Looking back on vertical software stocks' Q1 earnings, we examine the best and worst performers, including Doximity (NYSE:DOCS) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 11 vertical software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.53%, while on average next quarter revenue guidance was 2.08% under consensus. There has been a stampede out of high valuation technology stocks, but vertical software stocks held their ground better than others, with the share price up 0.16% since earnings, on average.

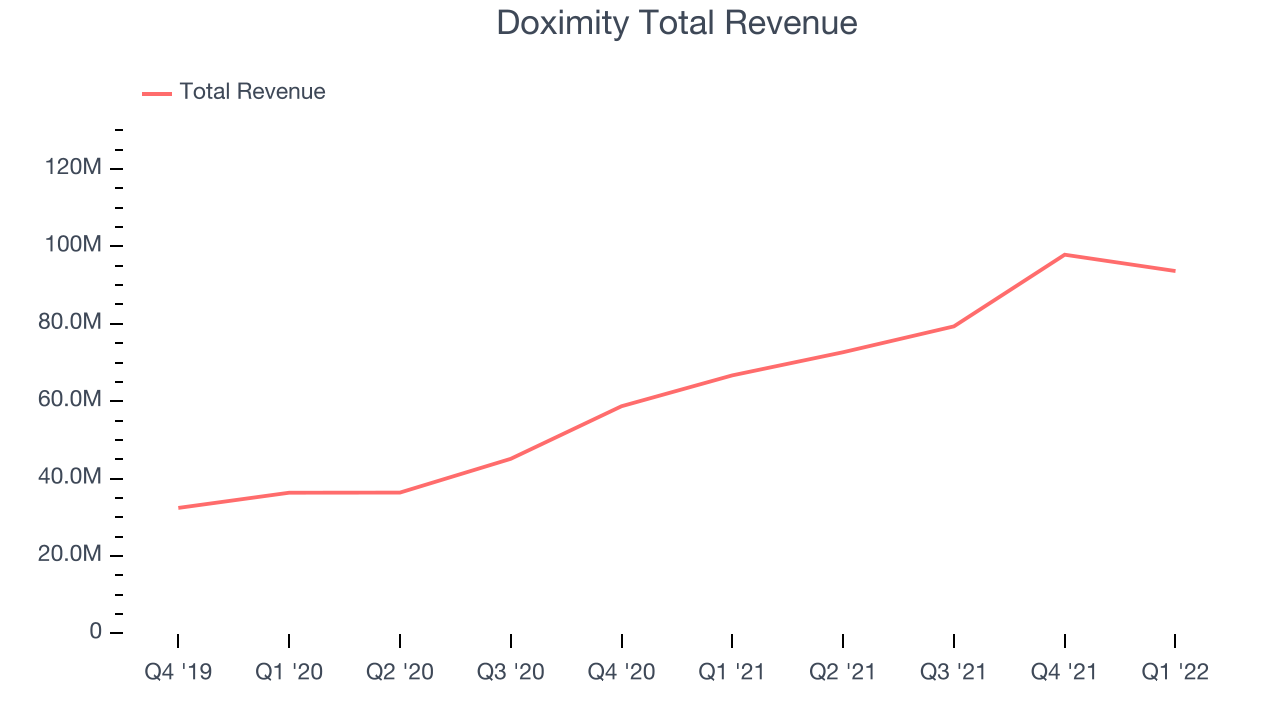

Doximity (NYSE:DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading professional network for U.S. medical professionals.

Doximity reported revenues of $93.6 million, up 40.4% year on year, beating analyst expectations by 3.86%. It was a weaker quarter for the company, with an underwhelming guidance for the next year.

"We're proud to now serve over 2 million US healthcare professionals, including over 80% of US physicians and over 50% of Physician Assistants and Nurse Practitioners," said Jeff Tangney, co-founder & CEO at Doximity.

The stock is up 14.1% since the results and currently trades at $38.57.

Is now the time to buy Doximity? Access our full analysis of the earnings results here, it's free.

