Wrapping up Q1 earnings, we look at the numbers and key takeaways for the vertical software stocks, including Doximity (NYSE:DOCS) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 17 vertical software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.61%, while on average next quarter revenue guidance was 0.07% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but vertical software stocks held their ground better than others, with the share prices up 21.2% since the previous earnings results, on average.

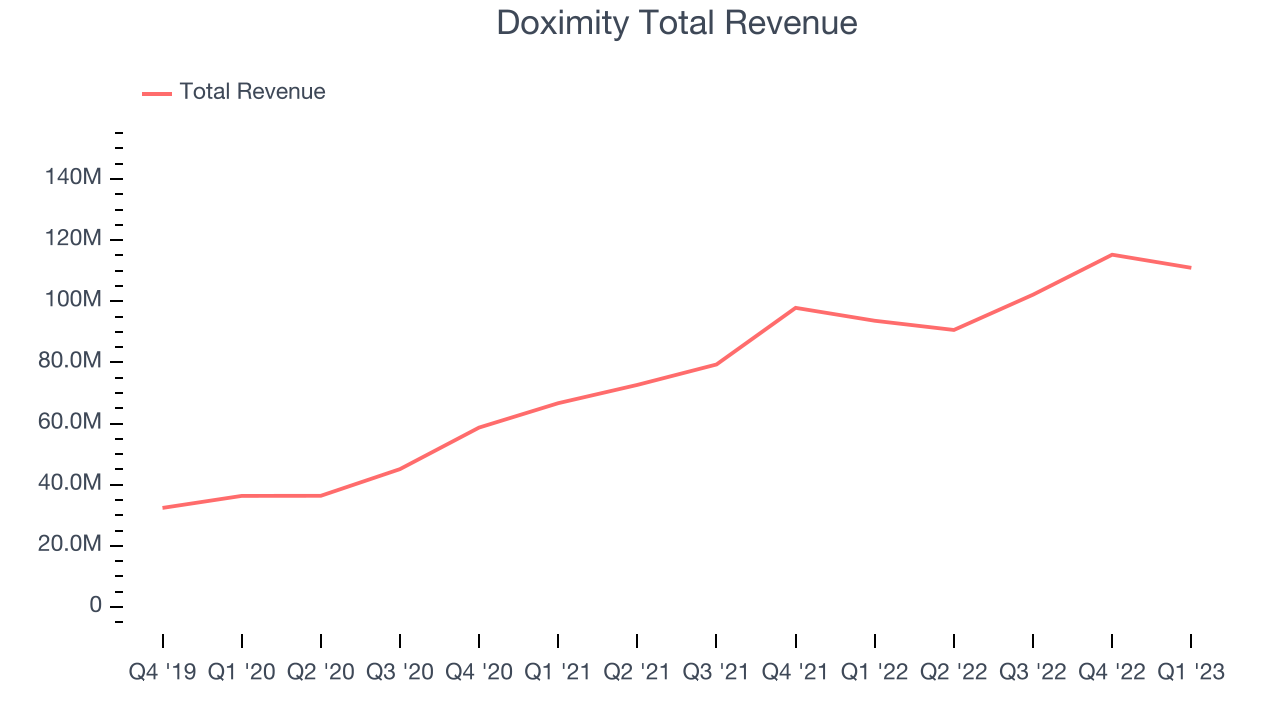

Doximity (NYSE:DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Doximity reported revenues of $111 million, up 18.5% year on year, in line with analyst expectations. It was a weaker quarter for the company, with revenue and adjusted EBITDA guidance for the next quarter below Consensus.

“With the public health emergency officially over, we’re proud to emerge with a record number of providers using our physician cloud in Q4 to power their scheduling, fax, e-signature, and telehealth needs,” said Jeff Tangney, co-founder and CEO at Doximity.

The stock is down 3.31% since the results and currently trades at $32.74.

Is now the time to buy Doximity? Access our full analysis of the earnings results here, it's free.

