), Microsoft (NASDAQ: MSFT), and Alphabet’s Google Cloud Platform (NASDAQ: GOOGL). IBM (NYSE:IBM) and Oracle (NYSE:ORCL) round out the larger players. A second set of rivals are niche cloud providers that target certain verticals or geographies such as OVH, Vultr, Linode, and Heroku, which is owned by Salesforce.com (NYSE:CRM).

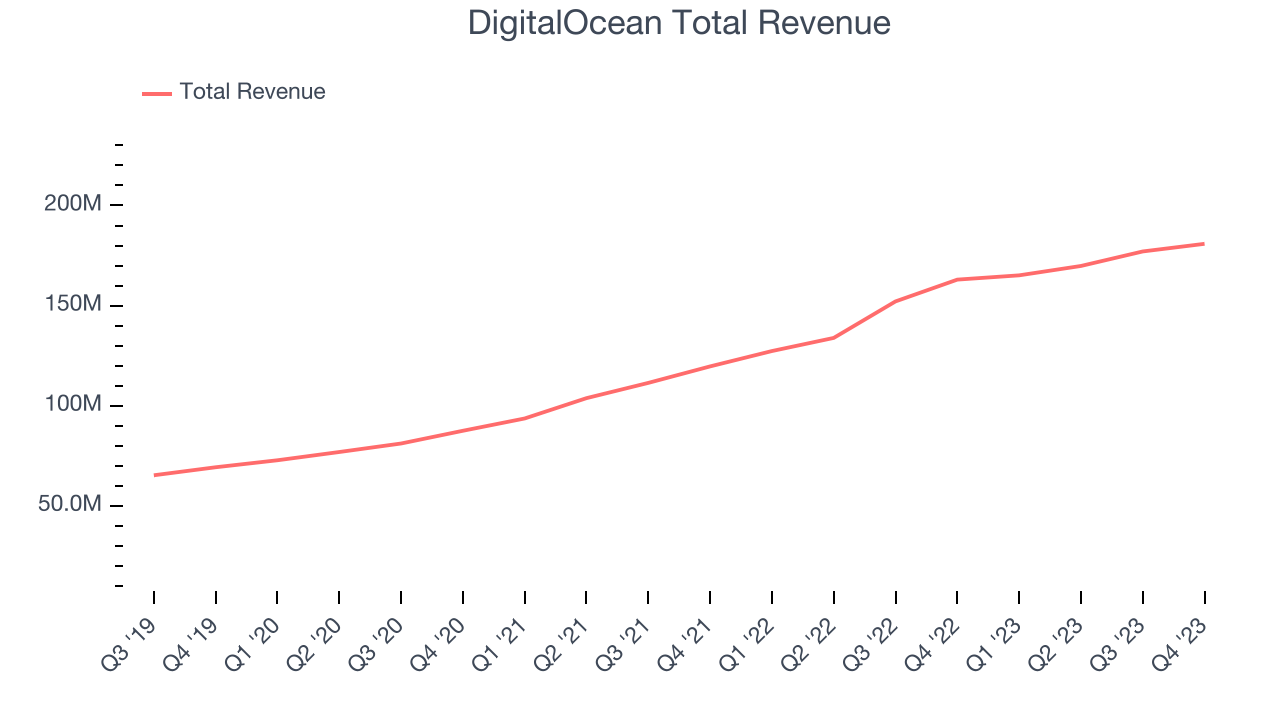

Sales Growth

As you can see below, DigitalOcean's revenue growth has been strong over the last two years, growing from $119.7 million in Q4 FY2021 to $180.9 million this quarter.

This quarter, DigitalOcean's quarterly revenue was once again up 11% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $3.81 million in Q4 compared to $7.25 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that DigitalOcean is expecting revenue to grow 10.5% year on year to $182.5 million, slowing down from the 29.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $765 million at the midpoint, growing 10.4% year on year compared to the 20.2% increase in FY2023.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

DigitalOcean's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 96% in Q4. This means DigitalOcean's revenue would've decreased by 4% over the last 12 months if it didn't win any new customers.

DigitalOcean's already weak net retention rate has been dropping the last year, signaling that some customers aren't satisfied with its products, leading to lost contracts and revenue streams.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. DigitalOcean's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 58.9% in Q4.

That means that for every $1 in revenue the company had $0.59 left to spend on developing new products, sales and marketing, and general administrative overhead. DigitalOcean's gross margin is lower than a we would typically see in a SaaS business due to the different nature of its business and it's deteriorated even further over the last year. This is probably the opposite direction that shareholders would like to see it go.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. DigitalOcean's free cash flow came in at $26.86 million in Q4, down 21.4% year on year.

DigitalOcean has generated $133.6 million in free cash flow over the last 12 months, a solid 19.3% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from DigitalOcean's Q4 Results

DOCN delivered very solid free cash flow and we were also glad to see its revenue narrowly outperformed Wall Street's estimates. On the other hand, gross margin decreased. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 4.3% after reporting and currently trades at $37.39 per share.

Is Now The Time?

When considering an investment in DigitalOcean, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that DigitalOcean isn't a bad business. We'd expect growth rates to moderate from here, but its . And while its gross margins show its business model is much less lucrative than the best software businesses, the good news is its very efficient customer acquisition hints at the potential for strong profitability.

DigitalOcean's price-to-sales ratio based on the next 12 months is 4.3x, suggesting that the market is expecting more moderate growth, relative to the hottest tech stocks. There are things to like about DigitalOcean and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $36.20 per share right before these results (compared to the current share price of $37.39).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.