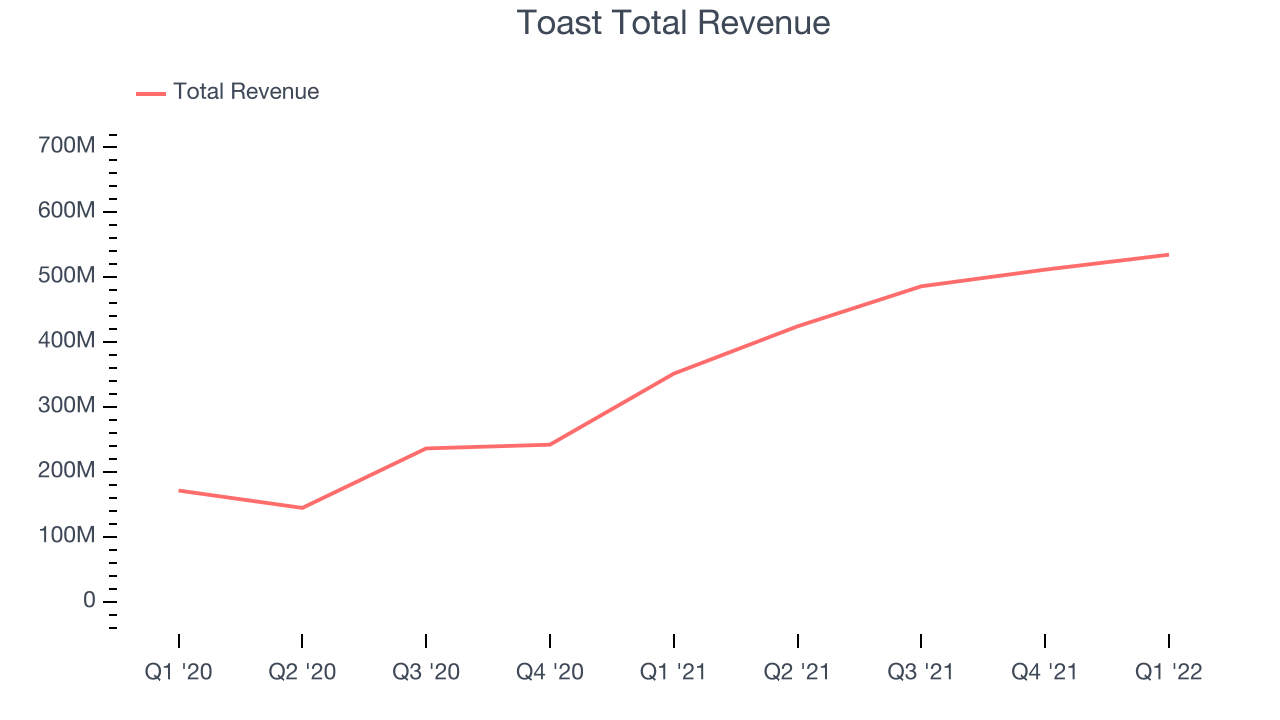

Best Q1: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $535 million, up 52% year on year, beating analyst expectations by 9.07%. It was an incredible quarter for the company, with a significant improvement in gross margin and a very optimistic guidance for the next quarter.

Toast delivered the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 1.82% since the results and currently trades at $14.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $320.1 million, up 36.3% year on year, missing analyst expectations by 0.31%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year below analysts' estimates.

Unity had the weakest performance against analyst estimates in the group. The company added 31 enterprise customers paying more than $100,000 annually to a total of 1,083. The stock is down 12.3% since the results and currently trades at $42.14.

Read our full analysis of Unity's results here.

Veeva Systems (NYSE:VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $505.1 million, up 16.4% year on year, beating analyst expectations by 1.85%. It was a mixed quarter for the company, with a decent beat of analyst estimates but a slow revenue growth.

The stock is up 23.4% since the results and currently trades at $207.16.

Read our full, actionable report on Veeva Systems here, it's free.

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $42.7 million, up 18.3% year on year, beating analyst expectations by 2.63%. It was a weaker quarter for the company, with a decline in net revenue retention rate and a decline in gross margin.

The stock is up 24.1% since the results and currently trades at $11.07.

Read our full, actionable report on Olo here, it's free.

The author has no position in any of the stocks mentioned