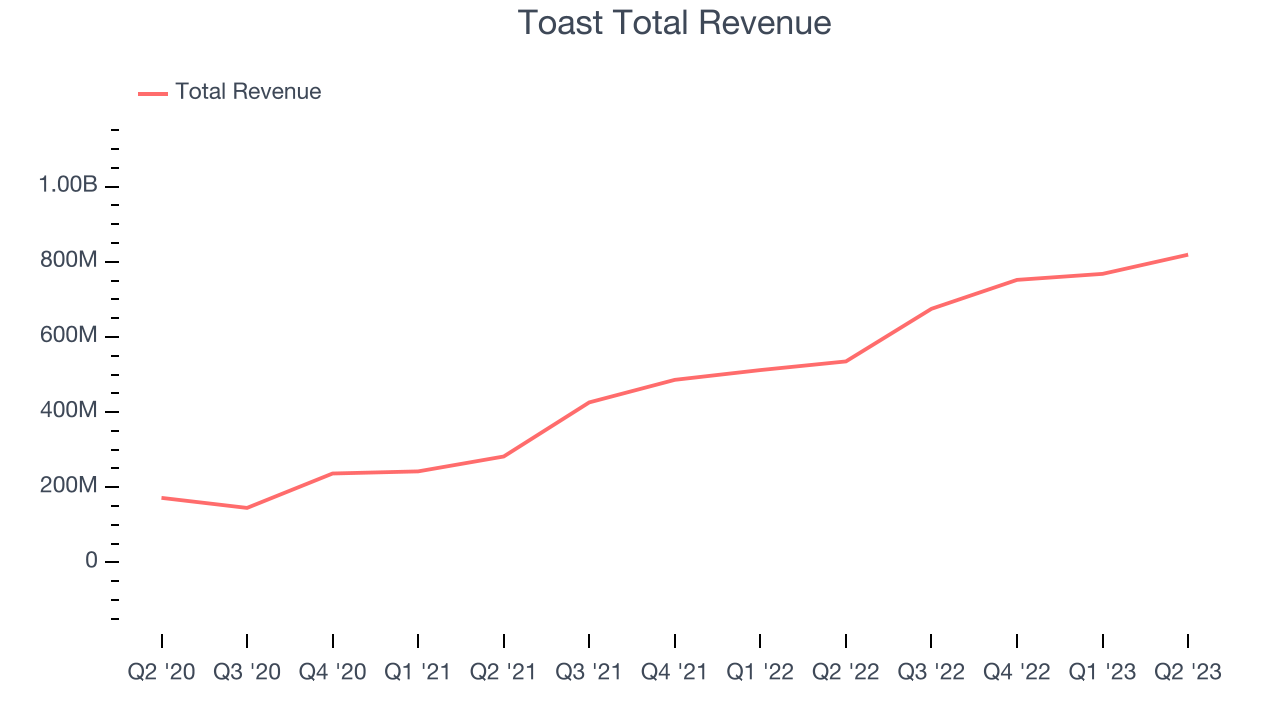

Best Q1: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $819 million, up 53.1% year on year, beating analyst expectations by 7.22%. It was a very strong quarter for the company, with a solid beat of analyst estimates and very optimistic guidance for the next quarter.

Toast achieved the highest full year guidance raise among its peers. The stock is up 11% since the results and currently trades at $21.62.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: nCino (NASDAQ:NCNO)

Founded in 2011 in North Carolina, nCino (NASDAQ:NCNO) makes cloud-based operating systems for banks and provides that software as a service.

nCino reported revenues of $113.7 million, up 20.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with revenue guidance for the next quarter and full-year missing analysts' expectations.

The stock is up 18.9% since the results and currently trades at $32.63.

Read our full analysis of nCino's results here.

2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

2U reported revenues of $238.5 million, down 5.85% year on year, missing analyst expectations by 0.02%. It was a slower quarter for the company, with bottom-line estimates missing expectations and declining gross margin.

2U had the weakest performance against analyst estimates among the peers. The stock is down 17.8% since the results and currently trades at $4.19.

Read our full, actionable report on 2U here, it's free.

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $52.2 million, up 22.2% year on year, beating analyst expectations by 2.92%. It was a strong quarter for the company, with a significant improvement in net revenue retention rate. In addition, revenue guidance for the next quarter came in above Consensus, and full-year revenue guidance was lifted.

The stock is up 4.7% since the results and currently trades at $7.13.

Read our full, actionable report on Olo here, it's free.

The author has no position in any of the stocks mentioned